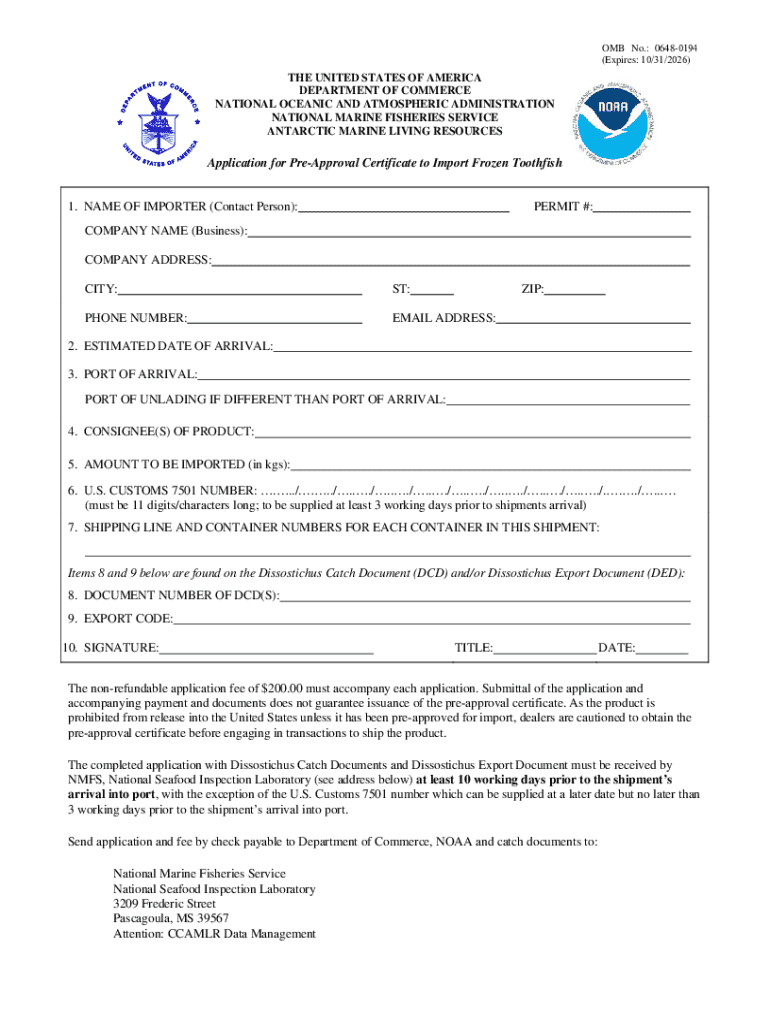

Get the free Application for Pre-approval Certificate to Import Frozen Toothfish

Get, Create, Make and Sign application for pre-approval certificate

Editing application for pre-approval certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for pre-approval certificate

How to fill out application for pre-approval certificate

Who needs application for pre-approval certificate?

Understanding and Completing the Application for Pre-Approval Certificate Form

Understanding the pre-approval certificate

A pre-approval certificate is a crucial document that provides prospective applicants with a preliminary confirmation of eligibility from lenders or service providers. This certificate typically indicates that an individual or business meets certain criteria and is likely to receive the necessary funding or insurance, pending final verifications. The pre-approval certificate plays a vital role across several domains, including real estate transactions, insurance policies, and business financing.

In real estate, a pre-approval certificate is often the first major step towards purchasing a home. It helps buyers understand their purchasing power, streamline the mortgage process, and enhances their position when making an offer. In insurance, having a pre-approval can expedite claims processing and ensure that eligible coverage is quickly accessed. Similarly, for business applications, pre-approval facilitates faster access to funds, thereby aiding in project momentum or operational needs.

The benefits of obtaining a pre-approval certificate

Securing a pre-approval certificate offers numerous advantages that can significantly enhance the applicant's experience. One of the primary benefits is the faster processing of applications. This is especially important when time is of the essence, such as in the competitive housing market or urgent business needs. By having a pre-approval upfront, applicants can bypass some preliminary checks, making the overall process smoother.

Enhancing credibility is another vital benefit. A pre-approval certificate signifies financial readiness and seriousness to lenders or insurers. It assures providers that the individual or business is prepared to engage meaningfully, which can lead to better terms on loans or insurance. Additionally, the pre-approval can streamline the application process across various platforms, whether for mortgage lenders, insurance companies, or financial services, saving both time and effort during the application journey.

Eligibility criteria for a pre-approval certificate

Eligibility for a pre-approval certificate generally involves meeting specific requirements, which can vary based on industry standards. Commonly, applicants need to demonstrate a degree of financial stability, which may include aspects like credit score, income level, and debt-to-income ratio. Collectively, these factors help establish an applicant’s capability of managing future commitments effectively.

Industry-specific requirements can also come into play. For instance, in the real estate sector, lenders might require detailed financial statements, proof of employment, or tax documents. In the insurance arena, the requirements can include risk assessments or previous claim histories. Common documentation needed may consist of identification proofs, bank statements, and tax returns. It’s crucial for applicants to ensure they meet these criteria to avoid delays or rejections in their application process.

Step-by-step guide to completing the pre-approval certificate application form

Completing the application for a pre-approval certificate involves several organized steps. Each step ensures that applicants are well-prepared and that all necessary information is accurately provided. Start by gathering necessary documents, which may include your identification, financial statements, and proof of income. Being organized at this stage can significantly streamline the process.

Next, access the application form. On pdfFiller’s platform, users can easily navigate to find the right template that suits their specific needs. Once you have the appropriate form, fill it out by carefully reading each section and providing all requested information. Remember to double-check entries in financial statements and personal identification to prevent any errors that may lead to delays.

After filling out the form, proceed to review and edit your application. pdfFiller offers several editing tools that can help ensure accuracy in your document. Finally, submit your application using the recommended submission methods on pdfFiller's platform. Adhering to best practices, like confirming receipt of the application, can improve communication with the issuing entity.

Understanding the approval process

Post-submission, applicants often have questions about the approval process and timelines. Typically, the initial review occurs shortly after submission. Depending on the workload, the issuing body assesses the application, and a response may be provided within a few business days to weeks. It’s essential to stay engaged and monitor any notifications or requests for further information during this timespan.

The possible outcomes of your application can vary: it may be approved, denied, or left pending for additional information. An approved status is favorable as it grants you the pre-approval. In contrast, a denial can come with specific reasons, which can guide you on how to rectify issues or exclusions, while a pending status often means further documentation is needed for a decision.

Common pitfalls to avoid when applying for a pre-approval certificate

Navigating the application for a pre-approval certificate can be fraught with challenges. One of the most prevalent pitfalls is failing to provide complete or accurate documentation. Applications that are missing required documents or contain errors often get delayed or denied, so it’s crucial to double-check all entries and attachments before submission.

Another common issue applicants face is misunderstanding the eligibility requirements. Familiarizing oneself with industry-specific criteria and guidelines can help avoid unnecessary complications during the approval process. Additionally, ignoring deadlines and follow-up communications may create obstacles; staying proactive and responsive can make a difference in the overall outcome.

Frequently asked questions (FAQs)

A frequent query revolves around the difference between pre-qualification and pre-approval. Pre-qualification is a preliminary step where lenders provide an estimate of how much you might be able to borrow based on the information you provide; conversely, pre-approval involves a thorough review of your financial information leading to an official certificate.

The validity of a pre-approval certificate typically lasts between 60 to 90 days, depending on the issuing organization. Should applicants find themselves in a situation where their application has been denied, they can usually seek feedback for improvement or take time to rectify the issues before reapplying.

Updating information post-submission can be vital if financial situations change. Applicants should promptly communicate any changes to ensure that previous evaluations remain accurate and relevant.

Other considerations

State-specific requirements can heavily influence the application process, as different locations may have varying regulations regarding pre-approval certificates. For instance, some states may necessitate additional disclosures or have different timelines for processing requests. Additionally, being aware of the roles that various organizations or lenders play in issuing pre-approval can provide further clarity on what to expect.

Furthermore, utilizing additional resources, such as pdfFiller's comprehensive functionality, can enhance the overall experience. The platform simplifies managing such documents beyond just pre-approval, catering to an array of needs from e-signing to collaborative editing.

Interactive tools & features on pdfFiller

pdfFiller empowers users with interactive tools that significantly aid in the application for pre-approval certificate forms. Features such as e-signature capabilities enable faster document processing, as signed documents can be returned quickly without the need for physical redirection. This can be especially advantageous in time-sensitive situations.

Collaborative tools on the platform allow teams to work together efficiently, ensuring everyone involved in the application process can access, review, and comment on the document. This not only enhances the quality of the submitted application but also fosters better communication among team members.

Final thoughts on securing your pre-approval certificate

Securing a pre-approval certificate is integral to ensuring a smooth transaction process, particularly in sectors like real estate and finance. Preparation is key; gathering the appropriate documentation and understanding the criteria can facilitate a more straightforward experience. By leveraging resources like pdfFiller, users benefit from streamlined document management, which is invaluable beyond just pre-approval tasks.

Ultimately, the diligence demonstrated during the application process can lead to favorable outcomes that expedite transactions and provide peace of mind. Utilizing cloud-based solutions not only simplifies the application for pre-approval certificate forms but can also foster ongoing management and organization of important documents moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application for pre-approval certificate directly from Gmail?

How can I send application for pre-approval certificate for eSignature?

How do I edit application for pre-approval certificate on an Android device?

What is application for pre-approval certificate?

Who is required to file application for pre-approval certificate?

How to fill out application for pre-approval certificate?

What is the purpose of application for pre-approval certificate?

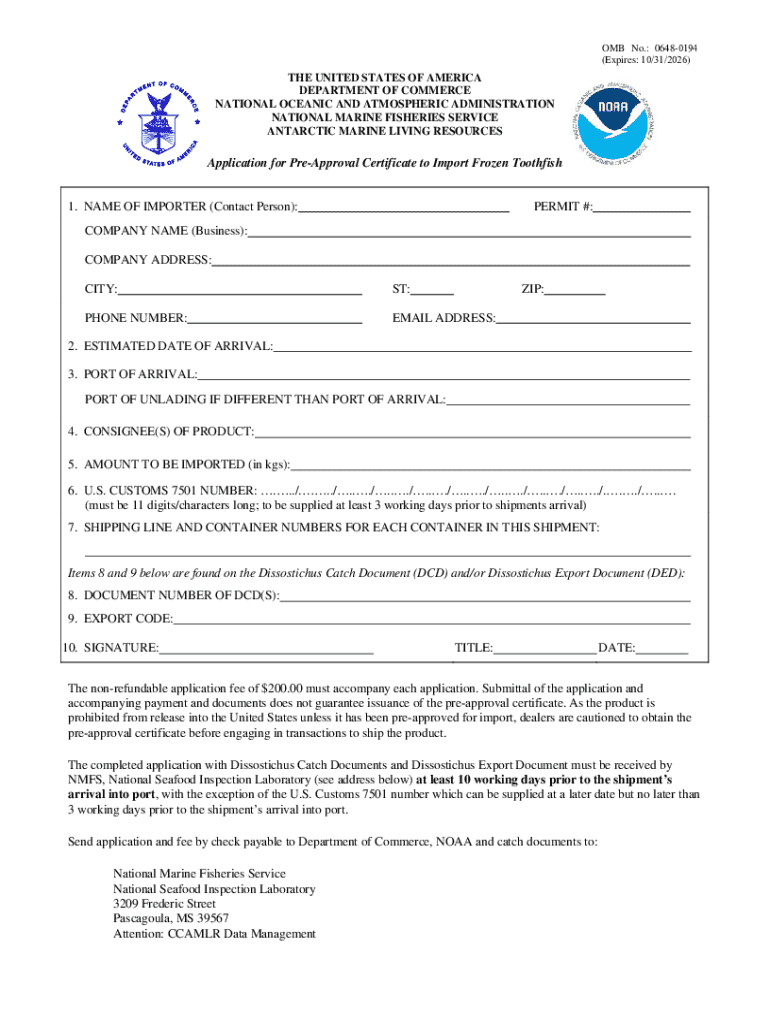

What information must be reported on application for pre-approval certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.