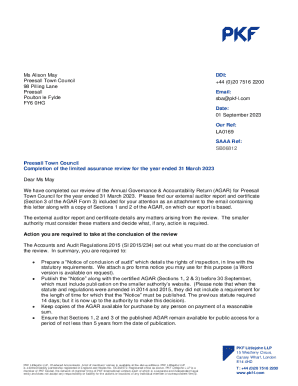

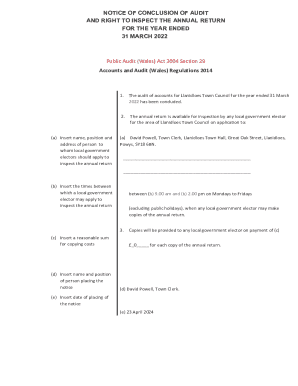

Get the free Notice of 25th Annual General Meeting

Get, Create, Make and Sign notice of 25th annual

Editing notice of 25th annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of 25th annual

How to fill out notice of 25th annual

Who needs notice of 25th annual?

Your Comprehensive Guide to the Notice of 25th Annual Form

Overview of the 25th annual form

The Notice of 25th Annual Form serves as a critical component in reporting various financial details to tax authorities. Its primary purpose is to ensure that all taxpayers provide accurate information regarding their income, deductions, and credits. Filing this form not only fulfills a legal obligation but also enables taxpayers to potentially reduce their tax liability by accurately reporting deductions and credits.

Key features of the 25th annual form

The 25th Annual Form is designed to capture an expansive array of financial information. A fundamental aspect of completing this form is understanding the data requirements, which revolve around several key areas including income reporting and applicable tax deductions.

Step-by-step instructions for completing the 25th annual form

Completing the 25th Annual Form can seem daunting; however, breaking it down into manageable steps can significantly ease the process.

Step 1: Gathering necessary information

Begin by collecting all necessary personal and financial information. Essential documents include previous tax returns, W-2 forms from employers, 1099s for any freelance work, and statements regarding investment income.

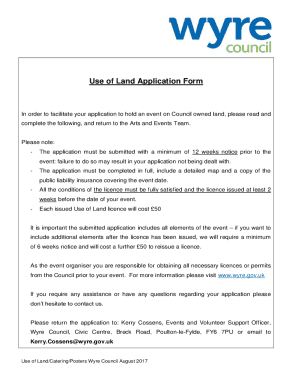

Step 2: Filling out the form

The form is divided into sections. Each section captures specific categories of information.

Step 3: Reviewing and editing your form

Once completed, it is vital to review your form thoroughly. Common errors include simple math mistakes and misreported figures. Double-checking all numbers can help ensure that the form is accurate before submission.

Step 4: Submitting your form

After verifying all information, you have multiple methods for submission.

Lastly, confirm your submission, be it electronically or through mail, to ensure that your form has been received without issues.

Managing your submission

Once your 25th Annual Form is submitted, it’s important to manage and track its status effectively. Many taxpayers often want to know where their submission stands after filing.

How pdfFiller enhances your 25th annual form experience

Employing pdfFiller for your Notice of 25th Annual Form offers numerous advantages, streamlining the process significantly.

Frequently asked questions (FAQs)

Tax season can bring many questions regarding the submission and potential repercussions of the Notice of 25th Annual Form. Here are some common queries.

Additional tips for success with the 25th annual form

To ensure a smooth filing experience, consider these tips that can significantly enhance your ability to submit the Notice of 25th Annual Form accurately.

Connect with community resources

Building connections with others going through the same process can provide both support and valuable insights.

Quick links for easy navigation

By providing quick access to relevant tools and resources, pdfFiller ensures that you have everything at your fingertips.

Stay updated

Importantly, the landscape of tax forms and submissions can evolve. Staying updated is essential for compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice of 25th annual without leaving Google Drive?

Can I sign the notice of 25th annual electronically in Chrome?

Can I create an electronic signature for signing my notice of 25th annual in Gmail?

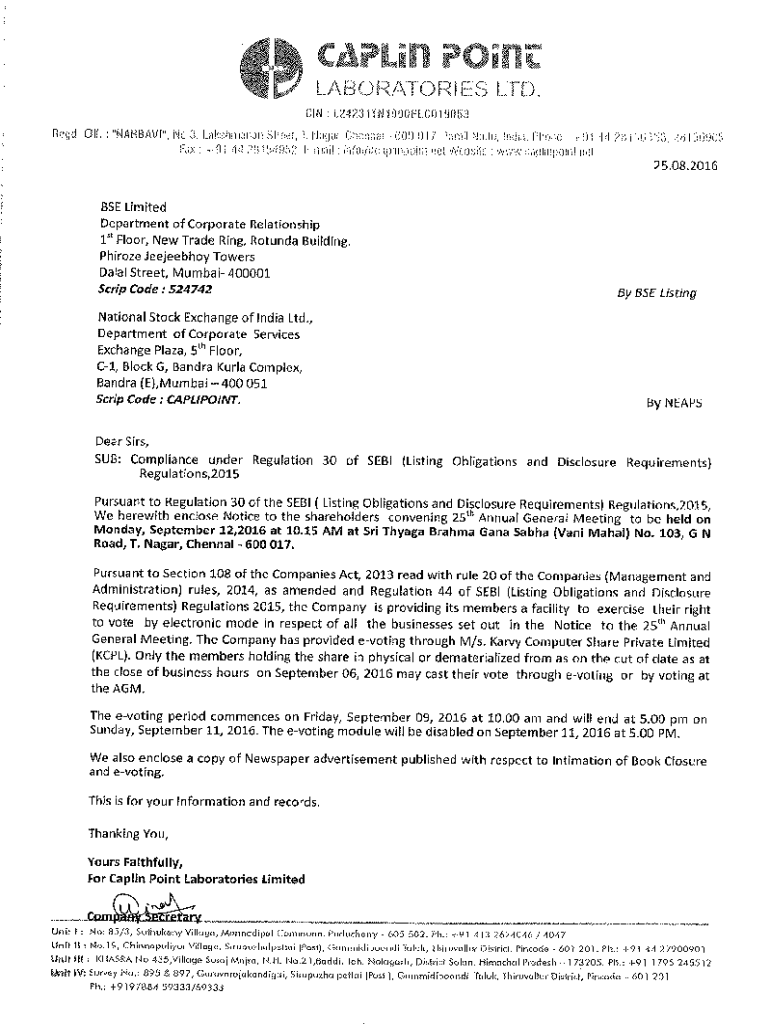

What is notice of 25th annual?

Who is required to file notice of 25th annual?

How to fill out notice of 25th annual?

What is the purpose of notice of 25th annual?

What information must be reported on notice of 25th annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.