Get the free the Effect of Dividend Policy, Capital Structure, Profitability, and Growth on Firm ...

Get, Create, Make and Sign form effect of dividend

How to edit form effect of dividend online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form effect of dividend

How to fill out form effect of dividend

Who needs form effect of dividend?

Form Effect of Dividend Form: A Comprehensive How-to Guide

Understanding the dividend form: An overview

The form effect of dividend form is crucial, particularly for taxpayers who must accurately report their income. Understanding the significance of dividend forms and their implications in tax reporting can affect overall financial outcomes. Taxpayers need to grasp the pertinent terms and definitions related to dividends and taxation to ensure compliance.

What is a dividend form?

A dividend form serves as an official document required for taxpayers to report dividend income received from investments. The purpose of a dividend form is to provide necessary details regarding the amount of dividends earned, which the Internal Revenue Service (IRS) will use to assess tax liability. There are various types of dividend forms, among which Form 1099-DIV and Form 4860 are most commonly utilized.

The role of Form 1099- in reporting dividends

Form 1099-DIV plays a critical role in the reporting of dividends, serving as a summary for both the taxpayer and the IRS. The form is furnished by entities that have made dividend payments. It includes vital information, such as the amount of ordinary and qualified dividends, capital gains distributions, as well as foreign tax paid. Understanding who must issue and receive a Form 1099-DIV is essential for compliance.

Differentiating between ordinary dividends and qualified dividends is crucial, as they are taxed differently. Ordinary dividends are taxed at the taxpayer's regular rate, while qualified dividends benefit from preferential tax rates. This distinction can have a significant impact on the taxpayer's overall tax strategy.

How to fill out Form 1099-

Filling out Form 1099-DIV accurately is essential for reporting dividends correctly. Follow these step-by-step instructions to ensure proper completion of the form.

To avoid common mistakes, double-check all entries for accuracy, ensuring that names and TINs match IRS records. Utilizing pdfFiller can streamline the process, offering interactive tips and features to complete the form seamlessly.

Filing your dividend form: Key steps

Filing your dividend form is a critical part of tax compliance. Determining when to file is essential; generally, Form 1099-DIV must be filed by the issuer to the recipient by January 31 of the following tax year. Accurate and timely filing prevents penalties and audit risks. Depending on the method chosen, there are differences in the filing process.

Moreover, keep in mind important deadlines for submission to ensure compliance and avoid any issues with tax authorities.

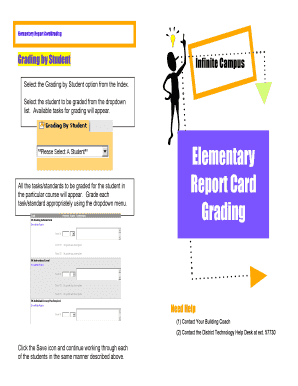

Managing your Form 1099- with pdfFiller

Managing your Form 1099-DIV is simplified using pdfFiller. The platform allows users to upload and edit dividend forms with ease. Collaboration features enable multiple users to work on the same document, enhancing efficiency. ESignature options facilitate quick approvals, making it easier to finalize and file necessary documentation without delays.

For secure document management, pdfFiller offers features for storing and retrieving important tax documents safely, providing peace of mind for your financial records.

Frequently asked questions (FAQs) about dividends and Form 1099-

Navigating dividend forms can bring questions. Below are some frequently asked questions concerning Form 1099-DIV.

Implications of dividend income for your taxes

Understanding how dividend income impacts overall tax liability is essential for strategic financial planning. Dividend income is generally taxed, affecting your total taxable income. To minimize tax obligations related to dividends, leverage qualified dividend rates by holding investments longer to qualify for lower tax brackets, as well as synchronizing dividend income with your financial goals.

User scenarios: Real-life applications of the dividend form

Real-life scenarios can provide deeper understanding in the management of Form 1099-DIV. For instance, an investor receiving substantial dividends may streamline Form 1099-DIV directly through financial software, efficiently reporting income. Conversely, a new investor might experience confusion regarding dividend calculations or oversight that results in missing their form, leading to tax complications.

Best practices for dividend form management

Effective organization of dividend forms throughout the year can alleviate stress during tax season. Utilize tracking tools that can log dividends as they accrue, maintaining accurate records that support information on your Form 1099-DIV. Develop a routine to regularly check for any dividend payments and related forms received.

Adopting these best practices will streamline your financial documentation process, ensuring compliance with tax regulations and reducing misunderstandings with the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form effect of dividend?

Can I create an electronic signature for signing my form effect of dividend in Gmail?

Can I edit form effect of dividend on an Android device?

What is form effect of dividend?

Who is required to file form effect of dividend?

How to fill out form effect of dividend?

What is the purpose of form effect of dividend?

What information must be reported on form effect of dividend?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.