Get the free Consolidated Corporate Income Tax Return

Show details

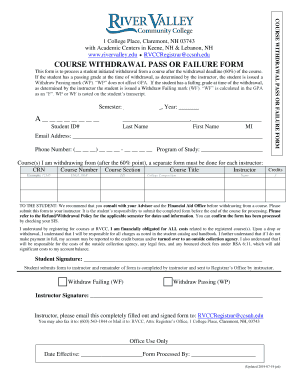

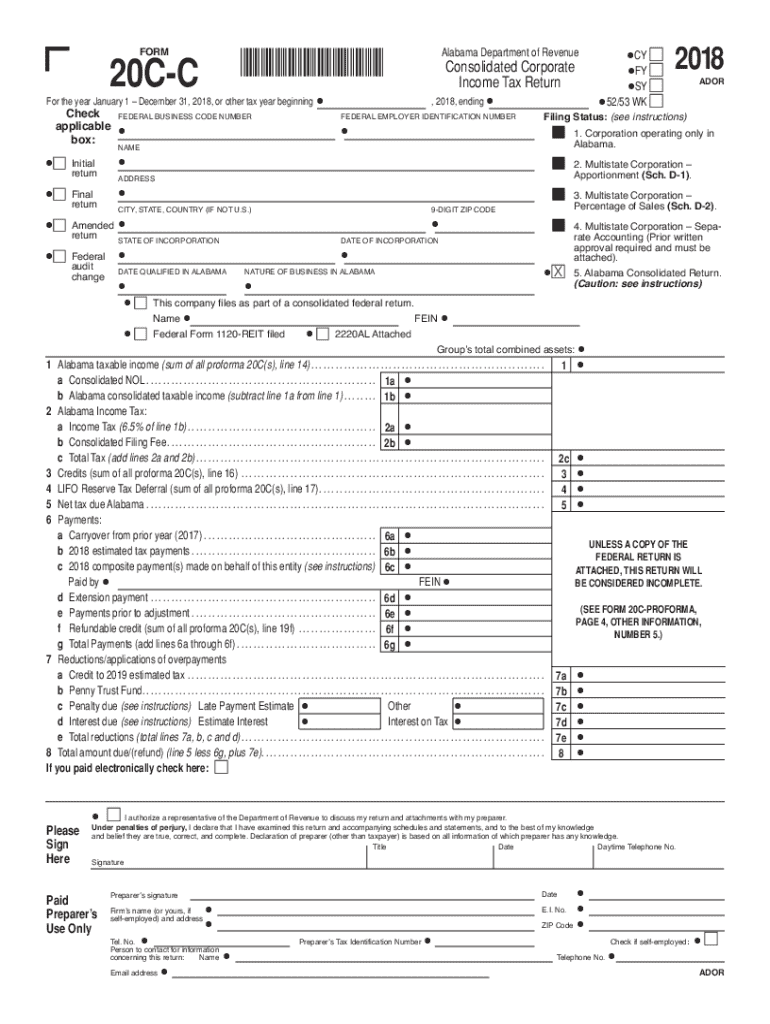

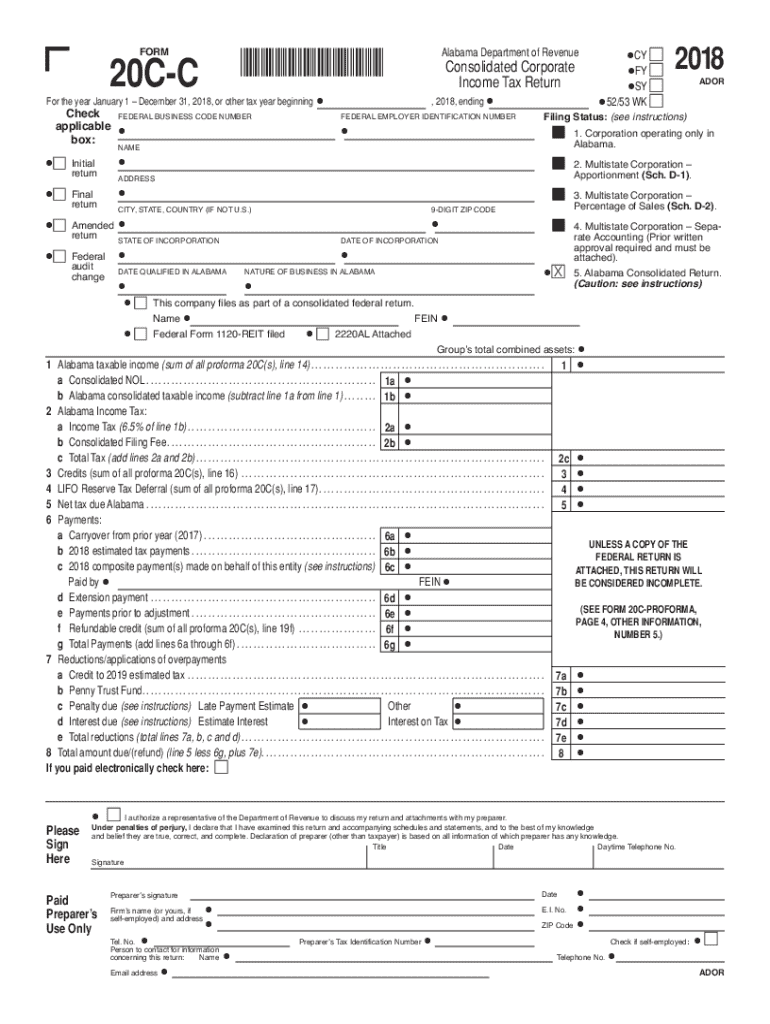

This document is a tax return form used for filing a consolidated corporate income tax return in Alabama for the year 2018.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated corporate income tax

Edit your consolidated corporate income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated corporate income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consolidated corporate income tax online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit consolidated corporate income tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated corporate income tax

How to fill out consolidated corporate income tax

01

Gather all relevant financial statements of the parent company and its subsidiaries.

02

Determine the consolidation method to be used (e.g., full consolidation, proportional consolidation).

03

Eliminate intercompany transactions, including sales, receivables, payables, and investments.

04

Calculate non-controlling interests where applicable.

05

Prepare the consolidated income statement by combining revenues and expenses of the parent and subsidiaries.

06

Complete all required tax forms for the consolidated corporate income tax return.

07

Review and validate all figures to ensure accuracy and compliance with tax laws.

08

Submit the consolidated tax return by the due date, along with any supporting documentation.

Who needs consolidated corporate income tax?

01

Corporations with multiple subsidiaries that require a consolidated view of their financial performance.

02

Companies looking to comply with tax regulations that mandate consolidated reporting.

03

Entities seeking to provide a clear financial picture to investors and stakeholders.

04

Groups with intercompany transactions that need accurate tax reporting to avoid double taxation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consolidated corporate income tax to be eSigned by others?

When you're ready to share your consolidated corporate income tax, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the consolidated corporate income tax in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your consolidated corporate income tax directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit consolidated corporate income tax on an iOS device?

Use the pdfFiller mobile app to create, edit, and share consolidated corporate income tax from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is consolidated corporate income tax?

Consolidated corporate income tax is a tax that allows affiliated corporations to combine their income, deductions, and credits into a single tax return. This approach facilitates a comprehensive assessment of the group's taxable income, ensuring that the overall tax liabilities reflect the financial positions of all the corporations involved.

Who is required to file consolidated corporate income tax?

Affiliated corporations that meet certain criteria, such as being part of a controlled group or having the majority ownership by the parent company, are required to file consolidated corporate income tax. This typically includes parent-subsidiary relationships and partnerships where the parent company owns a significant stake in the subsidiaries.

How to fill out consolidated corporate income tax?

To fill out consolidated corporate income tax, a corporation must first compile financial statements for all affiliated companies. Then, they should complete the applicable tax forms (such as IRS Form 1122 and 1120) by adding, subtracting, and eliminating intercompany transactions. It's essential to follow specific IRS guidelines for disclosures and adjustments that apply to consolidated returns.

What is the purpose of consolidated corporate income tax?

The purpose of consolidated corporate income tax is to provide a clear and fair tax structure for affiliated corporations. It aims to prevent tax avoidance through intercompany transactions and ensures that profits and losses are appropriately reported, enabling a holistic view of the tax liability for the entire corporate group.

What information must be reported on consolidated corporate income tax?

The information that must be reported on consolidated corporate income tax includes the financial results of each subsidiary, intercompany transactions, any deductions or credits claimed by the group, and adjustments made to account for consolidation. Additionally, detailed disclosures related to ownership interests, and financial position changes must be included.

Fill out your consolidated corporate income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Corporate Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.