Get the free Business Property Statement for 2023

Get, Create, Make and Sign business property statement for

Editing business property statement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business property statement for

How to fill out business property statement for

Who needs business property statement for?

Comprehensive Guide to the Business Property Statement for Form

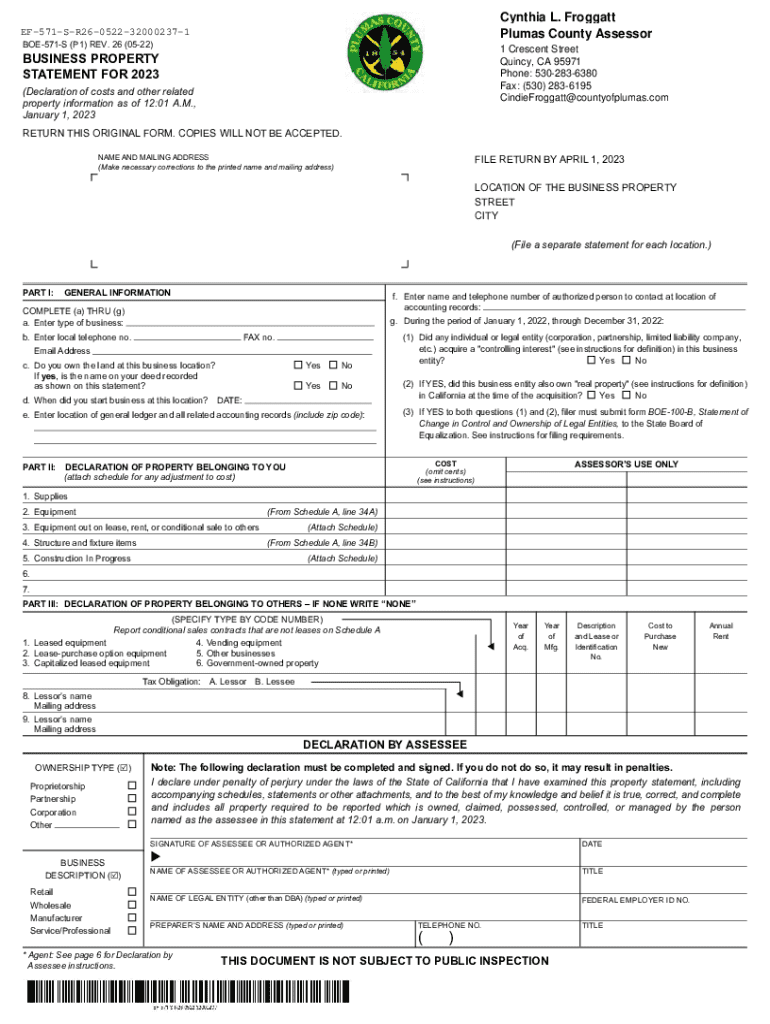

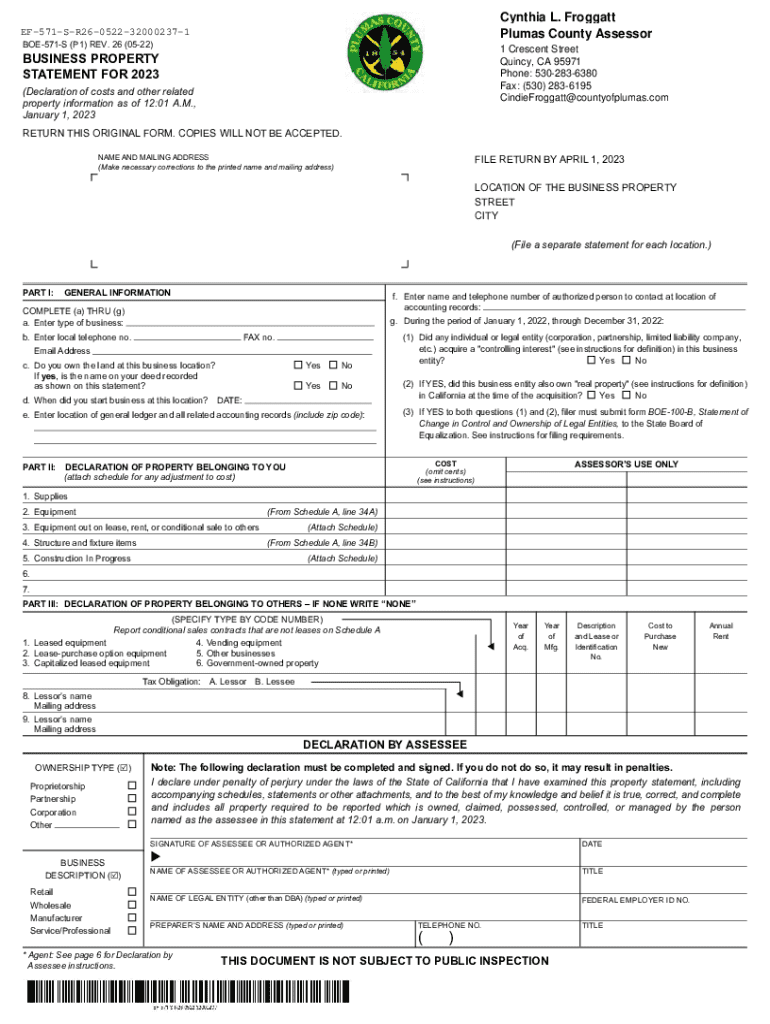

Understanding the business property statement

A Business Property Statement (BPS) is a crucial document for businesses and property owners that provides an inventory of all personal business-related property, including fixtures and equipment. This form plays an essential role in the tax assessment process, ensuring property is accurately assessed for taxation purposes. By reporting the value of your business assets, the BPS helps determine the property taxes owed to local governments.

Filing the Business Property Statement on time is imperative as it affects tax liabilities and compliance status. Jurisdictions have specific regulations that govern BPS, and staying updated with these requirements is vital. Regular filing timelines are generally set at the beginning of the year, with deadlines typically around April 1st in many regions, including San Mateo County.

Eligibility and filing requirements

Not every business is required to file a Business Property Statement. Typically, businesses with tangible personal property that carries a significant value—usually defined by local property tax regulations—are required to submit this form annually. This includes rapidly depreciating assets like machinery and equipment that contribute to a firm's operational capabilities.

Exemptions can apply, particularly for small businesses. For instance, some jurisdictions exempt personal property valued below a certain threshold from needing a BPS. Local regulations, such as those in San Mateo County, might also vary, so it's essential to familiarize yourself with specific rules applicable to your area.

Preparing to file your business property statement

Preparation is the key to efficiently filing your Business Property Statement. Begin by gathering all pertinent information and documentation related to your business assets. Essential details include the business name, physical address, and contact information. You will also need a comprehensive list of personal property, which should encompass everything from office equipment to machinery used in production.

Valuation is another critical component. Understanding how to accurately assess the value of your personal property can help minimize errors and discrepancies later on. Tools such as industry guidelines, appraisals, and depreciation schedules can assist in establishing the correct values for your assets.

How to file your business property statement online

Filing your Business Property Statement online streamlines the process. To begin, access your local Assessor’s Office website, locate the e-File Portal, and create an account if you do not already have one. The interface of online systems is typically user-friendly, allowing you to navigate through various sections of the filing process smoothly.

Once logged in, you can input your property information, upload necessary supporting documents, and submit your application. Ensure you receive a submission confirmation through email or displayed on the portal, allowing you to track your application efficiently.

Completing the business property statement

The Business Property Statement consists of several distinct sections, each focusing on different categories of business assets. Schedule A is designed for detailing the cost of equipment. This is where you will enumerate all equipment used for business operations, detailing acquisition costs and year of purchase to ensure accurate assessments.

Following Schedule A, Schedule B deals with building improvements and leasehold improvements. Here, you should account for any renovations or improvements made to your business premises. Collectively, accurate representation of land and land improvements is critical for comprehensive tax evaluation.

When completing the form, avoid common pitfalls such as providing outdated valuations or missing items from your inventory list. A meticulous review of the BPS prior to submission is advisable to ensure both accuracy and completeness.

Special cases and considerations

There are special circumstances surrounding the Business Property Statement that require attention. Businesses that have relocated, changed ownership, or closed should provide updates on their status accordingly. This is critical for maintaining accurate tax records and avoiding penalties.

In particular cases, such as leased equipment, it is important to report these items accurately, as the leasing agreement may stipulate who is responsible for reporting the asset’s value. For businesses operating short-term rentals or business apartments, understanding specific reporting requirements can also save you from compliance issues. If discrepancies arise during your assessment, know the processes for disputing these findings.

After filing: managing your business property statement

Once you have filed your Business Property Statement, it's crucial to keep track of any deadlines associated with tax payments. Failing to file on time can result in penalties, which can significantly impact your financial health. Understanding the timeline for when to expect your assessment notice is equally important, as this will shape your financial preparations for property tax payments.

If you disagree with your assessment, there are established procedures to follow, starting with contacting your local Assessor’s Office to discuss your concerns. Ensuring you know the important deadlines and dates for appeals or re-assessments can protect you from incurring unnecessary costs.

FAQs regarding the business property statement

Many business owners often have similar questions regarding the Business Property Statement. Frequently asked questions include inquiries about acceptable filing methods, how to manage audits and assessments, and what exemptions may apply to specific business types. Engaging with your local Assessor's Office can provide clarity on these topics.

Key contacts for assistance typically include the local Assessor’s Office and professional tax advisors. Familiarizing yourself with recurring issues, like reporting errors or valuation disputes, enhances your ability to tackle them expeditiously.

Navigating additional resources

For further assistance, various resources are available to help you through the Business Property Statement process. Links to related forms, deadlines, and supporting documents can typically be found on your local Assessor’s Office website. This can include important guidelines on how to accurately file your statement, specific forms you may need, and deadlines that you must adhere to.

Understanding where to find additional assistance can streamline the process considerably. Partner agency resources can offer guidance on compliance issues, asset management, and tax implications.

Important reminders and filing tips

Maintaining compliance is crucial when it comes to your Business Property Statement. Remember to double-check all asset values, ensure listing completeness, and submit on time to avoid penalties. Resourcefulness in managing documentation is also a key factor; consider keeping electronic copies where possible.

Engaging with professional tax advisors can provide added insight, especially for businesses with more complex property situations. Proactive consultations can help businesses navigate potential pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business property statement for?

Can I create an electronic signature for signing my business property statement for in Gmail?

Can I edit business property statement for on an iOS device?

What is business property statement for?

Who is required to file business property statement for?

How to fill out business property statement for?

What is the purpose of business property statement for?

What information must be reported on business property statement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.