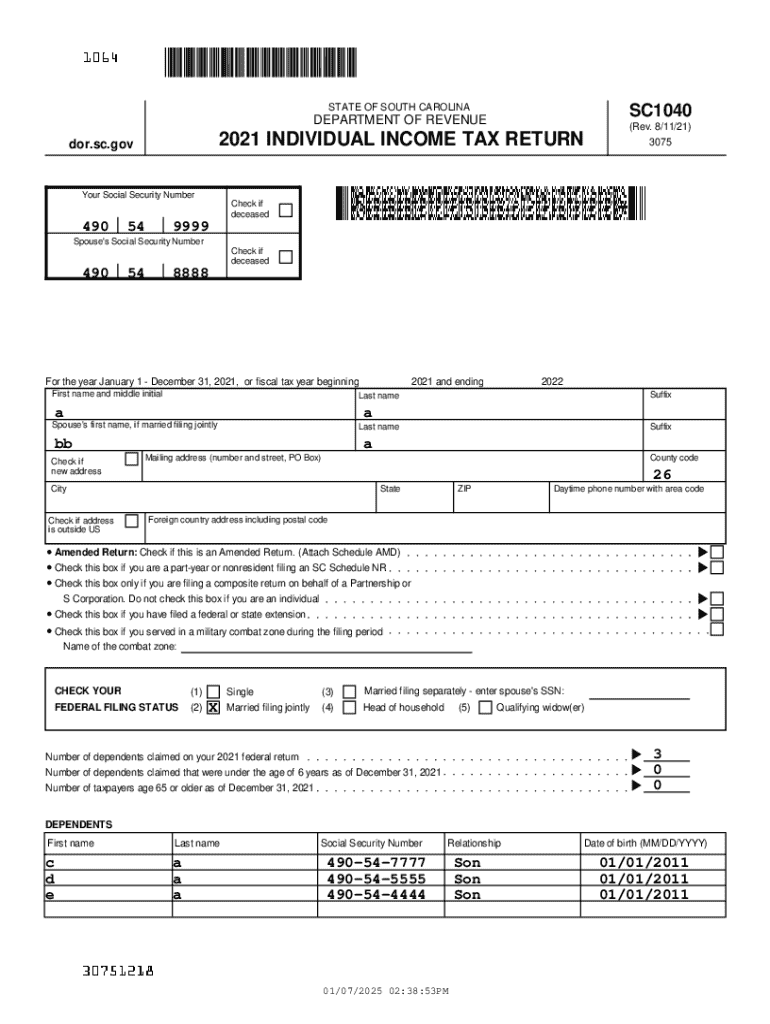

Get the free 2021 Individual Income Tax Return

Get, Create, Make and Sign 2021 individual income tax

Editing 2021 individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 individual income tax

How to fill out 2021 individual income tax

Who needs 2021 individual income tax?

2021 Individual Income Tax Form - How-to Guide

Understanding the 2021 individual income tax form

The 2021 individual income tax form is a critical document that U.S. taxpayers must complete to report their annual income to the Internal Revenue Service (IRS). The form, usually referred to as Form 1040, serves the essential purpose of calculating the taxpayer's tax liability based on their reported income, deductions, and credits. Accurate filing is not only crucial for compliance with tax laws but also helps prevent issues such as audits or penalties.

Filing taxes accurately is vital because the IRS relies on these forms to assess the tax owed by individuals. Mistakes or omissions on your 2021 individual income tax form can lead to fines or delayed refunds, emphasizing the need to understand every aspect of the form before submission.

Key features of the 2021 individual income tax form

The 2021 individual income tax form comprises several major sections, each playing a specific role in the tax reporting process. The main sections include:

In 2021, some changes from previous tax years included adjustments to deduction limits and new credits for taxpayers, such as the expanded Child Tax Credit, which impacted the overall tax filing experience.

Preparing to fill out the form

Before diving into filling out the 2021 individual income tax form, gathering essential documents is paramount. These documents help ensure that all income is reported accurately and eligible deductions are accounted for. Essential documents include the following:

Moreover, to ensure a smooth completion of your form, a checklist should be created. This list should include verifying personal information, confirming proper income documentation, and checking eligibility for deductions and credits to avoid omissions during filing.

Step-by-step instructions for filling out the form

Section 1: Personal information

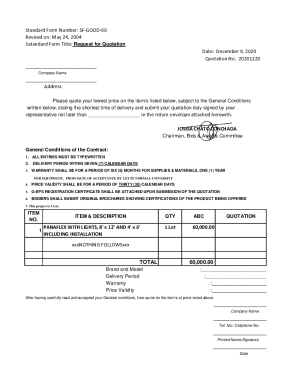

In the first section of the 2021 individual income tax form, you must correctly input your personal information. Ensure that your name, address, and Social Security number are accurate and match any previous tax documents. Choose your filing status correctly, based on whether you are single, married, or head of household.

Section 2: Income reporting

The income reporting section requires you to detail various sources of income. Wages will be listed from your W-2s, while income from freelance work or side jobs should come from 1099 forms. Ensure to report any additional types of income, such as investment profits or rental earnings, to provide a comprehensive overview of your earnings throughout the 2021 tax year.

Section 3: Calculating deductions and credits

In this key section, you need to decide whether to take the standard deduction or itemize your deductions. The standard deduction for single filers in 2021 was $12,550, while married couples filing jointly received $25,100. If you opt for itemization, collect your receipts and documentations to substantiate your claims. Additionally, consider the common credits available, such as the Earned Income Tax Credit or Child Tax Credit, as these can significantly reduce your tax liability.

Section 4: Review and double-check

Post completion, it's crucial to review all information for accuracy. Common mistakes to rectify include numerical errors, missed income, or incorrectly filing statuses that can have lasting impacts. Ensure that all forms referenced in the 2021 individual income tax form are attached to your submission. Utilizing tools such as pdfFiller can help to verify your form before submission, ensuring a thorough review process.

Tools for filling out the 2021 individual income tax form

Utilizing online tools can simplify the process of filling out your 2021 individual income tax form significantly. pdfFiller offers interactive features that allow users to easily edit PDF documents, ensuring a seamless document-handling experience. These tools provide benefits such as:

Navigating the pdfFiller platform is straightforward. Users can save their progress, share forms with others, and utilize step-by-step guidance for efficient form completion. This approach empowers users to become confident in managing their 2021 individual income tax form.

Managing your completed tax form

Once you've completed your 2021 individual income tax form, you must decide how to submit it. You have two main options: e-filing or mailing your forms. E-filing is increasingly popular due to its speed and efficiency, while mailing forms allows for traditional, physical submission.

For efficient record-keeping, keep copies of your submitted forms alongside any supporting documentation for future reference. After filing, you can track the status of your return online through the IRS website or by calling their office. Being prepared to respond to any inquiries from the IRS regarding your 2021 individual income tax form is also vital to ensure compliance and resolve any potential issues promptly.

Additional tax resources for the 2021 tax year

To support taxpayers in navigating their 2021 individual income tax form and other related issues, various supplementary tax resources are available. The IRS offers a plethora of materials on their website, including additional forms and schedules, educational content, and assistance hotlines. It's beneficial to visit these resources to familiarize yourself with specific state-specific tax requirements that may influence your filing process.

Moreover, community organizations and local tax agencies can provide crucial insights and local FAQs for taxpayers seeking further assistance.

FAQs for the 2021 individual income tax form

Taxpayers often have specific questions related to the filing of the 2021 individual income tax form. Common queries include inquiries about deadlines, eligibility for certain credits, and clarification on what constitutes taxable income. Familiarizing yourself with these frequently asked questions can alleviate anxiety and better prepare you for the filing process.

If you encounter common issues while filling out your form, consider consulting with tax professionals or utilizing online forums where experienced filers can offer troubleshooting tips and advice.

Connecting with tax professionals

While many individuals choose to file their own 2021 individual income tax form, certain situations may warrant the assistance of a tax professional. Complex tax situations, such as owning a business, dealing with multiple income streams, or encountering audits, benefit greatly from expert guidance.

Consulting a tax professional can offer you peace of mind, as they can navigate the intricacies of tax law and help you maximize deductions and credits, ultimately resulting in potential savings.

Staying informed: Updates in taxation for future years

Tax laws are subject to frequent changes, and staying updated on these changes can be beneficial for future filings. As you complete your 2021 individual income tax form, take note of any anticipated updates that may affect subsequent years, including adjustments to deduction amounts or new credits.

Regularly accessing reliable tax education resources and listening to IRS announcements will ensure you remain informed and ready for subsequent tax seasons.

Quick links and navigation

To streamline the process of accessing tax resources, consider compiling direct links to various helpful materials. Examples of these include links to IRS guidelines, tax calculators, and local tax offices. Quick access to these resources can facilitate timely resolution of any queries regarding the 2021 individual income tax form.

These resources are designed to empower individuals and teams seeking comprehensive, access-from-anywhere document creation solutions through pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2021 individual income tax without leaving Google Drive?

How can I send 2021 individual income tax for eSignature?

Can I create an eSignature for the 2021 individual income tax in Gmail?

What is individual income tax?

Who is required to file individual income tax?

How to fill out individual income tax?

What is the purpose of individual income tax?

What information must be reported on individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.