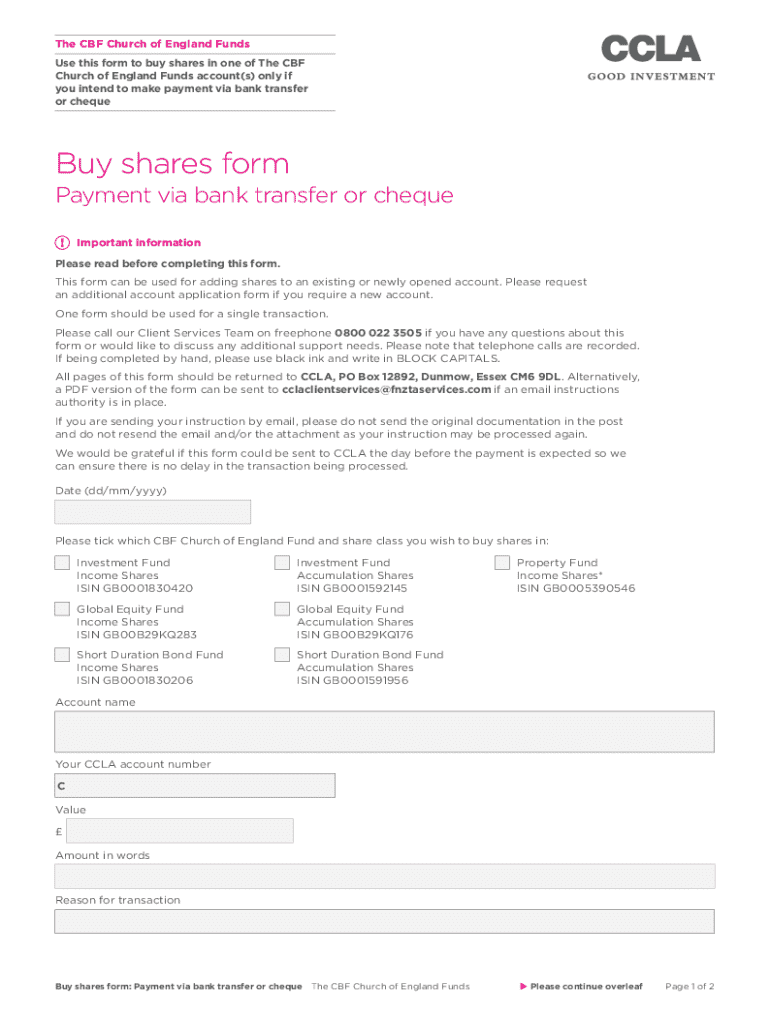

Get the free Buy Shares Form

Get, Create, Make and Sign buy shares form

Editing buy shares form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buy shares form

How to fill out buy shares form

Who needs buy shares form?

How to Buy Shares Form - A Comprehensive Guide

Understanding the basics of buying shares

Shares, or stocks, represent a unit of ownership in a company. Investing in shares means acquiring a piece of that company, which necessitates a foundational understanding of different share types. Common shares provide shareholders with voting rights and potential dividends, whereas preferred shares typically offer fixed dividends but no voting rights. Each type serves different investment strategies depending on your goals and risk appetite.

Investing in shares is not merely about purchasing a piece of paper; it encompasses the prospect of substantial financial returns and provides a pathway to diversify your investment portfolio. By holding a variety of shares in different sectors, you can mitigate risks significantly, balancing potential losses in one area with gains in another.

Preparing to buy shares

Establishing clear investment goals is crucial before delving into the world of shares. Are you looking for short-term gains, or do you prefer the stability and growth potential of long-term investing? A thorough risk tolerance assessment allows you to understand how much market volatility you can withstand without panic selling.

Choosing the right investment account is equally essential. You might consider options like a standard brokerage account for flexibility or a retirement account like an IRA for tax advantages. Accessing the buy shares form through pdfFiller can simplify the process of setting up these accounts, helping you get started on your investment journey with ease.

Researching potential shares

Before making any purchase, thorough research is indispensable. Look into a company's performance metrics, such as earnings-per-share, price-to-earnings ratios, and growth rates. With the right tools, including pdfFiller for organizing your research documents, you can effectively manage this information to analyze various stocks.

Additionally, staying updated on market trends and sector performance is vital. Utilize financial news, analyst reports, and other research resources to identify stocks that align with your investment goals. The more informed you are, the better your chances of making sound decisions in your share purchases.

The process of buying shares

Filling out a buy shares form can be streamlined into a series of straightforward steps:

Managing your share portfolio

Once you've purchased shares, effective portfolio management becomes necessary to track performance. Utilize investment tracking tools and apps that provide insight into how your chosen stocks are performing against market changes to make informed decisions. Regular assessments of market conditions and rebalancing your portfolio based on performance and your investment goals can lead to greater returns.

Knowing when to sell your shares is as crucial as the buying decision. Consider market indicators, company performance, and changes in your financial goals that can signal it might be time to exit an investment. Consistently reviewing your strategy will help you remain aligned with your long-term objectives.

Advanced strategies for buying shares

As you become more comfortable with the process, employing advanced strategies can enhance your investment outcomes. Dollar-cost averaging is one effective method; by consistently investing a fixed amount in shares over time, you reduce the impact of volatility on your overall purchase price.

Another strategy to consider is utilizing stop-loss orders, which automatically sell your shares if they fall below a specified price. This can help limit potential losses during market downturns. By understanding these strategies and making them part of your buying process, you can better handle market fluctuations without succumbing to emotional trading.

Legal and tax implications

Investing in shares carries legal responsibilities, particularly regarding tax implications of your investments. Understanding how capital gains tax applies to your profits when selling shares is crucial for successful long-term investing. Keeping meticulous records of your transactions with the assistance of pdfFiller may help to ensure compliance during tax season.

Regulatory compliance is another aspect to consider. Familiarize yourself with the key regulations governing trade and investments, including the requirements imposed by the Securities and Exchange Commission (SEC) to ensure your transactions remain above board.

Utilizing pdfFiller for your investment journey

pdfFiller streamlines document management by providing a platform for creating, signing, and managing your investment documents efficiently. Whether you're filling out your buy shares form or maintaining records of your transactions, pdfFiller's cloud-based solution makes accessing your documents straightforward and reliable from anywhere.

The collaborative features offered by pdfFiller are particularly beneficial for teams engaged in group investments. Sharing forms and managing documentation collectively can simplify the collaborative process, enabling seamless communication among team members while ensuring everyone stays informed and aligned.

Frequently asked questions

As you navigate the world of investing, questions are bound to arise. Common queries include how much initial capital is required to start investing in shares and which platform is deemed the best for buying shares. Starting your investment journey can begin with as little as a few hundred dollars, depending on your chosen platform.

For first-time investors, understanding what to avoid—like emotional decision-making or chasing after hot stocks without research—is vital to long-term success. Engaging with investment communities, seeking support, and sharing insights can enhance your overall investing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit buy shares form in Chrome?

How do I edit buy shares form on an iOS device?

How do I complete buy shares form on an iOS device?

What is buy shares form?

Who is required to file buy shares form?

How to fill out buy shares form?

What is the purpose of buy shares form?

What information must be reported on buy shares form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.