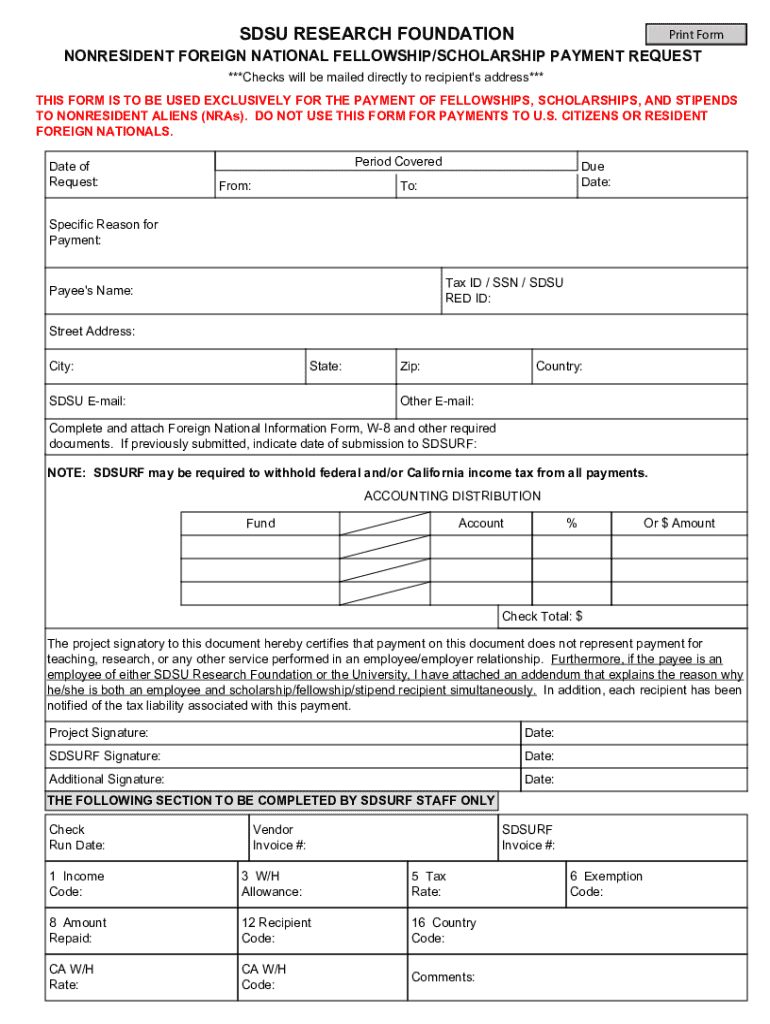

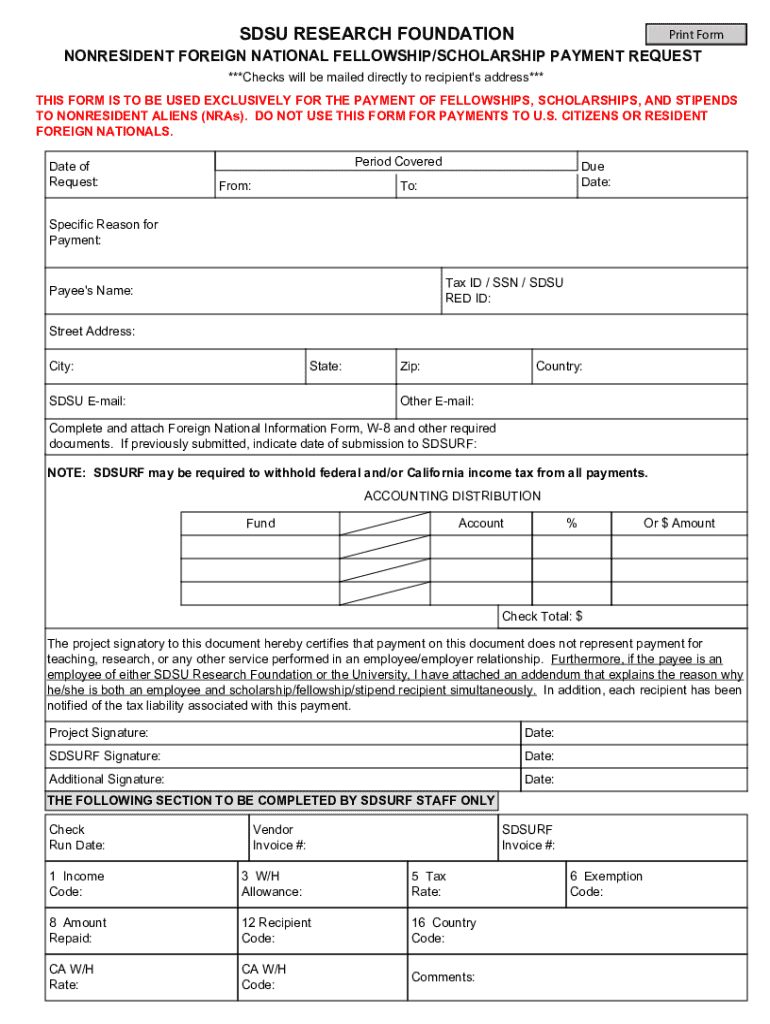

Get the free Nonresident Foreign National Fellowship/scholarship Payment Request - foundation sdsu

Get, Create, Make and Sign nonresident foreign national fellowshipscholarship

How to edit nonresident foreign national fellowshipscholarship online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonresident foreign national fellowshipscholarship

How to fill out nonresident foreign national fellowshipscholarship

Who needs nonresident foreign national fellowshipscholarship?

A comprehensive guide to nonresident foreign national fellowship/scholarship forms

Understanding nonresident foreign national fellowships and scholarships

Nonresident foreign national fellowships and scholarships are crucial funding mechanisms designed to support academically talented individuals from outside the United States. They offer financial assistance to students and researchers pursuing advanced study or research in the U.S. educational system. The core purpose of these programs is to attract international talent, promote diversity in academia, and facilitate cross-cultural exchange and collaboration.

These programs empower nonresident foreign nationals to access quality educational resources, enhance their skills, and contribute to their home countries' advancement upon completion. By bridging financial gaps, they allow participants to focus on their academic and research pursuits without excessive financial strain.

Eligibility criteria for nonresident foreign national fellowships and scholarships

Eligibility for nonresident foreign national fellowships and scholarships varies by program but generally includes certain key requirements. For many programs, applicants must be citizens of countries outside the U.S., be enrolled or accepted in an accredited American institution, and demonstrate academic excellence through transcripts, letters of recommendation, and personal statements.

While scholarships focus primarily on academic merit and financial need, fellowships may also consider research experience and project proposals. It's important to meticulously review each program's specific criteria, as these will outline distinctions, particularly between fellowships and scholarships, and what each entails.

Types of funding and support

Funding options for nonresident foreign nationals encompass several forms, including scholarships, fellowships, and grants. Each type serves different purposes and audiences. Scholarships typically provide financial support based solely on academic merit or financial need, while fellowships usually involve a work or research obligation in conjunction with the funding amount.

Grants may be available for specific projects or studies, requiring a formal application detailing how funds will be utilized. Understanding the differences between qualified and non-qualified payments is also essential — qualified payments often cover tuition and fees, while non-qualified payments may include living stipends or travel expenses and have varying tax implications under U.S. tax law.

Tax withholding and reporting requirements

Nonresident foreign nationals must navigate the complexities of U.S. tax laws regarding scholarships and fellowships. Generally, the income derived from these funding sources is subject to tax withholding. The Internal Revenue Service (IRS) requires nonresident aliens to report any income earned, including scholarship amounts, which could impact their tax obligations and potential refunds.

The key form for tax reporting is the IRS Form 1040-NR, which designates the income earned by nonresident aliens. Familiarizing oneself with IRS regulations and potential treaty benefits with one’s home country can significantly affect the final tax liability. Nonresident foreign nationals should keep meticulous records of all funding received and expenditures related to their academic or research activities.

Application process for nonresident foreign national fellowships and scholarships

The application process for fellowships and scholarships requires careful preparation and attention to detail. First, applicants should identify relevant programs aligning with their academic goals. Following this, they must gather necessary documentation, which typically includes application forms, proof of enrollment or acceptance, academic transcripts, and personal essays.

Common mistakes to avoid during the application process include failing to proofread documents, missing deadlines, and applying for unrelated programs. Each application should be tailored to present a compelling case for funding.

Immigration and tax documentation

Maintaining appropriate immigration status is critical for nonresident foreign nationals, especially when seeking financial support through scholarships and fellowships. Documentation related to immigration status must be accurately maintained and submitted where required. For instance, the Form I-20 or DS-2019 may need to be presented when applying for fellowships, indicating legal student status.

Tax documentation, particularly the Individual Taxpayer Identification Number (ITIN), is equally important. Nonresidents may require an ITIN when applying for tax refunds or to fulfill tax obligations in the U.S. The process to acquire an ITIN involves filing Form W-7, which requests this identification. Understanding the requirements and being organized with documentation will streamline the application process.

Payment processing for scholarships and fellowships

Once awarded, the disbursement of funds through scholarships or fellowships typically follows a systematic process. Funds may be distributed in one lump sum or in installments, depending on the specific program's guidelines. Applicants should expect to receive funds via their educational institution, which may include direct deposits to their accounts or checks provided in person. Familiarizing oneself with the timing of payments, which can vary, is essential to plan financially for tuition and living expenses.

The source of income also affects the timing and method of payment. For example, institutional funds may be processed more rapidly than external funding from private sources. The goal is to ensure that recipients effectively manage their finances and are prepared to utilize the funds responsibly for their education.

Interaction with U.S. tax treaties

Tax treaties can greatly benefit nonresident foreign nationals, offering preferential tax treatment on certain types of income, including scholarships and fellowships. These treaties are agreements between the U.S. and other countries to avoid double taxation and can sometimes exempt individuals from certain U.S. taxes. Nonresident foreign nationals should inquire whether their home country has an agreement with the U.S. and how to apply such benefits when filing tax returns.

Navigating the complexities of tax treaties requires an understanding of terms and provisions specific to each agreement. For example, countries like Canada and the United Kingdom have favorable terms that can greatly mitigate tax burdens. Speaking with a knowledgeable tax consultant or financial advisor can help clarify how to utilize these treaty benefits effectively.

Common questions and clarifications

Many nonresident foreign nationals have questions concerning their fellowship or scholarship status in relation to immigration and taxation. A common query includes whether these funding sources affect immigration status — generally, they do not, provided that the recipient maintains their enrollment and visa status aligned with their educational goals.

Helpful tips for managing fellowship and scholarship forms

To successfully navigate the complexities of the nonresident foreign national fellowship/scholarship form, it's vital to employ best practices in organization and documentation management. Ensuring clarity and detail when filling out forms not only conveys professionalism but also allows for a smoother review process by funding bodies.

Insights from real experiences

Hearing from past recipients of nonresident foreign national fellowships and scholarships can provide invaluable insights. Many highlight the importance of being thorough in applications and understanding funding dynamics. Learning from those who successfully navigated this pathway reinforces that persistence and attention to detail are crucial to achieving funding.

Real-life experiences reveal that networking within academic departments can significantly enhance visibility among scholarship committees. Furthermore, applicants often express the necessity of tailoring their applications to reflect genuine passions for their field of study, which resonate distinctly with funders.

Conclusion on importance of proper documentation

Understanding and managing your nonresident foreign national fellowship/scholarship form is critical, not just for obtaining funding but for maintaining compliance with U.S. laws. Incorrect or incomplete submissions can lead to delays or lost opportunities. Therefore, utilizing comprehensive document management solutions like pdfFiller can empower you to edit, sign, and collaborate on documents from any location, ensuring that your application is as polished and professional as possible.

Investing time in understanding the entire process and seeking assistance when needed can significantly improve your chances of success. Achieving funding through these forms can open doors to numerous academic and professional opportunities, making the effort truly worthwhile.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nonresident foreign national fellowshipscholarship directly from Gmail?

How can I get nonresident foreign national fellowshipscholarship?

Can I create an electronic signature for signing my nonresident foreign national fellowshipscholarship in Gmail?

What is nonresident foreign national fellowship scholarship?

Who is required to file nonresident foreign national fellowship scholarship?

How to fill out nonresident foreign national fellowship scholarship?

What is the purpose of nonresident foreign national fellowship scholarship?

What information must be reported on nonresident foreign national fellowship scholarship?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.