Get the free Checking Account Switch Kit

Get, Create, Make and Sign checking account switch kit

How to edit checking account switch kit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checking account switch kit

How to fill out checking account switch kit

Who needs checking account switch kit?

Your Comprehensive Guide to the Checking Account Switch Kit Form

Understanding the importance of a switch kit

A checking account switch kit simplifies the process of transitioning from one bank to another, whether you're looking for better fees, improved customer service, or enhanced account features. This kit serves as a roadmap, ensuring you do not overlook critical steps during your switch.

Using a switch kit helps to prevent unnecessary complications, such as missed payments, overdraft fees, or mistakes with your banking details. Additionally, it streamlines communication between you, your employer, and service providers. The benefits of a seamless switching process are clear: you can enjoy a new banking experience without the stress.

Preparing for the switch

Before diving into the switch process, it's crucial to assess your current financial needs. This involves evaluating your spending habits, budgeting practices, and banking features you prioritize. Research several checking account options to find one that aligns best with these needs.

Create a checklist to streamline your switching process. This list should include items like your current account details, a new bank's required documentation, and important contacts such as your employer's HR department. A well-organized preparation phase sets a positive tone for the entire switching experience.

Step-by-step guide to using your switch kit

The transition to a new checking account involves several crucial steps to ensure a secure and efficient process.

**Step 1: Open your new account.** It's beneficial to open your new account before closing your old one. This allows you to ensure everything is working smoothly, and you can start transferring funds immediately. Gather required documentation like identification, proof of address, and your Social Security number.

**Step 2: Get organized.** Use tools such as spreadsheets or checklists to track your pending transitions. Putting together a timeline will keep you on track and ensure nothing is overlooked.

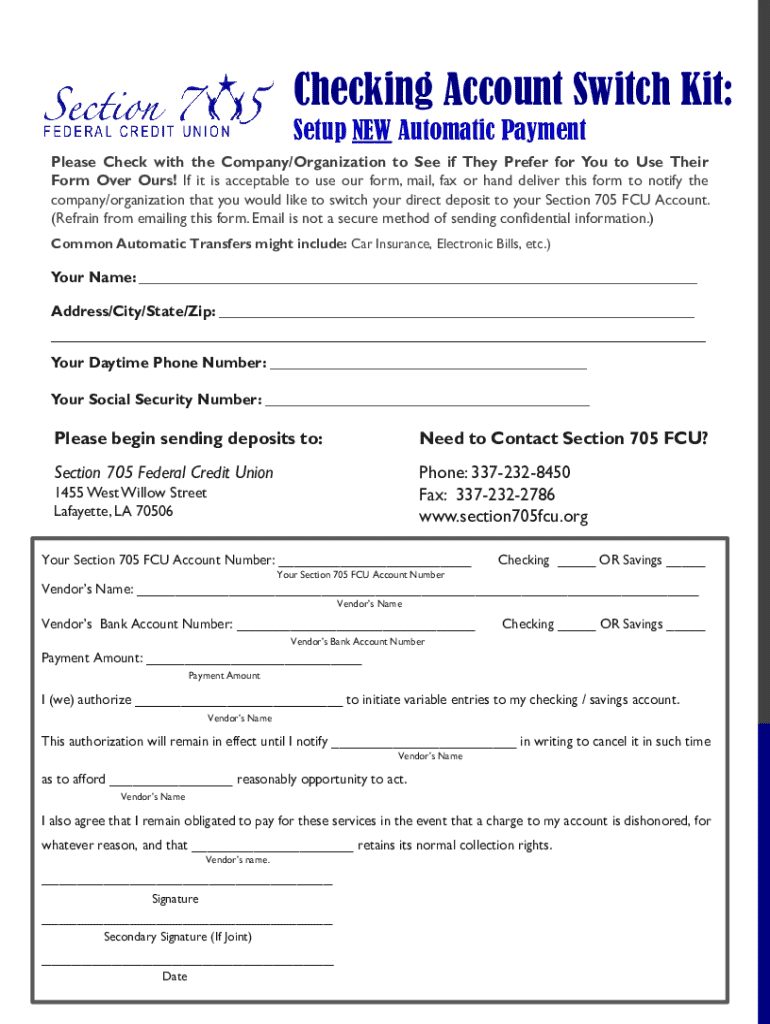

**Step 3: Transfer your direct deposits.** Notify your employer or benefits provider about your new banking details. You can fill out a direct deposit switch form—this can often be found in your switch kit. It's vital for continuous income flow.

**Step 4: Update your automatic payments.** Identify all recurring payments such as utilities, subscriptions, and loans. Inform each service provider of your new banking details. Tools like pdfFiller make managing authorization forms digitally easy.

**Step 5: Transfer any automated transfers and investments.** Make necessary changes to scheduled transfers. Maintain clear records during this time to help keep your financial history intact.

**Step 6: Close your old financial account.** When ready, closing your old account securely is essential. Ensure you check for any missed transactions and that there are no potential overdrafts.

**Step 7: Destroy old documents and forms of payment.** Once your old account is closed, it's important to securely dispose of outdated checks and debit cards to protect your financial identity.

Essential tools included in the switch kit

A well-crafted checking account switch kit includes various tools that enhance your switching experience. You can access downloadable forms and templates that ease communication with your bank and service providers. An interactive checklist will provide clarity during the transition, ensuring you stay on top of each step.

Additionally, explore documentation options that allow electronic signatures, streamlining the signing process of necessary forms. This prevents delays and simplifies your experience, helping you complete the transition with minimal friction.

Unique considerations for different scenarios

Switching with joint accounts requires clear communication with all account holders. It's essential to jointly decide on a new bank and ensure both parties are on board with the transition.

Small businesses switching accounts might face unique challenges, especially when handling payroll. In such cases, careful planning is crucial to minimize disruptions. For individuals with outstanding loans or mortgages, notify your loan holders of the switch, ensuring they have your new banking information.

Frequently asked questions

How long does the switch process usually take? On average, a seamless switch can be executed in about two weeks, but this varies depending on your specific circumstances.

What to do if I encounter complications during the switch? If issues arise, don't hesitate to contact customer support at both your old and new banks. They can provide guidance and reassurance.

Can I still access my old account information after closure? Generally, once your old account is closed, direct online access is terminated. However, banks typically provide a final statement for your records.

Useful tips for a smooth transition

Monitor both your old and new account statements during this transition. This vigilance will help you catch any discrepancies or missed payments promptly. Documenting every step you take is crucial for maintaining personal records, especially if a dispute arises.

Don’t hesitate to reach out to customer support during this process. Having a reliable resource can alleviate anxieties and put you back in control should questions arise.

Troubleshooting common issues

If a payment fails during your transition, act quickly. Contact the service provider to inform them of the situation and offer your new account details immediately to avoid penalties.

Unexpected bank fees may surface during this transition. Review all statements and be proactive in addressing any discrepancies with both banks.

Contacting support resources effectively can make a significant difference. Be clear about your concerns and provide necessary details to facilitate swift assistance.

Final thoughts on your banking experience

After completing the switch, evaluate your new checking account to ensure it meets your expectations. Explore how pdfFiller can manage your future banking documents and forms digitally, simplifying your financial management further.

Ensuring continuous access to your financial health management tools is paramount; staying organized and vigilant about your new banking platform will help you maintain control of your finances.

Explore more with pdfFiller

Discover additional features for ongoing document management with pdfFiller. This powerful platform helps you streamline your document creation, editing, and signing process, making it an invaluable resource as you navigate your banking experiences.

Read testimonials from users who have successfully switched accounts using pdfFiller’s solutions. It’s time to take control and simplify your banking transitions with user-friendly document management tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my checking account switch kit directly from Gmail?

How do I edit checking account switch kit straight from my smartphone?

How can I fill out checking account switch kit on an iOS device?

What is checking account switch kit?

Who is required to file checking account switch kit?

How to fill out checking account switch kit?

What is the purpose of checking account switch kit?

What information must be reported on checking account switch kit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.