Get the free Prospectus Supplement

Get, Create, Make and Sign prospectus supplement

Editing prospectus supplement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out prospectus supplement

How to fill out prospectus supplement

Who needs prospectus supplement?

Prospectus Supplement Form: How-to Guide

Understanding the prospectus supplement form

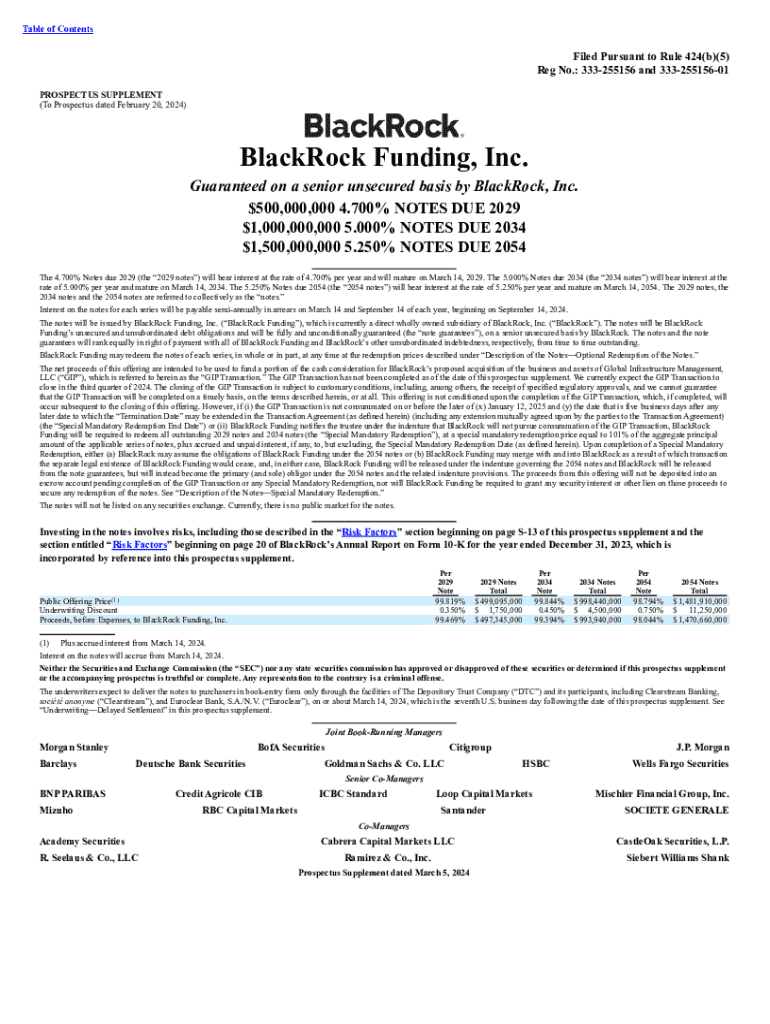

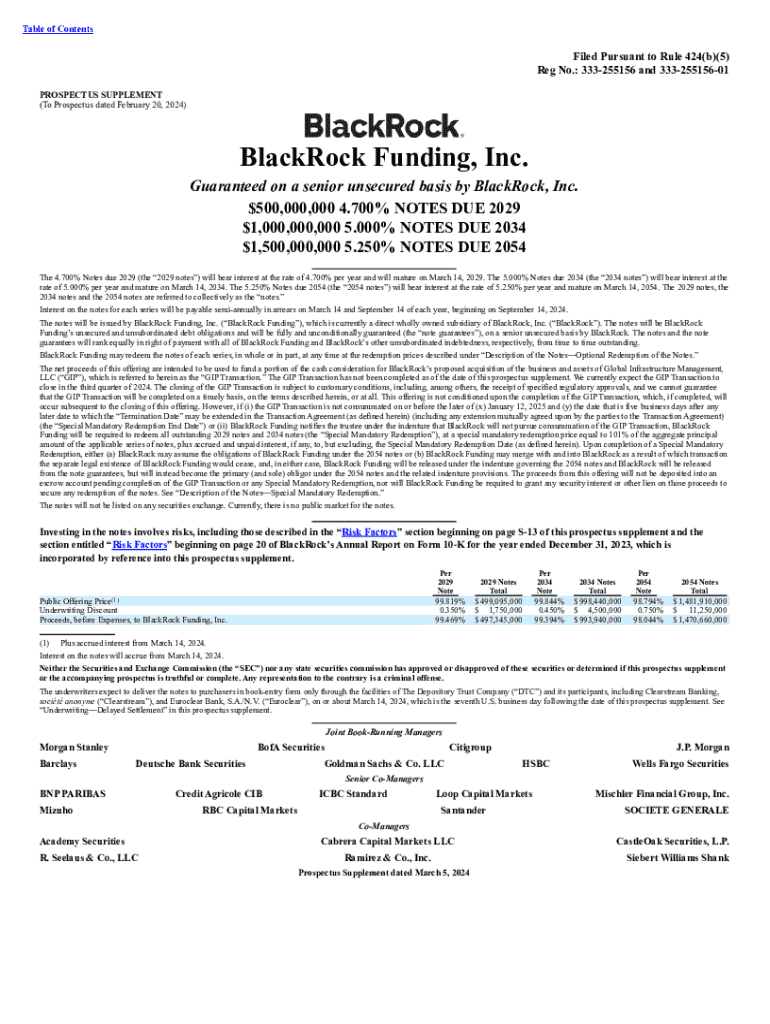

The prospectus supplement form serves as an essential component in the realm of securities offerings. It acts as an addendum to the initial prospectus, providing updated information that is critical for investors and regulators alike. This document informs stakeholders about new developments, changes in terms of the securities being offered, or the company’s financial standing, ensuring that all parties are adequately informed.

The importance of this form cannot be overstated. In the highly regulated environment of financial securities, compliance with securities laws is paramount. The prospectus supplement form helps issuers maintain transparency and uphold their obligations to the Securities and Exchange Commission (SEC), which ultimately reinforces investor confidence.

A prospectus and a prospectus supplement serve different but interconnected purposes. While the prospectus provides a comprehensive view of the investment offering and its associated risks, the prospectus supplement focuses solely on updating or adding information relevant to that offering. This distinction is crucial for ensuring that investors are making well-informed decisions based on the most current data.

Essential components of a prospectus supplement

Several key components comprise a well-drafted prospectus supplement form. Firstly, company background and financial condition are critical elements that outline the financial health, operational achievements, and any recent significant changes that may affect investor decisions. This section should articulate clear insights into the company’s strategy and performance metrics.

The description of securities offered must be laid out in straightforward terms to foster understanding. This includes details about the types of securities available, pricing, and potential changes in terms. Furthermore, stating the intended use of proceeds is vital; investors need to understand how their contributions will be utilized, whether for expansion, debt repayment, or research and development.

Additionally, the prospectus supplement should contain statements of risks and legal considerations, informing investors of possible risks associated with the investment. Compliance with SEC disclosure regulations is non-negotiable and ensures that the prospectus supplement is both comprehensive and accurate.

Step-by-step guide to completing the prospectus supplement form

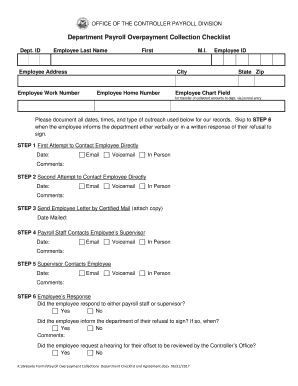

Completing the prospectus supplement form can be a meticulous process that warrants attention to detail. Begin by gathering all necessary information. This includes financial statements, reports, and any updates or changes relevant to the securities being offered. Collecting these documents can streamline the completion process and decrease errors.

During the filling out of the form, it’s vital to adhere to the detailed instructions provided for each section of the document. Avoid common pitfalls, such as providing outdated information or neglecting to address potential risks. This careful attention will bolster the clarity and effectiveness of the supplement.

Once you’ve completed the form, reviewing and editing the content is essential. Prioritize accuracy and clarity; any misleading information can not only harm investor trust but also lead to regulatory repercussions. Using tools from pdfFiller can facilitate effective editing that ensures polished and professional output.

Electronic submission requirements

Filing the prospectus supplement with the SEC electronically is now standard practice. The submission process requires you to follow specific protocols outlined by the SEC, which include adhering to submission deadlines and ensuring proper formatting to avoid rejections. Improper submissions can lead to delays in the offering process, adversely affecting the company’s funding endeavors.

Leveraging cloud-based solutions such as pdfFiller can simplify the submission process. These platforms offer features that facilitate timely filing, compliance checks, and ease of access, which can ultimately enhance the management of your documents.

Best practices for managing your prospectus supplement

Managing your prospectus supplement requires collaboration and vigilant tracking of updates. Engage with your legal counsel to ensure that every legal aspect is comprehensively addressed. This teamwork ensures all necessary disclosures are made transparently, thereby fostering trust among investors.

Keeping track of changes and versions is important in maintaining an updated prospectus supplement. Utilizing pdfFiller enables users to monitor modifications efficiently, thereby allowing for smooth transitions between drafts and final versions.

Integrating features such as eSigning ensures that approvals are swift, allowing your document to move through each stage with fewer hold-ups. Smooth collaboration ensures that updates can be communicated effectively across teams.

Common challenges and solutions

Issuers often encounter common challenges when preparing the prospectus supplement. Regulatory compliance can pose difficulties, particularly for those unfamiliar with SEC guidelines. A thorough knowledge of these regulations, combined with the assistance of legal professionals, can mitigate risks associated with compliance failures.

Navigating complex legal language also poses a challenge. When drafting a prospectus supplement, utilize clear, jargon-free language to make information accessible to all investors. Submit drafts for outside review to identify areas where wording may create confusion.

Discrepancies in information are another hurdle that can lead to mistrust among stakeholders. Diligently cross-reference all data used in the supplement to ensure consistency throughout the document and mitigate potential discrepancies before submission.

Tips for effective communication with stakeholders

Presenting the prospectus supplement to investors requires thoughtful communication strategies. Addressing stakeholders’ concerns should be a priority, emphasizing how the updates and information within the supplement align with their interests and investment goals. Effective presentations can enhance understanding and foster investor confidence.

Transparency and ongoing updates are instrumental in maintaining healthy relationships with investors. Clearly communicate all changes and be prepared to answer any questions that arise regarding the information provided in the prospectus supplement.

Moreover, crafting a compelling narrative that outlines the company’s vision and future plans can significantly enhance investor confidence. Articulate how the securities offering contributes to the overall success of the company, thus aligning investor interests with company objectives.

Interactive tools and resources on pdfFiller

pdfFiller offers a suite of interactive tools designed to simplify document creation, including the prospectus supplement form. Users can benefit from editing and formatting tools that allow for seamless modifications, making it easier to maintain consistency and accuracy.

The integration of eSignature capabilities streamlines the approval process, allowing multiple stakeholders to sign and verify documents from anywhere. Additionally, the cloud-based platform provides easy access to files, enabling teams to collaborate from various locations without losing track of document revisions.

Conclusion on the importance of mastering the prospectus supplement form

Mastering the prospectus supplement form is crucial for both issuers and investors in today’s financial landscape. A well-completed form not only ensures compliance with regulatory requirements but also builds trust with potential investors by providing them with the most relevant and up-to-date information.

The long-term advantages for both parties are multifaceted. By successfully navigating the process outlined in this guide and utilizing tools like those offered on pdfFiller, stakeholders can facilitate a smoother offering process, enhancing their ability to communicate effectively and transparently—elements that are essential for building lasting investor relationships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get prospectus supplement?

How do I execute prospectus supplement online?

How do I edit prospectus supplement online?

What is prospectus supplement?

Who is required to file prospectus supplement?

How to fill out prospectus supplement?

What is the purpose of prospectus supplement?

What information must be reported on prospectus supplement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.