Get the free Matching Gift Form

Get, Create, Make and Sign matching gift form

How to edit matching gift form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gift form

How to fill out matching gift form

Who needs matching gift form?

Matching gift form how-to guide

Understanding matching gifts

Matching gifts are a powerful philanthropic tool that allow employees to double or even triple their charitable contributions to nonprofit organizations. When a donor makes a donation to an eligible charity, their employer matches that gift, significantly amplifying the impact of the donor's contribution. This system not only incentivizes charitable giving but also enhances the partnership between companies and nonprofits.

The mechanics behind matching gifts involve employers setting aside funds to match donations made by employees to specific organizations. Typically, companies have predefined guidelines outlining which organizations qualify, the maximum match amount, and the process for submitting matching gift forms. Understanding how these gifts work is crucial for donors eager to maximize their charitable efforts.

Matching gift forms serve as the bridge between employees' donations and the corresponding company matches. These forms are essential because they ensure that the donating employee receives the full benefit of both their contribution and their employer's support, creating a direct impact on fundraising efforts for the nonprofit.

Exploring the matching gift form

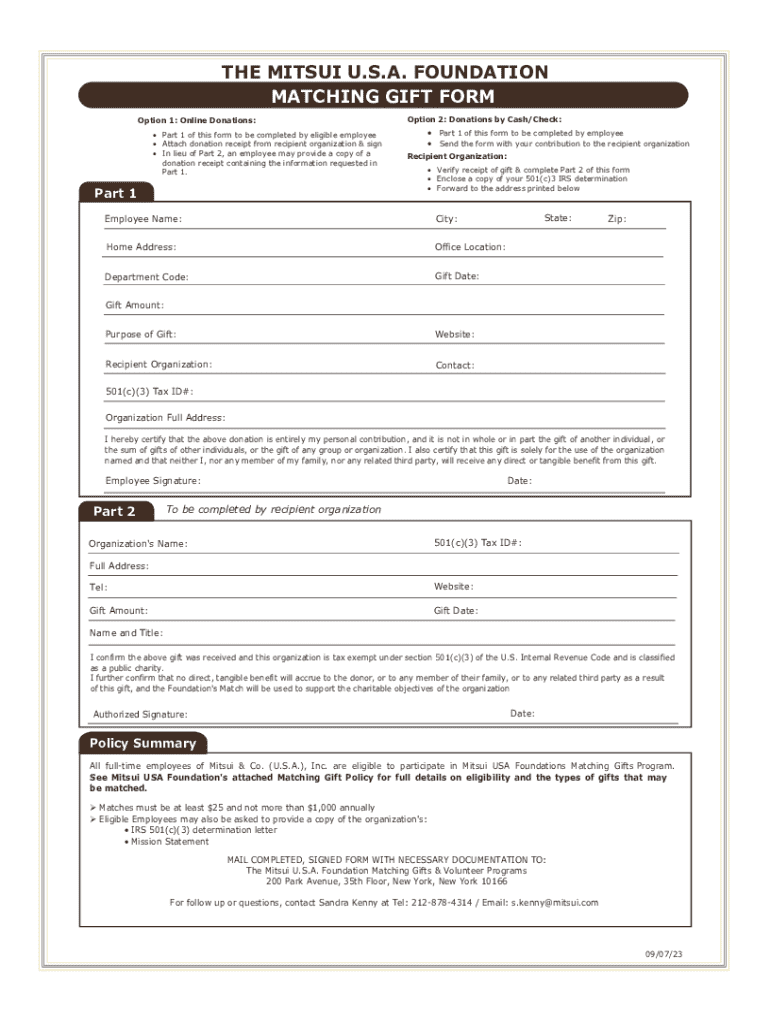

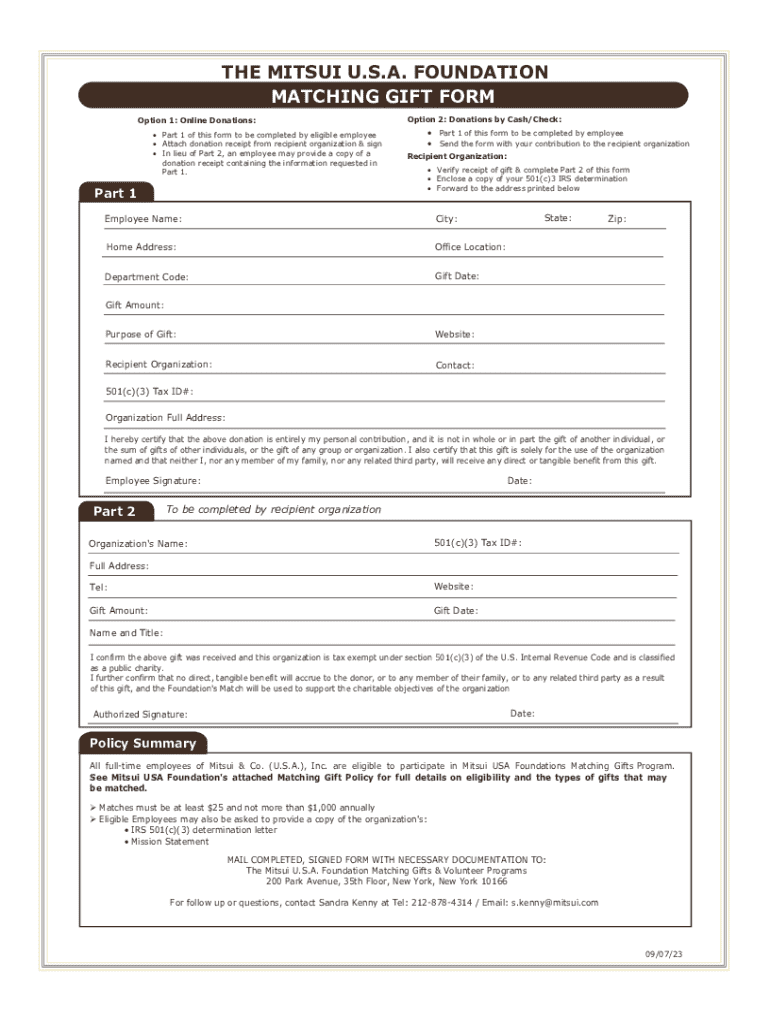

A typical matching gift form comprises several key components that facilitate the verification and processing of matching gifts. The most important elements include the donor's name, the name of the recipient organization, the amount donated, and the company's matching gift policy specifics. It is essential to pay attention to these components to ensure a smooth submission process.

Matching gift forms can come in various types, each catering to different submission preferences:

How to fill out a matching gift form

Filling out a matching gift form can be straightforward if approached methodically. Here’s a step-by-step guide to ensure successful submission:

After your submission, consider following up with your HR department or the nonprofit to confirm that the matching gift request has been processed.

Matching gift databases and tools

Matching gift databases play a vital role in simplifying the form-filling process. These databases contain comprehensive lists of companies, their matching contributions, and eligibility requirements. They help donors verify if their employer matches donations and assist in gathering pertinent information for filling out matching gift forms.

Some popular matching gift databases include:

Additionally, interactive tools like pdfFiller’s editable forms are invaluable. Users can create, edit, and manage their matching gift forms on a single, cloud-based platform. This approach not only streamlines the process but also boosts efficiency and helps in tracking submissions.

Frequently asked questions (FAQs)

Many donors hold misconceptions about matching gifts that can prevent them from participating effectively. Addressing common questions is crucial. For instance, some may wonder whether their donations to smaller or local charities are eligible for matching gifts. Others might not know that certain types of donations or events, like sponsorships or gala tickets, may not qualify.

Resources are available to verify eligibility for both donors and nonprofits. Websites like Charity Navigator or GuideStar can provide clear insights into nonprofit organizations’ matching gift policies.

In unique situations, such as international donations, it's essential to consult with the company's HR department. They can offer guidance tailored to specific cases and help facilitate the process.

Case studies: Successful matching gift campaigns

To illustrate the positive impact of matching gifts, consider notable organizations like the American Red Cross, which experienced a substantial increase in donations during their matching gift campaigns. By leveraging the power of matching contributions, they successfully encouraged donors to engage further.

Donor testimonials highlight the value of these initiatives. For example, a donor from a tech company shared how matching gifts transformed their giving experience: "Knowing that my employer matched my gift made me feel like my contribution had a much larger impact. It's a simple but powerful way to amplify your generosity."

For nonprofits: Maximizing matching gifts

Nonprofits can significantly benefit from promoting matching gift programs. Educating donors about such opportunities is vital. Placing clear instructions on donation pages, including easy access to matching gift forms, can simplify the process for donors.

Strategies for encouraging donors to submit forms include:

By leveraging technology and maintaining open communication, nonprofits can increase the number of matching gift submissions and, consequently, their fundraising success.

For companies: Best practices for aligning with nonprofits

Companies play an essential role in supporting matching gift initiatives. By establishing clear and accessible matching gift policies, businesses can encourage employee participation. Best practices include providing comprehensive guides to employees on the process and expectations of matching gifts.

By setting up an efficient matching gift program, companies can reap several benefits:

Ultimately, companies should view matching gift policies as a means to foster a culture of giving and engagement within their workforce.

Resource hub

A comprehensive glossary can help clarify terms commonly associated with matching gifts and forms. Terms like "eligibility criteria," "donor-advised fund," and "authority levels" can be especially beneficial for individuals navigating this space.

Essential links and tools for further exploration include:

Connecting with donors and nonprofits

Engaging with both donors and nonprofits through online platforms enhances awareness about matching gift initiatives. Communication plays a pivotal role; companies and nonprofits should collaborate in fostering repeat engagement with potential donors.

Building long-term relationships can be achieved by effectively marketing matching gift programs, providing clear instructions, and sharing success stories that highlight the impact of such efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the matching gift form in Gmail?

How do I edit matching gift form on an Android device?

How do I fill out matching gift form on an Android device?

What is matching gift form?

Who is required to file matching gift form?

How to fill out matching gift form?

What is the purpose of matching gift form?

What information must be reported on matching gift form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.