Get the free Understanding Tax Credit Communities - Nj Only

Get, Create, Make and Sign understanding tax credit communities

Editing understanding tax credit communities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding tax credit communities

How to fill out understanding tax credit communities

Who needs understanding tax credit communities?

Understanding Tax Credit Communities Form

Overview of tax credit communities form

The Tax Credit Communities Form is a vital document that allows organizations to apply for federal or state tax credits intended to support community development and low-income housing initiatives. These credits are designed to incentivize investment in underserved areas, ultimately improving economic opportunities and living conditions for residents.

Tax credits play a crucial role in community development by reducing tax liabilities for investors who fund projects that bring significant benefits to their communities. This form serves as a gateway for applicants to access these financial incentives, encouraging the development of affordable housing, recreational facilities, and various community-oriented projects.

Eligibility criteria for tax credit communities

To qualify for the Tax Credit Communities Form, applicants must meet specific eligibility requirements. These requirements ensure that the funds are distributed to projects that genuinely support low-income individuals and communities.

Income requirements for applicants typically stipulate that the individual or organization must demonstrate financial need, which generally aligns with local median income levels. Projects focused on low-income housing are especially prioritized for funding.

Types of projects eligible for funding include affordable housing developments, economic stimulation initiatives, and community resource centers. Applicants must also be cognizant of geographic limitations as some programs restrict funding to certain municipalities or regions.

In addition, special provisions often exist for low-income housing initiatives. These may include streamlined application processes or reduced requirements for documentation to facilitate quick and efficient funding.

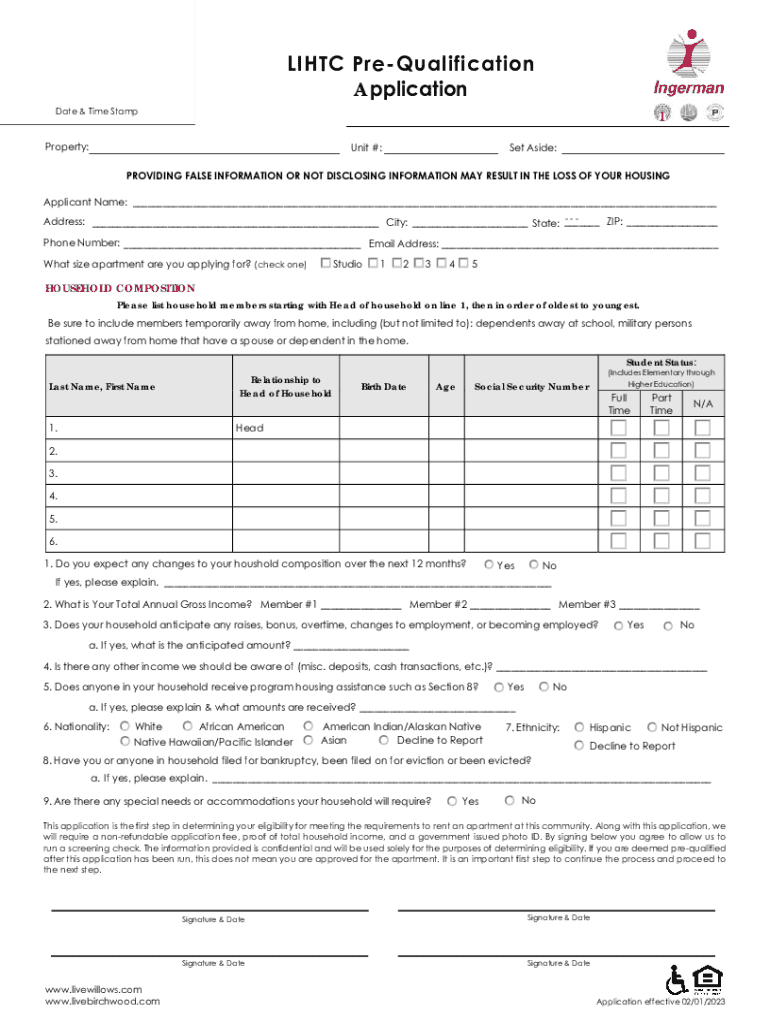

Step-by-step instructions for filling out the tax credit communities form

Filling out the Tax Credit Communities Form can be daunting, but following a structured approach helps simplify the process. Preparation is key, starting with the collection of necessary documents.

Once documents are in order, applicants should move on to the form itself. It's divided into several sections, each focusing on different information.

Common mistakes often arise during form completion, such as incomplete information or discrepancies between documents and form entries. Double-checking information and ensuring all required fields are filled can minimize such errors.

Tools for editing and managing the tax credit communities form

pdfFiller offers a comprehensive platform for managing and editing the Tax Credit Communities Form. With its user-friendly features, applicants can streamline the form completion process.

To ensure compliance with regulatory guidelines, pdfFiller provides tools and resources that help users verify their submissions meet all necessary requirements before submission.

Submission process for tax credit communities form

Once the form is completed, understanding the submission process is vital for ensuring timely processing. The submission should be sent to the appropriate governmental agency that oversees tax credit allocations, and it's crucial to adhere to their specific guidelines.

Important deadlines vary based on the funding cycle, so being aware of timelines is crucial for successful application submissions. Applicants should also track their application status through the agency's online portal, allowing them to confirm receipt and check for any updates.

Post-submission management

After submitting the Tax Credit Communities Form, applicants can expect a review period. Understanding this timeframe is essential for planning, as review durations can vary. During this time, applicants may receive follow-up questions or requests for additional details.

In case of approval, applicants will receive confirmation as well as guidelines detailing next steps to access funds. Conversely, if the application is denied, the reviewer typically provides feedback on the reasoning, which can be useful for making improvements in future submissions.

Ancillary forms and documents required

Applicants should prepare additional forms that complement the Tax Credit Communities Form to bolster their applications. These may include documentation necessary for a comprehensive assessment of the project’s needs.

Resources for ongoing support and guidance

Finding guidance throughout the tax credit application process can be beneficial. Connecting with tax credit advisors who specialize in these projects can provide invaluable insights into successful applications.

Additionally, community workshops and webinars often educate potential applicants on best practices and recent changes in tax credit regulations. Many of these resources also include a FAQ section to address common queries, ensuring applicants remain informed.

Links to relevant agencies also play a critical role, as they often provide contact information for further assistance and clarifications regarding the Tax Credit Communities Form.

Case studies of successful applications

Examining real-life examples of applications successfully funded through the Tax Credit Communities Form can provide valuable lessons for future applicants. One noteworthy case involved a community center that used tax credits to create affordable housing units.

This project received $1 million in funding, greatly enhancing the services available to local residents. The ripple effect included job creation and increased economic activity, which underscores the substantial impact tax credits can have on community revitalization.

Future changes and updates to tax credit programs

Staying informed about potential changes to tax credit programs is essential for applicants. Recent legislative modifications can significantly affect tax credit allocations, impacting funding availability for future projects.

As programs evolve, being aware of upcoming updates or changes will help applicants stay competitive. These insights often come through newsletters, webinars, or state agency announcements.

Engaging in platforms that discuss tax credit news can also foster connections with professionals who monitor these developments closely.

Join the community of tax credit professionals

Networking with tax credit professionals offers numerous advantages. Engaging with peers in the community allows applicants to share experiences, resources, and strategies that can enhance their applications.

Joining professional organizations focused on tax credits can yield benefits such as access to exclusive resources, continuing education opportunities, and more robust support systems. Online forums and discussion groups can also serve as valuable platforms for collaboration and networking among those involved in the tax credit landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit understanding tax credit communities on a smartphone?

How do I fill out understanding tax credit communities using my mobile device?

How do I edit understanding tax credit communities on an Android device?

What is understanding tax credit communities?

Who is required to file understanding tax credit communities?

How to fill out understanding tax credit communities?

What is the purpose of understanding tax credit communities?

What information must be reported on understanding tax credit communities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.