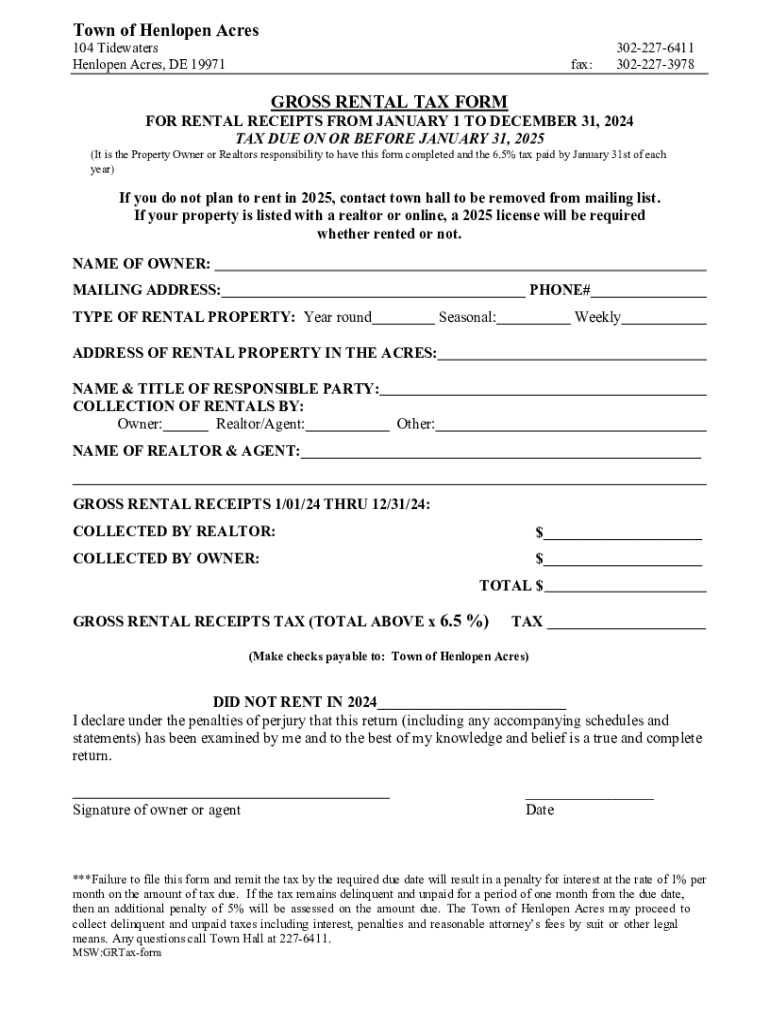

Get the free Gross Rental Tax Form - henlopenacres delaware

Get, Create, Make and Sign gross rental tax form

How to edit gross rental tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gross rental tax form

How to fill out gross rental tax form

Who needs gross rental tax form?

Your Comprehensive Guide to the Gross Rental Tax Form: Everything You Need to Know

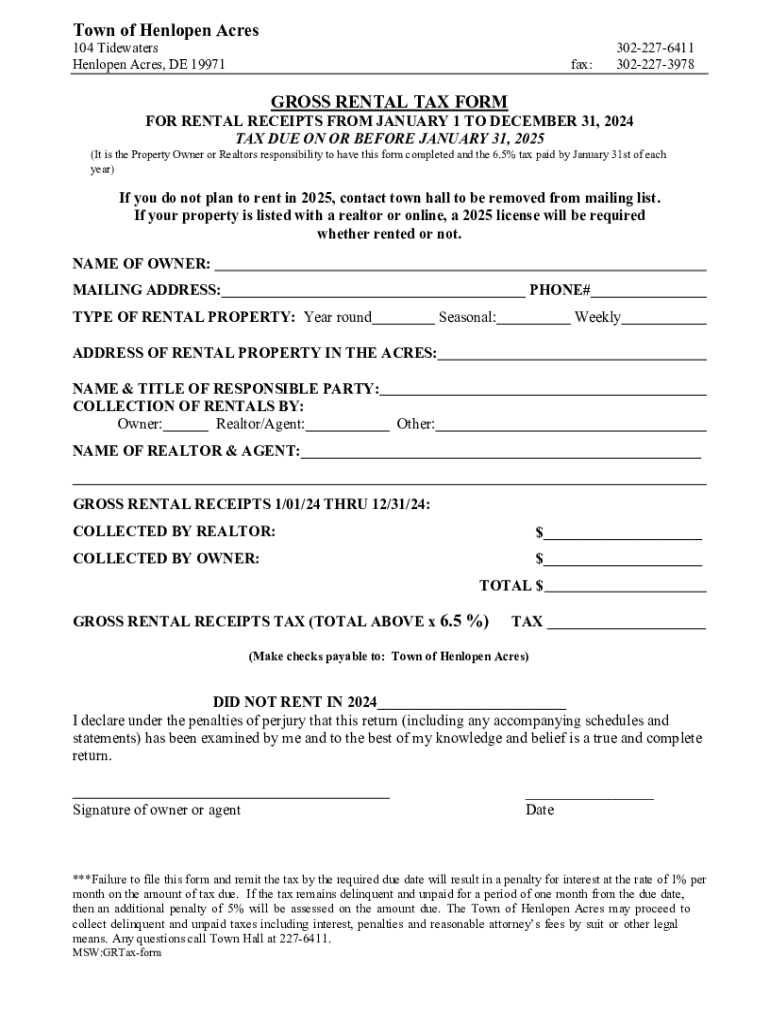

Understanding the gross rental tax form

The gross rental tax form is a crucial document for property owners reporting rental income to state or local tax authorities. This form captures all rental earnings without deductions for expenses, making it a pivotal tool in ensuring accurate tax compliance. For property owners, understanding this form is essential not just for fulfilling their legal obligations, but also for maximizing potential deductions on their taxes.

While the gross rental tax focuses solely on the income generated from rentals, it’s important to distinguish it from other forms of rental-related taxes, such as income tax or property tax. Each of these tax types serves different purposes and involves different rates and regulations, thus understanding how they interplay is beneficial for landlords.

Eligibility criteria for filing

Determining who needs to file the gross rental tax form hinges on property ownership and income generation. Generally, individuals or entities that receive rental income are required to file. This includes various types of properties, categorized broadly as follows:

In contrast, certain properties might not qualify for filing this tax form. For instance, properties used purely for personal purposes or those that do not generate any income are typically ineligible.

Preparing for filing

Filing the gross rental tax form requires thorough preparation. To get started, gather essential documents to ensure accurate reporting. Key documents include:

Be mindful of deadlines; late submissions can incur penalties. Most jurisdictions have specific filing dates, so check local regulations for your exact dates.

Step-by-step guide to filling out the gross rental tax form

Filling out the gross rental tax form involves several sections that require detailed information. Here's a breakdown for clarity:

Accuracy is paramount; double-check your entries to avoid common filing pitfalls, such as misreporting income or omitting essential details.

Editing the gross rental tax form

Modifying your gross rental tax form for clarity is easy with tools like pdfFiller. This platform allows users to edit PDF forms seamlessly, ensuring that your document is not only complete but also easy to understand.

Signing the gross rental tax form

Once your gross rental tax form is complete, it needs to be signed. Understanding the eSigning process is beneficial, as it may expedite form submission, especially when using pdfFiller’s electronic signature tools.

Legally, eSignatures hold the same weight as handwritten signatures in many jurisdictions. Ensure that your method of signing complies with local regulations. This guarantees your form's validity and acceptance by tax authorities.

Submitting your gross rental tax form

Once signed, the next step is submission. Depending on local regulations, you may have options for submission:

After submission, confirm that your form was received either through email acknowledgment or tracking status. Staying proactive helps eliminate uncertainties regarding your filing.

Post-filing procedures

After submitting your gross rental tax form, it's essential to manage any subsequent communications from tax authorities. Be prepared for potentially receiving requests for additional information or even audit notices. Respond promptly to these inquiries to avoid complications.

If you discover any errors post-filing, understand the process of amending your gross rental tax form. Amendments protect you from potential penalties, ensuring that your tax obligations remain accurate and compliant.

Tools and resources

To simplify the process of calculating and reporting your rental taxes, consider utilizing various tools and resources. Interactive calculators can help estimate the tax you owe based on your reported rental income.

Additionally, pdfFiller offers templates that streamline access to common forms. You can find official state and federal tax regulatory websites through their platform, allowing for easy navigation and compliance review.

Frequently asked questions (FAQs)

Many landlords often have the same questions when it comes to the gross rental tax form. Common inquiries typically cover areas like allowable deductions, protocols for reporting estimated income, and implications of late filing.

Providing clear answers to these questions can demystify the filing process and equip landlords with the information they need to navigate their responsibilities confidently.

Support and additional help

Finding support while managing the complexities of tax forms is vital. Through pdfFiller, users can access live support options to clarify any challenges faced during the filing process. Additionally, community forums provide a space to share experiences or ask questions from peers.

Learning opportunities such as webinars and tutorials are also available, helping users enhance their understanding and application of the gross rental tax form.

Latest updates and changes in rental tax regulations

The landscape of rental tax regulations can shift, making it essential for landlords to stay informed. Recent changes may impact the rates, allowable deductions, or filing processes for gross rental taxes.

Understanding these updates empowers property owners to remain compliant and capitalize on any new opportunities or incentives for tax relief.

Explore related topics

Property owners often benefit from understanding related tax obligations. For example, learning more about residential and commercial tax responsibilities can provide deeper insights into overall estate management. Related topics, such as real estate deductions or strategies for optimizing rental income reporting, can also enhance a landlord’s financial strategies.

By exploring these connections, landlords can not only enhance their filing expertise but also potentially increase their profitability.

Customer experiences and testimonials

User success stories highlight how pdfFiller streamlines the tax filing process for rental owners. Many users report increased confidence and efficiency when handling their forms digitally, thanks to the platform’s intuitive features.

Testimonials showcase a community of satisfied users who appreciate the ease of editing, signing, and managing their documents from a single, cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit gross rental tax form from Google Drive?

Can I create an electronic signature for signing my gross rental tax form in Gmail?

How do I complete gross rental tax form on an Android device?

What is gross rental tax form?

Who is required to file gross rental tax form?

How to fill out gross rental tax form?

What is the purpose of gross rental tax form?

What information must be reported on gross rental tax form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.