Get the free Nebraska Individual Income Tax Return

Get, Create, Make and Sign nebraska individual income tax

Editing nebraska individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska individual income tax

How to fill out nebraska individual income tax

Who needs nebraska individual income tax?

Nebraska Individual Income Tax Form - How-to Guide

Understanding the Nebraska Individual Income Tax Form (Form 1040N)

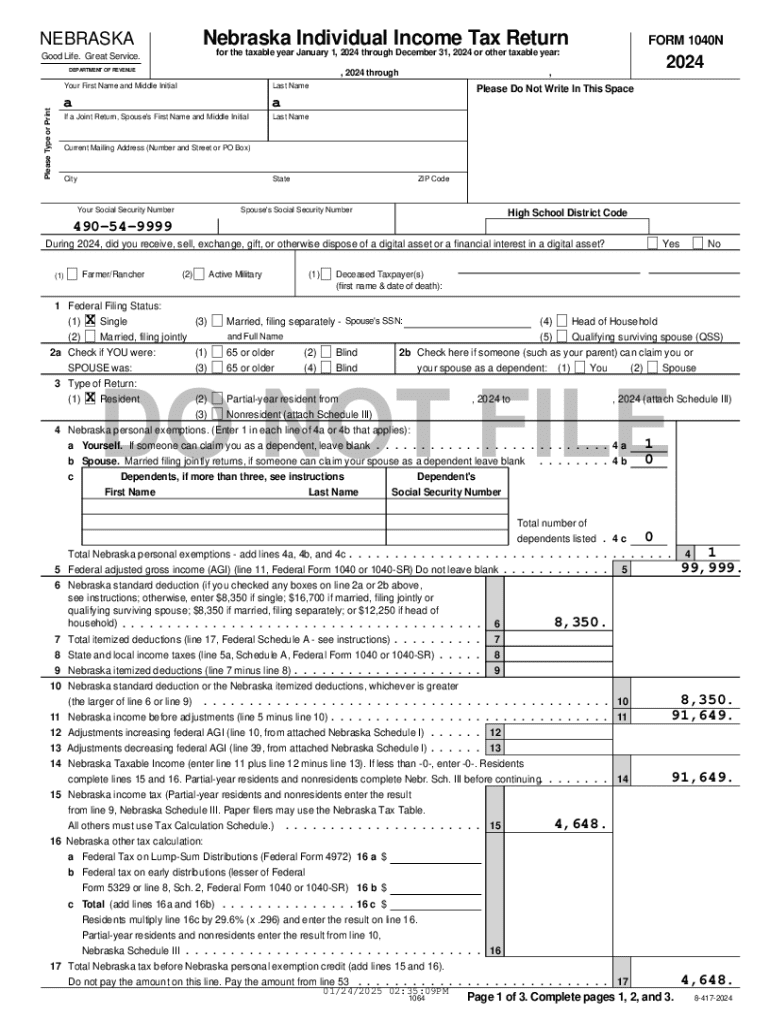

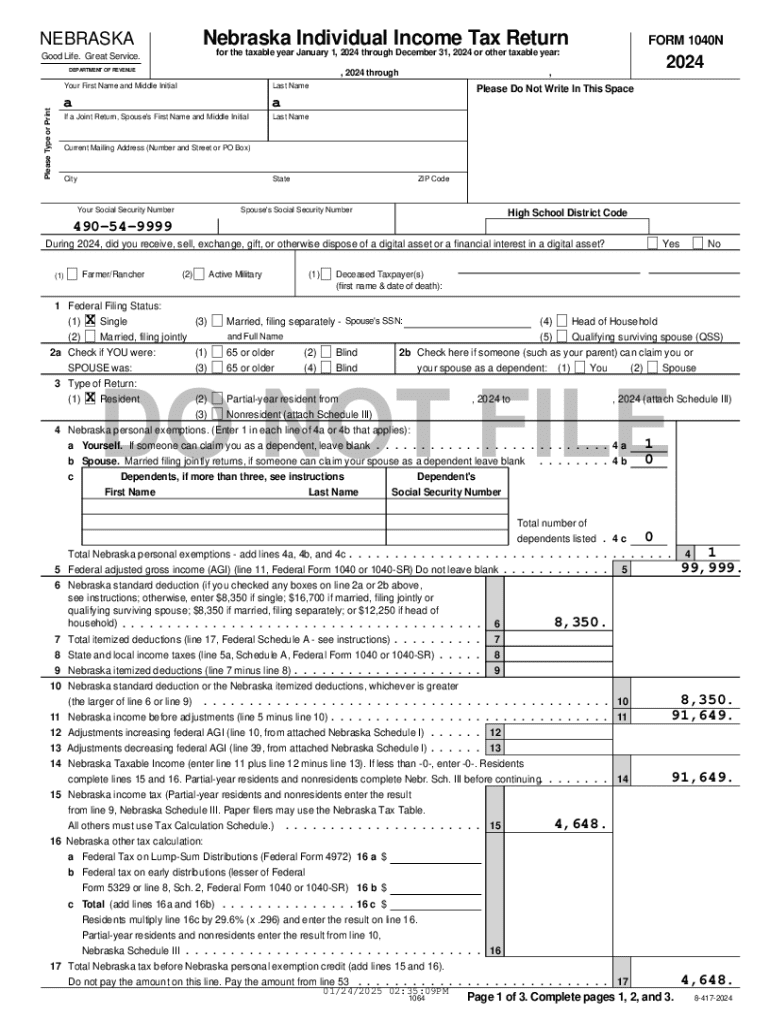

The Nebraska Individual Income Tax Form, commonly known as Form 1040N, is essential for residents who earn income in Nebraska. This form is a tool for reporting your income, deductions, and tax credits to the Nebraska Department of Revenue. Timely submission of this form is crucial for compliance with state tax laws. Failing to file or misreporting can lead to penalties and interest on any due tax.

Form 1040N showcases several key features, including sections for personal information, income reporting, and eligibility for various deductions and credits. It's important to understand these sections to maximize your potential refunds or minimize tax liabilities. Eligibility to file this form generally includes individuals earning taxable income within Nebraska, subject to certain thresholds and conditions.

Who must file Nebraska Form 1040N?

Criteria for filing Form 1040N typically include any Nebraska resident who has gross income at or above the established thresholds set for the tax year. Generally, if your income is above a certain level, you’re required to file. It’s important to note that even if you earn less than the threshold, you may wish to file to qualify for potential credits or refunds.

Exceptions to this requirement may include individuals who are claimed as dependents by someone else or those whose income is exclusively from specific sources that are exempt from taxation. Joint filers, as well as those who file separately, have differing requirements and should be aware of the thresholds that apply to their specific situations.

Key deadlines for Nebraska Individual Income Tax Filing

Understanding tax deadlines is crucial for avoiding penalties. The standard deadline for filing Form 1040N falls on April 15 of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline will typically be extended to the next business day.

If you need extra time to prepare your tax return, you can apply for an extension, which can provide an additional six months. However, it’s important to realize that this extension applies only to the filing of your return, not the payment of any taxes owed. Late submissions can lead to interest and penalties, making it vital to meet payment deadlines even if your filing is delayed.

Step-by-step guide for filling out Nebraska Form 1040N

**Step 1: Gathering necessary information** Before tackling Form 1040N, ensure you have all necessary materials at hand. This includes personal identification, Social Security numbers for yourself and dependents, and financial documents such as W-2s and 1099s.

**Step 2: Section-by-section breakdown of the form** Start by filling out the personal information section, accurately listing names and addresses. Next, report all income sources in the income reporting segment, including wages and interest income. Move on to deductions and credits, where you can adjust your income based on various eligible expenses. Finally, calculate your total tax liability to determine what you owe or your potential refund.

**Step 3: Reviewing your form for accuracy** It’s advisable to take a moment to review your completed Form 1040N for any mistakes. Common pitfalls include errors in personal information or miscalculating income. Use a checklist to ensure completeness, confirming all sections are filled out correctly and that you have attached necessary documents.

Interactive tools and resources on pdfFiller

pdfFiller offers a robust platform for managing your tax documents, including Form 1040N. Users can create and edit their forms easily thanks to pdfFiller’s intuitive interface. One of the standout features is the eSignature functionality, allowing you to sign your Form 1040N digitally. This not only streamlines the process but ensures you can submit your paperwork quickly.

Collaboration is another significant aspect of pdfFiller. Teams can manage multiple forms simultaneously, facilitating easier preparation during tax season. With accessible templates and instant filing tips provided by pdfFiller, individuals and teams alike can navigate the complexities of Nebraska tax requirements with confidence.

Filing options: How to submit your Nebraska tax return

Taxpayers in Nebraska have a couple of options to submit their Form 1040N. E-filing is the most efficient method; it’s fast, secure, and allows for quicker processing. Many taxpayers prefer this method due to its immediacy and reduced error rate compared to paper filing.

For those choosing to file by mail, be sure to follow the specific instructions provided on the form. Mail your completed tax return to the address indicated for residents. Remember that while e-filing offers numerous benefits, such as immediate confirmation of submission, paper filing remains a viable option for those who prefer traditional methods.

What to do after filing Nebraska Form 1040N?

After you submit your Form 1040N, it’s essential to monitor the status of your tax refund. The Nebraska Department of Revenue provides online tools that allow you to check your refund status easily. By entering specific details, you can get updates on when you can expect your refund.

Additionally, it’s helpful to understand refund timelines. Typically, electronic refunds are processed faster than paper returns. Once you receive your refund, keep all documentation organized for future reference. It’s recommended to save these records for at least three years, ensuring you have adequate proof in the event of an audit.

Common issues and troubleshooting

Handling discrepancies in reported income is a common issue taxpayers face. If you receive a notice from the Nebraska Department of Revenue regarding inconsistencies, promptly address these issues to avoid penalties. Ensure all your forms are aligned, and if necessary, consult a tax professional for assistance.

For tax-related inquiries, the Nebraska Department of Revenue provides resources to aid taxpayers. Utilize these avenues for clarification on requirements or if you encounter complex situations.

Additional forms and supplements

When filing your Nebraska individual income tax, you might encounter additional forms such as Nebraska Schedule I, which includes adjustments to income, and Schedule E, which accounts for credit for taxes paid to other states. Depending on your personal financial situation, these additional forms may be necessary.

Ensuring you find and complete these forms correctly is paramount. Resources like pdfFiller can assist you in accessing these supplementary forms quickly, streamlining your overall tax filing experience.

Maintaining compliance: Tax rates and changes

Understanding the current Nebraska income tax rates is crucial for effective planning. Rates can vary significantly, impacting how much you owe. For 2023, Nebraska has a progressive tax rate ranging from 2.46% to 6.84% based on income brackets. It is essential to stay informed about any notable changes from previous tax years, as even minor adjustments can considerably affect your filing strategy.

As tax rates and laws evolve, keeping abreast of these shifts can aid in more accurate predictions for future tax conditions. Taxpayers should leverage the insights provided by platforms like pdfFiller for comprehensive details on rates and filing strategies.

Reaching out for help

If you encounter challenges while filing your Nebraska Individual Income Tax Form or require clarification on specific topics, reach out to the Nebraska Department of Revenue. Contact details can be found on their website, where representatives are ready to assist with your inquiries.

Additionally, consider utilizing professional tax preparation services if you feel overwhelmed or if your tax situation is particularly complex. Community resources may also provide free assistance during tax season, especially for low-income individuals, ensuring everyone has access to necessary help.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nebraska individual income tax in Chrome?

How do I edit nebraska individual income tax on an iOS device?

How do I fill out nebraska individual income tax on an Android device?

What is nebraska individual income tax?

Who is required to file nebraska individual income tax?

How to fill out nebraska individual income tax?

What is the purpose of nebraska individual income tax?

What information must be reported on nebraska individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.