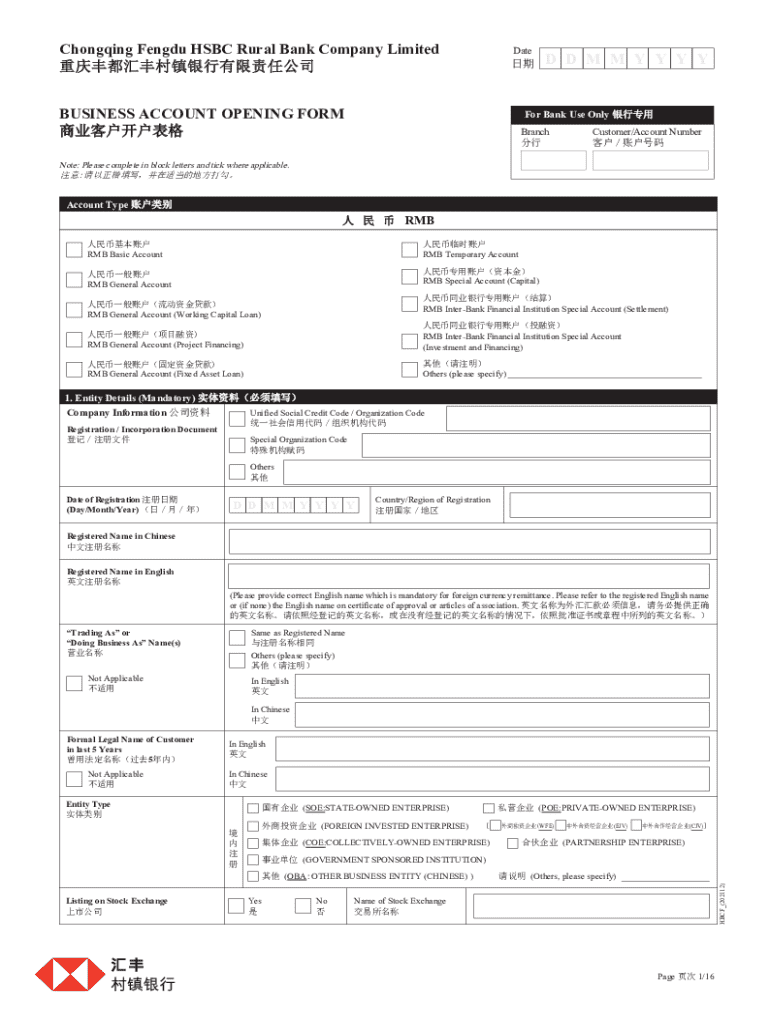

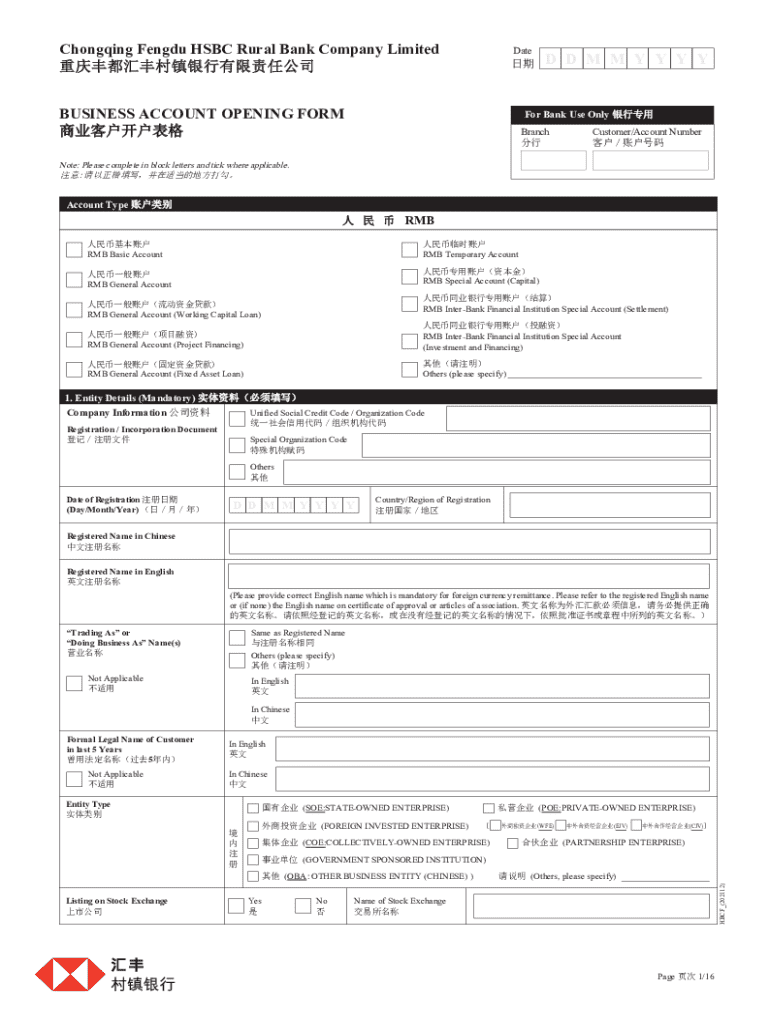

Get the free Business Account Opening Form

Get, Create, Make and Sign business account opening form

Editing business account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business account opening form

How to fill out business account opening form

Who needs business account opening form?

Comprehensive Guide to the Business Account Opening Form

Understanding the business account opening form

A business account opening form is an essential document that enables businesses to establish a financial relationship with a bank or financial institution. This initial step is critical as it allows businesses to manage their finances professionally.

The importance of a business account cannot be overstated. It separates personal and business finances, thereby simplifying bookkeeping, tax preparation, and providing credibility to your business in financial dealings. Reliability on a professional account can enhance trust from clients and suppliers alike.

Why use a digital business account opening form?

In the digital age, adopting a digital business account opening form streamlines the application process significantly compared to traditional paper forms. The accessibility and convenience of online forms allow users to fill them out from virtually anywhere at any time.

Additionally, digital forms come with advantages such as real-time updates and tracking, meaning businesses can monitor their application status without the need for physical visits or phone calls. Enhanced security measures associated with digital forms ensure that sensitive business information remains protected.

pdfFiller stands out as an ideal solution for seamless form management. It provides a user-friendly interface that simplifies the process of completing, signing, and managing business account opening forms and other essential documents.

Steps to fill out the business account opening form

Gathering necessary information

Before initiating the application process, it is crucial to gather all necessary information to ensure a smooth experience. Key pieces of information include the business name, address, type of business entity (e.g., LLC, Corporation), and contact details.

Required documents typically include business licenses, tax identification numbers, partnership agreements, and personal identification for the business owners. Having these documents ready will expedite the completion of the opening form.

Navigating pdfFiller tools

Accessing the business account opening form via pdfFiller is straightforward. Simply navigate to the pdfFiller website and search for the business account opening form. Once located, you can use interactive tools available on the platform, including text fields, checkboxes, and dropdown menus, to fill out the form efficiently.

Completing the form

When filling the business account opening form, pay attention to the sections that require detailed information such as business information, owner information, and financial details.

Ensuring accuracy and completeness in each section is paramount to avoid delays in the processing of your application.

Editing and customizing your business account opening form

pdfFiller offers comprehensive editing tools that allow users to personalize their business account opening form. Adding logos and branding elements can make the form more professional and tailored to your business's identity.

Furthermore, users can customize fields based on specific business needs, ensuring that all necessary information is included in compliance with banking regulations.

Properly formatted forms also enhance the likelihood of acceptance by banking institutions, making these tools invaluable.

The eSignature process

Incorporating eSignatures into the business account opening process has become increasingly important. Some banks and financial institutions require electronic signatures to streamline the application process and reduce paper use.

pdfFiller makes adding an electronic signature simple. Users can easily sign the completed business account opening form online, ensuring a quick submission.

Additionally, eSignatures are legally valid in various jurisdictions, making them a trusted method for executing important business documents.

Managing and storing your business account opening form

After completing and signing your business account opening form, options for saving and storing completed forms in pdfFiller are abundant. You can choose to save forms in the cloud, ensuring they are easily accessible whenever needed.

Organizing documents efficiently aids in easy retrieval and future reference. Moreover, pdfFiller allows users to share completed forms with team members or financial advisors, streamlining collaboration.

Common mistakes to avoid while filling out the business account opening form

Filling out a business account opening form can be challenging, and many individuals make common mistakes that can lead to delays. Typical errors include providing inaccurate information, leaving required fields blank, or not having the necessary documents handy.

To minimize chances of errors, double-check your form before submission. Consider checking the application against a checklist of requirements and documents.

If in doubt, consider reaching out to your bank's customer support for assistance.

Additional templates and forms related to business financing

Alongside the business account opening form, pdfFiller offers a myriad of other useful templates to enhance comprehensive financial management. Related forms include the Business Loan Application, Financial Consultation Registration Form, Tax Calculation Form, and Expense Report Form.

These forms interconnect seamlessly, providing businesses with all necessary documentation for efficient financial operations and planning.

Case studies and success stories

Numerous businesses have successfully benefited from utilizing digital forms like those offered by pdfFiller. For example, a local café managed to reduce the time taken to open a new business account by 50% after switching from paper to digital forms.

Testimonials from users highlight the efficiency and convenience found through pdfFiller, emphasizing how digital documentation has transformed their business operations.

Future enhancement of business forms

As technology continues to evolve, so do business documentation processes. Digital forms will become even more integral to business operations, leveraging advancements in AI and machine learning for increased automation and accuracy.

pdfFiller is committed to evolving its platform to meet these changing needs, ensuring that users have access to cutting-edge features that enhance the form completion experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business account opening form?

Can I create an eSignature for the business account opening form in Gmail?

How do I edit business account opening form on an iOS device?

What is business account opening form?

Who is required to file business account opening form?

How to fill out business account opening form?

What is the purpose of business account opening form?

What information must be reported on business account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.