Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Understanding the Form 10-K: A Comprehensive Guide

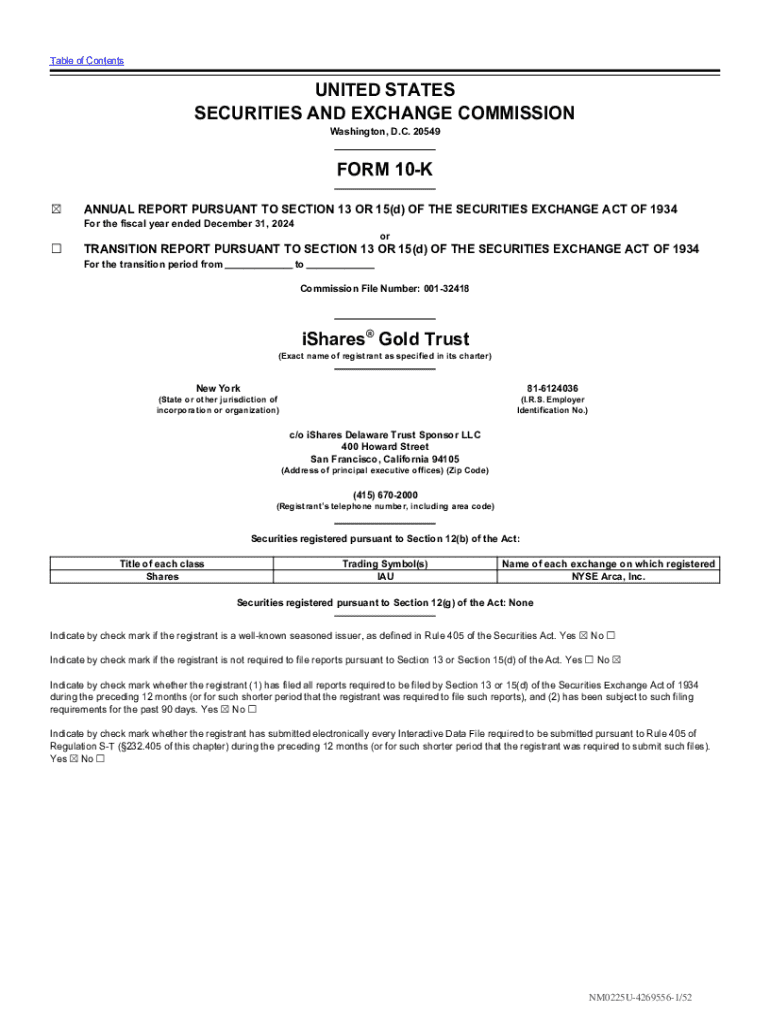

Understanding Form 10-K

The Form 10-K is an essential document that publicly traded companies in the United States are required to file with the Securities and Exchange Commission (SEC). This comprehensive report provides a detailed overview of a company’s financial performance, business operations, and other critical information that stakeholders need to make informed decisions. The primary purpose of the Form 10-K is to provide investors with a holistic view of the company's financial health and strategic direction, enhancing transparency.

For investors and stakeholders, the Form 10-K is an invaluable resource. It not only showcases a company's strengths and weaknesses but also outlines potential risks and future growth prospects. By understanding this document, investors can make better-informed decisions regarding their investments. Each year, companies file this report to provide insights into their operations, performance metrics, and compliance with legal standards, making it a critical tool for due diligence.

Contents of a Form 10-K

The Form 10-K is structured into several key sections that guide the reader through various aspects of the company's operations and financial standing. The document typically includes four main parts: a business overview, financial information, corporate governance, and exhibits, along with financial statement schedules. This clear organization helps stakeholders navigate the complex information contained within.

Each part contains detailed items that cover specific facets of the company's performance and operations. Understanding these sections can help users glean critical insights from the document.

How to prepare and file a Form 10-K

Preparing a Form 10-K can seem daunting due to its comprehensive nature. However, breaking down the process into manageable steps can ease the workload. The first step involves gathering all necessary financial data from different departments, including finance, operations, and legal.

Collaboration is crucial during this phase. Teams must work together to ensure that each section is not only accurate but also communicates the company's story effectively. Addressing risk factors and any ongoing legal proceedings is particularly important, as this informs potential investors of challenges that may impact their investment.

Filing deadlines and compliance

The SEC has established specific filing deadlines for Form 10-K, which vary based on the company’s public float. Large accelerated filers must file within 60 days after the end of their fiscal year, while accelerated filers have 75 days. Non-accelerated filers have a 90-day deadline. Adhering to these timelines is critical for maintaining compliance and avoiding penalties.

Consequences of late filings can include fines, damage to reputation, and loss of investor trust. Timely submissions reinforce commitment to transparency and uphold corporate governance standards.

Common pitfalls in Form 10-K preparation

Organizations often face several challenges when preparing their Form 10-K. Misleading statements can cause legal compliance issues, while incomplete or inaccurate disclosures may mislead investors and regulators alike. It’s crucial to ensure that all content reflects the true state of the business and adheres to SEC regulations.

To avoid such pitfalls, companies must adopt systematic review processes, ensuring every statement is accurate and clearly presented. Engaging legal and financial advisors during the preparation process can also mitigate risks.

Enhancing your Form 10-K

Enhancing the content of a Form 10-K is not just about meeting legal requirements but also about captivating the reader's attention. Using clear and concise language is vital, as it conveys professionalism and clarity. Additionally, employing visualizations for financial data, such as charts or graphs, can significantly enhance understanding while making the document more engaging.

Maintaining consistency with previous reports is equally essential. This approach not only allows investors to track performance over time but also builds expectations for future filings.

Managing and storing your Form 10-K with pdfFiller

pdfFiller offers cloud-based document management solutions that streamline the process of preparing and storing your Form 10-K. By utilizing pdfFiller, teams can collaborate on drafts in real-time, making revisions and updates accessible from anywhere. This flexibility is particularly crucial as teams may not always be in the same location.

Cloud-based systems enhance accessibility and simplify approval processes. For example, using electronic signatures ensures swift approvals without the need for physical documents. Implementing best practices for storing and retrieving your Form 10-K is essential for maintaining compliance and ensuring readiness for future audits.

Related forms and additional filing requirements

In addition to Form 10-K, companies often file other reports that provide further insights into their financial health and operations. Form 10-Q, the quarterly report, offers interim financials and updates since the last Form 10-K, while Form 8-K is triggered by significant events that investors should be aware of between periodic reports. Understanding these filings complements the information presented in Form 10-K.

Awareness of related forms is vital for stakeholders who wish to maintain a comprehensive understanding of a company's ongoing performance and market position.

Key highlights and takeaways

Completing a Form 10-K requires thorough understanding and meticulous attention to detail. Key insights include recognizing the importance of accurate reporting in fostering investor trust, meeting legal requirements, and presenting a clear picture of the company's operation. Companies must not only focus on compliance but also consider the broader narrative of their business when crafting their Form 10-K.

Through diligent preparation, effective communication, and leveraging tools like pdfFiller, companies can ensure that their Form 10-K is not only compliant but also engaging and informative.

External links for further research

For individuals and teams looking to dive deeper into the specifics of Form 10-K requirements and best practices, external resources provide valuable insights. The SEC's official guidelines outline comprehensive filing instructions and requirements, helping companies maintain compliance. Various financial reporting standards and articles focusing on financial disclosures also serve as excellent references for enhancing understanding and execution of Form 10-K.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 10-k?

How can I edit form 10-k on a smartphone?

How can I fill out form 10-k on an iOS device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.