Get the free Consolidated Reports of Condition and Income for a Bank With Domestic Offices Only—f...

Get, Create, Make and Sign consolidated reports of condition

How to edit consolidated reports of condition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consolidated reports of condition

How to fill out consolidated reports of condition

Who needs consolidated reports of condition?

Comprehensive Guide to the Consolidated Reports of Condition Form

Understanding the consolidated reports of condition form

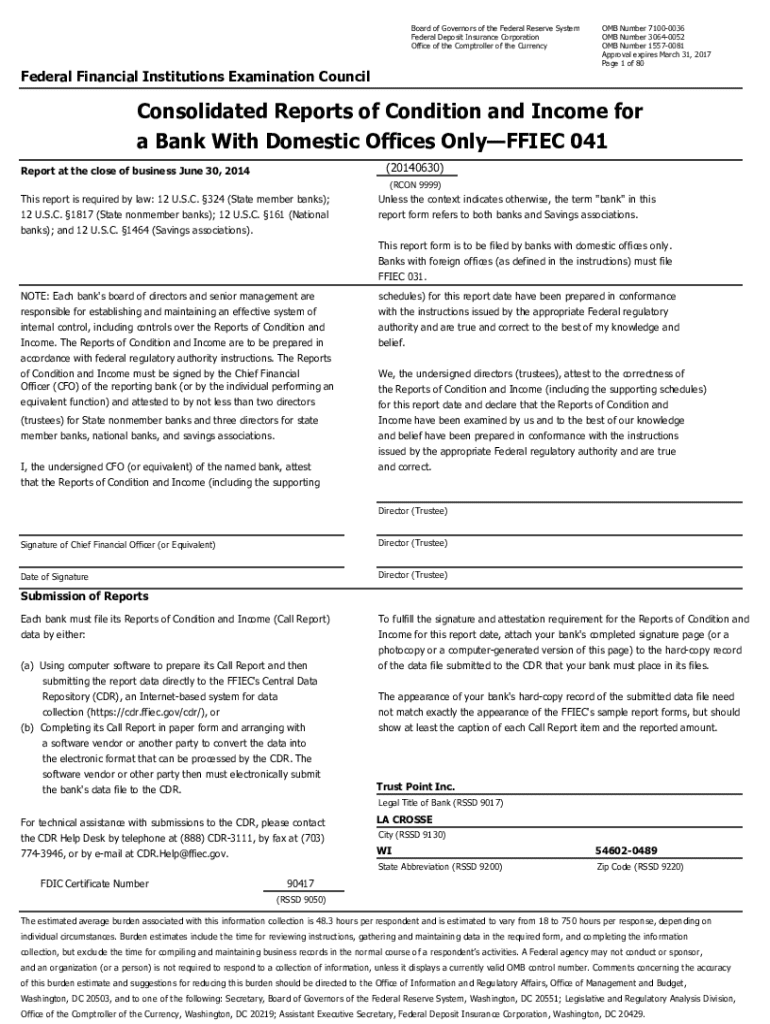

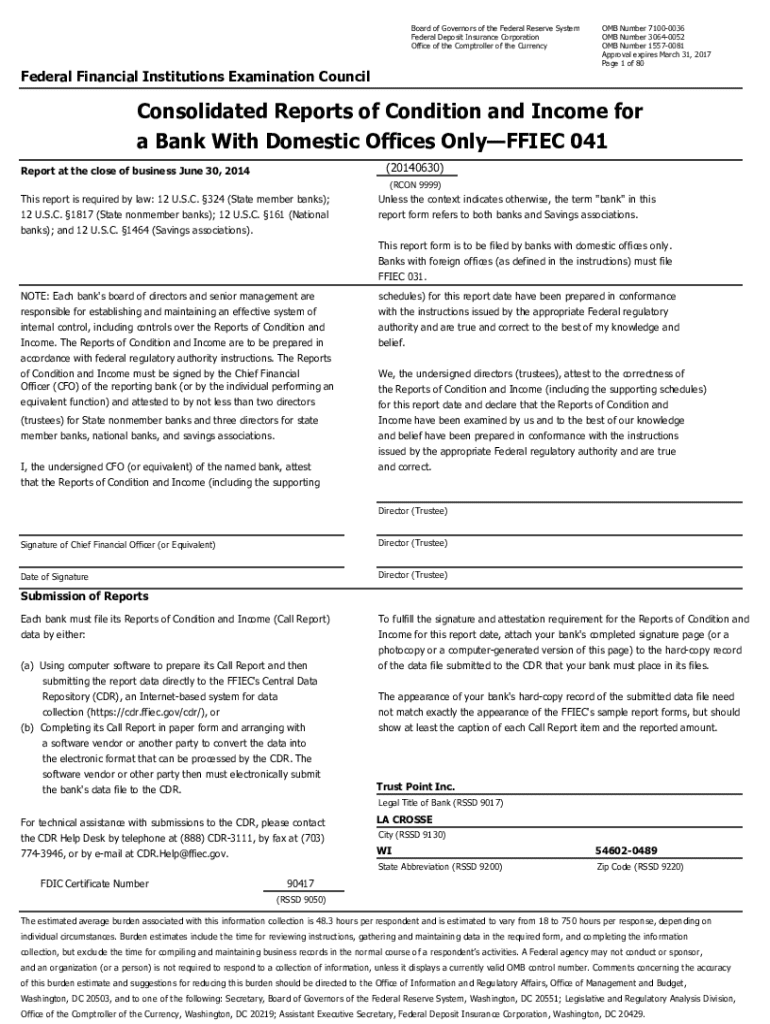

The consolidated reports of condition form is an essential financial document that provides a comprehensive snapshot of a financial institution’s status. This form serves as a critical tool for banks and financial institutions to report their financial status and to maintain transparency with regulatory bodies. By compiling data from various reporting periods, the consolidated report aggregates vital information that reflects an institution’s financial health.

This form is paramount in financial reporting because it consolidates data, allowing for deeper analysis and insights into an institution's performance indicators. With accurate reporting, stakeholders can make informed decisions regarding investments, lending, and regulatory compliance, thereby fostering trust and credibility in the financial system.

Who needs to complete this form?

The consolidated reports of condition form is primarily required for banks and financial institutions. These entities need to ensure compliance with regulations set forth by federal and state regulatory bodies, such as the Federal Reserve and the Office of the Comptroller of the Currency (OCC). Additionally, any financial institution that holds a federal charter or is insured by the Federal Deposit Insurance Corporation (FDIC) must submit this form.

Understanding the regulatory requirements is crucial for these institutions. Each regulatory body may have specific instructions regarding the frequency and format for submission. Noncompliance can lead to significant penalties, highlighting the necessity for accuracy and timeliness in reporting.

Key components of the consolidated reports of condition form

To properly complete the consolidated reports of condition form, it’s important to understand its key components. The form is typically divided into sections that include balance sheet information and income statement data, each providing vital insight into the financial health of the institution.

The balance sheet section focuses on assets, liabilities, and equity considerations. It details all financial resources, obligations, and ownership interests of the institution. Meanwhile, the income statement overview examines revenue streams and expense categories to provide insights into operational performance.

Step-by-step guide to completing the consolidated reports of condition form

Completing the consolidated reports of condition form requires meticulous attention to detail. The first step is gathering necessary data, which entails identifying financial documents like balance sheets, income statements, and transaction records from various departments.

Next, while filling out the form, it’s imperative to input the financial data accurately. Users should review each section carefully for any discrepancies. Common pitfalls include misreporting numbers or neglecting to account for certain assets or liabilities, which can lead to significant misrepresentations.

Interactive tools & solutions for form management

Utilizing interactive tools like pdfFiller can significantly streamline the process of managing the consolidated reports of condition form. With pdfFiller, users can easily edit, sign, and collaborate on forms in a cloud-based environment. The platform provides features specifically designed to simplify financial documentation, allowing for real-time updates and adjustments as needed.

To maximize efficiency, users can leverage the platform's tools for form management. For example, pdfFiller allows users to save and retrieve forms effortlessly, integrate with workflow systems, and maintain an organized filing system. These features not only save time but also enhance collaboration among team members and departments.

Regulatory framework and compliance considerations

A robust understanding of the regulatory framework surrounding the consolidated reports of condition form is essential for compliance. Institutions must be aware of the specific laws and regulations that govern their reporting activities, which are outlined by various regulatory bodies.

For instance, the Federal Reserve and the OCC provide detailed guidelines concerning report submissions. Institutions should be vigilant about important deadlines to ensure compliance and avoid penalties. Utilizing supervisory resources can aid in staying informed about changes to regulations, assisting in future reporting endeavors.

Analysis and interpretation of reports

Once the consolidated reports of condition are filed, it’s crucial to analyze and interpret the data effectively. This analysis involves understanding the balance sheet and income statement, allowing stakeholders to glean insights into the institution's financial health.

Key performance indicators (KPIs) such as liquidity ratios, profitability margins, and asset quality ratios present critical information for assessment. By observing trends in these metrics, institutions can make informed decisions that drive growth and mitigate risk.

Further information and resources

For those seeking further education on the consolidated reports of condition form, numerous resources are available. Users can access sample forms and templates, which illustrate the format and content needed for accurate reporting. Frequently asked questions can help clarify common doubts regarding completion and submission.

Additionally, specific links to government, industry, and educational resources can provide updated information on regulations and best practices. Engaging with these materials can enhance one’s understanding of financial reporting standards and improve compliance initiatives.

Community insights and experiences

Members of the banking community often have unique insights and experiences regarding the completion and submission of the consolidated reports of condition form. Community banks, in particular, face specific challenges that differ from larger institutions, including resource constraints and regulatory demands.

Sharing best practices within the industry can significantly aid smaller institutions in preparing their reports. Leveraging insights from peers can lead to improved accuracy, more efficient submissions, and greater compliance with regulatory requirements.

Staying updated

Staying informed about changes in the regulatory landscape is crucial for institutions required to complete the consolidated reports of condition form. Many regulatory bodies provide newsletters, alerts, and updates that can help institutions anticipate changes and adjust their reporting practices accordingly.

To ensure ongoing compliance and knowledge, institutions can subscribe to news releases from relevant bodies. Engaging with educational opportunities related to financial reporting can further strengthen expertise in navigating regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consolidated reports of condition for eSignature?

How do I fill out the consolidated reports of condition form on my smartphone?

How do I edit consolidated reports of condition on an Android device?

What is consolidated reports of condition?

Who is required to file consolidated reports of condition?

How to fill out consolidated reports of condition?

What is the purpose of consolidated reports of condition?

What information must be reported on consolidated reports of condition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.