Get the free Direct Deposit Authorization

Get, Create, Make and Sign direct deposit authorization

Editing direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization

How to fill out direct deposit authorization

Who needs direct deposit authorization?

Direct deposit authorization form: How-to guide long-read

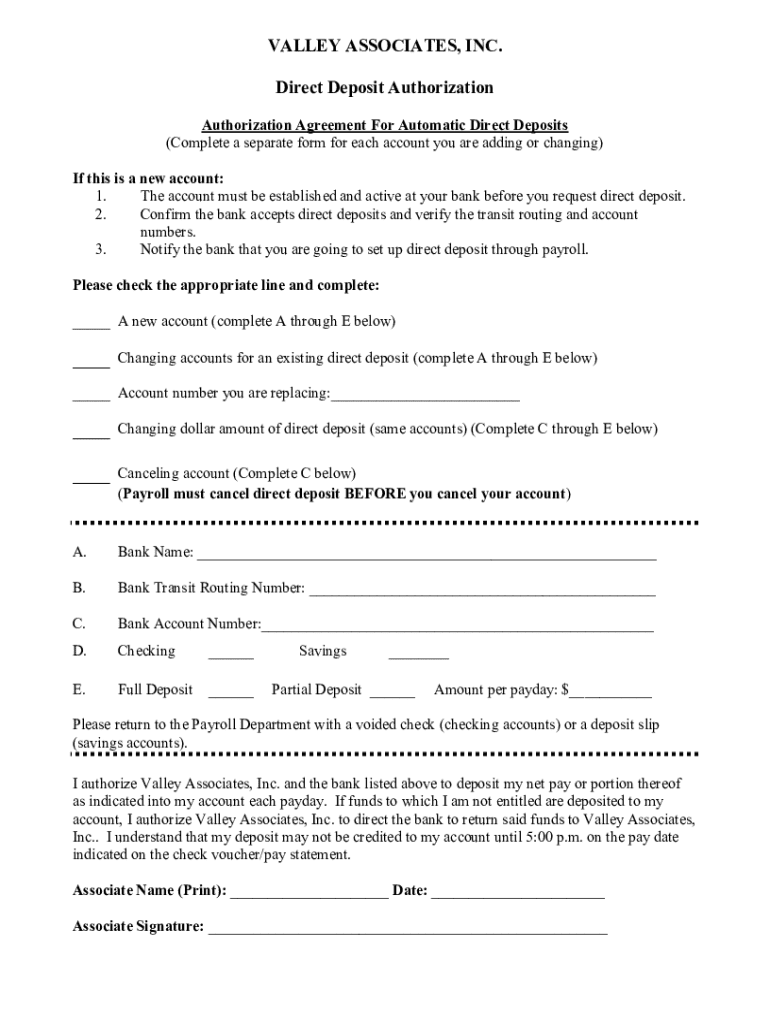

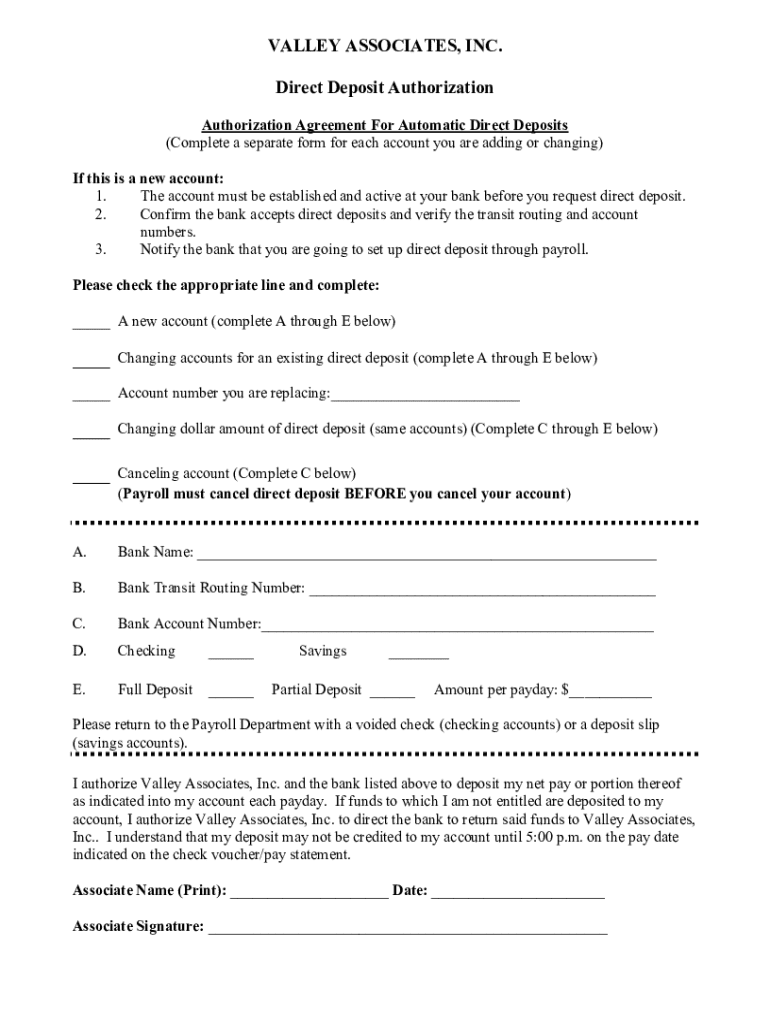

Understanding the direct deposit authorization form

A direct deposit authorization form is a crucial document that enables the electronic transfer of funds—usually salaries or benefits—directly into a bank account. This method eliminates the need for physical checks, streamlining the payment process and contributing to efficient money management for both employers and employees.

Utilizing a direct deposit authorization form is paramount for ensuring timely and secure payment transactions. The efficiency it brings is particularly beneficial in a fast-paced economy, where delays in payment processing can result in financial strain. Key stakeholders involved in this process include employees who receive payments, employers responsible for issuing payments, and the financial institutions that facilitate the transfer of funds.

Key components of a direct deposit authorization form

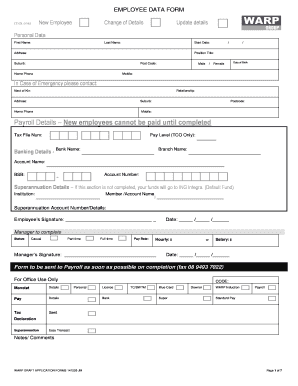

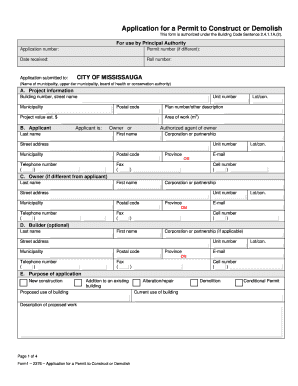

To effectively complete a direct deposit authorization form, it's essential to understand its key components. Firstly, the Personal Information Section collects vital information such as the individual's name, address, and social security number. This information is necessary for identification and processing of payments.

Next is the Bank Information section, which includes details like account number, routing number, and type of account — whether it’s a checking or savings account. Accuracy in this section is critical, as any errors can lead to misdirected payments. Furthermore, the Authorization Signature is vital; it confirms the individual's consent to process payments to the specified account. Lastly, the Terms and Conditions section usually encompasses information regarding the authorization process, revocation rights, and any potential fees associated with direct deposits.

Step-by-step guide to completing the direct deposit authorization form

Completing the direct deposit authorization form might seem daunting, but breaking it down into manageable steps can simplify the process. The first step is to gather necessary information. Essential documents include your identification (like a driver’s license), bank account details, and social security number.

Moving on to Step 2, fill out the form accurately. For example, in the Personal Information section, write your full name as indicated in official documents. Below are some fields with examples: - Name: John Doe - Address: 123 Main St, Springfield, IL These instructions will guide you through each important section. After you fill out the form, Step 3 involves reviewing it for any mistakes. Double-check account numbers and names to ensure they match the documents you provided. Finally, Step 4 includes submitting the form. You have options for this — you can submit it digitally via email, mail it in, or deliver it in person to your HR department.

Editing and customizing your direct deposit authorization form

In situations where customization is necessary, using tools like pdfFiller can enhance your experience. Editing the direct deposit authorization form is straightforward. Begin by uploading the form to the pdfFiller platform, where you can make necessary adjustments to match your employer's requirements.

PdfFiller provides features for adding text, annotations, and even digital signatures, which is critical for ensuring the document remains legally compliant. Customizing your form appropriately is essential as it upholds the authenticity of the document and adheres to company policies.

Signing the direct deposit authorization form

Signing the direct deposit authorization form can be done in various ways, but understanding eSigning options is imperative. Electronic signatures are legally recognized and offer security measures such as encryption, ensuring that your signature is protected during the signing process.

To use pdfFiller for eSigning, upload your completed form and follow the prompts to add your signature. Once signed, you can easily provide copies to your employer, bank, and keep a personalized copy for your records. This process ensures that all relevant parties verify the agreement.

Common mistakes to avoid

Completing the direct deposit authorization form correctly is vital, yet there are common mistakes that individuals often overlook. One of the most critical errors is providing inaccurate bank details. Always double-check your account and routing numbers to avoid payment mishaps.

Another common pitfall is omitting required signatures. Ensure that you sign and date the form, as many employers will not process a form without these. Lastly, not keeping copies of your submission can create confusion. Always save at least one copy for your personal records to refer to if any discrepancies arise later.

Managing your direct deposit agreements

Once you've submitted your direct deposit authorization form, it's important to actively manage your direct deposit agreements. To track your submissions and confirm when payments are processed, utilize financial apps or your bank’s online platform to monitor your deposits.

If your bank information changes, it's essential to submit a new direct deposit authorization form promptly. For those instances when you need to revoke previous authorization, make sure to follow the outlined procedures from your employer, as they may vary. Lastly, keeping your forms updated helps prevent any payment disruptions.

FAQs about the direct deposit authorization form

Understanding common questions surrounding the direct deposit authorization form can cushion the anxiety that comes with managing payroll matters. One frequent inquiry is, 'How long does it take for direct deposit to start?' Typically, it can take one full pay cycle before you receive your first direct deposit.

Another common question pertains to changing bank accounts after submission. Yes, you can change your bank account; just ensure to complete a new authorization form. Lastly, you might wonder what happens if there’s an error in your deposit. It’s vital to contact your HR department immediately to rectify any issues and address incorrect payments.

Utilizing interactive tools on pdfFiller

PdfFiller offers an array of online tools and resources that simplify the process of working with the direct deposit authorization form. Users benefit from interactive features that allow for easy collaboration, making it perfect for teams who need to share and edit forms simultaneously.

The cloud-based platform means you can access your documents from anywhere, providing flexibility and convenience. This ease of access is especially beneficial in today's hybrid work environments, enabling individuals and teams to manage their documentation efficiently from home or on the go.

Exploring additional document solutions

In addition to the direct deposit authorization form, pdfFiller offers a vast template library featuring related finance and employment forms. Whether you're looking for tax forms, work agreements, or reimbursement requests, you can find the necessary documentation all in one place.

PdfFiller streamlines the document creation process, allowing users to handle multiple forms related to employment matters. Leveraging this comprehensive resource enhances the productivity of both individuals and teams, making the management of financial and employment documents less cumbersome.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my direct deposit authorization in Gmail?

How do I execute direct deposit authorization online?

Can I edit direct deposit authorization on an Android device?

What is direct deposit authorization?

Who is required to file direct deposit authorization?

How to fill out direct deposit authorization?

What is the purpose of direct deposit authorization?

What information must be reported on direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.