Get the free Alcohol Beverages Gross Sales Receipts Quarterly Reports

Get, Create, Make and Sign alcohol beverages gross sales

How to edit alcohol beverages gross sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alcohol beverages gross sales

How to fill out alcohol beverages gross sales

Who needs alcohol beverages gross sales?

Understanding the Alcohol Beverages Gross Sales Form: A Comprehensive Guide

Understanding alcohol beverages gross sales form

The alcohol beverages gross sales form is an essential document used by businesses in the alcohol industry to report sales figures to regulatory authorities. This form serves multiple purposes, including tax assessment, compliance with state laws, and industry analysis. Accurate reporting through this form is crucial not only for legal compliance but also for maintaining a trustworthy relationship with patrons and stakeholders.

Accurate reporting in the alcohol beverage industry is of utmost importance due to the stringent regulations surrounding alcohol sales. Several state and federal laws govern these sales, and failing to report correctly can lead to hefty fines or even loss of licenses. Therefore, understanding the requirements and filling out the gross sales form correctly is essential for compliance.

Who needs to file the alcohol beverages gross sales form?

Filing the alcohol beverages gross sales form is not limited to large enterprises. Individuals or businesses that engage in the sale of alcohol products are required to submit this form. This includes a variety of sellers such as restaurants, bars, liquor stores, and breweries. Each of these establishments must fill out this form accurately and timely to ensure compliance.

In addition to restaurants and bars, retailers selling alcohol need to be vigilant about their reporting practices. Specific categories of sellers may have unique reporting requirements, especially if they sell alcohol for off-premises consumption, which often involves different tax implications compared to on-premises sales. Certain exceptions do exist; for instance, non-profit organizations holding special events may have different reporting obligations.

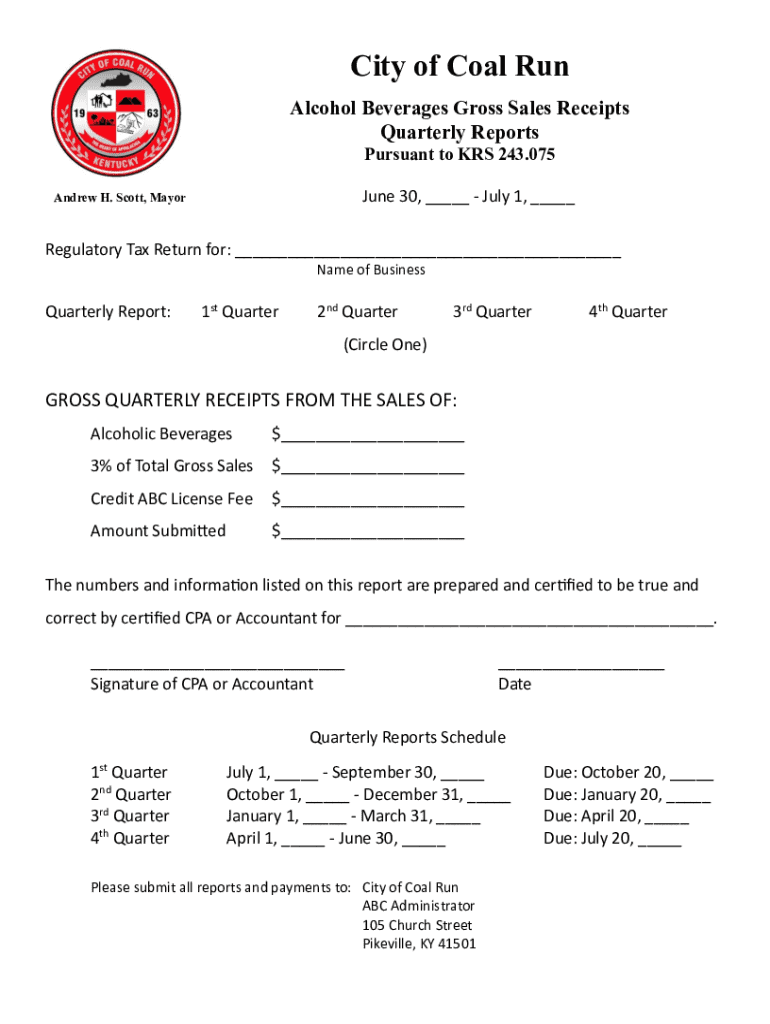

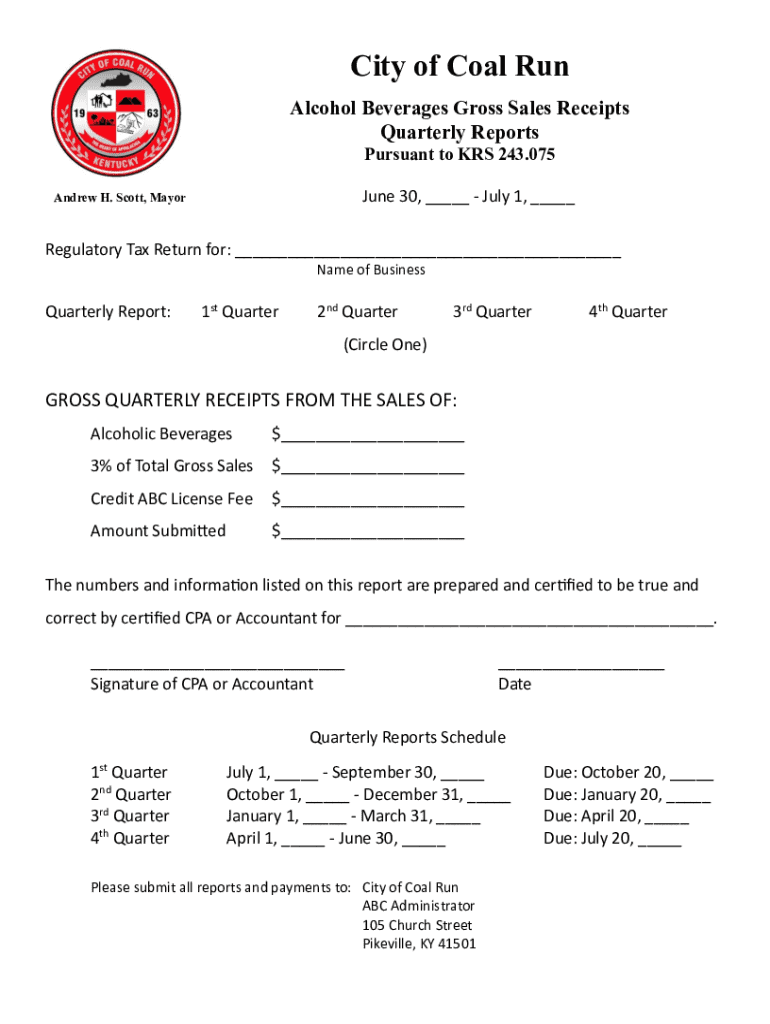

Detailed breakdown of the alcohol beverages gross sales form components

To properly fill out the alcohol beverages gross sales form, one must be acquainted with its various components. Each section serves a distinct purpose that contributes to overall accuracy and compliance. Let's break down the form into manageable sections.

Section 1: Business information

This section requires critical details about the business, such as the business name, address, and licensing number. This information helps identify the business in regulatory databases.

Section 2: Sales data

Here, businesses report their sales figures, distinguishing between on-premises (consumption at the venue) and off-premises (sales for home consumption) categories. Accurate categorization is essential for compliance and accurate tax assessments.

Section 3: Adjustments and deductions

This section addresses any returns, refunds, discounts, or promotions that might impact total sales. Proper documentation is important to support these adjustments.

Section 4: Signatory section

Finally, the form must include appropriate signatures and certifications, often requiring that a responsible party verify the accuracy of the reporting. This acts as a legal acknowledgment of the information submitted.

Filling out the alcohol beverages gross sales form

Completing the alcohol beverages gross sales form requires a systematic approach to ensure every detail is accurately captured. Start by gathering all necessary documentation that supports your sales figures.

Next, fill in each section methodically. Be diligent about accuracy, as errors can lead to compliance issues. Common pitfalls include incorrect categorization of sales and underreporting due to lack of careful tracking.

Utilizing interactive tools available on pdfFiller can streamline the filling process. These tools offer automated filling options and templates that can significantly reduce the time spent on form completion.

To ensure accuracy, consider cross-referencing your entries with business sales records, and pay attention to new regulations that might affect reporting practices.

Editing and managing your alcohol beverages gross sales form

Once you've filled out the alcohol beverages gross sales form, managing it effectively is equally important. pdfFiller’s editing features allow users to make necessary adjustments without starting from scratch. This is useful when facing changing business dynamics or updating sales figures.

Collaboration is another strong point of using pdfFiller. Team members can engage in real-time, ensuring everyone involved is on the same page. Moreover, securely storing forms in the cloud protects against loss and makes retrieval easier.

Submitting your alcohol beverages gross sales form

After completing the alcohol beverages gross sales form, the next step is submission. Depending on state regulations, businesses often have multiple options, including online submission or mailing a hard copy of the form. It’s crucial to choose the method that aligns with regulatory requirements to avoid submission errors.

Keep in mind the importance of deadlines—that's where many businesses falter. Ensure submissions are made on time to avoid penalties. Tracking your submission status after sending it is advisable, as this helps confirm compliance.

Frequently asked questions (FAQs)

It’s common for first-time filers or even experienced businesses to have questions regarding the alcohol beverages gross sales form. Common concerns revolve around reporting specifics, adjustments, and additional documentation required.

Clarifications about what constitutes taxable sales or how to handle complimentary drinks often arise. Businesses should refer to their local tax authorities for specific guidance tailored to their situation.

State-specific variations in filing the alcohol beverages gross sales form

Each state has its own regulations and requirements concerning the alcohol beverages gross sales form. Understanding these variations is vital for proper compliance. States may have different definitions of taxable sales, exclusions, and reporting deadlines.

Resources for navigating state-specific requirements are invaluable. Businesses should invest time in understanding local laws, as failure to comply can have serious repercussions.

Professional assistance and resources

If confusion persists regarding the alcohol beverages gross sales form, consulting a tax professional is advisable. They bring expertise that can simplify your filing process, ensuring compliance and optimizing your reporting strategy.

Moreover, pdfFiller provides support services and a comprehensive document management solution to assist users in navigating these complexities efficiently. Using a cloud-based solution allows businesses to manage their documents seamlessly while ensuring accuracy.

Integrating document management in your business operations

Integrating document management within your operations can streamline workflow processes. pdfFiller offers tools that facilitate collaboration and document storage, setting up a more organized and efficient way to handle alcohol beverages gross sales forms.

Being a cloud-based platform, pdfFiller provides accessibility from anywhere, making it easier to manage documents on the go. Future trends in document management will likely emphasize automation and smart document solutions, further aiding businesses in the alcohol industry.

Conclusion: Streamlining your alcohol sales reporting process

Ensuring that your alcohol beverages gross sales form is filled out accurately and submitted on time can greatly benefit your business. By utilizing pdfFiller’s features, you can efficiently manage and streamline your reporting process.

Embracing efficient document practices will help businesses remain compliant with regulations, leading to improved relationships with regulatory bodies and streamlined operations overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find alcohol beverages gross sales?

How do I edit alcohol beverages gross sales online?

How do I edit alcohol beverages gross sales on an iOS device?

What is alcohol beverages gross sales?

Who is required to file alcohol beverages gross sales?

How to fill out alcohol beverages gross sales?

What is the purpose of alcohol beverages gross sales?

What information must be reported on alcohol beverages gross sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.