No income statement template form: A comprehensive guide

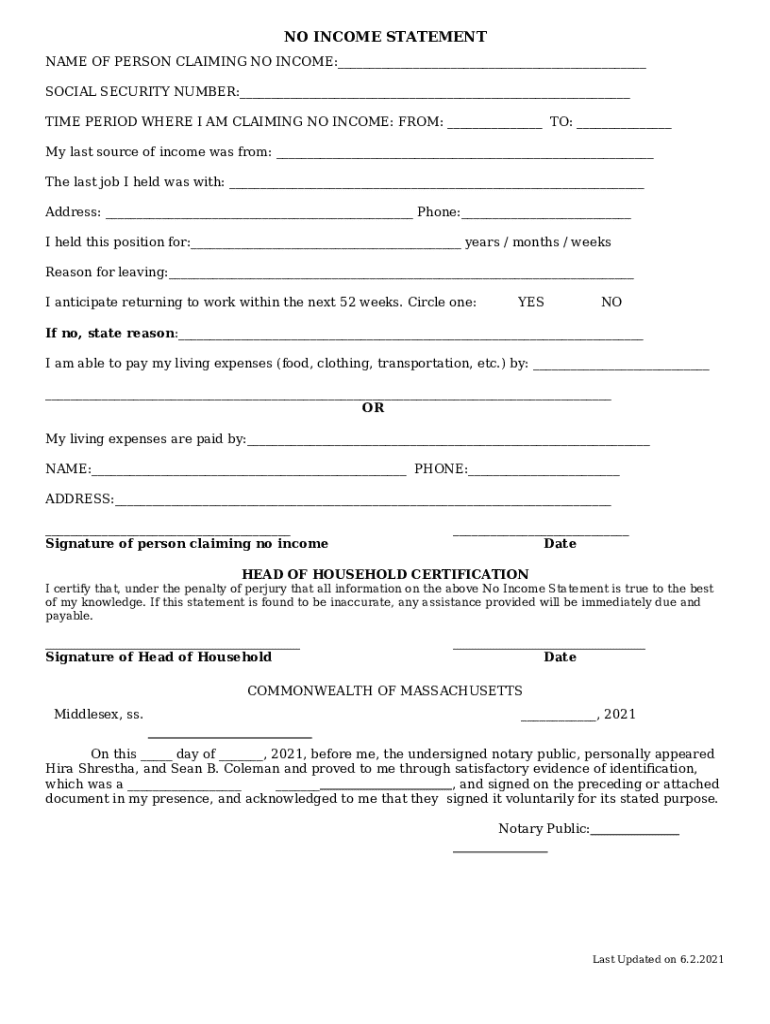

Understanding the no income statement template form

An income statement provides insight into a business's profitability over a specific period, detailing revenues, expenses, and net income. In scenarios where businesses either do not have structured income or prefer not to disclose traditional financial metrics, a no income statement template form offers an essential alternative. This form helps organize financial data without the structure of a conventional income statement, often fitting freelancers and small enterprises that may not have consistent or standard accounting practices.

Utilizing a no income statement template promotes clarity around financial performance, facilitating better decision-making and offering stakeholders a concise view of key financial components. The clarity gained from structured templates can simplify financial discussions, especially in casual or less formal business environments.

When to use a no income statement template

The no income statement template is particularly relevant in various scenarios where traditional income statements fall short. For example, freelancers may not have steady revenue streams at all times, making it cumbersome to adhere to the rigid formatting of standard income statements. Similarly, small businesses just starting or those in casual industries may find that a traditional statement does not align with their financial documentation needs.

Adopting a no income statement template enables businesses to present a simplified financial overview without the complexity. The template also suits legal and tax situations, as it provides a straightforward presentation of financial data, which can support filings for tax reporting. It's crucial to ensure compliance with local tax regulations when opting for this approach, as different jurisdictions may have distinct requirements for financial disclosure.

Key components of a no income statement template

A typical no income statement template provides several essential sections to help users convey their financial status accurately. Key components include:

Contact Information: Identify the business or freelancer, including name, address, and contact details.

Revenue Sources (if applicable): Outline any non-standard revenue streams that may not fit traditional definitions.

Expense Categories: Detail relevant expenses to give a comprehensive overview of costs.

Statements of Cash Flow: Include sections for tracking cash inflows and outflows to provide insight into liquidity.

Depending on individual business models, it's essential to assess what financial details to include or omit from the document. Regular updates can ensure that information remains relevant and accurate.

Interactive features of the pdfFiller no income statement template

pdfFiller enhances the user experience for managing no income statement templates with its cloud-based editing functionalities. This platform allows users to create, edit, and customize templates seamlessly, ensuring that they can manage their documents remotely, from anywhere.

One key feature includes eSigning, streamlining approvals without the need for printed documents. Teams benefit from collaboration tools that allow them to share financial information effortlessly. These features enable users to leverage pdfFiller's platform fully, enhancing overall document management efficiency.

Step-by-step guide to filling out the no income statement template

Completing a no income statement template can be streamlined with a few clear steps. Here’s a simple guide to get you started:

Selecting the right template on pdfFiller – search for the no income statement template that fits your needs.

Customizing the template to fit your needs by adding your business name, logo, and editing fields for accuracy.

Saving and exporting documents to the desired format, ensuring you have a backup of your work.

Sharing the completed document with stakeholders or team members using pdfFiller's sharing functionalities.

By following this step-by-step approach, users can effectively manage their financial visibility without hassle.

Common mistakes to avoid when using a no income statement template

When working with a no income statement template, there are several common pitfalls that can compromise financial accuracy. Businesses should be vigilant to avoid:

Misreporting or omitting important financial details, which can lead to misunderstandings about financial health.

Confusing taxable income with reported revenue, as different contexts may apply during financial assessments.

Neglecting to regularly update the document, which is essential for maintaining an accurate financial portrayal.

Avoiding these mistakes will help ensure accurate and reliable financial reporting, paving the way for sound business decisions.

Best practices for managing your no income statement template

To effectively manage your no income statement template, adopting best practices can enhance both clarity and utility. Implementing a routine of regular reviews and updates is fundamental; this ensures that all data presented remains relevant to current business circumstances.

Moreover, utilizing pdfFiller’s secure cloud platform for document storage guarantees the safety of sensitive financial data. Encouraging team members to engage with the template appropriately, while adhering to compliance measures, is also critical in maintaining accuracy and trust among stakeholders.

Real-life examples and use cases

Numerous individuals and enterprises have successfully employed no income statement templates to streamline their financial reporting. For instance, a freelance graphic designer might use this template to showcase project revenues and expenses instead of traditional income statements, facilitating clearer communication with clients.

Small businesses, especially those in creative industries, have reported advantages such as reduced paperwork and improved organization, enabling them to focus more on core business activities rather than cumbersome financial documentation. Their experiences highlight the practical benefits of utilizing pdfFiller's no income statement template for effective financial management.

FAQs about no income statement templates

As curiosity grows surrounding the no income statement template, several frequently asked questions arise. One common concern is the legality and acceptance of this form by various institutions. Generally, as long as all relevant financial data is included, a no income statement template can serve as an acceptable alternative in many contexts.

It's also crucial to properly integrate the no income statement with other financial documents, ensuring coherence within business records. Users often seek further resources to help them adapt the template to their specific business circumstances, indicating a clear demand for additional guidance and support.

Additional features of pdfFiller relevant to document management

Beyond the primary functionalities tied to the no income statement template itself, pdfFiller offers a suite of additional features that elevate document management. This includes integration with other essential tools for seamless workflow, making it easier for teams to maintain consistency across their filing systems.

Analytics and tracking capability provides insights into document accessibility, allowing users to monitor who views or interacts with their files. Moreover, the support channels available for troubleshooting present an added layer of assistance, ensuring that users have the necessary guidance whenever required.