Get the free Business Property Statement for 2025

Get, Create, Make and Sign business property statement for

Editing business property statement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business property statement for

How to fill out business property statement for

Who needs business property statement for?

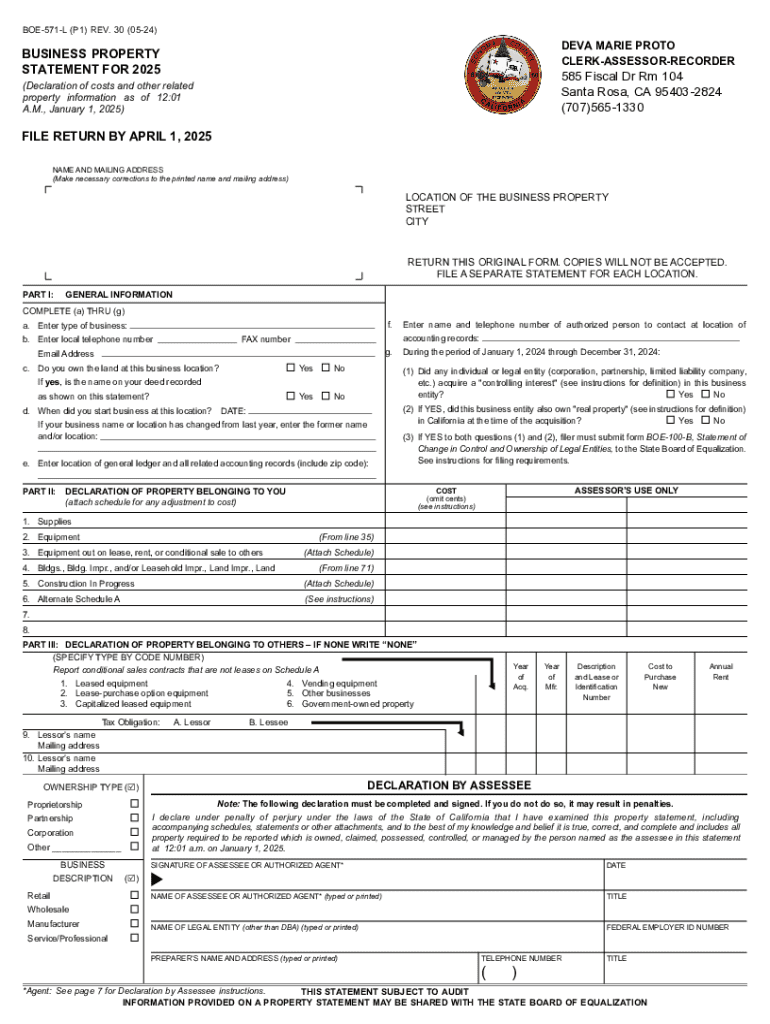

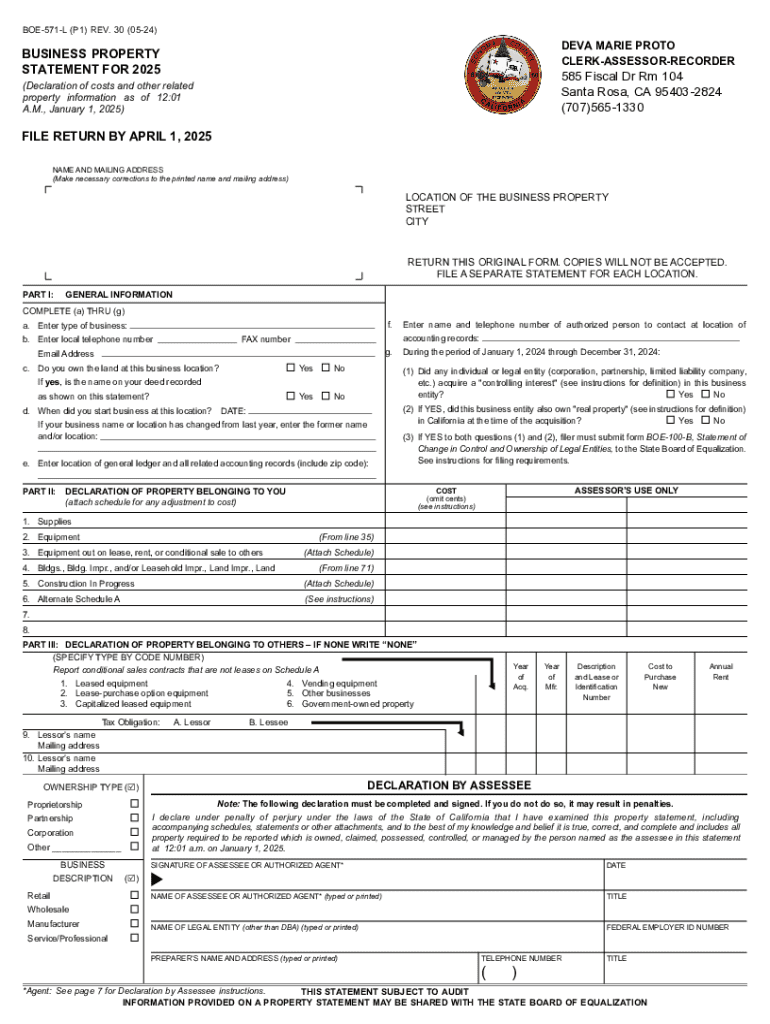

Comprehensive Guide to the Business Property Statement for Form 571-

Understanding the business property statement (Form 571-)

The Business Property Statement, also known as Form 571-L, is a critical document for businesses that own personal property used for commercial purposes. This form captures an extensive inventory of all business assets, which are subject to property taxation. By reporting your assets accurately, you comply with local tax regulations and ensure you aren't overtaxed.

Maintaining accurate records is paramount for any business owner. Incorrect or incomplete submissions can lead to tax discrepancies, potential audits, and financial penalties. Therefore, businesses should have a well-organized system for tracking their assets year-round, which will simplify the filing process significantly.

Filing deadlines for the Business Property Statement typically fall between mid-February and June 30 each year. Missing these deadlines can result in late fees and other penalties, which can be challenging for small and large businesses alike. It’s essential to stay ahead of the filing schedule.

Eligibility and filing requirements

Not every business is required to file a Business Property Statement. Generally, any business entity—irrespective of size—that owns personal property valued over a specific threshold must submit the form. This includes small businesses, which might have a modest inventory, as well as large enterprises with extensive assets. However, the requirements can vary between states and counties.

There are specific exemptions that could apply, such as businesses that are out of operation, with their assets removed. Furthermore, leased equipment often requires specific reporting guidelines different from owned property. Ensure you understand all nuances of your industry when filing.

How to access the business property statement

Accessing the Business Property Statement is relatively simple. Business owners can choose between online filing or traditional mail. Online filing is often more convenient, allowing users to submit their forms directly through a government portal.

To electronically file your Business Property Statement, follow these steps:

If you prefer traditional filing methods, you can download the form from your local Assessor’s office website or receive a printed copy via email. Follow the instructions closely and send it via mail to avoid penalties.

Completing the business property statement

Completing the Business Property Statement demands attention to detail across its various sections. Here’s a breakdown of key components:

Common mistakes include underreporting assets, failing to update asset values, and confusing leased equipment with owned equipment. Ensuring clarity and transparency in your records will minimize these risks.

Assessor's personal property section and communication

If any uncertainties arise during the filing process, contacting the Assessor's Office can be beneficial. They provide support and clarification for any questions regarding assessments or filing requirements.

Having clear communication channels with the Assessor's Office ensures that businesses remain compliant and can access helpful resources.

Navigating potential filing challenges

Filing your Business Property Statement can come with its challenges. If you disagree with your assessment, the process for formal disputes typically involves filling out a specific appeal form and providing evidence to support your case.

Understanding the consequences of late filings is equally crucial. Late submission can lead to penalties, including fines which can be a burden on financially smaller enterprises. If you're subject to an audit, ensure your records are well-organized and easily accessible, as thorough documentation will be your best defense.

Special considerations

Business personal property refers to all tangible assets that aren’t considered real estate, such as machinery, equipment, and furnishings. It’s essential to differentiate between taxable and non-taxable business property to maintain compliance.

Each region may have specific regulations affecting what is classified as taxable. Always consult local guidelines to ensure compliance.

Filing tips for success

To ensure a successful filing experience, pay close attention to the following tips:

Remember to anticipate common questions other businesses have when filing, which can further guide your preparation.

Insights from the business division

Staying updated on the latest changes to filing requirements is crucial. Regularly check your local Assessor’s Office website, as they may provide updates that impact your filing process.

Resources are available through various partner agencies that guide businesses in their reporting processes. Don't hesitate to reach out for assistance since clarity can often accelerate compliance and reduce errors.

Future considerations and best practices

To stay informed about legislative changes regarding business property, regularly consult tax resources and updates from the IRS or your local government.

By adhering to best practices in filing the Business Property Statement, you can cultivate a more efficient and compliant business operation, benefiting both your financial health and your peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business property statement for?

How do I fill out business property statement for using my mobile device?

Can I edit business property statement for on an Android device?

What is business property statement for?

Who is required to file business property statement for?

How to fill out business property statement for?

What is the purpose of business property statement for?

What information must be reported on business property statement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.