Get the free Arizona Form 140 (2022)

Get, Create, Make and Sign arizona form 140 2022

Editing arizona form 140 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 140 2022

How to fill out arizona form 140 2022

Who needs arizona form 140 2022?

Understanding Arizona Form 140 for 2022: A Comprehensive Guide

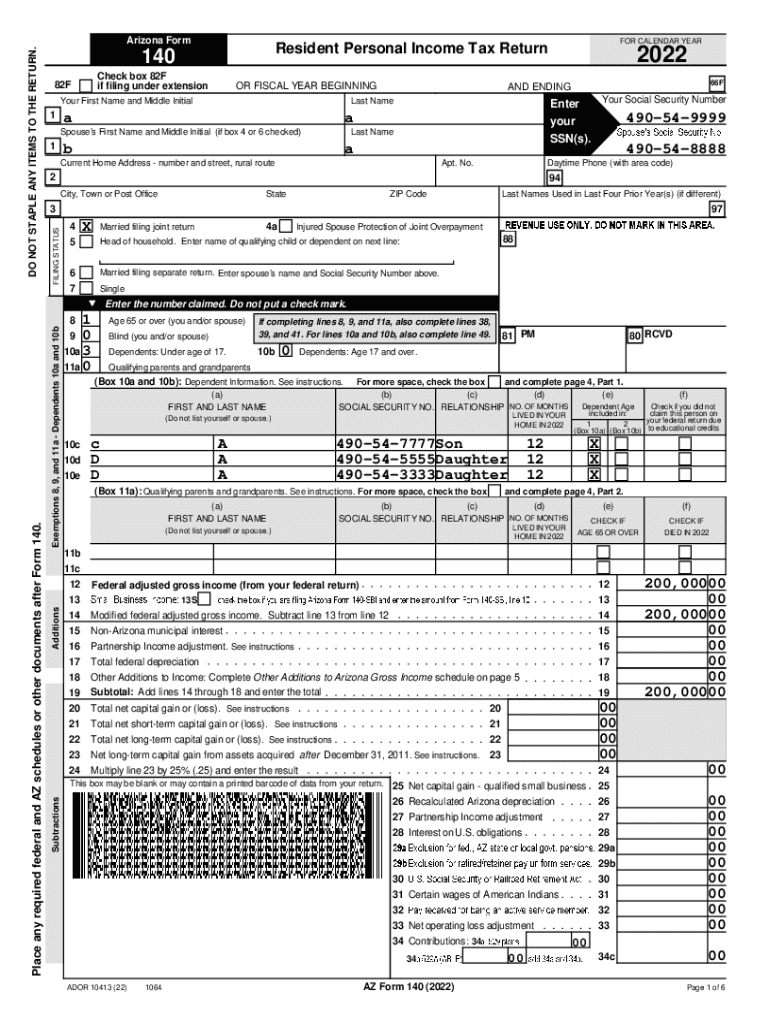

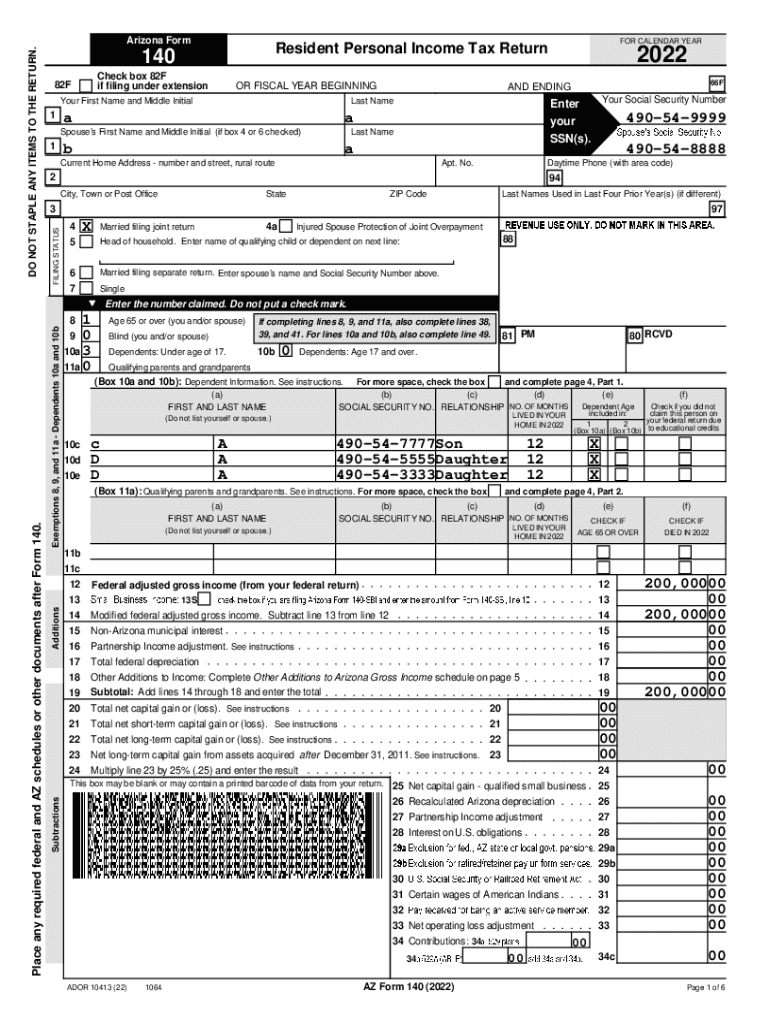

Overview of Arizona Form 140

Arizona Form 140 is the state's individual income tax return for residents. It plays a pivotal role in determining how much state taxes residents need to pay based on their income from the previous year.

The form is essential for filing accurate tax returns and directly impacts an individual's tax obligations in Arizona. Understanding its purpose and proper completion is vital for financial planning and compliance.

Purpose of Arizona Form 140

The primary purpose of Arizona Form 140 is to report income and calculate taxes owed to the state of Arizona. It's designed for residents who earn income and need to align with state tax regulations.

Who should use Arizona Form 140?

Arizona residents who earn income, whether from wages, self-employment, or other sources, should use Form 140. Exceptions may apply for non-residents or individuals with very low income who might not be required to file.

Key changes in the 2022 version of Arizona Form 140

For 2022, several key updates were introduced. These include adjustments to tax rates, changes in standard deductions, and the introduction of new credits designed to benefit taxpayers.

Detailed instructions for filling out Arizona Form 140

Completing Arizona Form 140 requires attention to detail across various sections. Here’s how to navigate through the process easily.

Step-by-step guide to completing the form

Personal information section

In this section, you will need to provide personal information such as your name, address, and Social Security number. It's crucial to ensure that this data is accurate to avoid processing delays.

Income information section

Report all sources of income, including wages, interest, and dividends. Keep track of any common deductions you might be eligible for, such as educational expenses or retirement contributions. This step is fundamental to minimize your taxable income.

Tax calculation section

Calculate your tax using the provided tax tables. You may need to refer to additional schedules if your situation involves complex factors such as capital gains or rental income.

Signature and date section

Don’t forget to sign and date your form. Signing verifies that all information presented is truthful and accurate, which is a requirement for submission.

Interactive tools for Arizona Form 140

To facilitate a smoother filing experience, various interactive tools are available.

Online editing tools available at pdfFiller

pdfFiller offers robust online editing tools that allow you to complete Arizona Form 140 digitally. This increases efficiency and reduces paper clutter.

Electronic signature process made easy

The benefits of eSigning your form include quicker processing and enhanced security. With a step-by-step eSigning guide available on pdfFiller, you can easily navigate the process.

FAQs about Arizona Form 140

It's common for filers to have specific questions regarding Arizona Form 140. Here are some frequently asked questions.

What if made a mistake on my Form 140?

If you realize you've made an error, it's crucial to amend the form as soon as possible to avoid penalties.

How do request a refund?

To request a refund, ensure you provide accurate banking information on the form. Refunds typically take several weeks to process.

Can file Arizona Form 140 electronically?

Yes, Arizona Form 140 can be filed electronically through authorized e-filing providers, streamlining the process and reducing paperwork.

How do check the status of my Arizona tax return?

You can check the status of your tax return online through the Arizona Department of Revenue website or by contacting their support line.

Common pitfalls when filling out Arizona Form 140

Filing your Arizona Form 140 accurately is vital. Here are some common pitfalls to avoid.

Missed deduction opportunities

Many filers overlook potential deductions, which can lead to higher tax bills. It’s important to be aware of all eligible deductions.

Incorrect information and its consequences

Providing incorrect information can result in audits or penalties. Double-check all entries before submission.

Deadline compliance and potential fees

Filing after the deadline can lead to late fees or additional penalties. Mark your calendar and plan to file early.

Managing your Arizona Form 140 post-submission

After submitting your Arizona Form 140, managing documentation is crucial.

Keeping copies of submitted forms

Always keep copies of your submitted forms for personal records and for any potential future inquiries or audits.

How to amend your tax return if necessary

If corrections are needed, follow the procedures for amending a tax return as outlined by the Arizona Department of Revenue. Ensure timely submission of amendments.

User support and contact

pdfFiller provides a range of user support options to assist you with any questions regarding the Arizona Form 140.

How to reach pdfFiller customer support

Customer support can be reached via various channels, ensuring you get timely assistance for any issues.

Community forums and user tips

Joining community forums related to Form 140 can provide insights from other users and expert tips on completing your returns.

Feedback and improvement suggestions

Users are encouraged to provide feedback on their experiences, which can help improve services and features of pdfFiller.

Additional features of pdfFiller

pdfFiller offers an extensive suite of features for managing documents effectively. Here’s a closer look.

Collaboration tools for teams

For teams, pdfFiller provides collaboration tools to streamline document sharing and feedback, enhancing efficiency.

Organizing and storing documents efficiently

Users can categorize and archive documents as needed, ensuring that important forms and records are easily accessible when required.

Benefits of a cloud-based document management system

A cloud-based approach means that users can access their documents from anywhere. This flexibility is crucial for those managing multiple forms or those who might need to edit documents on the go.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit arizona form 140 2022 from Google Drive?

How do I make changes in arizona form 140 2022?

How do I make edits in arizona form 140 2022 without leaving Chrome?

What is arizona form 140?

Who is required to file arizona form 140?

How to fill out arizona form 140?

What is the purpose of arizona form 140?

What information must be reported on arizona form 140?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.