Get the free Understanding Tax Credit Communities

Get, Create, Make and Sign understanding tax credit communities

Editing understanding tax credit communities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding tax credit communities

How to fill out understanding tax credit communities

Who needs understanding tax credit communities?

Understanding Tax Credit Communities Form

Overview of tax credit communities

Tax Credit Communities are initiatives designed to stimulate the development of affordable housing through various tax credits provided by both federal and state governments. They aim to alleviate the housing crisis by incentivizing developers and investors to create low-income housing options. Understanding the nuances of tax credit communities, including the types of credits available, is crucial for stakeholders involved in housing development.

The importance of tax credits in affordable housing development cannot be overstated. They offer significant financial incentives that make it feasible for developers to invest in projects that serve low and moderate-income populations. Tax credit programs, such as the Low-Income Housing Tax Credit (LIHTC), have proven effective in increasing the stock of affordable rental units across various communities.

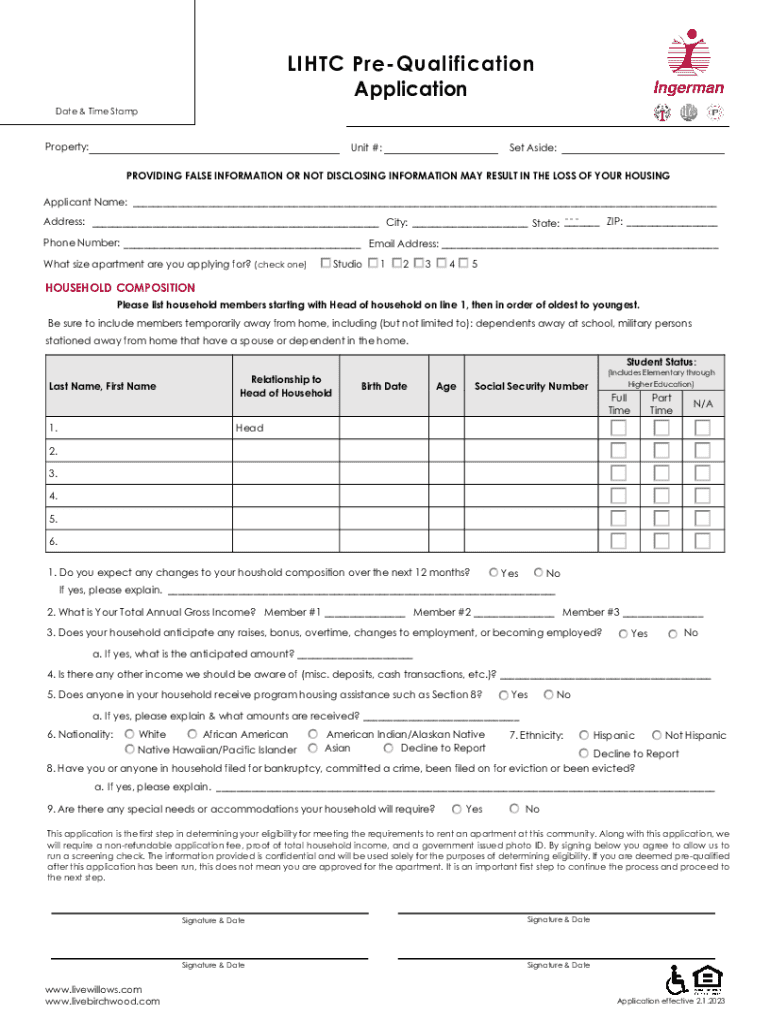

Understanding the tax credit communities form

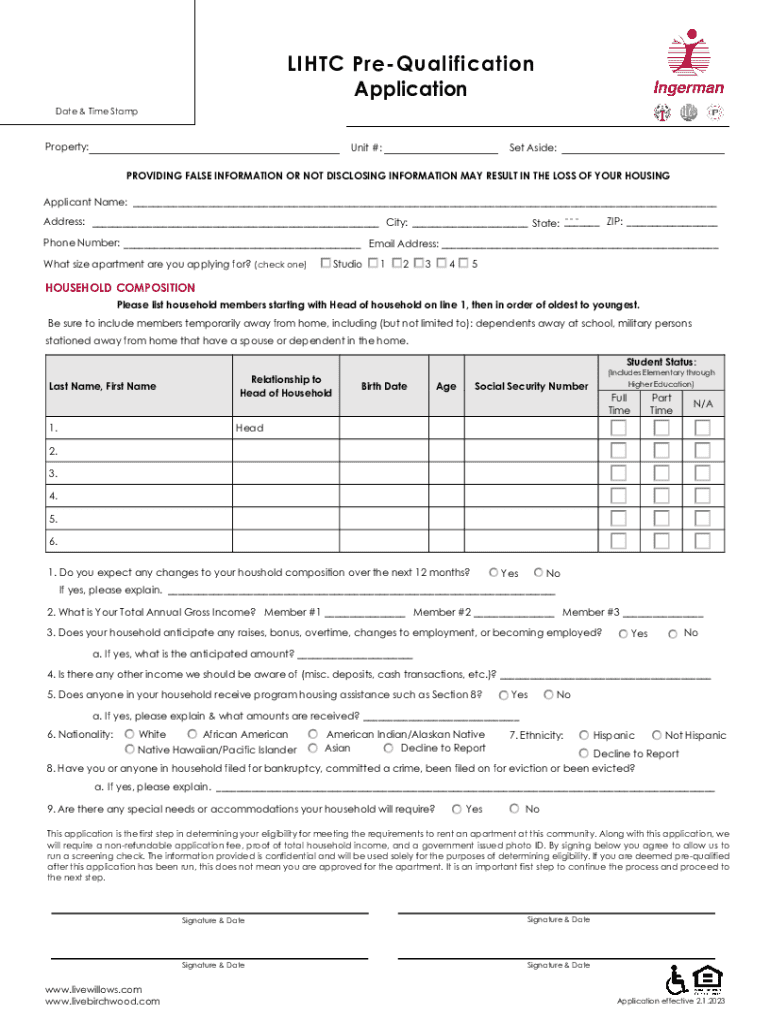

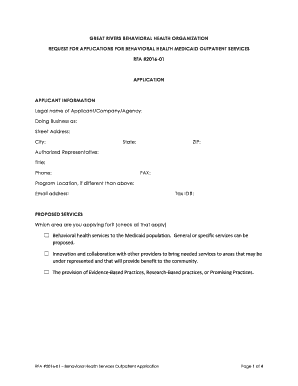

The Tax Credit Communities Form is a crucial document used in the application process for accessing tax credits. It serves as an official submission that compiles all required information about a project, its financials, and compliance measures. This form is essential not only for application submission but also for ensuring that projects meet eligibility and compliance criteria set by regards to tax credit allocation.

This form streamlines the process of gathering essential information in one location, making it easier for applicants to present a cohesive overview of their project. Understanding and accurately completing the Tax Credit Communities Form is vital for securing funding and approvals necessary for affordable housing initiatives.

Components of the tax credit communities form

The Tax Credit Communities Form comprises several key sections designed to capture comprehensive project details. Each component must be filled out meticulously to facilitate a successful application. Below, we break down the sections of the form.

A. General information section

This section collects crucial information about the applicant, including names, organization details, and contact information. Accuracy is essential here since any discrepancies can lead to processing delays or rejections.

B. Project details

Project details focus on the specific nature of the undertaking. It is essential to describe the type of projects eligible for tax credits, such as new constructions, renovations, or adaptive reuse projects. Required documentation must also be included to support these project claims.

. Financial information

Accurate financial reporting is crucial to demonstrate the viability of the project. This section requires comprehensive financial details, including a budget overview, funding sources, and projected revenues. It must also be supported by various financial documents such as tax returns and pro forma statements.

. Compliance information

Compliance is a critical component, ensuring that all project aspects align with relevant guidelines and laws. The form requires documentation to verify compliance with local zoning laws, building codes, and any financial regulatory requirements.

Step-by-step guide to completing the tax credit communities form

Completing the Tax Credit Communities Form may seem daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide to help ensure your application is complete and accurate.

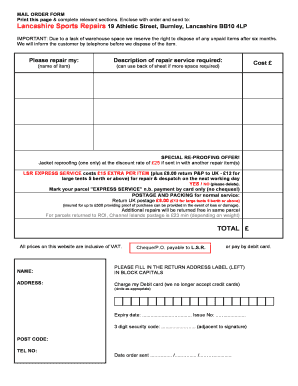

Step 1: Gathering necessary documents

Before starting the form, prepare all related documents. This includes financial statements, project proposals, and compliance letters. Organizing these documents in advance will save time and reduce the headache of searching for information at the last minute.

Step 2: Completing each section of the form

Filling out each section of the form requires careful attention to detail. Here’s a breakdown of what to do in each part:

Step 3: Reviewing your form for accuracy

Before submission, thoroughly review your form. Errors can delay processing or lead to rejections. Use a detailed checklist to ensure that everything has been completed accurately.

Step 4: Submitting the form

Understanding the submission process is crucial. Forms can typically be submitted digitally or in paper format, depending on the specific guidelines set forth by the administering body.

Additional tools and resources

Access to various tools and resources can significantly enhance your ability to complete the Tax Credit Communities Form seamlessly. Interactive tools assist in filling out forms accurately, while additional resources enable users to manage document workflows efficiently.

Managing your tax credit application

Once the application is submitted, managing its progress is important. Keeping track of application status, ensuring documentation retention, and knowing where to turn for assistance can streamline the process.

Understanding related documentation

In addition to the Tax Credit Communities Form, additional documentation may be required to strengthen your application. Understanding these requirements can significantly improve your chances of approval and ensure comprehensive compliance with regulations.

Support and contacts for assistance

Navigating the complexities of the Tax Credit Communities Form can be challenging, but numerous resources exist to assist you. Reaching out for support can provide clarity and enhance your application process.

Further opportunities related to tax credits

Beyond the initial application, there are numerous opportunities to expand your understanding and leverage tax credits more effectively. Engaging with additional programs, workshops, and webinars can foster knowledge and innovative approaches to housing development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get understanding tax credit communities?

How do I make changes in understanding tax credit communities?

How can I edit understanding tax credit communities on a smartphone?

What is understanding tax credit communities?

Who is required to file understanding tax credit communities?

How to fill out understanding tax credit communities?

What is the purpose of understanding tax credit communities?

What information must be reported on understanding tax credit communities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.