Get the free Automatic Premium Payment Program Authorization Agreement

Get, Create, Make and Sign automatic premium payment program

Editing automatic premium payment program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out automatic premium payment program

How to fill out automatic premium payment program

Who needs automatic premium payment program?

Your Guide to the Automatic Premium Payment Program Form

Overview of the automatic premium payment program

The automatic premium payment program is designed to simplify the payment process for insurance premiums, ensuring that coverage remains uninterrupted. With this program, policyholders can authorize their insurers to automatically deduct premium payments from their selected payment method, be it a bank account or a credit/debit card. The primary intention behind automatic premium payments is to eradicate the hassle of manually tracking payment due dates and to ensure compliance with policy requirements.

How the automatic premium payment program works

Automatic premium payments operate on a straightforward mechanism. Once you enroll, your insurance company will automatically withdraw payments at predefined intervals, such as monthly, quarterly, or annually. This process allows for flexibility in financial planning and ensures that you remain covered during those payment cycles.

The payment methods accepted typically include direct bank transfers and credit/debit cards. However, before opting into the program, it’s essential to ensure that your account has sufficient funds to avoid payment failures, which can lead to policy lapses and unwanted complications.

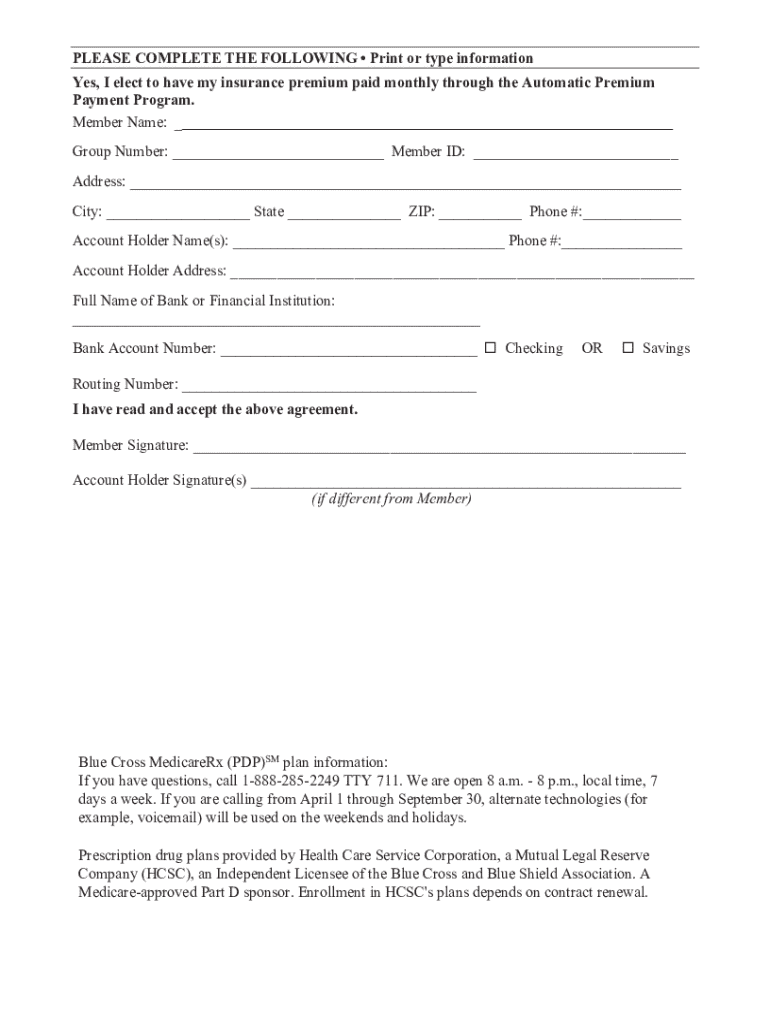

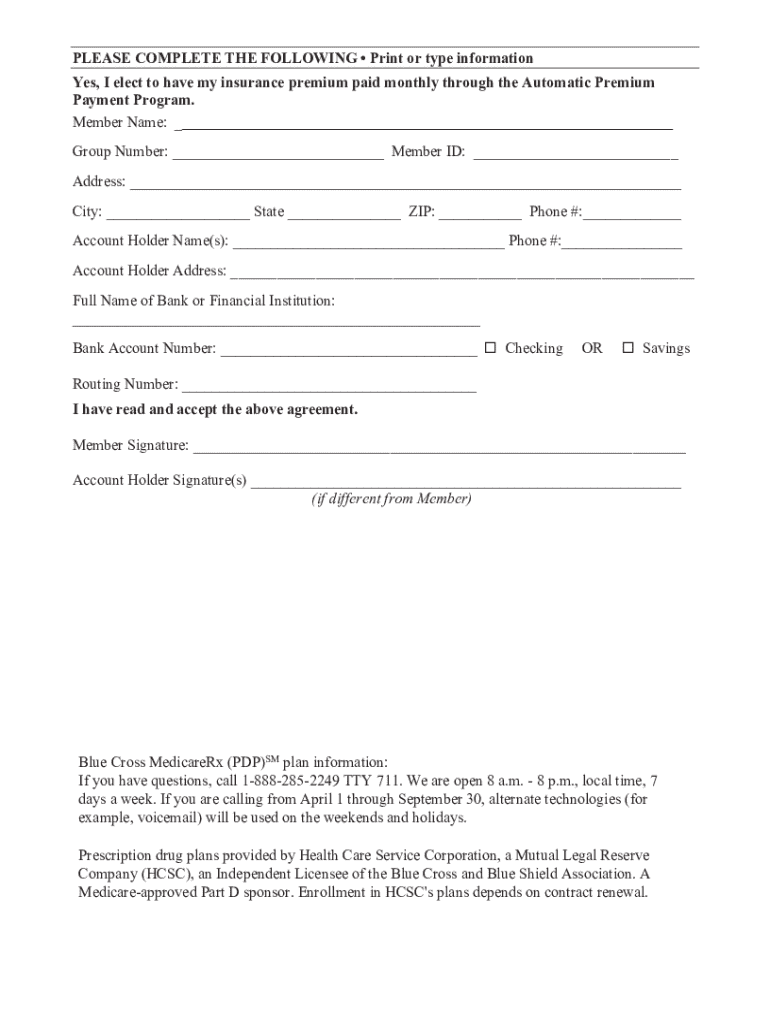

Steps to complete the automatic premium payment program form

To enroll in the automatic premium payment program, you should follow these essential steps:

Managing your automatic premium payments

Once enrolled, managing your automatic premium payments becomes significantly easier. It’s crucial to regularly monitor your payment status to ensure that funds are being processed accordingly.

If you need to update your payment information, such as changing your bank account or credit card details, ensure you notify your insurer promptly to prevent any disruptions in coverage. Lastly, should you wish to stop automatic payments due to changes in your financial situation, it’s essential to understand the procedures associated with cancellation.

Troubleshooting common issues

Payment failures can occur for a multitude of reasons, such as insufficient funds or expired payment methods. If you encounter an issue, the first step is to identify the cause; this could involve checking your bank account or reviewing your payment information.

If you need assistance, customer support is available through various channels, including phone or email, and an FAQ section can often answer common issues related to the automatic premium payment program.

Real-world scenarios and FAQs

Understanding the automatic premium payment program can pose questions for new enrollees. Some common inquiries include how long it takes for payments to process, whether payment dates can be adjusted, and what happens if your address changes during the payment period.

User testimonials often highlight the peace of mind achieved by adopting automatic payments. Many express relief at the simplicity of managing their premium payments, emphasizing the program's role in maintaining uninterrupted coverage without constant maintenance.

Conclusion on the benefits of pdfFiller for managing automatic payments

Integrating the automatic premium payment program with effective document management solutions like pdfFiller can significantly enhance your experience. With its cloud-based platform, pdfFiller allows users to create, edit, and eSign documents seamlessly, making it easy to manage your automatic premium payment program form alongside other essential documents.

Customizing your payment experience is easy with pdfFiller's diverse tools, making it the ideal solution for individuals and teams looking to streamline their documentation.

Next steps for streamlining your documentation

Ready to sign up for pdfFiller and access the automatic premium payment form? By exploring pdfFiller's user-friendly platform, you can gain a comprehensive solution for document management. Whether enhancing personal finance documentation or managing a team’s forms, pdfFiller empowers users to continuously improve their document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the automatic premium payment program in Chrome?

How can I edit automatic premium payment program on a smartphone?

How do I fill out automatic premium payment program on an Android device?

What is automatic premium payment program?

Who is required to file automatic premium payment program?

How to fill out automatic premium payment program?

What is the purpose of automatic premium payment program?

What information must be reported on automatic premium payment program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.