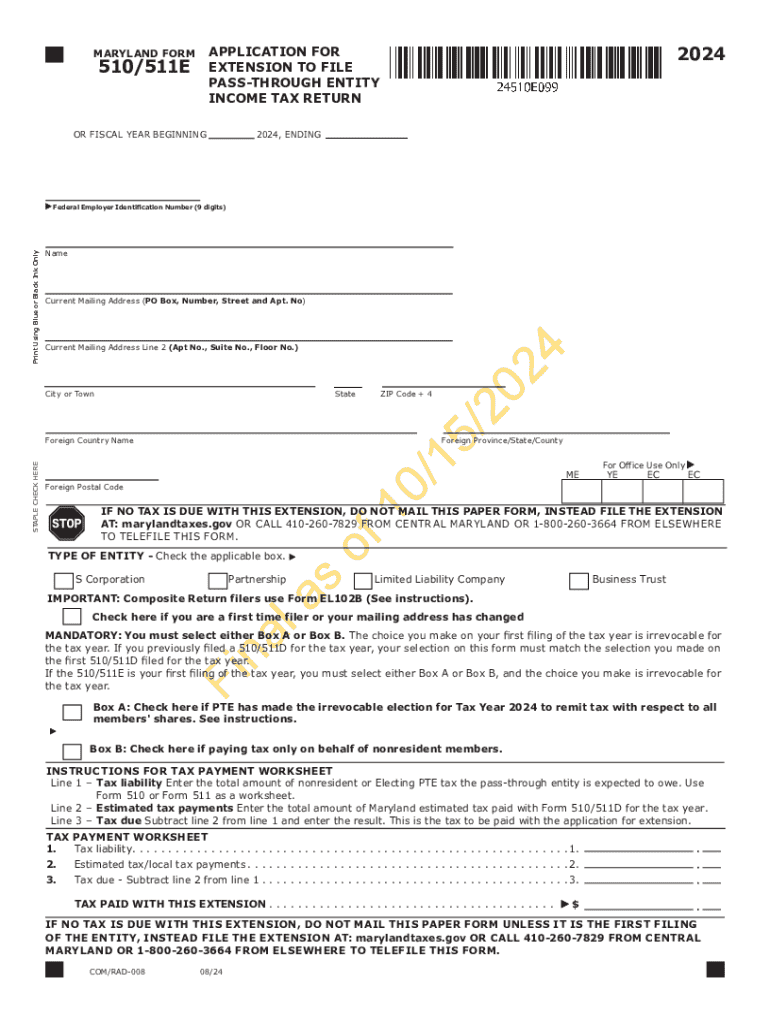

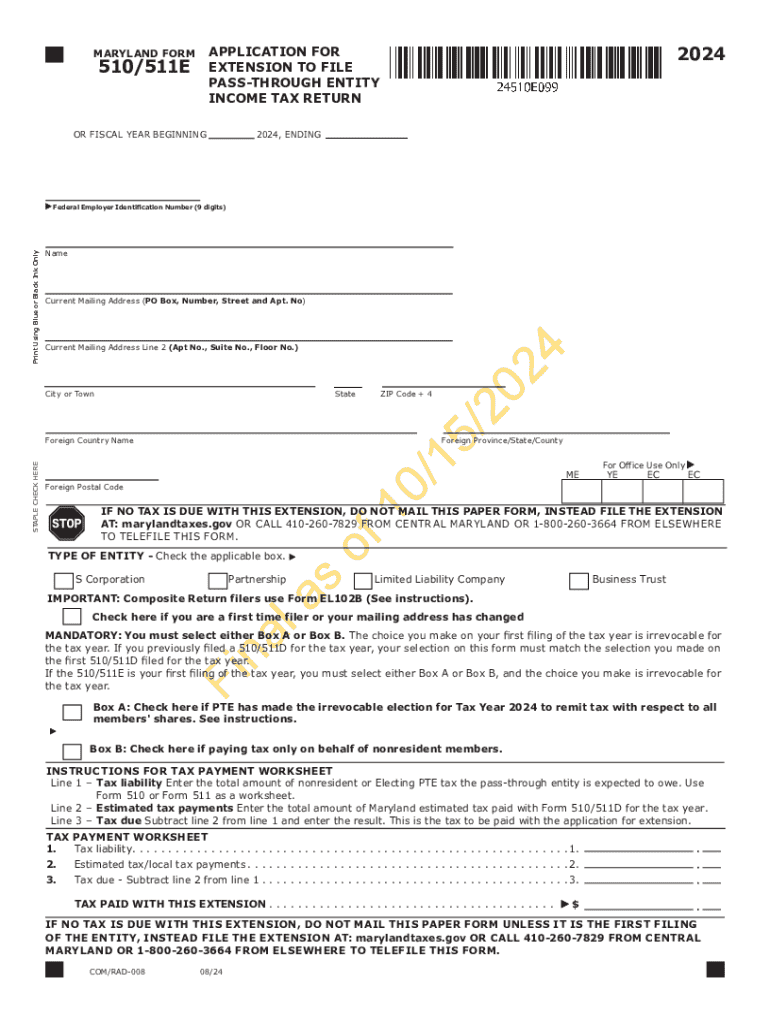

Get the free Application for Extension to File Pass-through Entity Income Tax Return

Get, Create, Make and Sign application for extension to

How to edit application for extension to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for extension to

How to fill out application for extension to

Who needs application for extension to?

Application for extension to form: A comprehensive guide

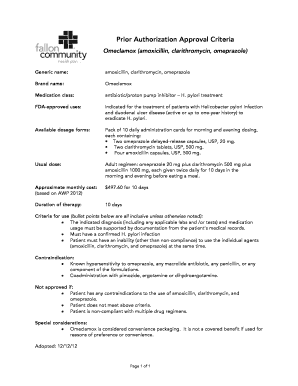

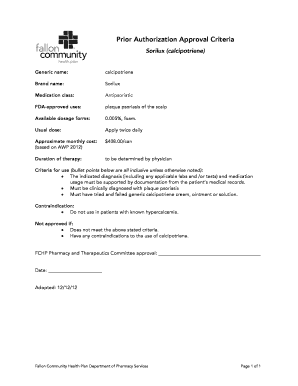

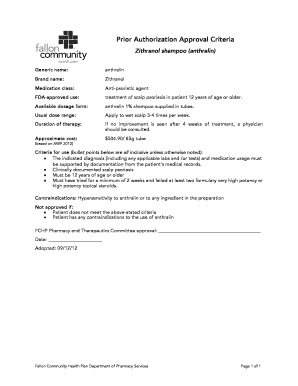

Understanding application for extension

An application for extension allows individuals and organizations to request additional time to submit necessary forms or documents, such as tax filings or other compliance-related forms. The primary purpose of an extension application is to provide flexibility in meeting deadlines, which can be critical for ensuring that all required information is accurate and comprehensive. Timely submissions of extension applications are crucial, as they can help avoid penalties associated with late filings and keep entities in good standing with regulatory authorities.

Eligibility for filing an extension

Many individuals and entities can apply for an extension on various deadlines. Generally, those eligible include individual taxpayers, small businesses, and corporations who need additional time for submitting tax returns and other forms. Situations that warrant filing for an extension could involve complex financial situations, the need for additional documentation, or significant life events that impact one’s ability to file on time.

Key benefits of applying for an extension

Submitting an application for extension offers several advantages. First, it helps individuals and businesses avoid penalties for late filing, which can accumulate quickly and create financial strain. Additionally, it provides extra time for accurate document preparation, allowing for a thorough review of financial documentation before submission. This is particularly valuable during peak filing periods when many may feel rushed.

Moreover, having an extension can significantly reduce stress. The additional time can allow for better organization and deliberation, which leads to fewer mistakes. After all, submitting accurate forms is crucial for compliance and maintaining a favorable standing with authorities.

Detailed step-by-step guide to applying for an extension

Navigating the process of applying for an extension can be straightforward if approached with clarity. Below is a detailed step-by-step guide to assist you in successfully filing an extension.

Submitting your application

Submitting your extension application can be done efficiently through modern platforms. For those who prefer online filing, tools like pdfFiller provide streamlined options. You can directly upload your completed application and submit it electronically, simplifying the process and saving time.

Alternatively, for those who opt for traditional methods, mailing the application is still a viable option. However, this route may require more attention to details such as postage and ensuring that the application is sent with ample time to reach the office before the deadline.

Payment requirements

When applying for an extension, be aware of any associated fees that may apply. These fees can vary depending on the form and jurisdiction. Moreover, knowing your payment methods can also expedite the process. With pdfFiller, options for payment are diversified, allowing for credit/debit card transactions and alternative online payment methods.

Additionally, consider the financial implications of filing for an extension and plan accordingly. Any delay in filing can carry penalties, so it's wise to ensure that you are aware of all possible costs.

FAQs about extension applications

The process of applying for an extension can raise several questions. Here are common inquiries that many applicants have.

Common mistakes to avoid when filing for an extension

Avoiding common pitfalls when applying for an extension can save you time and trouble. One of the most frequent mistakes includes missing key details on the forms, which may delay processing or lead to outright rejections.

Incorrect submissions can occur, especially when deciding between online and paper filing methods. Additionally, understanding state-specific requirements is crucial, as not all states have the same protocols for extensions. Familiarizing yourself with these can help streamline the process.

Tips for managing documentation post-extension application

Once your extension application is submitted, it's essential to manage your documentation efficiently. Organizing the documents required for further tax preparations can help ensure that you are ready when the new deadline arrives.

Using tools like pdfFiller can assist in editing and managing these documents effectively. The platform offers collaborative features, allowing teams to work together seamlessly on shared files, even if working remotely.

Managing deadlines after filing for an extension

Understanding your new deadline is essential in the extension process. After submitting your application, make sure to note down the new due date for your filings and set reminders accordingly.

Planning further actions post-extension can also be critical. Whether it involves gathering more documents, consulting a tax professional, or ensuring that your finances are in order, establishing a plan can help mitigate stress.

Leveraging technology for seamless filing

Technological advancements have transformed the extension filing process, simplifying it significantly. Platforms like pdfFiller not only streamline the submission but also provide interactive tools for document management, ensuring greater accuracy and efficiency.

The cloud-based platform allows for access from anywhere, facilitating real-time collaboration among teams or individuals. This capability is invaluable for those who need to share documents without the constraints of physical meetings or signings.

Conclusion

In summary, the process of applying for an extension to form is a vital part of maintaining compliance and ensuring accurate submissions. By recognizing eligibility, understanding benefits, and following a clear step-by-step guide, applicants can navigate the complexities of extension applications with confidence. Utilizing resources like pdfFiller enhances this experience, empowering users to edit and manage their documents seamlessly from any location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in application for extension to?

How do I edit application for extension to straight from my smartphone?

How can I fill out application for extension to on an iOS device?

What is application for extension to?

Who is required to file application for extension to?

How to fill out application for extension to?

What is the purpose of application for extension to?

What information must be reported on application for extension to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.