Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

Editing beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

A comprehensive guide to beneficiary designation forms

Understanding beneficiary designation forms

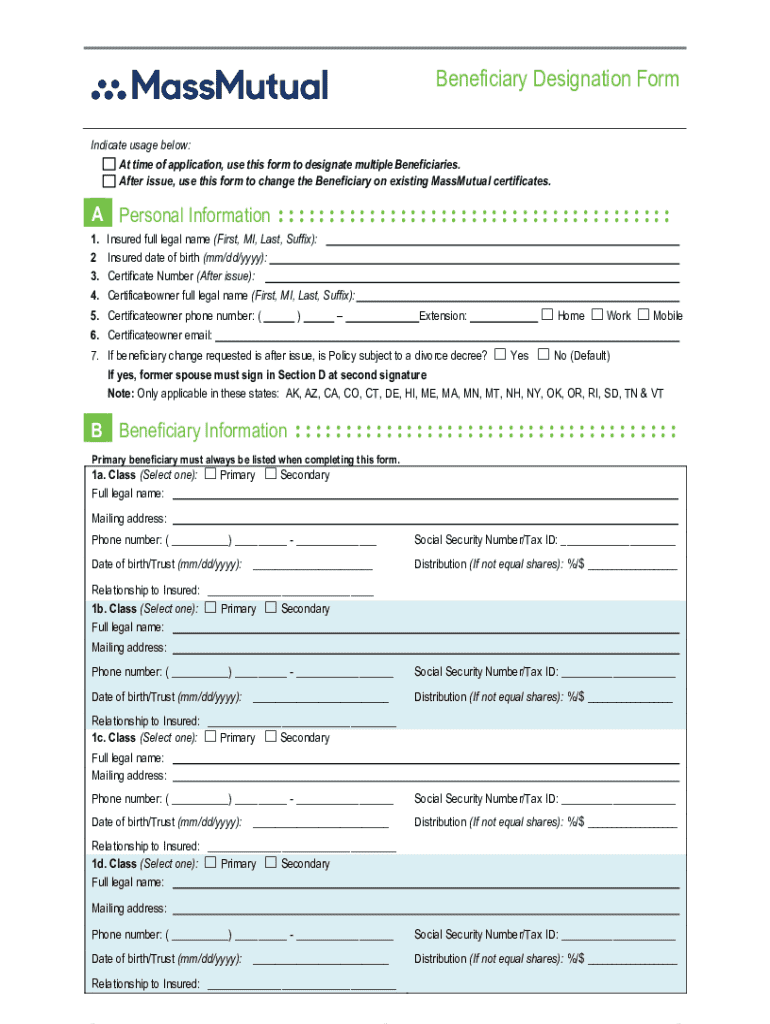

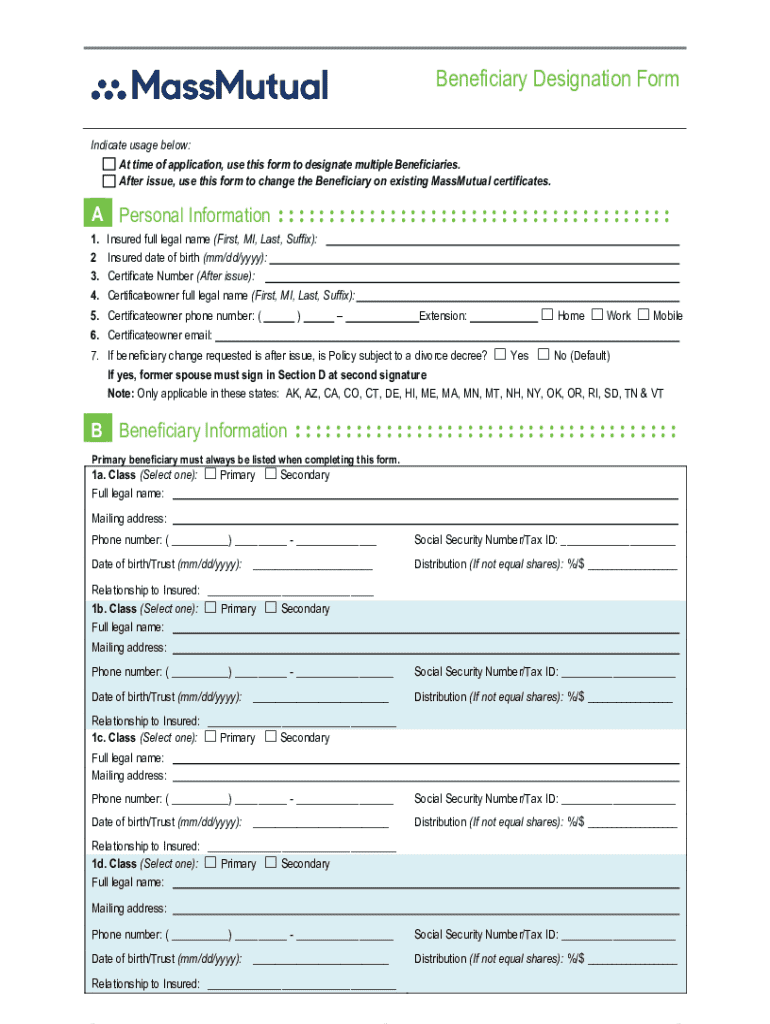

A beneficiary designation form is a crucial document that identifies who will receive assets from a policy or account upon the account holder's death. It is commonly used in life insurance policies, retirement accounts, and other financial assets. This form serves not only to clarify an individual's wishes but also to simplify the distribution process during an emotionally challenging time.

Regularly updating beneficiary designations is vital, especially after significant life events such as marriage, divorce, or the birth of a child. Neglecting to update this form can lead to unintended consequences, like an ex-spouse receiving funds instead of a current spouse or children. Awareness of different types of beneficiary designation forms, including individual and entity designations, can aid individuals in planning their estates more effectively.

Key components of beneficiary designation forms

When filling out a beneficiary designation form, specific key components must be included. Essential information often includes personal details such as your name, contact information, and policy number. Additionally, details about the beneficiary, such as their full name and relationship to you, will also be required for clarity.

Selecting beneficiaries involves understanding the difference between primary and contingent beneficiaries, as it's essential to establish a clear hierarchy for distribution. Primary beneficiaries are first in line to receive assets, while contingent beneficiaries step in if the primary beneficiary is unavailable. Furthermore, designating individual beneficiaries (e.g., family members) versus entity beneficiaries (e.g., trusts or charities) can impact tax implications and the overall management of the inheritance.

Step-by-step guide to completing the beneficiary designation form

Preparing to fill out a beneficiary designation form entails gathering necessary information beforehand, streamlining the process. Start by collecting details regarding your identity, account information, and beneficiary selections. This preparation leads to more accuracy as you proceed to fill the form.

As you fill out the form, keep these sections in mind: begin with the personal information section, which usually asks for your name and policy number. Then, move on to the beneficiary selection, where you will indicate your chosen beneficiaries and their relationships to you. If the form allows for additional notes or instructions, be sure to utilize that space to communicate any specific wishes regarding the distribution of assets.

Finally, double-check your information for accuracy before submission. Errors could delay the distribution of benefits or result in misallocation, negatively affecting your loved ones.

Naming or changing your beneficiary

When it comes to naming beneficiaries, consider the circumstances around each designation. It’s particularly crucial to take minors into account, as legal guardianship can impact how assets are managed until they come of age. Furthermore, if you have dependents, think about their future needs and the most appropriate way for them to receive their inheritance.

To change a beneficiary designation, follow the account provider's required process for updating your information. It generally necessitates submitting a new beneficiary designation form, clearly outlining the changes. Documenting these changes is vital not only to keep records straight but also to ensure that all relevant parties are aware of the new designations.

Important considerations when designating a beneficiary

Designating beneficiaries requires sensitivity to various life factors, particularly marital status changes. For instance, getting married or divorced may necessitate updates to your beneficiary selections to avoid complications, such as an estranged spouse receiving benefits intended for a current partner. Community property laws can also play a role in distribution and should be understood clearly to avoid confusion.

Special trust considerations might arise depending on individual circumstances. Understanding trusts can safeguard an inheritance for a minor or ensure that funds are utilized as intended, adding a layer of protection and clarity for your estate planning.

Revoking your beneficiary designation

There are several reasons one might want to revoke a beneficiary designation, such as life changes like marriage or divorce or simply a shift in personal relationships. It is crucial to understand the steps involved in effectively revoking a designation, which typically involves submitting a revocation form or writing a new designation that overrides previous instructions.

Legal and financial implications exist whenever you revoke a designation. It’s essential to consult a professional if there is any uncertainty to ensure that your assets are protected according to your current wishes and to avoid potential disputes among beneficiaries.

Frequently asked questions about beneficiary designation forms

Many individuals have questions concerning beneficiary designation forms, particularly regarding legal requirements. For instance, do you need witnesses or notarization? Additionally, queries about the implications of designating a minor can arise. These forms can sometimes seem daunting, but understanding the key requirements can alleviate most common concerns.

Another frequent issue pertains to what to do if a beneficiary becomes unavailable, such as passing away. Addressing this by detailing contingent beneficiaries can provide guidance for smooth asset transfer and clarity during emotional periods.

Resources for completing your beneficiary designation form

Utilizing templates and samples from platforms like pdfFiller can significantly simplify the process of completing a beneficiary designation form. These resources serve as guides, ensuring you include all necessary information, and are especially helpful for first-time users.

In addition, interactive tools for document management on pdfFiller’s platform offer functionality that enhances the overall experience. This includes the ability to edit, eSign, and collaborate on documents, making it an invaluable resource for ensuring thorough and accurate submissions.

Maintaining your beneficiary information

Regularly reviewing your beneficiary designations ensures they reflect your current circumstances and intentions. Keeping these documents organized and accessible can prevent future conflicts and enable timely updates. Establishing a routine for document management will help prompt you to review beneficiary status after significant life events.

pdfFiller's cloud-based features allow users to maintain their documents efficiently, offering a secure environment where important forms can be stored, accessed, and updated whenever necessary, further simplifying the beneficiary management process.

Benefits of using pdfFiller for your beneficiary designation form

Utilizing pdfFiller for your beneficiary designation form comes with a host of benefits. The platform offers seamless editing and eSigning capabilities, which facilitate a smooth document creation experience. Whether you’re working alone or as part of a team, collaboration features allow multiple users to interact with the document, ensuring every detail is captured.

Moreover, pdfFiller offers security and accessibility, safeguarding your documents in the cloud while allowing you to access them from anywhere. This is particularly advantageous when changes need to be made promptly, ensuring your beneficiary designations are always up-to-date and reflect your wishes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit beneficiary designation form on an iOS device?

How do I edit beneficiary designation form on an Android device?

How do I fill out beneficiary designation form on an Android device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.