Get the free Billing Verification Form

Get, Create, Make and Sign billing verification form

Editing billing verification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out billing verification form

How to fill out billing verification form

Who needs billing verification form?

Billing Verification Form - How-to Guide

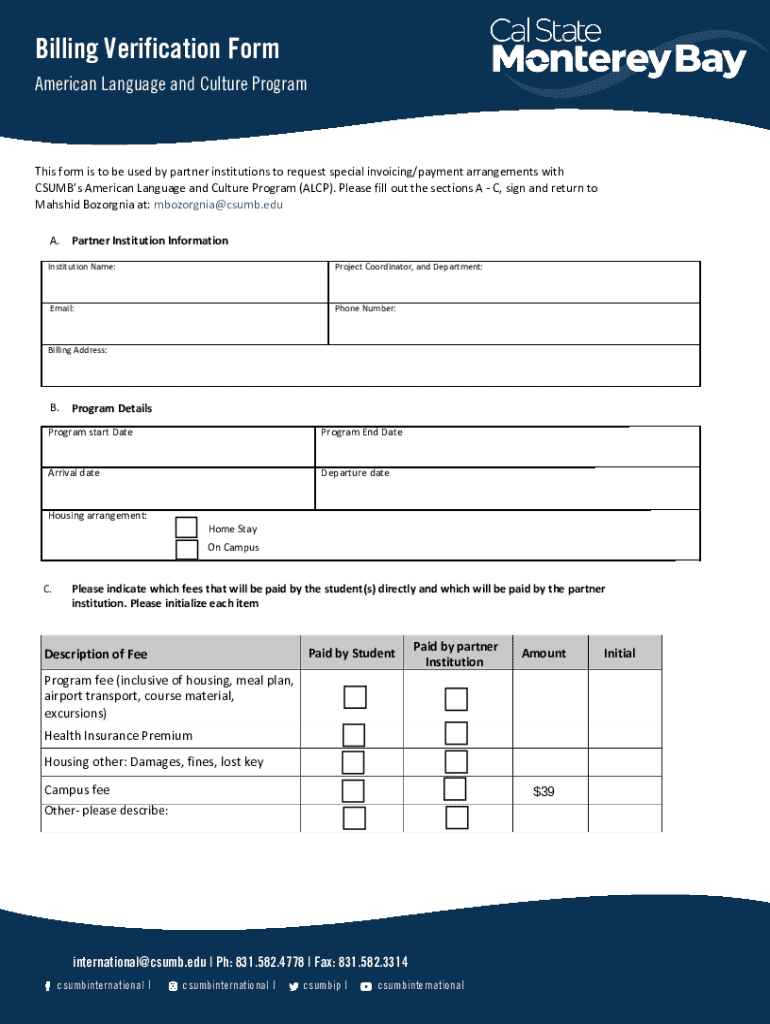

Understanding the billing verification form

A billing verification form serves as a crucial document designed to confirm the accuracy of billing information before services are rendered or payments processed. Its primary purpose is to ensure that the correct billing amounts are charged to the right parties, avoiding financial disputes or errors that can lead to significant headaches down the line. This form is indispensable in various industries, particularly healthcare, automotive, and rental sectors, where financial accuracy is paramount.

Accurate billing verification is not just a routine task; it plays a vital role in maintaining trust between patients, providers, and insurance companies. Miscommunication or inaccuracies can result in denied claims, delayed payments, or, worse, a damaged relationship between stakeholders. Hence, the billing verification form is crucial for all parties involved, ensuring that patient needs are met promptly and efficiently.

Components of the billing verification form

A well-structured billing verification form encompasses several essential fields, each serving a specific role in capturing necessary data. Start with patient information, which includes the patient’s name, date of birth, and contact information. This allows for easy identification and communication regarding their billing status.

Next, include insurance policy details such as the insurance provider's name, policy number, and the type of coverage. This section is critical, especially in the healthcare industry, where verification of benefits is necessary for service provision. Lastly, the form should specify the billing services requested, detailing the medical procedures, services, or products for which verification is being sought. The requirements can vary significantly based on the industry.

When to use the billing verification form

Several scenarios necessitate the utilization of a billing verification form. In healthcare, it’s often required before any medical services are rendered to ensure the patient's coverage is active and proper payment will be received. In the auto industry, billing verification is crucial when dealing with insurance claims, making sure all necessary details align before costs are incurred.

Rental housing also relies heavily on billing verification, commonly when new tenants apply or renew leases. Here, the form verifies the tenant’s eligibility based on their financial history. Each industry has its unique requirements and processes, underscoring the importance of utilizing the billing verification form appropriately and at the right time.

How to complete the billing verification form

Completing a billing verification form efficiently involves several structured steps. First and foremost, gather all necessary information, which may include identification documents, insurance cards, and any related prior billing statements. This foundational step ensures you’re equipped with all required data to fill out the form correctly.

Step two involves filling out the form accurately. Pay close attention while entering patient and insurance details, as discrepancies can lead to unnecessary complications. Common mistakes include typographical errors in policy numbers or outdated patient information. Be meticulous to avoid these pitfalls.

Once filled, proceed to contact relevant parties like insurance companies or billing departments if verification is needed. Here’s where it’s essential to draft clear and concise communication. Follow up with calls or emails ensuring all queries are addressed.

Step four is verifying coverage and eligibility. This process may involve checking online on the insurance provider’s portal or calling their helpline to confirm specific benefits. Document and record all verification results meticulously for future reference. Lastly, keep a proactive mentality; if issues arise, follow up accordingly.

Best practices for using billing verification forms

Employing best practices in billing verification forms can dramatically enhance accuracy and efficiency. First, keep the forms regularly updated to reflect all current patient and insurance information. This step ensures that the verification process is based on the most reliable data, reducing errors in billing or coverage discrepancies.

Regarding format, consider whether to utilize electronic or paper forms. Electronic forms offer the advantage of easy sharing and editing, while paper forms may be better suited for environments where digital access is limited. Integrating the billing verification process into routine administrative workflows will ensure that it becomes a seamless part of operations rather than an afterthought.

Billing verification across industries

Each industry has unique billing verification requirements and complexities. In healthcare billing verification, for instance, pertinent patient data and precise insurance verification are essential. Complexities arise with inconsistent coverage policies and constantly changing healthcare regulations. A successful billing verification method in a clinic setting might include automated systems that link directly to insurance databases, facilitating quicker confirmations.

The auto industry faces its nuances; unique documentation is often required for claims. An efficient process must address potential disputes over costs transparently, ensuring that all parties are aware of their responsibilities. Similarly, in rental housing, drafting comprehensive verification forms is important. These forms help property managers assess tenant eligibility while ensuring compliance with relevant regulations.

Common challenges and solutions

Challenges can arise during the billing verification process, particularly when there are discrepancies in billing information. These inconsistencies can lead to rejected claims from insurance providers or delays in payment acknowledgments. The key to addressing discrepancies lies in meticulous record-keeping and regular audits of billing information against insurance policies.

In cases where billing verification claims are rejected, it’s essential to understand the reasons behind denials. Often, incorrect codes or missing information lead to these issues. Establishing clear communication with insurance representatives can help clarify misunderstandings and facilitate quicker resolutions.

FAQs about the billing verification form

Failing to utilize a billing verification form can result in significant setbacks, including denied services and delayed payments. Users often inquire about the frequency of billing verification; ideally, such checks should occur every time a new service is initiated or if there are changes in coverage.

The responsibility for the billing verification process typically falls on administrative staff or designated billing professionals within an organization. As businesses grow, managing multiple billing verification forms across different departments becomes critical. Streamlining this process can enhance efficiency and prevent information overload.

Tools and resources for effective billing verification

There are numerous digital management platforms available that facilitate the effective handling of billing verification forms. Platforms like pdfFiller provide robust capabilities for users to seamlessly create, edit, eSign, and collaborate on billing documents. These cloud-based solutions enhance efficiency by allowing for document management from anywhere.

Moreover, utilizing interactive tools can enhance the process of creating and filling out forms online. Features such as templates and automatic status updates ensure that users stay informed throughout the billing verification process, leading to more streamlined operations.

Success stories

Numerous users have optimized their administrative processes through effective utilization of billing verification forms. Testimonials from healthcare providers highlight a reduction in billing errors and improved patient satisfaction due to quicker verification processes. A particular case study from a clinic reveals that by incorporating a digital billing verification system, they reduced claim denials by over 30%, consequently expediting patient service delivery.

These success stories not only demonstrate the tangible benefits of implementing such practices but also encourage others to streamline their processes. By adopting modern tools like pdfFiller, organizations can witness a significant transformation in how they manage billing verifications, providing clearer benefits to stakeholders and clients.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify billing verification form without leaving Google Drive?

Where do I find billing verification form?

How do I fill out the billing verification form form on my smartphone?

What is billing verification form?

Who is required to file billing verification form?

How to fill out billing verification form?

What is the purpose of billing verification form?

What information must be reported on billing verification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.