Get the free Bucks County Property Assessment Appeal

Get, Create, Make and Sign bucks county property assessment

Editing bucks county property assessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bucks county property assessment

How to fill out bucks county property assessment

Who needs bucks county property assessment?

Bucks County Property Assessment Form: Your Comprehensive Guide

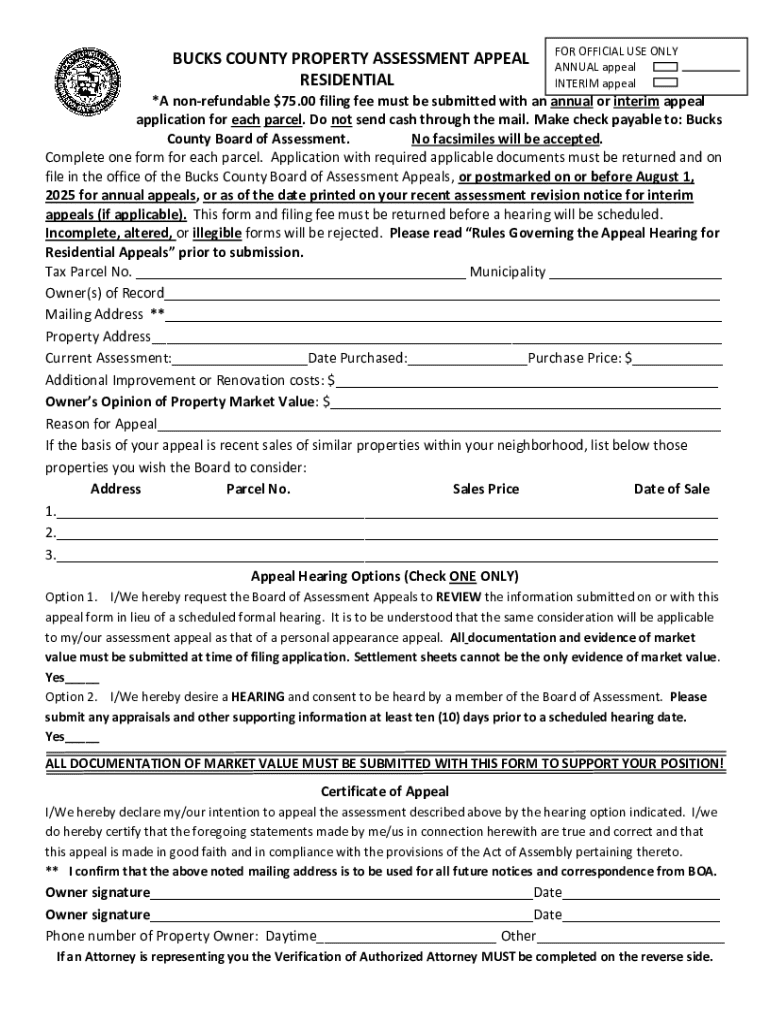

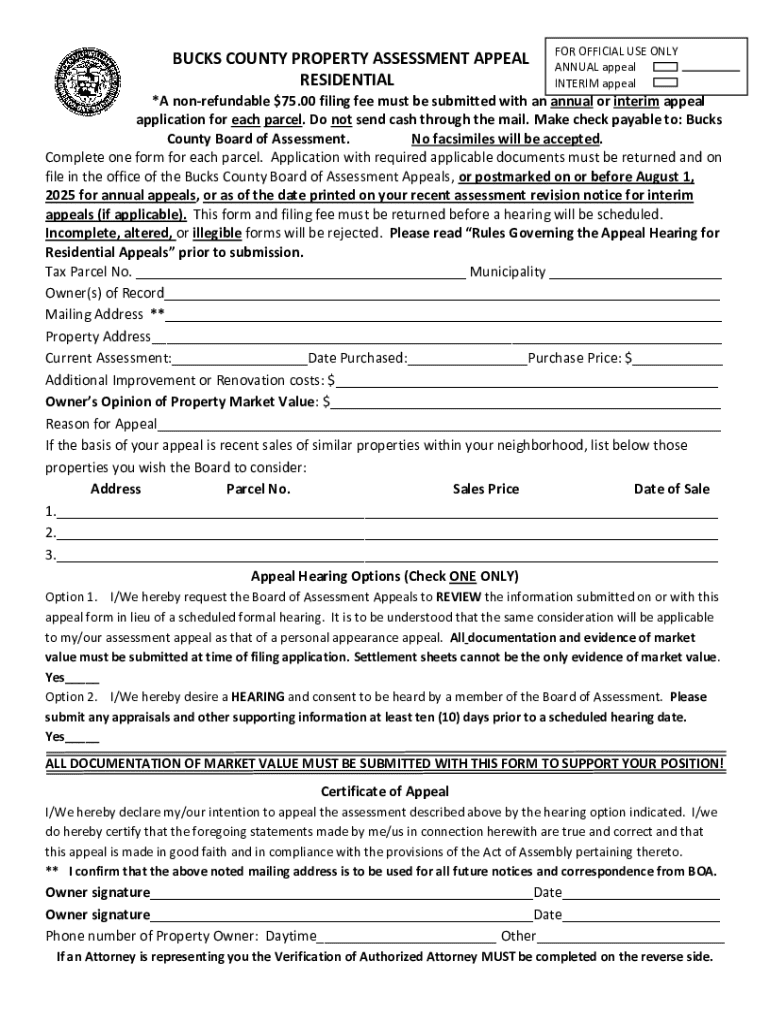

Overview of Bucks County property assessment

Property assessment in Bucks County plays a crucial role in determining the value of real estate for taxation purposes. This process involves evaluating the market value of properties to levy appropriate taxes, thus impacting overall municipal revenue and funding for public services. Accurate property assessment is not just a bureaucratic formality; it ensures that homeowners pay a fair share of taxes based on their property value, promoting equity among residents.

For homeowners, understanding the nuances of property assessments can provide significant financial advantages. A precise assessment can reflect true market conditions, potentially lowering tax liabilities and enhancing property values. Knowledge about the Bucks County property assessment form is essential for homeowners who wish to navigate this landscape effectively.

Who needs the Bucks County property assessment form?

The Bucks County property assessment form is essential for a variety of stakeholders within the community. Homeowners, including those who may be contesting their property's assessed valuation, real estate investors, and property management teams are all encouraged to use this form for different purposes. Understanding who needs the form helps streamline the assessment process and ensures that each party’s interests are represented.

Completing this form serves several purposes: applying for new tax assessments, contesting a current property value, or updating essential property information such as ownership and property type.

Detailed breakdown of the Bucks County property assessment form

The Bucks County property assessment form is structured to collect essential information directly related to the property and the owner. It helps county officials in making informed decisions regarding property values. The form is divided into several sections, each designed for specific information input, facilitating the assessment process.

Understanding key terminology used in the form can also ease the completion process. For instance, 'assessed value' refers to the official valuation assigned to the property by the county, which determines property taxes, while 'property type' distinguishes whether the property is residential, commercial, etc.

Step-by-step instructions for completing the form

Completing the Bucks County property assessment form might seem daunting at first, but following a structured approach simplifies the process. Preparation is key; gather all necessary documentation prior to filling in the form.

Be mindful of common mistakes, such as leaving sections incomplete or providing vague reasons for the assessment request. Clarity is vital in effectively conveying your situation to the county assessors.

Interactive tools for completing the application

With modern technology, completing the Bucks County property assessment form can be more accessible than ever. Utilizing platforms like pdfFiller allows users to engage with the form in an interactive manner. This cloud-based document management solution offers users real-time editing, eSigning capabilities, and collaborative features, making the process efficient.

Collaboration on documents helps prevent errors and ensures comprehensive input, allowing multiple perspectives to contribute before final submission.

Submitting your Bucks County property assessment form

Once you have filled out the Bucks County property assessment form, the next crucial step is submission. Understanding various submission methods will help ensure your form reaches the appropriate county officials promptly.

After submission, tracking your application’s status is essential. Utilize online tools or contact the appropriate office directly to confirm receipt and ask about the assessment timeline.

What to expect after submission

After submitting your Bucks County property assessment form, the county will initiate its review process. This involves examining your request, verifying the property details, and ultimately determining if any adjustments are necessary to the assessed value.

The timeline for receiving your assessment results can vary. Generally, property owners can expect a notification within a few weeks, but it is advisable to follow up if a prolonged period has passed without communication.

Frequently asked questions (FAQs)

As with any bureaucratic process, residents often have questions regarding property assessments. Understanding common inquiries can better prepare homeowners and investors alike.

For further questions, visit the Bucks County government’s official website or reach out to their offices directly for additional resources and assistance.

Additional tips and best practices

Successfully navigating the property assessment process requires attention to detail and strategic approaches. Implementing best practices can significantly improve the outcome of your assessment submission.

These strategies will not only help in getting a timely review but also contribute to a favorable outcome.

Testimonials and success stories

Real-life examples from Bucks County residents illustrate the importance and effectiveness of the property assessment process. Homeowners who diligently filled out the assessment form and provided necessary documentation often found their property tax bills reduced substantially.

One resident, John, contested an inflated assessment based on recent comparable sales data he gathered; his efforts led to a significantly lowered assessed value and lower taxes, showcasing the impact of thorough preparation and strategic documentation.

Conclusion on the importance of proper assessment

Understanding the Bucks County property assessment form and its implications empowers homeowners to take control of property value assessments. Leveraging tools like pdfFiller enhances the efficiency of filling out and submitting the form, ensuring accuracy and completeness.

Arming yourself with the knowledge of property assessments not only enhances personal financial management but also supports fair taxation practices within the community. Thus, navigating the assessment process with confidence is essential for every property owner in Bucks County.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bucks county property assessment to be eSigned by others?

How do I execute bucks county property assessment online?

Can I create an electronic signature for signing my bucks county property assessment in Gmail?

What is bucks county property assessment?

Who is required to file bucks county property assessment?

How to fill out bucks county property assessment?

What is the purpose of bucks county property assessment?

What information must be reported on bucks county property assessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.