Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-to Guide

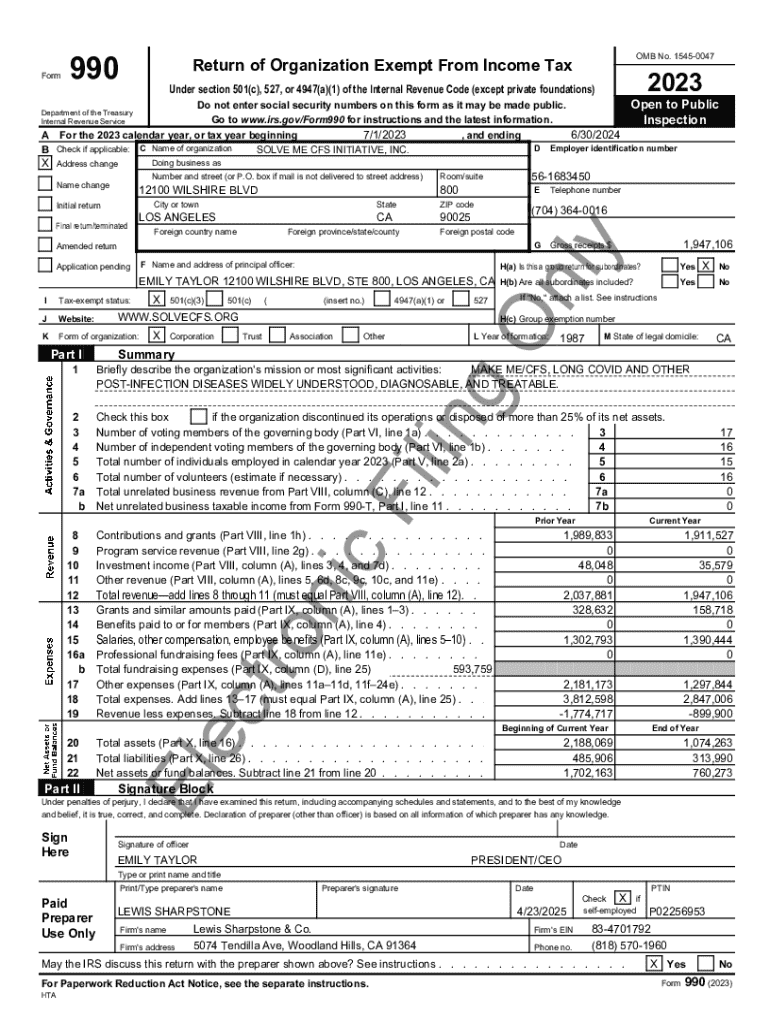

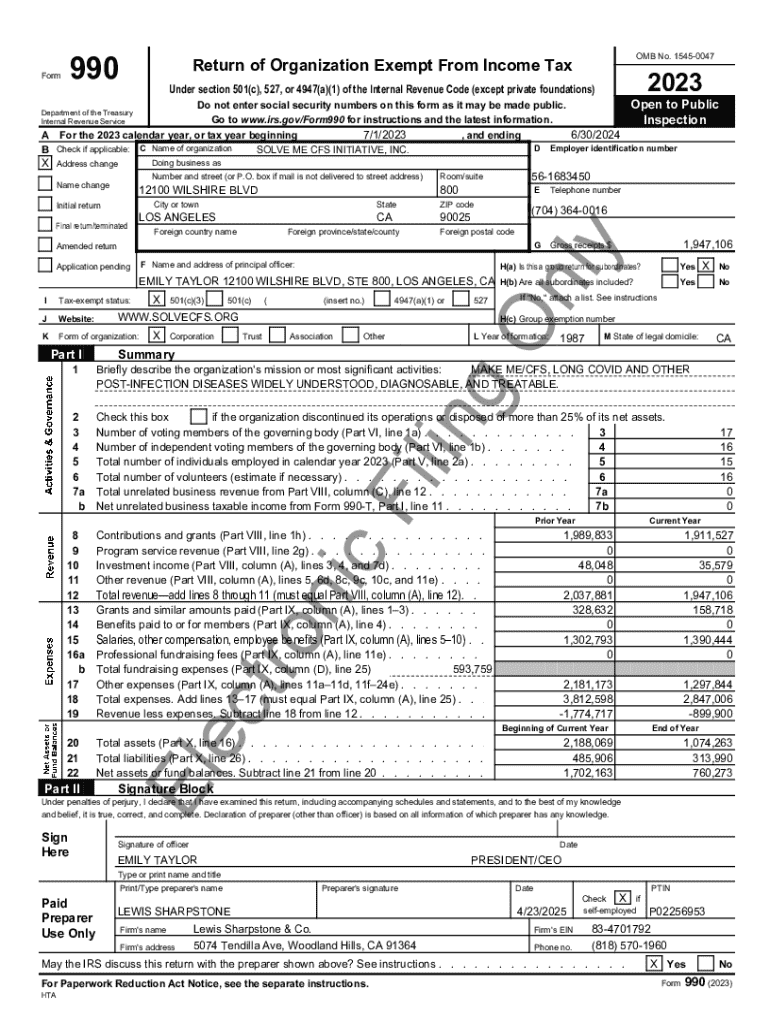

Overview of Form 990

Form 990 is an essential tool for tax-exempt organizations, providing a comprehensive overview of their financial health and operations. It's the IRS's primary form for collecting information about nonprofit organizations, ensuring transparency and fostering public trust. Nonprofits must file this form annually, detailing their income, expenses, program activities, and governance practices.

The significance of Form 990 lies not only in compliance with IRS requirements but also in its role as a transparency mechanism. It serves as a public record that allows potential donors and the community to assess a nonprofit's integrity and financial stewardship.

Understanding the types of Form 990

There are several versions of Form 990, each designed for different types of organizations based on their financial size and complexity. The main forms include 990, 990-EZ, and 990-N (commonly referred to as the e-Postcard).

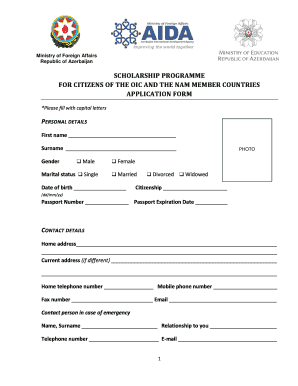

Navigating the Form 990

Understanding the structure of Form 990 is crucial for accurate completion. The form is divided into several parts and schedules, each covering different aspects of the organization's operations. Key sections include the organization’s mission, financial statements, details about governance, and program service accomplishments.

Navigating through Form 990 can appear daunting due to its length and detail. However, familiarizing oneself with its sections can streamline the process. Each part serves a distinct purpose, and knowing where to find critical information can improve efficiency in filling out the form.

Detailed instructions for filling out Form 990

Preparing to file Form 990 requires gathering necessary documentation, including financial statements, revenue reports, and descriptions of programs. Establishing a timeline for filing is crucial, as it allows organizations to collect accurate data and avoid last-minute rushes.

Here’s a detailed, step-by-step approach to completing Form 990:

Accurate reporting is vital, particularly in the financial section. Ensure all data corresponds with accounting records to avoid discrepancies that may raise red flags.

Common mistakes to avoid during this process include:

Editing and managing Form 990

Utilizing pdfFiller can streamline the editing process of Form 990. With its interactive tools, users can easily fill out forms online, ensuring data accuracy and form integrity. pdfFiller also allows users to save drafts and make revisions as necessary, providing a more flexible approach to form management.

eSigning and collaborating on Form 990 is made straightforward with pdfFiller, allowing multiple stakeholders to obtain electronic signatures efficiently. Following these steps can facilitate the review process among team members:

Filing Form 990

Organizations have two options for submitting Form 990: online or via paper submission. Online filing is generally more efficient, reducing paperwork and minimizing processing time. However, organizations must weigh the pros and cons of each method based on their specific needs.

The steps for filing online typically include accessing the IRS e-file system, entering data directly into the electronic form, and securely submitting the information. Paper filing involves printing the completed form and mailing it to the appropriate IRS address.

It’s crucial to note the deadlines for submission, which generally falls on the 15th day of the 5th month after the organization’s year-end. Extensions may be available by filing Form 8868 prior to the deadline, granting an additional six months for completion.

Compliance and regulatory considerations

Understanding the filing requirements associated with Form 990 is essential for nonprofits. Generally, organizations with gross receipts over $50,000 must file this form, although exceptions exist based on specific criteria, such as being a religious organization.

Organizations must also be aware of jurisdictional differences in filing mandates. Some states may have additional requirements that coincide with federal regulations, meaning nonprofits must be diligent in adhering to both.

Public inspection regulations indicate that the filed Form 990 becomes accessible to the public, providing vital transparency. Organizations must ensure compliance to avoid penalties, understanding what data is made publicly available through the IRS.

The importance of Form 990 in nonprofit evaluation

Researchers and donors increasingly utilize Form 990 as a critical tool for evaluating charities. By analyzing the data presented in this document, stakeholders can ascertain an organization’s impact, financial management practices, and overall effectiveness in serving its mission.

Incorporating Form 990 into annual reporting can significantly enhance transparency with stakeholders. Organizations can leverage insights derived from their filings to communicate achievements and challenges in a structured manner, fostering trust and ongoing support from the community.

Frequently asked questions

Individuals and teams often have questions regarding the nuances of Form 990, from filing procedures to deadlines. Common queries stem from uncertainty about eligibility, compliance issues, or how to interpret specific sections of the form.

Organizations seeking additional support can refer to IRS resources online or consult with a tax professional specializing in nonprofit law. Many accounting firms also provide guidance tailored to Form 990 compliance, ensuring organizations meet their obligations effectively.

Additional tips for nonprofits

Maintaining accurate records is vital for efficient Form 990 management. Organizations should implement robust documentation practices to ensure that all financial transactions and program developments are recorded systematically.

Leveraging insights gained from Form 990 filings can serve as a strategic tool for future planning. Analyzing trends from year to year—or noting changes in funding sources—can inform organizational strategy and help to guide resource allocation decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.