Get the free Nebraska Individual Income Tax Return

Get, Create, Make and Sign nebraska individual income tax

Editing nebraska individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska individual income tax

How to fill out nebraska individual income tax

Who needs nebraska individual income tax?

Comprehensive Guide to the Nebraska Individual Income Tax Form

Nebraska Individual Income Tax Form Overview

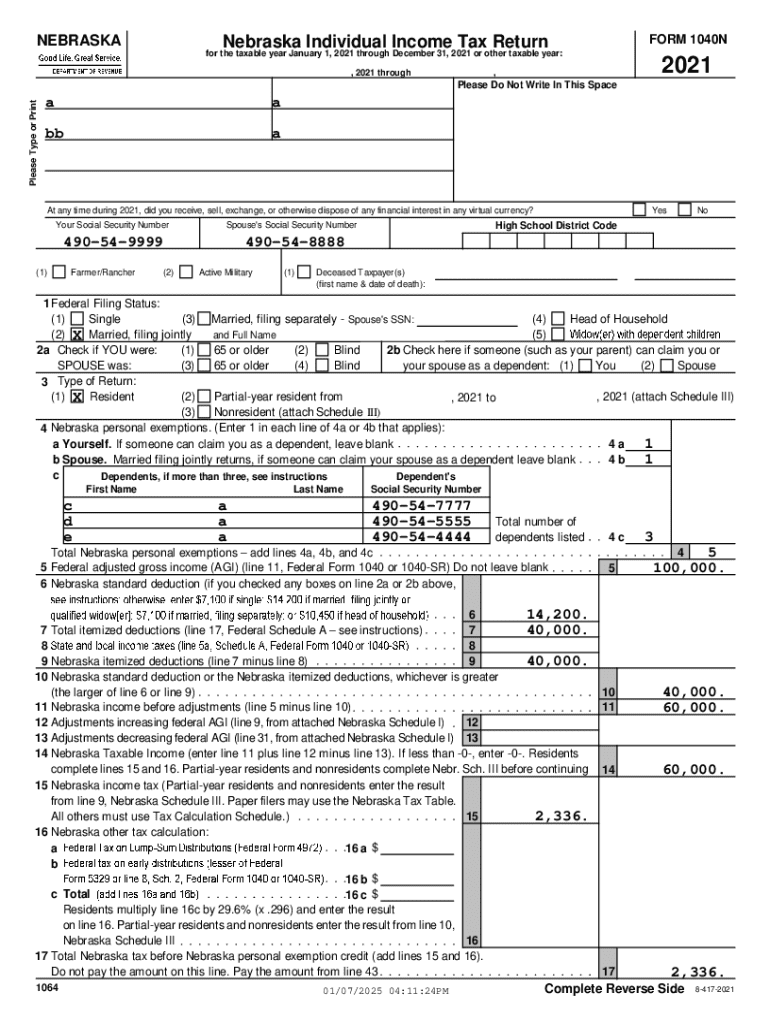

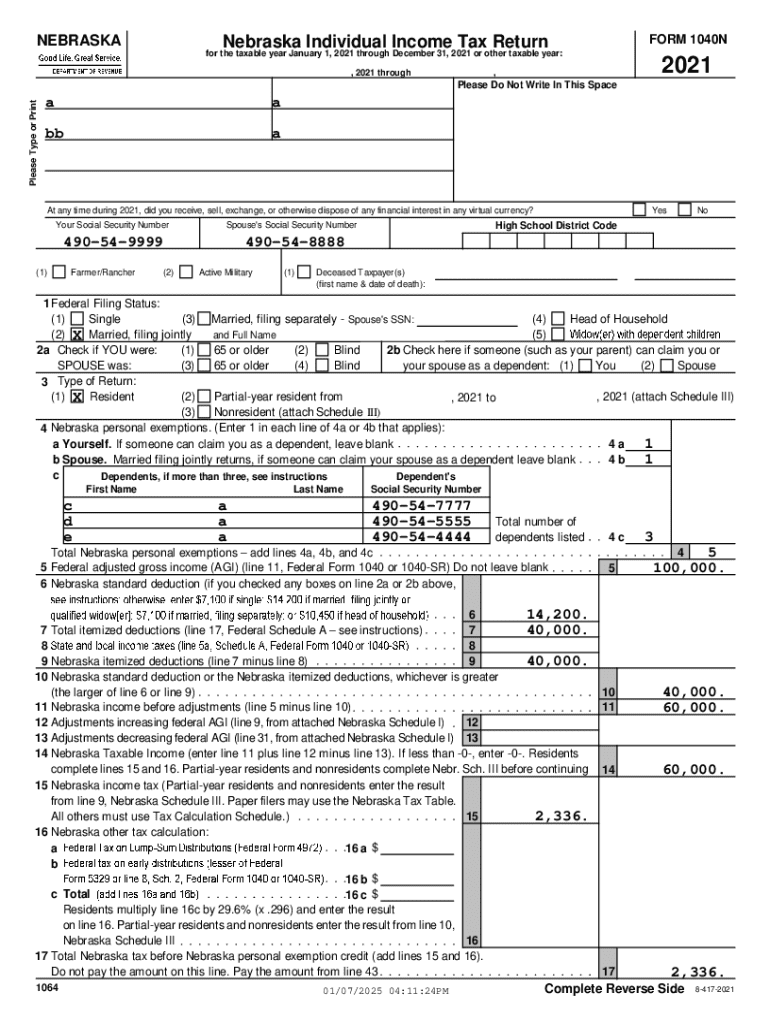

The Nebraska Individual Income Tax Form serves as a crucial document for residents and taxpayers within the state. This form, officially known as Form 1040N, is required for filing state income taxes and is vital for determining the amount of tax owed or refunds due. It's essential for Nebraska residents to understand this form to ensure compliance with state tax laws and to avoid any potential penalties.

Understanding Nebraska Form 1040N

Nebraska Form 1040N is the designated form used for individuals to report their income earned within the state. This form encompasses various sections that collect essential information ranging from personal details to income reporting and eligible deductions. The clarity and accuracy of information provided in this form directly influence the state’s assessment of tax liability.

Filing Nebraska Form 1040N is mandatory for residents who earn income exceeding the minimum income threshold established by the state. Additionally, non-residents who earn income in Nebraska may also be required to file this form. Understanding who must file is crucial for each taxpayer to maintain compliance and avoid possible fines.

Step-by-step instructions for completing Nebraska Form 1040N

Completing Nebraska Form 1040N correctly requires careful attention to detail. To begin, taxpayers should gather the necessary documentation. Commonly required documents include:

Filling out the form can be broken down into several sections, each addressing specific information:

Common mistakes during this process include incorrect Social Security numbers, misreported income amounts, and overlooking eligibility for deductions. Reviewing the form carefully before submission can help avoid these pitfalls.

Managing your Nebraska individual income tax form

After completing your Nebraska Individual Income Tax Form, deciding how to file it is essential. Taxpayers can choose between online and paper filing. Online filing offers several benefits such as immediate confirmation of receipt, user-friendly interfaces that guide you through the process, and often faster access to refunds. In contrast, paper filing may be preferred by those who are uncomfortable with digital technology or want to maintain a physical copy of their documentation.

Key deadlines for filing are important for all taxpayers to keep in mind. Nebraska's standard filing deadline aligns with the federal tax deadline, typically on April 15 each year. Failure to file by this date may result in penalties, so it’s advisable to act early.

Checking the status of your Nebraska tax refund

Once your Nebraska Individual Income Tax Form has been submitted, you may want to check the status of your refund. The Nebraska Department of Revenue provides a straightforward online platform to access refund information. To check the status, you will need specific details at hand, such as your Social Security number, the exact amount of your refund, and your filing status.

If additional support is required, taxpayers can contact the Nebraska Department of Revenue via phone or email. Their support team can assist with any queries regarding tax refunds or filing issues.

Other forms individuals may need

In addition to the Nebraska Individual Income Tax Form, taxpayers may require other complementary forms to facilitate accurate tax filing. These forms include Schedule II, which is necessary for itemizing deductions, and Form 1040N-CR, specifically for requesting a refundable credit. Understanding the use and requirement for these additional forms is essential for ensuring a thorough filing.

For added convenience, printable Nebraska state tax forms are available online through the Nebraska Department of Revenue's website. These downloadable forms make it easier for taxpayers to manage their documentation efficiently.

Resources for Nebraska tax filers

Navigating Nebraska's tax laws and regulations can be complex, but several resources can assist taxpayers. The Nebraska Department of Revenue provides comprehensive guidelines on tax laws detailing both individual and corporate tax responsibilities. Their website includes FAQs, instructional videos, and detailed articles about state tax laws.

For those needing hands-on assistance, local tax offices can offer personalized guidance. These offices have knowledgeable staff members who are equipped to answer specific questions and help taxpayers maneuver through their filing.

eSigning and managing your Nebraska form

In today's digital age, utilizing tools like pdfFiller can significantly enhance the filing experience for Nebraska Individual Income Tax Form. This cloud-based platform provides interactive tools that simplify the editing and signing of tax forms, allowing for streamlined document management.

One of the standout features of pdfFiller is its collaboration capabilities. Teams can work together on financial documents in real-time, making tax preparation much more efficient. Users can share documents, request eSignatures, and update information seamlessly from anywhere.

Navigating federal tax implications

Filing your state taxes isn't isolated from federal tax responsibilities. Understanding federal tax forms such as the IRS Form 1040 is essential for comprehensive tax management. Many taxpayers need to coordinate both their state and federal filings to ensure accuracy and compliance. Failure to do so can result in discrepancies that lead to audits or penalties.

Combining insights from both state and federal forms can maximize deductions and credits, ultimately benefiting the taxpayer’s financial situation. A coordinated approach leads to more successful tax filings.

Income tax rates in Nebraska

As of the current tax year, Nebraska has established a progressive income tax structure with rates ranging from 2.46% to 6.84%. Understanding these tax brackets is crucial for residents when calculating tax liabilities. The first bracket applies to those earning up to $3,400 for single filers, while the highest rate impacts individuals with income over $31,750.

Staying informed about the latest tax rates is essential for effective tax planning and can influence decisions around income earning, deductions, and other financial considerations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nebraska individual income tax in Gmail?

How do I execute nebraska individual income tax online?

How do I edit nebraska individual income tax on an iOS device?

What is nebraska individual income tax?

Who is required to file nebraska individual income tax?

How to fill out nebraska individual income tax?

What is the purpose of nebraska individual income tax?

What information must be reported on nebraska individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.