Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida Profit Corporation Form: A Comprehensive Guide

Understanding Florida profit corporations

Florida profit corporations are unique legal entities established to conduct business with the primary goal of generating profit. Unlike non-profit organizations, these corporations are structured to provide financial returns to their shareholders. This structure allows for enhanced ability to raise capital through the sale of stocks, thereby attracting investors more effectively.

Forming a profit corporation in Florida comes with numerous benefits, including limited liability for shareholders, access to capital markets, and perpetual existence. Additionally, Florida's friendly business climate, including no state income tax on corporations, promotes an attractive environment for entrepreneurs. It’s essential to understand the terminology: a registered agent is an individual or business designated to receive legal documentation, while articles of incorporation serve as the foundational documents that establish the corporation.

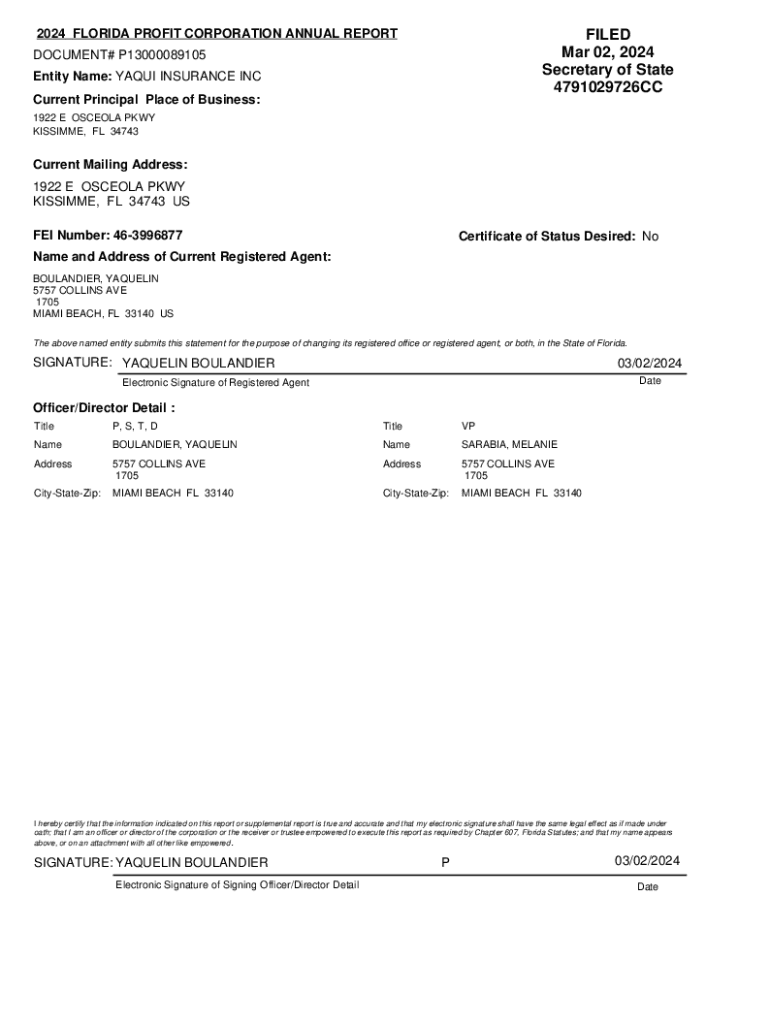

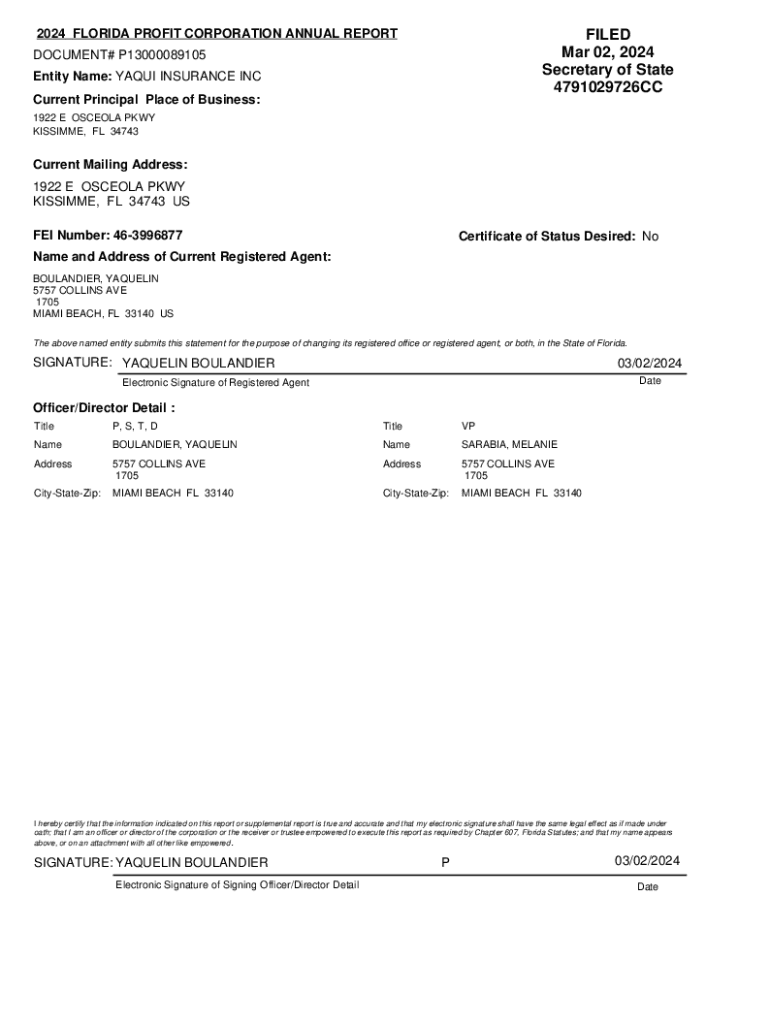

Step-by-step guide to filing the 2024 Florida profit corporation form

Filing your articles of incorporation is a critical step in establishing your profit corporation in Florida. The process consists of pre-filing preparations, e-filing the articles, alternative filing methods, and understanding post-filing requirements.

Preparing to file

Before diving into the 2024 Florida profit corporation form, it is vital to gather all necessary information. Key elements include the corporate name, which must be unique and distinguishable from existing entities in Florida, and the registered agent, who must be a resident of Florida or a corporation authorized to do business in the state. Additionally, you’ll need a business address and principal office, ensuring all documentation complies with local regulations.

Understanding the Florida Statutes related to profit corporations (Chapter 607) is key, as these laws govern formation, operation, and compliance requirements. Familiarizing yourself with the applicable statutes will facilitate a smoother filing process.

Steps to e-file your articles of incorporation

To begin the electronic filing process, access the Florida Online Filing System. The 2024 Florida profit corporation form is required to be filled out completely and accurately. Pay special attention to the following sections:

After filling out the form, thoroughly review all entries to ensure accuracy. Ensure the use of electronic signatures, which allows you to submit your document efficiently. Understanding the technical aspects of this process can prevent delays.

Alternative filing methods

If you prefer traditional methods, you can download and complete the Florida profit corporation form manually. After filling it out, you must mail it to the Division of Corporations, along with the required payment. Accepted payment methods include checks and money orders made payable to the Florida Department of State.

Important processing information

Upon submission of the 2024 Florida profit corporation form, expect a confirmation that your documents have been received. Typically, processing times range from 3 to 10 business days, but additional delays may occur due to common issues like incorrect information or the need for additional documentation.

Should there be any errors in your submission, the Division of Corporations will inform you. It’s advisable to review your filing thoroughly before submission to minimize the chances of rejection.

Post-filing requirements

After successfully filing your articles of incorporation, you may need to obtain copies for your records or for compliance purposes. Additional filings may include applying for an Employer Identification Number (EIN) through the IRS, and you'll also need to file periodic reports according to Florida corporate laws.

Furthermore, understanding Florida’s corporate income tax requirements is essential. Not all companies are required to pay this tax; however, if your corporation qualifies, you must file annually. Regulations dictate who must file, the tax base, and applicable rates.

Fees associated with forming a profit corporation in Florida

Establishing a profit corporation incurs various fees, which include the filing fee for the Articles of Incorporation and potential optional fees for expedited services. Additionally, there may be costs associated with obtaining necessary permits or licenses, depending on your business activities and location.

Be sure to verify the latest fee schedule on the Florida Department of State’s website to ensure you’re prepared for all associated costs. Payment options are available for both online filings and those sent by mail.

Resources for Florida profit corporations

Effective resource management is crucial for successful corporation formation. Some valuable quick links include the Florida Division of Corporations website (Sunbiz) where necessary forms and guidelines are accessible. It’s also beneficial to explore available external resources for additional guidance on filing expectations and requirements.

FAQs about the 2024 Florida profit corporation form

Many questions arise during the process of forming a profit corporation in Florida. One common inquiry is about what to do if your desired corporation name is already in use. In such cases, you may need to consider alternatives or modify the name slightly to differentiate it.

Facing rejected filings is another concern. If your filing is rejected, promptly address the issues highlighted by the Division of Corporations and resubmit your application with the necessary corrections. Reporting beneficial ownership information may also be required, and guidance on this can be found on state resources.

Interactive tools and features on pdfFiller

Utilizing pdfFiller's interactive tools significantly enhances the document filing experience. The platform empowers users to complete the 2024 Florida profit corporation form with ease, ensuring accurate data entry through intuitive interfaces.

The e-signing features streamline the process of obtaining necessary signatures while collaboration tools enable teamwork for those filing notifications and other necessary paperwork. Moreover, cloud-based access means users can manage their documents from anywhere, making it easier than ever to keep your business compliant.

Legal considerations and compliance

Adhering to Florida corporate laws is paramount as you scale your business. Understanding your rights and responsibilities as a corporation, including fiduciary duties of officers and directors, can lead to better governance and minimize legal issues.

Compliance with annual reporting requirements and revising company bylaws as necessary will help ensure ongoing adherence to state regulations, protecting both the corporation and its shareholders from potential liabilities.

Looking ahead: future compliance and updates

To ensure your profit corporation thrives, keeping track of changes in business legislation is crucial. Regular updates on the laws governing corporations will better prepare you as an owner or manager to adapt your business practices accordingly.

Preparing for annual reports and renewals ahead of deadlines can save you from last-minute stress, thus maintaining your corporation's good standing within Florida. Utilize tools such as pdfFiller to schedule reminders for these important tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 florida profit corporation without leaving Google Drive?

How do I edit 2024 florida profit corporation online?

How do I fill out the 2024 florida profit corporation form on my smartphone?

What is florida profit corporation?

Who is required to file florida profit corporation?

How to fill out florida profit corporation?

What is the purpose of florida profit corporation?

What information must be reported on florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.