Get the free Public Notice for Foreclosure Sale

Get, Create, Make and Sign public notice for foreclosure

Editing public notice for foreclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out public notice for foreclosure

How to fill out public notice for foreclosure

Who needs public notice for foreclosure?

A comprehensive guide to the public notice for foreclosure form

Understanding the public notice for foreclosure

A public notice for foreclosure is a legal declaration by a lender about a borrower's default on their mortgage payments. This notice serves several important functions, primarily alerting the public and the borrower to the impending legal foreclosure process. The public notice is a formal requirement in many jurisdictions that allows other stakeholders—such as potential bidders or buyers—to be aware of the property's distressed status.

The importance of the public notice in the foreclosure process cannot be overstated—it is often the first step in formally alerting the public to the lender's intention to seize the property. Key terms related to foreclosure notices include 'Notice of Default,' 'Notice of Sale,' and 'foreclosure auction,' each representing different stages and actions within the process.

The legal framework for foreclosure notices

Federal and state laws govern the issuance and requirements of foreclosure notices. The primary federal law is the Truth in Lending Act, which ensures disclosure of costs and terms of the mortgage. States have their own laws detailing the process, such as how notices must be published and the time frames involved.

Homeowners hold several rights during the foreclosure process, including the right to receive clear notifications and the ability to contest the foreclosure. Homeowners should be aware of protections such as the Right to Reinstate, which allows borrowers to catch up on missed payments before foreclosure is finalized, and the role of non-judicial foreclosure, which can expedite the process without court intervention.

The foreclosure process explained

The foreclosure process begins with a sequence of events that lead to a public notice for foreclosure. Initially, the lender contacts the borrower about missed payments, signaling the start of potential foreclosure. If payments remain unpaid, the lender issues a Notice of Default, a formal indication that the borrower is in breach of contract.

After the Notice of Default, there typically exists a waiting period before the Notice of Sale is issued, detailing when the property will be auctioned. The timeline for these notices can vary by state. Once the public notice is issued, the property often moves to the sale phase, usually within a few months depending on local regulations.

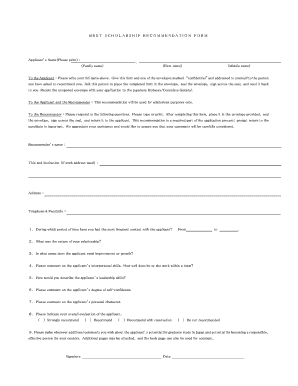

Filling out the public notice for foreclosure form

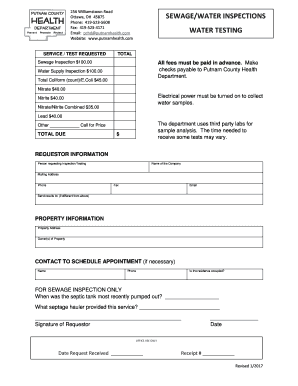

Completing the public notice for foreclosure form requires specific information to ensure compliance with legal standards. Necessary details include personal information such as the borrower's name and contact information, property details—including address and parcel number—and loan and lender information, such as loan number and lender's contact details.

Some common mistakes to avoid when completing the form include missing critical information, using outdated forms, or submitting the wrong version for your state jurisdiction. Best practices for filling out the form suggest reviewing the guidelines carefully and double-checking all entered data to reduce the chance of errors.

Editing and signing the public notice for foreclosure form

Editing the public notice for foreclosure form can be simplified with tools like pdfFiller, which allows for seamless document editing. This platform provides features such as text editing, annotation, and form filling, making it easy to customize the document as required. Collaborative features enable multiple parties to review and provide input on changes, ensuring accuracy and completeness.

For those needing an electronic signature, pdfFiller offers easy-to-use eSignature capabilities. Following these simple steps allows for secure signing: open the document, click on the ‘Sign’ option, and follow prompts to add your eSignature. This feature enhances convenience, especially when parties are not in the same location.

Managing and submitting your foreclosure notice

Timely submission of the public notice for foreclosure is critical, as each state has specific deadlines that must be met. After completing the form, know where to submit it—typically to your local county recorder or a designated court, depending on regional regulations.

To track your notice submission, maintain records of any confirmation receipts or documents sent. Many jurisdictions also provide online portals where you can check the status of your submitted documents, ensuring you stay informed on your case.

After the public notice: what’s next?

Following the issuance of a public notice for foreclosure, homeowners should consider their next steps thoughtfully. They can explore options to avoid foreclosure, such as loan modification, forbearance, or a short sale. It's essential to understand the timeline leading to the property sale after the notice; knowing this can help in strategizing your next move and avoiding further complications.

Various resources are available to assist during this challenging period. Legal help can be sought from local advocacy groups or organizations that specialize in foreclosure assistance, and there are numerous mortgage assistance programs designed to help struggling homeowners.

Understanding potential risks and scams

Homeowners should remain vigilant about common foreclosure scams that can exploit vulnerable individuals during this stressful time. Scammers might pose as agents offering to negotiate with lenders or manage foreclosure processes for upfront fees. Red flags for identifying fraudulent activity include unsolicited calls or emails asking for financial information or immediate payment.

If you suspect a scam, reporting it to the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB) can help protect others from falling victim to the same schemes. Staying informed and cautious can prevent financial loss during the foreclosure process.

Special cases: renting during foreclosure

When a property is in foreclosure, tenants have specific rights that protect them from sudden eviction. Under the Protecting Tenants at Foreclosure Act, a tenant may remain in the property until their lease expires, provided they have a legal lease. Communication strategies with landlords can also help; discussing the situation openly may lead to solutions that are beneficial for both parties.

Tenants facing foreclosure should explore available resources, such as local housing authorities that can provide guidance and support through the process. Understanding your rights ensures you are better prepared to handle the situation effectively.

Leveraging pdfFiller for future document needs

pdfFiller offers a robust solution for managing documents in a cloud-based environment, making it easy to access, edit, and store critical forms like the public notice for foreclosure. Users benefit from features such as template creation, secure sharing, and real-time collaboration, which are essential for streamlining any document process.

To organize your documents efficiently, utilize folders and tags within pdfFiller. This structure allows for quick access and retrieval, ensuring you can manage your document workflow seamlessly, especially during complex situations such as foreclosure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify public notice for foreclosure without leaving Google Drive?

How do I complete public notice for foreclosure online?

How do I edit public notice for foreclosure straight from my smartphone?

What is public notice for foreclosure?

Who is required to file public notice for foreclosure?

How to fill out public notice for foreclosure?

What is the purpose of public notice for foreclosure?

What information must be reported on public notice for foreclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.