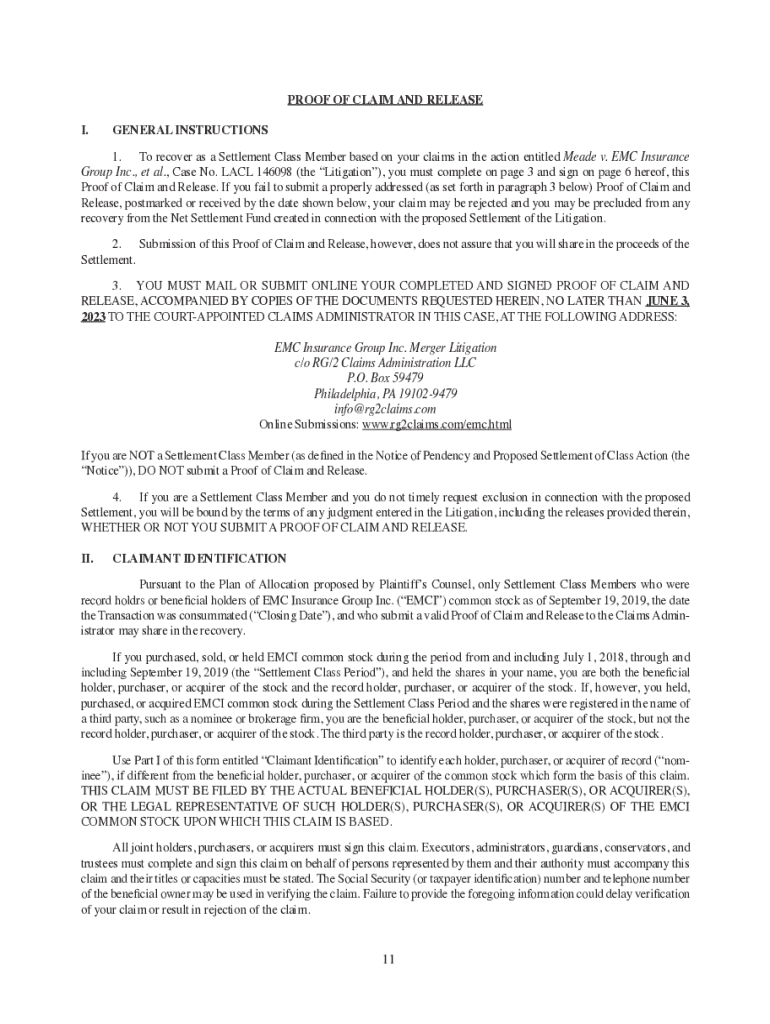

Get the free Proof of Claim and Release

Get, Create, Make and Sign proof of claim and

Editing proof of claim and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out proof of claim and

How to fill out proof of claim and

Who needs proof of claim and?

Understanding Proof of Claim and Form in Bankruptcy

Understanding the proof of claim

A proof of claim serves as a formal document filed by a creditor in bankruptcy proceedings, showcasing the amount owed by the debtor, alongside the basis of that debt. Its primary purpose is to assert a claimant’s right to be compensated from the debtor’s estate. Without providing this proof, creditors may find it challenging to recover owed amounts.

Navigating the claims process is crucial for creditors, as it determines how much they will receive from the bankruptcy estate. This form not only initiates the debt validation but also provides a structured way for creditors to present their claims in an organized manner to the court, ensuring their interests are protected during the bankruptcy proceedings.

For creditors, especially in more complex bankruptcy cases, the proof of claim document is an indispensable tool. It enables them to legally assert their claims and helps facilitate a more straightforward claims process within the bankruptcy framework.

Types of proof of claim forms

There are several types of proof of claim forms designed to cater to different types of claims within the bankruptcy system. Understanding the specific form suitable for your case is essential to ensure compliance with legal requirements.

Key components of the proof of claim form

Filling out the proof of claim form accurately is pivotal for its acceptance. The form requires specific basic information that outlines the creditor’s claim clearly.

Supporting documentation also plays a crucial role. Creditor claims must be backed by adequate evidence, such as promissory notes or invoices. Failure to provide these documents can result in your claim being denied or severely delayed.

Step-by-step guide to completing the proof of claim

Completing the proof of claim form can seem daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide.

Electronic filing vs. physical submission

Filing electronically has transformed the claims process, making it quicker and more efficient. Many courts now accept electronic submissions, which offers several advantages over traditional filing methods.

If you opt for electronic filing, familiarizing yourself with submission guidelines is essential. For those choosing physical submission, ensuring that forms are mailed or delivered to the correct location is equally important.

Advanced considerations for filing a proof of claim

Complex bankruptcy cases may pose unique challenges requiring additional documentation. Creditors need to navigate these issues carefully to maximize their claims effectively.

Being proactive in understanding eligibility and timeframes can help secure your claim and prevent complications.

Post-submission process

After submitting your proof of claim, your work isn’t entirely finished. Several follow-up steps are essential for ensuring your claim is processed correctly and efficiently.

Common challenges and how to overcome them

While filing a proof of claim is designed to be straightforward, various challenges can emerge. Understanding these obstacles will help you navigate them more effectively.

Resources for additional support

Understanding the complexities surrounding bankruptcy and proof of claim forms can be daunting. Various resources are available to assist you.

Tools for document management

Managing proof of claim forms and related documentation effectively is crucial for success. Leveraging technology can streamline this process.

Staying updated on bankruptcy and claims processing

The landscape of bankruptcy law is ever-evolving, making it essential for creditors to stay informed about changes that might affect their claims. Keeping current means potential benefits for your processes.

Frequently asked questions

Navigating the proof of claim process can lead to various questions regarding its implications and outcomes. Clarifying these doubts makes for a smoother experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my proof of claim and in Gmail?

How can I modify proof of claim and without leaving Google Drive?

Can I create an electronic signature for signing my proof of claim and in Gmail?

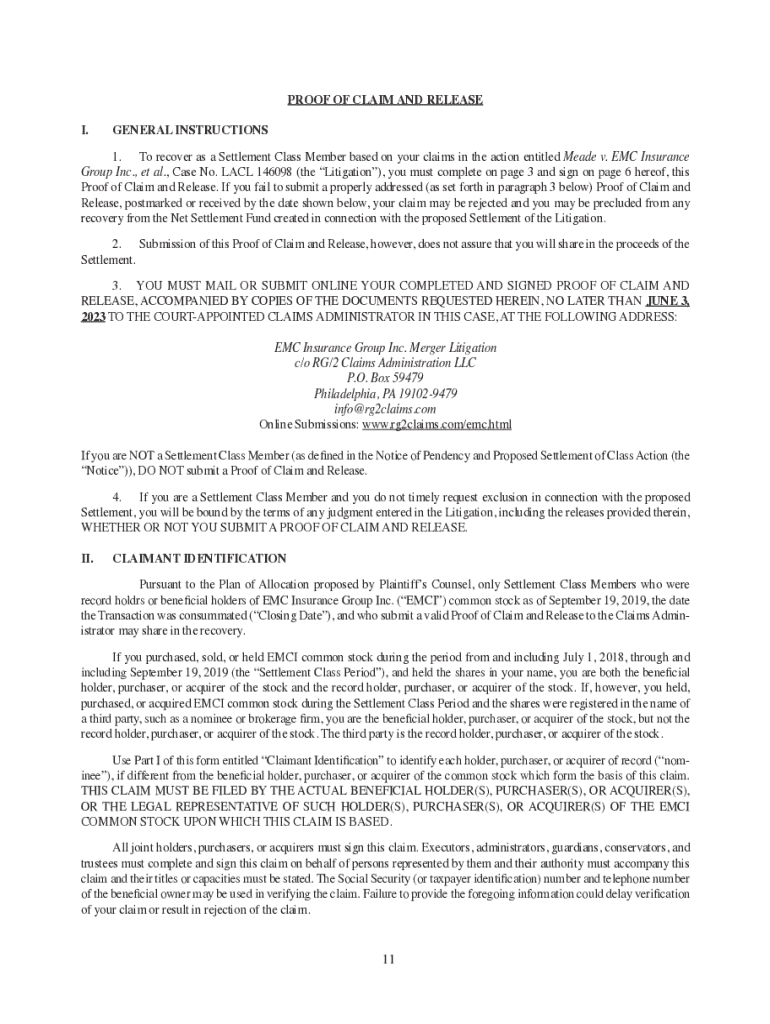

What is proof of claim?

Who is required to file proof of claim?

How to fill out proof of claim?

What is the purpose of proof of claim?

What information must be reported on proof of claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.