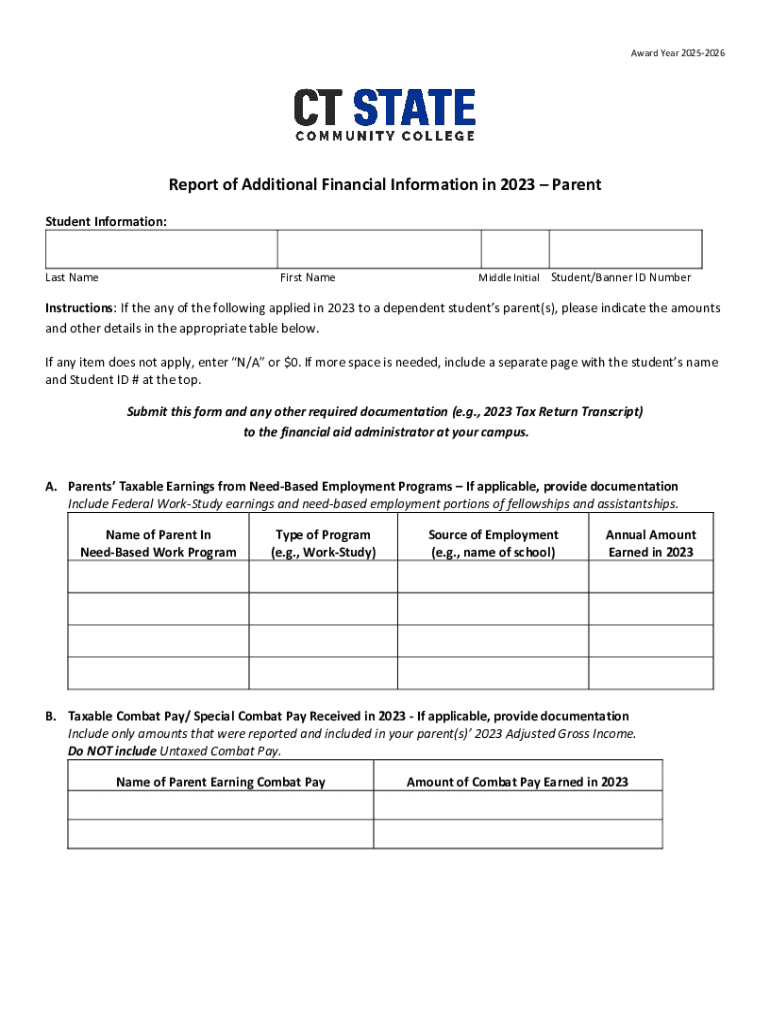

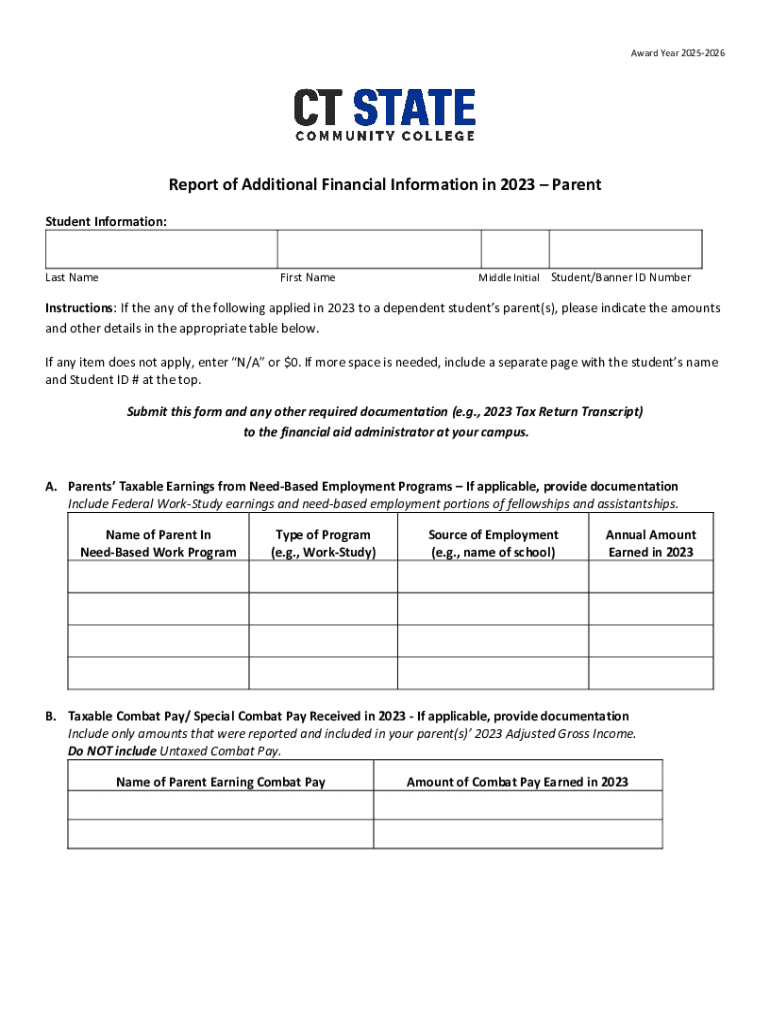

Get the free Report of Additional Financial Information in 2023 – Parent

Get, Create, Make and Sign report of additional financial

Editing report of additional financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out report of additional financial

How to fill out report of additional financial

Who needs report of additional financial?

Understanding the Report of Additional Financial Form: A Comprehensive Guide

Understanding the report of additional financial form

The report of additional financial form serves as a crucial document in the realm of financial assistance, designed specifically to provide institutions with a clearer picture of a student's financial situation. This report enables educational institutions, scholarship committees, and financial aid offices to better assess individual needs and allocate resources effectively. Circumstances ranging from sudden job loss to changes in family income often necessitate submitting this additional report, as they reflect a student’s true financial need.

This form is essential for students, families, and individuals who may find their financial circumstances differ from what was initially reported. For instance, a student may have received a scholarship based on prior income levels that no longer reflect their current situation, prompting the need for a report to avoid any discrepancies and ensure continued eligibility for financial assistance.

Who should use this form?

The report of additional financial form is particularly targeted at students in various educational stages—from high school seniors applying for college scholarships to undergraduates adjusting their financial aid packages. It is also relevant for families experiencing unexpected financial hardships, such as medical emergencies. Schools, scholarships, and financial aid programs often request this form to assess each applicant's unique needs accurately.

Specifically, those experiencing financial changes due to the following situations may need to submit this form:

Key information required on the form

Completing the report of additional financial form requires a comprehensive range of information to ensure accurate assessments. Key personal information includes the applicant's name, address, and contact details, which are essential for identifying the individual and corresponding with them throughout the financial review process.

Next, financial details are paramount. This includes a detailed breakdown of income sources, such as wages, scholarships, grants, and any additional financial resources. It's also vital to report any changes in financial status, like new sources of income or loss of existing income, as these can significantly impact financial aid eligibility. Alongside these, educational information such as enrollment status and the institution’s details is required, allowing institutions to gauge the applicant's current academic commitments.

Lastly, dependency status must be clearly defined, as it determines whether the applicant is considered independent or dependent. This classification has implications for the amount of financial aid assistance they may qualify for, underscoring the importance of providing accurate information.

Step-by-step guide to completing the report

To successfully complete the report of additional financial form, begin by gathering the necessary documentation. Essential documents typically include tax returns, recent pay stubs, bank statements, and any legal proof of financial changes, such as divorce decrees or letters of unemployment.

Once you have this information at hand, fill out the form methodically. Each section should reflect your current financial situation accurately. Be cautious of common pitfalls, such as overstating income or forgetting to add new expenses; these can lead to discrepancies later on.

After filling out the form, reviewing your information is crucial to ensure completeness and correctness. Creating a checklist of the required sections and ensuring all are filled out can prevent missing important details. The importance of double-checking for accuracy cannot be overstated, as inaccuracies can lead to delays in processing your request.

Submitting your report

The next critical step is submission. Consider your submission method, as options typically include electronic and paper submissions. Electronic submissions often streamline the process, making it faster and more efficient. Utilizing platforms like pdfFiller can enhance this process by simplifying eFiling, storing your forms securely, and providing easy access at any time.

Don't forget to pay attention to deadlines. Each institution or program has its own deadlines for submission, which are crucial to meet to avoid missing out on financial aid opportunities. Marking key dates on your calendar allows for timely submissions, reducing stress and ensuring a smoother transition into the academic year.

Follow-up actions after submission

Once you've submitted your report, tracking its status becomes essential. Platforms like pdfFiller typically offer a means of checking the status of your submission, helping you stay informed. Regularly checking the status can preclude any surprises and enable proactive communication should questions arise.

If the financial aid office reaches out for more information, responding promptly and clearly is vital. Being organized and having key documents at hand can aid in expediting any additional queries they may have. Effective communication during this follow-up can help maintain a positive relationship with the financial aid office and ensure your application is processed smoothly.

Frequently asked questions (FAQs)

Many applicants have questions regarding special circumstances that might apply to them. For instance, what if you face unemployment or a health-related financial crisis? Many institutions have provisions for dealing with such unique situations; thus, documenting these circumstances and discussing them with the financial aid office is often helpful.

Another common inquiry pertains to amending the report once submitted. If you've discovered errors or need to update information, it’s best to contact the financial aid office immediately to understand their process for making changes.

Lastly, what if your report is denied? Clarifying the reasons for denial can provide insights into the appeal options available. Often, institutions allow for a formal appeal, which can be a crucial step in receiving the assistance needed for educational pursuits.

Additional tools and resources for users

In today's digital age, utilizing interactive tools on platforms like pdfFiller enhances the form-filling experience. Various calculators and estimation tools can assist in accurately assessing your financial standing, making the process smoother.

Educational resources are also available, including articles and guides that provide further insight into financial aid processing. Engaging with these materials can help applicants stay informed and equipped to tackle their financial challenges.

Lastly, pdfFiller offers robust customer support for those needing assistance while completing the form. By reaching out to support, users can quickly resolve any queries, ensuring a better overall experience.

Best practices for financial reporting

Maintaining accurate financial records throughout the year is a hallmark of best practices in financial reporting. Keeping organized documentation of income, expenses, and significant financial changes can facilitate quicker and more accurate reporting when required.

Understanding trends in financial aid is also crucial. This includes being aware of any changes in policies that may affect your eligibility. Regularly reviewing financial aid announcements can alleviate confusion and prepare you for upcoming applications.

Lastly, creating a system for organizing documentation can aid future submissions, ensuring that everything needed is readily available. Techniques such as digitizing records and setting recurring reminders for updates can streamline future applications and reporting.

Success stories

Various students have shared their success stories regarding the accurate reporting of their financial needs. Many found that timely and thorough submissions enabled them to secure funding that was critical for their educational pursuits. Testimonials reflect the positive changes experienced when institutions took the time to understand their unique financial situations.

The importance of financial transparency cannot be overstated. Students who maintain honest and consistent communication about their financial status often report better outcomes, illustrating the real-life implications of submitting complete reports. These stories underscore the value of using resources like pdfFiller to support effective and accurate financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify report of additional financial without leaving Google Drive?

How do I fill out the report of additional financial form on my smartphone?

How do I complete report of additional financial on an Android device?

What is report of additional financial?

Who is required to file report of additional financial?

How to fill out report of additional financial?

What is the purpose of report of additional financial?

What information must be reported on report of additional financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.