Get the free Ira and Esa Excess Contribution Removal Form

Get, Create, Make and Sign ira and esa excess

Editing ira and esa excess online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira and esa excess

How to fill out ira and esa excess

Who needs ira and esa excess?

IRA and ESA Excess Form - How-to Guide

Understanding IRA and ESA

An Individual Retirement Account (IRA) is a crucial financial tool for retirement savings, offering various tax benefits. The two primary types of IRAs are Traditional and Roth. A Traditional IRA allows you to make contributions that may be tax-deductible, with taxes deferred until withdrawal. In contrast, Roth IRAs are funded with after-tax dollars, enabling tax-free withdrawals during retirement. Each account type has specific contribution limits set by the IRS, which are $6,500 for those under 50 and $7,500 for those 50 and older in 2023, alongside potential tax implications based on your income.

An Education Savings Account (ESA), also known as a Coverdell ESA, is specifically designed to help families save for educational expenses. Contributions are limited to $2,000 per beneficiary per year, and earnings grow tax-free if used for qualified education expenses. ESAs also present tax advantages, making them an attractive choice for parents and guardians looking to fund education savings.

Why the excess form is necessary

Filing an excess form is critical for taxpayers who contribute more to their IRAs or ESAs than allowed. Excess contributions trigger penalties that can severely affect your overall financial health. For IRA excess contributions, a 6% penalty applies for each year the excess remains in the account. Similarly, for ESAs, any amount contributed above the annual limit does not incur penalties immediately, but excess amounts will be subject to taxes and potential penalties if not addressed promptly.

Ensuring compliance with IRS regulations through the timely filing of the excess form helps mitigate these penalties. Reporting excess contributions accurately demonstrates adherence to tax laws and can save individuals from costly fees, making the form an essential part of maintaining good financial standing.

Identifying excess contributions

To identify excess contributions for your IRA, start by reviewing your total contributions against the IRS limit. Calculate your contributions over the year, including any rollovers and transfers. Subtract the limit from your total contributions to establish whether there’s an excess. For example, if you contributed $8,000 to your IRA in a year with a limit of $6,500, the excess amount is $1,500. This simple calculation reveals potential penalties that could apply.

In the case of an ESA, the process focuses on annual contributions. If a parent contributes $2,500 for a child in a single year, the excess amount is $500. It's essential to keep track of contributions made by multiple custodians, as contributions from different accounts for the same beneficiary can aggregate and exceed the $2,000 annual limit.

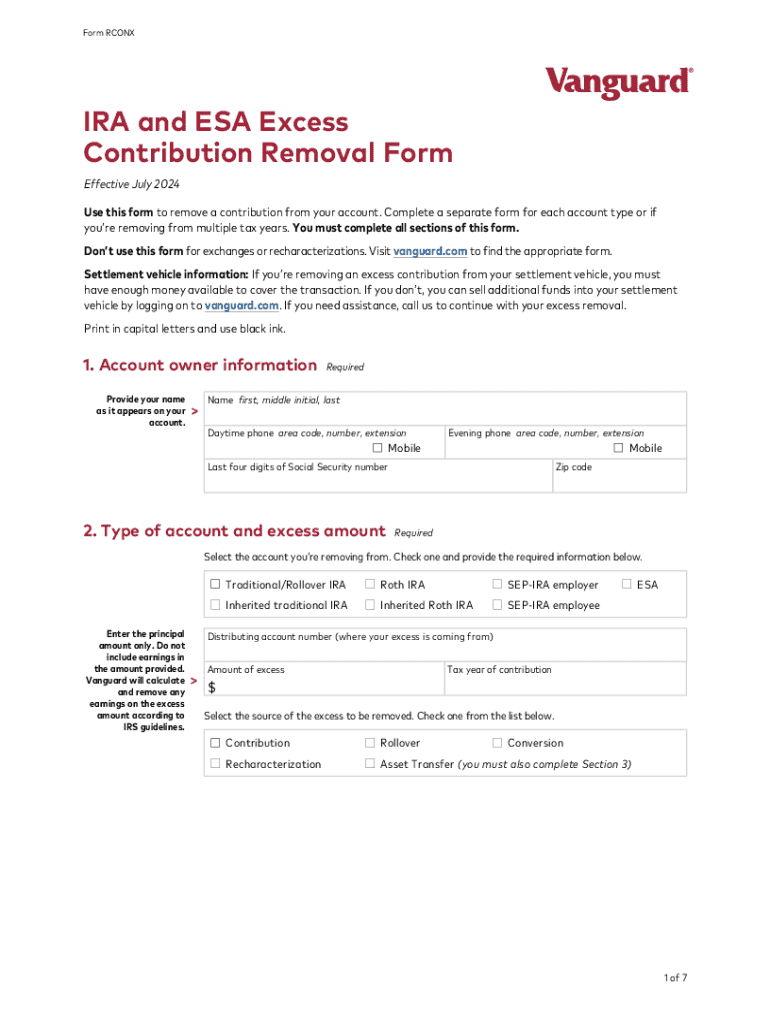

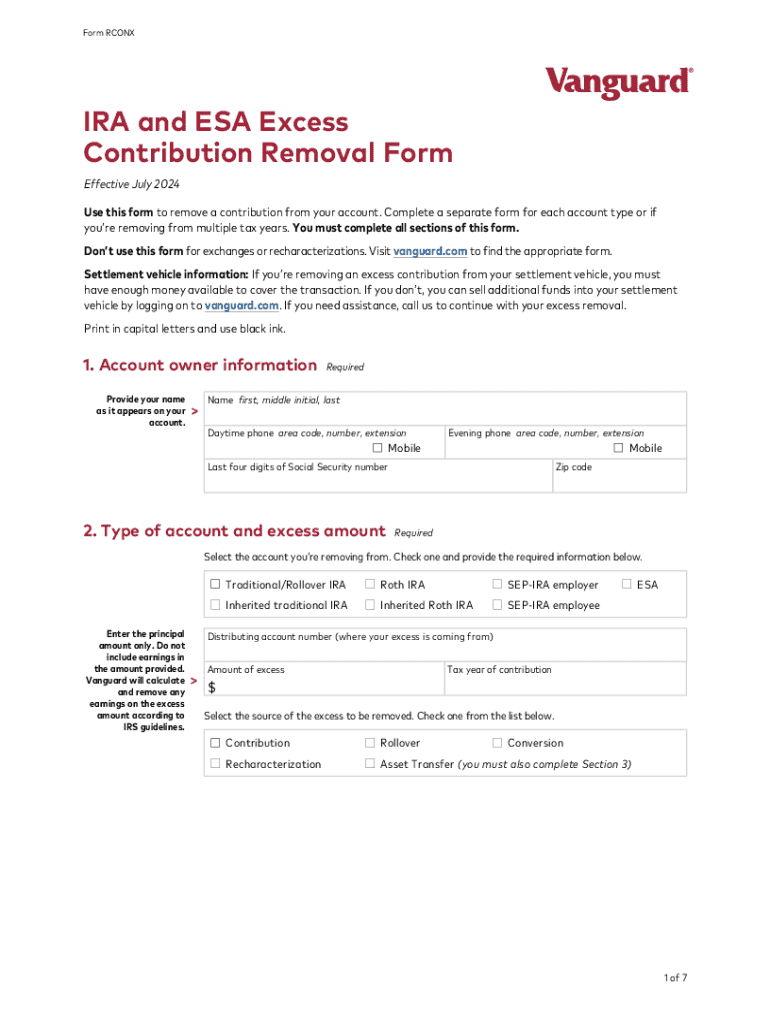

Filling out the IRA and ESA excess form

The IRS Form 5329 is crucial for reporting excess contributions to both IRAs and ESAs. This form requires specific information to accurately assess the situation. Key sections include personal information, contribution details, and statements regarding penalties associated with excess contributions. Filling out each section correctly is important to avoid any disputes with the IRS.

When completing the form, ensure that every detail is accurate, from providing your Social Security number to confirming the type of account and the excess contribution amount. Many users make mistakes in transferring numbers or miscalculating excess totals, which can complicate the process.

Submitting the excess form

The completed IRA and ESA excess form should be submitted to the IRS, either electronically or via mail depending on your preferences or accounting needs. Ensure you pay close attention to state-specific requirements that may also mandate certain forms or additional documentation.

Timing is key when submitting the excess form. Ideally, you should submit the form as soon as you discover the excess contribution to avoid penalties. The IRS sets deadlines at April 15 following the tax year in which the excess contribution occurred, and missing this deadline could lead to increased penalties.

Managing your accounts post-submission

Following the submission of your excess form, it’s crucial to actively monitor your contributions going forward. Consider setting up reminders to review your account contributions periodically. Maintaining awareness of IRS limits is essential, as it can help you avoid future excess contributions. This proactive approach not only safeguards your financial health but also simplifies tax planning.

Utilizing tools like pdfFiller can greatly enhance your document management process. It offers features allowing users to edit forms, store completed documents securely, and track submissions easily. The platform enables you to maintain a seamless record of all your essential financial documents, ensuring compliance with regulatory requirements.

Troubleshooting common issues

When dealing with the IRS, it’s common to encounter queries related to your tax forms. Typical questions often revolve around the legitimacy of your reported excess contributions or requests for additional documentation. Being prepared with accurate records and prompt responses can help facilitate a smoother resolution process.

If you miss a submission deadline, act quickly to rectify the situation. Engage with the IRS as soon as possible to explain your circumstances and inquire about options for late submissions. There may be relief provisions available, especially if you act promptly and provide compelling reasons for your delay.

FAQs about IRA and ESA excess form

Frequently, individuals encounter conceptual roadblocks when dealing with IRA and ESA excess forms. Questions often arise concerning the exact markers that define excess contributions, the procedural steps for resolution, and the nuances of tax penalties involved. It's beneficial to systematically address these inquiries to ensure clarity.

Clarifying specific terms—like the distinction between taxable income and contribution limits—can help demystify the complexities of IRAs and ESAs. Understanding how excess contributions impact your tax return will arm you with knowledge to better manage your accounts and avoid costly penalties.

Additional support and resources

If you're seeking more assistance regarding the IRA and ESA excess form, the IRS website serves as a valuable resource, providing detailed documentation and guidelines on compliance and reporting. Additionally, locating qualified financial advisors can offer personalized insights tailored to your unique financial situation.

For those grappling with form management, pdfFiller stands out as an essential tool. Its capabilities extend well beyond simple document editing; users can securely store forms, utilize eSign features, and enhance their overall document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ira and esa excess in Gmail?

How do I make edits in ira and esa excess without leaving Chrome?

How can I fill out ira and esa excess on an iOS device?

What is ira and esa excess?

Who is required to file ira and esa excess?

How to fill out ira and esa excess?

What is the purpose of ira and esa excess?

What information must be reported on ira and esa excess?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.