Get the free Non-federal Direct Deposit Enrollment Request Form

Get, Create, Make and Sign non-federal direct deposit enrollment

Editing non-federal direct deposit enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-federal direct deposit enrollment

How to fill out non-federal direct deposit enrollment

Who needs non-federal direct deposit enrollment?

Understanding the Non-Federal Direct Deposit Enrollment Form

Understanding non-federal direct deposit

Direct deposit is the electronic transfer of payments directly into a bank account rather than issuing paper checks. For non-federal direct deposit, the focus is on private employers and private entities, allowing employees or recipients to receive their funds directly into their bank accounts without government intervention.

The benefits of non-federal direct deposit are numerous. Firstly, it enables faster access to funds, significantly reducing the waiting time for deposit clearance. Enhanced security is another key feature, as it minimizes the risk of lost or stolen checks. Additionally, the convenience of managing payments makes this method increasingly popular among individuals and companies alike.

Key features of pdfFiller for direct deposit

pdfFiller stands out as an exceptional tool for managing the direct deposit enrollment process, particularly through its advanced PDF editing capabilities. Users benefit from seamless editing tools that facilitate smooth input of information on direct deposit forms, ensuring accuracy and ease of use.

In addition to editing, pdfFiller offers eSigning capabilities which allow users to legally sign their forms electronically. This is particularly useful for those who wish to complete the enrollment process quickly without the hassle of printing and scanning. The platform also enables real-time collaboration among team members, making it easier to manage multiple enrollments or edit forms collectively.

Cloud-based accessibility means that users can access their forms from anywhere, at any time. This flexibility is ideal for those who are often on the move or need to complete paperwork outside of their usual workspace.

How non-federal direct deposit works

Understanding the mechanics of non-federal direct deposit is crucial for potential users. At its core, the direct deposit process involves coordinating with a bank's Automated Clearing House (ACH) network, which processes transactions electronically. Once the necessary forms are submitted to the employer or agency, they set up the payments to be made through direct deposit into the designated bank account.

Various types of payments can be made via non-federal direct deposit, ensuring a wide range of use cases. This can include paychecks from private employers, government benefits from entities that do not fall under federal agencies, and tax refunds issued directly by states or other organizations.

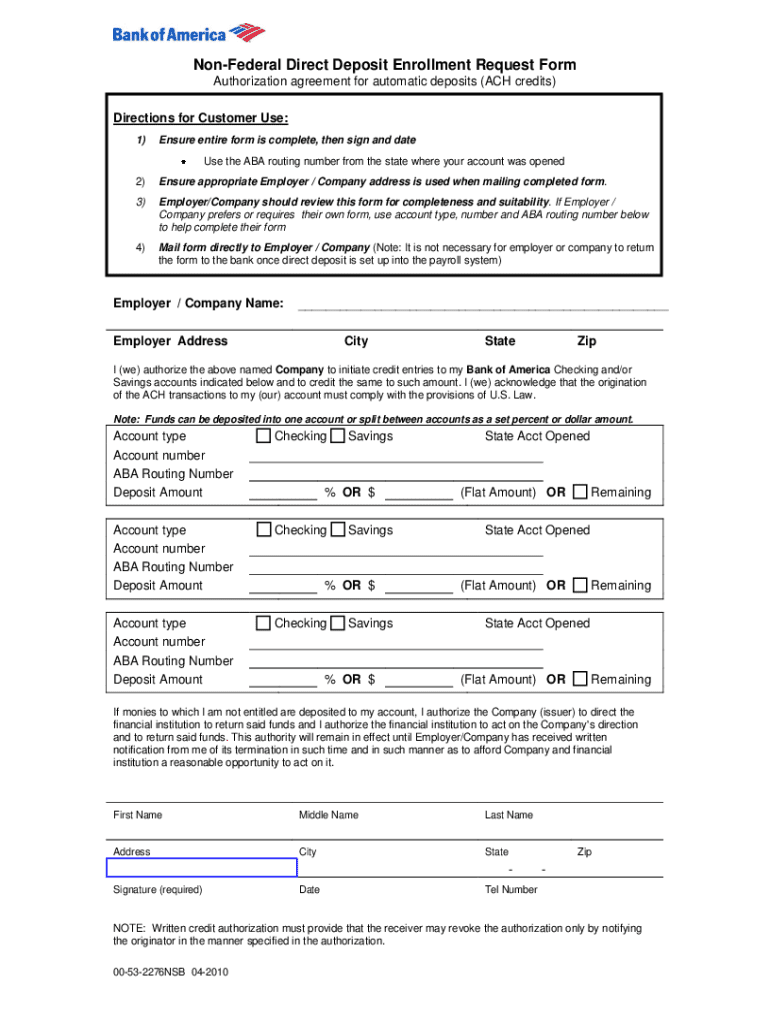

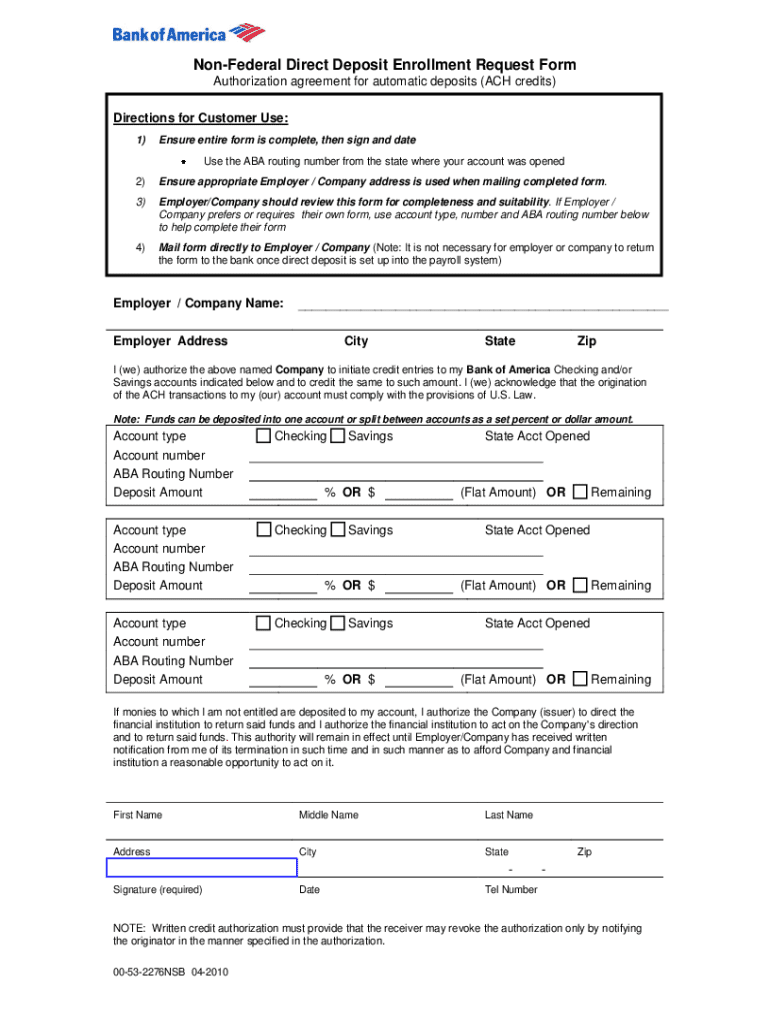

Step-by-step guide to filling out the non-federal direct deposit enrollment form

Filling out the non-federal direct deposit enrollment form can be straightforward when following a systematic approach. Start by accessing the form on pdfFiller's platform, making use of its interactive fields and auto-fill options to minimize manual input.

The next step involves providing essential information, which typically includes personal details such as your name and address, as well as your bank account information including account number and routing number. Additionally, you may need to include details about your employer or the agency issuing the payments.

After entering your details, it’s crucial to thoroughly review the form for accuracy. pdfFiller provides review tools that can highlight any missing or incorrect information. Finally, you can eSign the document directly within the platform, ensuring proper submission procedures are followed for sending the form to the designated employer or agency.

Managing your non-federal direct deposit enrollment

Once your non-federal direct deposit enrollment is complete, it is essential to manage it effectively. Keeping track of your application status ensures that you are aware of when deposits begin. In addition, life circumstances can change, and you may need to make updates to your enrollment, such as changing bank information or discontinuing direct deposit altogether.

When making changes, know the procedures required for submitting updated information, either through your employer or the agency. Various questions frequently arise regarding direct deposit management, such as the consequences of missed payments or how to address errors in deposits. Addressing these proactively can save a great deal of trouble down the line.

Common questions about non-federal direct deposit

Many individuals have queries regarding the non-federal direct deposit process. One common concern is what happens if a payment is missed. Communication with your employer or payment agency is paramount in such situations to resolve issues quickly.

Another frequent question is whether multiple accounts can be used for direct deposits. The answer often varies; however, many employers allow splitting payments across accounts. Handling errors in direct deposit could involve contacting your bank and your employer to rectify any discrepancies.

Tips for a smooth direct deposit experience

For a seamless experience with non-federal direct deposit, staying informed about your rights and responsibilities is key. Regularly checking your account statements and verifying amounts deposited can help catch discrepancies early. Being proactive in addressing any concerns will aid in maintaining a positive banking experience.

Consider utilizing pdfFiller’s features for ongoing document management related to your direct deposits. The platform not only supports initial enrollment but also keeps you efficient and organized with any required changes over time. This ensures that your direct deposit enrolment remains current and accurate.

Interactive tools and resources

pdfFiller provides a comprehensive suite of tools tailored specifically for users who need to fill out forms. With features that include text editing, eSigning, and real-time collaboration, the platform empowers users to take control of their documents regarding their non-federal direct deposits.

On the pdfFiller site, you’ll find links to other relevant forms and templates that support various financial needs. Plus, if assistance is required, customer support options are readily available to answer any questions or guide users through the process, ensuring reliability and satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in non-federal direct deposit enrollment?

How do I complete non-federal direct deposit enrollment on an iOS device?

How do I edit non-federal direct deposit enrollment on an Android device?

What is non-federal direct deposit enrollment?

Who is required to file non-federal direct deposit enrollment?

How to fill out non-federal direct deposit enrollment?

What is the purpose of non-federal direct deposit enrollment?

What information must be reported on non-federal direct deposit enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.