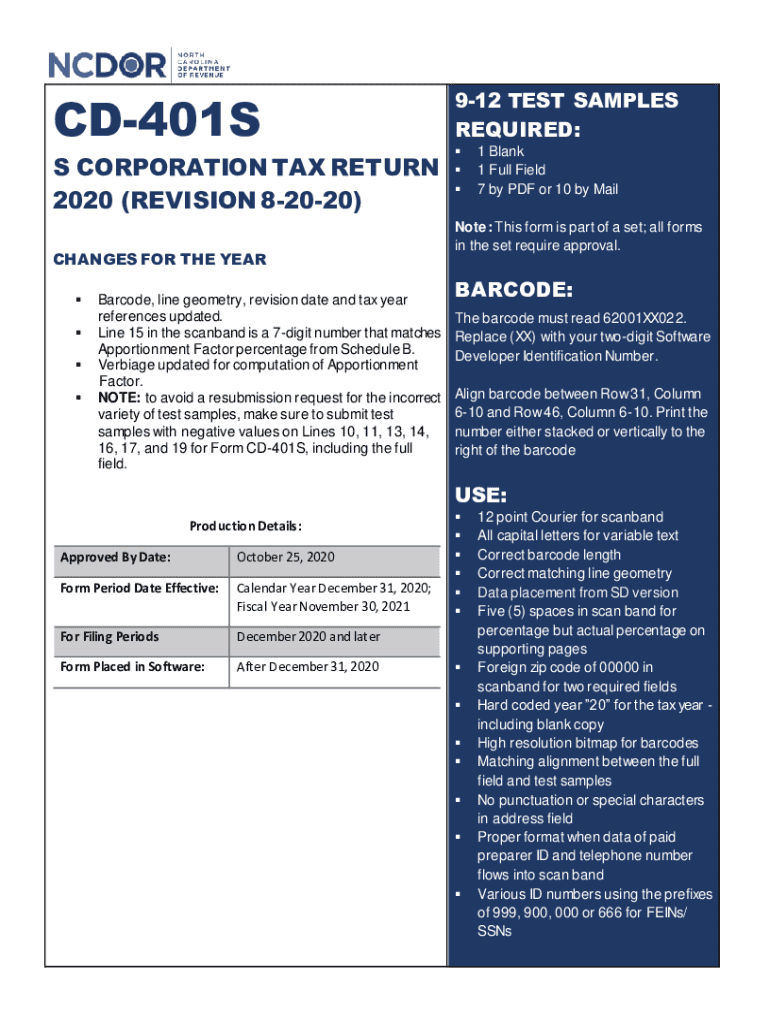

Get the free Cd-401s S Corporation Tax Return 2020 (revision 8-20-20)

Get, Create, Make and Sign cd-401s s corporation tax

How to edit cd-401s s corporation tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cd-401s s corporation tax

How to fill out cd-401s s corporation tax

Who needs cd-401s s corporation tax?

-401S S Corporation Tax Form: A Comprehensive How-to Guide

Understanding the -401S S Corporation Tax Form

The CD-401S form is essential for S Corporations operating in North Carolina. It serves to report income, deductions, and credits, ensuring compliance with state tax regulations. Filing this form accurately and on time is crucial for avoiding penalties and ensuring that the S Corporation retains its favorable tax status.

S Corporations in North Carolina must meet specific eligibility criteria, such as having no more than 100 shareholders, all of whom must be individuals, certain trusts, or estates. Additionally, the corporation must be based in the U.S. and cannot be a financial institution or insurance company.

Who needs to use the -401S form?

Businesses that operate as S Corporations in North Carolina are required to file the CD-401S form. This includes various types of small businesses, partnerships, and even some charitable organizations that meet the definition of an S Corporation. It's important to understand that not every business structure qualifies; those that are classified as C Corporations or sole proprietorships must satisfy different filing requirements.

There are exceptions to the filing rule. For instance, if an S Corporation has been inactive during the tax year, it may not need to file. Additionally, specific types of businesses, such as banks and insurance companies, may have separate requirements and should not file the CD-401S.

Detailed instructions for completing the -401S form

Completing the CD-401S form involves several critical sections. The first is the header information, where businesses must provide their legal name, address, and federal employer identification number (EIN). This ensures that the state can accurately identify the corporation and its associated tax responsibilities.

Next, businesses report their income. This section includes various types of income such as sales revenue, investments, and other sources. It's essential to include all income earned during the tax year as this forms the basis for the corporation's tax liability.

Deductions play a crucial role in reducing taxable income, and S Corporations are allowed to deduct business expenses like salaries, rent, and utilities. Following the income reporting, the balance sheet section should outline the corporation's assets, liabilities, and equity, providing a snapshot of the company's financial health.

Lastly, Schedule B requires information on shareholders, including their names, addresses, and respective shares owned. This is vital for transparency and ease of reference during audits.

Common mistakes to avoid include errors in income reporting and misinterpretations regarding deduction eligibility. Ensuring accurate entries will help prevent audits and possible fines.

Using interactive tools on pdfFiller for the -401S form

pdfFiller offers robust tools for completing the CD-401S form. Users can easily access a digital template of the form on the pdfFiller platform. The drag-and-drop feature allows businesses to upload supporting documents and insert them directly into their tax filings, making the process seamless and efficient.

Once the CD-401S form is complete, pdfFiller provides secure eSigning options. Users can electronically sign their documents without the hassle of printing and scanning. This not only saves time but also enhances security and tracking capabilities.

Managing your -401S documents on a cloud-based platform

With pdfFiller, managing tax documents like the CD-401S becomes more straightforward. The cloud-based platform allows businesses to organize and store their S Corporation files efficiently. By categorizing documents based on fiscal years or specific tax obligations, companies can retrieve information swiftly when needed.

Collaboration is another key benefit of pdfFiller. Teams can invite members to review tax documents, comment, and suggest edits. This enhances teamwork and ensures that the final submission is accurate and thoroughly vetted.

Filing the -401S form: Options and deadlines

Filing the CD-401S form can be done in a few ways. Businesses can choose to file electronically through the North Carolina Department of Revenue website or submit a physical copy via mail. Electronic filing often speeds up processing times and is recommended for timely submissions.

Key deadlines must be adhered to for compliance. Typically, the CD-401S form is due on the 15th day of the fourth month following the end of the corporation's fiscal year. If necessary, businesses can file for an extension, allowing an extra six months for completion.

Frequently asked questions about the -401S form

Common inquiries regarding the CD-401S form often center around deadlines and amendments. If a business misses its filing deadline, it may incur penalties, but there are ways to appeal for relief under certain conditions. It is advisable to consult the North Carolina Department of Revenue for specific guidance.

Amending a submitted CD-401S form is also a concern. Businesses can file an amended return to correct any errors on the original form. Proper documentation must accompany this amended return to support the changes made.

Related documents and forms for S Corporations

In addition to the CD-401S form itself, S Corporations should be aware of associated documents that may be required during tax season. This includes NC CD-401S Information and Instructions and any other state-specific forms related to business income and deductions.

Having quick access to these forms is essential. Proper preparation can streamline filings and ensure all necessary information is included, reducing the risk of errors or omissions.

Tax reminders for S Corporations in North Carolina

Awareness of tax deadlines and obligations is key for S Corporations in North Carolina. It's essential to track all important dates, including the filing of the CD-401S form and payment deadlines for any outstanding tax liabilities. Creating a tax management calendar can greatly aid in maintaining compliance.

Additionally, each year businesses should review their eligibility criteria and any changes in tax law that may impact their filing status. Staying proactive can prevent last-minute complications and ensure a smoother tax season.

Additional resources at pdfFiller

pdfFiller offers a range of tools that simplify document management for businesses. With features like real-time collaboration, users can work together on the CD-401S form, making edits, comments, and suggestions seamlessly. This enhances accuracy and expedites the filing process.

Using pdfFiller ensures compliance with documentation requirements while providing an all-in-one solution for managing forms like the CD-401S. The platform is user-friendly and designed to cater to businesses of all sizes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute cd-401s s corporation tax online?

How do I edit cd-401s s corporation tax in Chrome?

How can I fill out cd-401s s corporation tax on an iOS device?

What is cd-401s s corporation tax?

Who is required to file cd-401s s corporation tax?

How to fill out cd-401s s corporation tax?

What is the purpose of cd-401s s corporation tax?

What information must be reported on cd-401s s corporation tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.