Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

A comprehensive guide to the financial disclosure statement form

Understanding financial disclosure statements

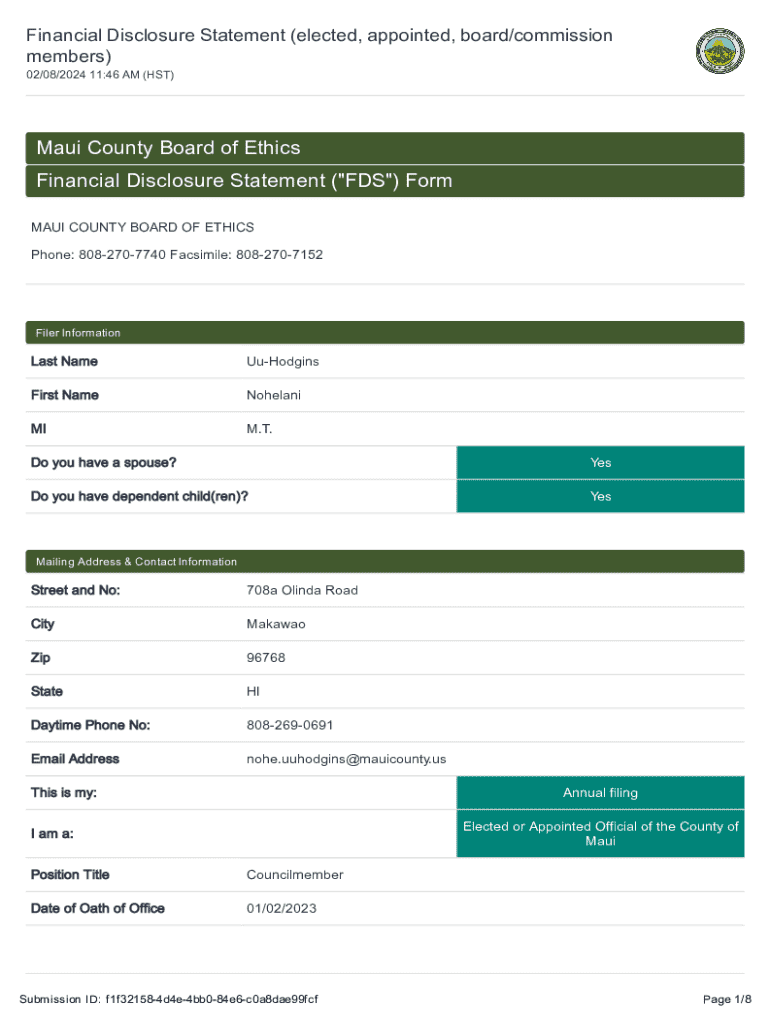

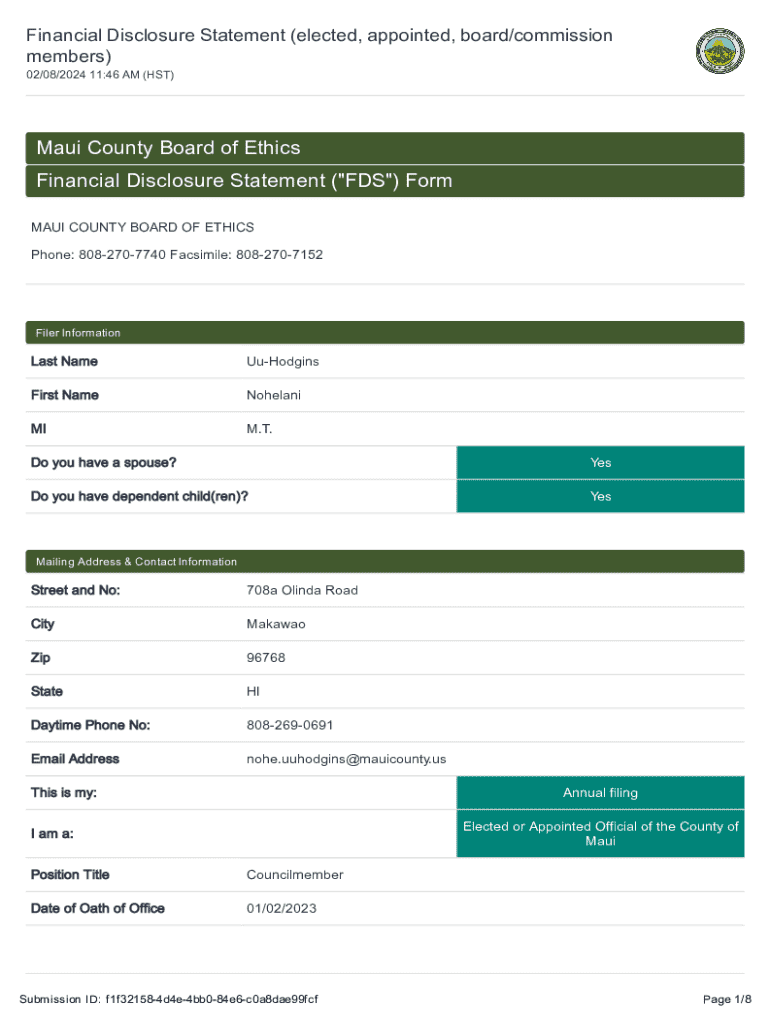

A financial disclosure statement form is a document that provides an overview of an individual's financial activities. This form typically covers sources of income, assets, liabilities, and various financial interests. Its primary purpose is to promote transparency and accountability among public officials and candidates, thereby helping to prevent conflicts of interest in governance. Ensuring the integrity of public service starts with comprehensive financial disclosures, as they allow constituents to hold their elected officials accountable.

Various individuals are mandated to file a financial disclosure statement, including elected officials, candidates for public office, and government employees. In many jurisdictions, these filings are not merely a formality; they are crucial for maintaining ethical standards in public service.

Types of financial disclosure statements

Financial disclosure statements vary depending on the role and responsibilities of the individual. Here are the primary types:

Each type of statement has specific filing requirements and deadlines, which can vary by state or jurisdiction. Compliance with these requirements is essential to avoid penalties and ensure public trust.

Key components of a financial disclosure statement

A financial disclosure statement contains several critical components designed to capture a thorough overview of an individual's financial situation. Understanding these components ensures that individuals can comply properly.

By including detailed information on these components, individuals contribute to maintaining transparency and trust in public service.

How to fill out the financial disclosure statement form

Completing a financial disclosure statement can seem daunting. However, by breaking it down into manageable steps, you can efficiently prepare the required documentation.

To ensure accuracy and completeness, double-check your entries and refer to the instructions provided with the form to mitigate common mistakes, such as underreporting income or failing to include assets.

Editing and modifying your financial disclosure statement

Once submitted, a financial disclosure statement is not set in stone. It’s essential to know how to edit and modify submitted forms, especially in the event of changing financial circumstances.

Using tools like pdfFiller provides interactive features that make editing documents simple. You can collaborate with team members or co-signers to ensure accuracy in your submissions. These tools can enhance the reviewing process and allow for efficient updates.

eSigning your financial disclosure statement

Signature validation is an essential aspect of submitting your financial disclosure statement. An electronic signature ensures authenticity, providing a layer of security to your disclosures.

To electronically sign your financial disclosure form, utilize pdfFiller’s straightforward signing features. This method not only saves time but also complies with legal implications surrounding electronic signatures, making the submission process seamless.

Submitting your financial disclosure statement

The submission process involves several steps to ensure your financial disclosure statement is filed correctly and on time. Here’s a simple breakdown of how to proceed:

Staying organized and aware of deadlines is vital for compliance and to uphold the integrity of the disclosure process.

Managing your financial disclosure statements

Effective management of financial disclosure statements is essential for individuals who file on a regular basis. Using pdfFiller allows for seamless storage and access to your forms from anywhere. This cloud-based platform ensures that your documents are safe, organized, and readily available.

Best practices for document management include regularly updating your statements and securely storing supporting documents in your digital vault. Understanding privacy and compliance regulations further safeguards your information while ensuring that you remain compliant with any applicable laws.

Frequently asked questions (FAQs)

Even with clear guidelines, questions surrounding financial disclosure statements often arise. Here are some common queries:

Addressing these questions promptly helps maintain clarity and transparency throughout the filing process.

Real-life examples

Studying well-completed financial disclosure statements provides valuable insights into best practices. Case studies reveal common traits of successful filings and highlight the pitfalls of poorly executed disclosures.

These examples underscore the importance of thoroughness and attention to detail when filing financial disclosures.

Navigating regulatory changes and updates

Financial disclosure regulations can evolve, so staying informed is crucial. Regularly consult reliable resources to stay abreast of new legislation, requirements, and best practices.

Subscribing to newsletters or regulatory updates related to financial disclosures can significantly enhance your knowledge and help you remain compliant.

Resources and tools for financial disclosure

Various online resources can make filing your financial disclosure statement simpler. pdfFiller offers interactive tools to aid in completing statements and provides access to sample forms that can guide you through the process.

Utilizing these resources can make a marked difference in your filing experience and outcomes.

Conclusion and next steps

Filing a financial disclosure statement is a vital part of maintaining transparency in public service. Utilizing the tools available at pdfFiller can streamline the entire process, making it an integral part of your document management strategy.

If you have questions about your financial disclosure statement or need help navigating the platform, reach out for support. The right tools and guidance will empower you to file with confidence.

User testimonials and success stories

Many individuals and teams have significantly benefited from using pdfFiller for their financial disclosure statements. Testimonials showcase improved efficiency in filing, decreased stress related to deadlines, and enhanced collaboration when necessary.

These success stories inspire confidence in utilizing online platforms to navigate financial documentation effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute financial disclosure statement online?

Can I create an electronic signature for the financial disclosure statement in Chrome?

How can I edit financial disclosure statement on a smartphone?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.