Get the free Audit Certificate Form

Get, Create, Make and Sign audit certificate form

Editing audit certificate form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out audit certificate form

How to fill out audit certificate form

Who needs audit certificate form?

A comprehensive guide to the audit certificate form

Understanding the audit certificate form

An audit certificate is a key document issued by an external auditor that validates the accuracy and completeness of an organization's financial statements. It serves not only as a confirmation of compliance with accounting standards but also enhances credibility in the eyes of stakeholders. The audit certificate's importance cannot be overstated; it ensures transparency and fosters trust in financial reporting.

The significance of an audit certificate in compliance and financial reporting is profound, especially for organizations that wish to maintain a strong reputation. It acts as a quality assurance measure that confirms management's representations about financial performance and position are fairly presented.

Common use cases for audit certificates include their role in nonprofit and government entities where accountability is paramount, as well as in corporate financial reporting where they help attract investors and secure funding. Additionally, grant applications often require an audit certificate to verify the accurate use of funds.

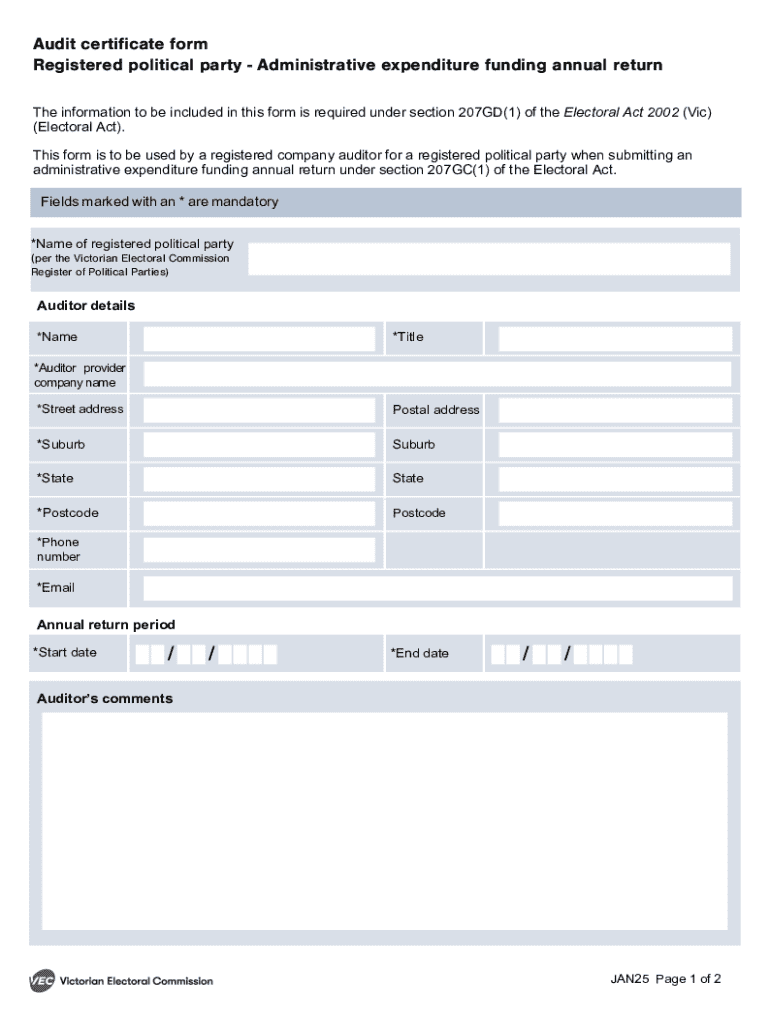

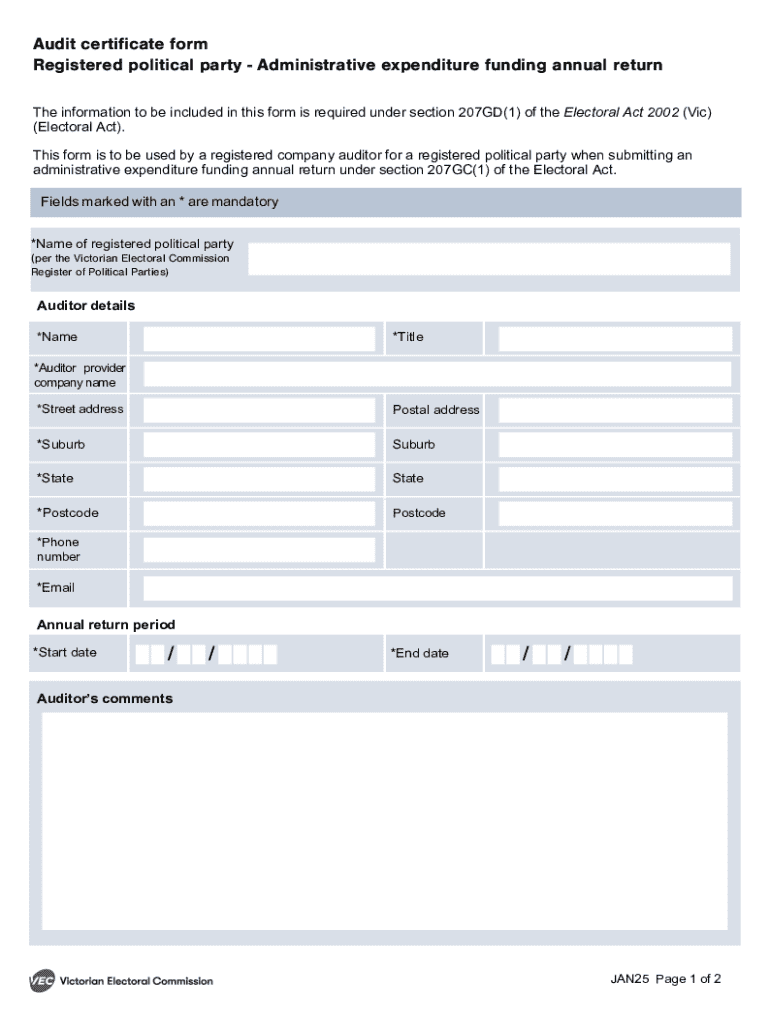

Key elements of an audit certificate form

An audit certificate form encompasses essential information that provides clarity and integrity to the audit process. First and foremost, the auditor’s details must be included, comprising their name, qualification, and registration number. Following that, the company information is crucial, particularly its name, address, and Employer Identification Number (EIN).

Another critical aspect of the form is the financial period under audit. This indicates the specific timeframe for which the financial statements have been scrutinized, providing context to the findings presented in the audit certificate.

Verification and certification statements, often written in legal language, streamline the process of affirming that financial statements have been comprehensively reviewed. Understanding this legal language is essential to grasp the implications behind the auditor's conclusions.

Step-by-step guide to completing the audit certificate form

Completing an audit certificate form requires a structured approach to avoid errors and ensure accuracy. The first step in this process is to gather the necessary documentation, which includes financial statements, previous audit reports, and any pertinent contracts and agreements that might influence the audit results.

Once all required documents are collected, proceed to fill out the form, paying close attention to detail. Line-by-line instructions should be followed meticulously. Start by entering the company information such as the legal name and EIN, ensuring they match official documents.

Include the auditor's qualifications, detailing their experience and any relevant certifications. It's equally important to specify the scope of the audit, clarifying any limitations the auditor faced during their review.

Reviewing the form for accuracy is the next critical step. Double-check all entries for typos or inconsistencies, focusing on figures and dates most prone to errors.

Finally, obtain signatures and date the document. Verify who needs to sign the audit certificate, which typically includes both the auditor and a representative from the audited organization. Date stamps are crucial as they mark the official completion of the audit process.

Editing and customizing your audit certificate form

Editing your audit certificate form can be streamlined using pdfFiller's tools. This platform offers robust features for altering PDF documents, making it easy to customize your audit certificate to suit specific requirements. For instance, modifying fields for additional information or correcting entries can be accomplished with just a few clicks.

Adding digital signatures is another valuable feature of pdfFiller. This capability allows both auditors and company representatives to sign electronically, eliminating the need for physical signatures that can delay the audit process. Best practices for document customization involve ensuring compliance with relevant regulations even after edits, as certain elements must remain unchanged to uphold the integrity of the audit certificate.

Collaboration features on pdfFiller facilitate team input, ensuring that all necessary stakeholders can contribute to and review the audit certificate before finalization.

Interpreting your audit certificate

Understanding the key components of your audit certificate is vital for grasping its implications. One of the primary elements is the auditor's opinion, which can be categorized into various types such as unqualified, qualified, adverse, and disclaimer opinions. An unqualified opinion, for example, indicates that the financial statements present a true and fair view without any reservations.

On the other hand, a qualified opinion suggests that there are certain exceptions to the accuracy of the statements, while an adverse opinion warns that the statements do not present a fair view, pointing to significant discrepancies. Understanding these opinions allows organizations to gauge their financial health and prepare for any follow-up actions.

The implications of audit findings extend beyond internal stakeholders; they affect investors, regulators, and other third-party parties. Thus, interpreting the results accurately is essential for strategic planning and resource allocation in future audits.

Common challenges and solutions in the audit process

Organizations often encounter challenges while filing audit certificates, with miscommunication between auditors and company representatives being a frequent hurdle. Ensuring that all parties are aligned on expectations and timelines is crucial in mitigating these issues. Delays in document collection can also stall audits, requiring proactive steps to gather necessary information before the audit begins.

To resolve such issues efficiently, organizations should embrace effective communication strategies. Regular check-ins with auditors and constant updates on document status can help in expediting the process. Utilizing pdfFiller’s support resources, such as customer support and educational webinars, can further empower teams to navigate these challenges seamlessly.

Compliance and regulatory considerations

Organizations must adhere to relevant standards and guidelines when issuing audit certificates. In the United States, Generally Accepted Accounting Principles (GAAP) provide the framework for financial reporting, while international bodies advocate for the International Financial Reporting Standards (IFRS). Understanding these standards is essential for organizations to ensure their audit certificates comply with both national and international expectations.

As regulations evolve, so do the requirements for audit certificates. Staying informed about changing regulations is paramount for organizations to maintain compliance. Regular training sessions for accounting and auditing staff can help reinforce this knowledge and ensure that the team is well-versed in the latest developments.

Real-world applications of audit certificates

Audit certificates are not merely regulatory checkboxes; they play a pivotal role in real-world applications, particularly in securing funding. For instance, nonprofits often rely on audit certificates to demonstrate financial accountability and transparency to potential donors and grantors. Case studies from this sector reveal successful audits leading directly to increased funding opportunities and long-term trust with stakeholders.

Moreover, in the corporate world, an unqualified audit opinion can significantly influence investor relations. Investors often perceive such certificates as indicators of financial health, leading to enhanced investment opportunities and partnerships. Lessons learned from diverse case studies highlight the critical importance of maintaining a disciplined audit process.

Additional tools and resources for audit certificate management

To effectively manage audit certificates, organizations can leverage an array of tools designed for efficient audit management. pdfFiller provides essential features allowing users to create, edit, and store audit certificates seamlessly within a cloud-based environment. This accessibility empowers users to manage their documents from anywhere, which is increasingly important in today's remote working landscape.

Additionally, organizations can explore third-party resources focused on enhancing compliance and audit preparation. Training and educational materials like workshops and online courses adeptly fill gaps in knowledge and skills. Staying updated with industry standards and requirements is crucial as audit processes evolve.

Future trends in auditing and certification

The landscape of auditing and certification is witnessing significant transformations, primarily due to advancements in technology. Innovations such as AI-driven analytics and real-time auditing have begun to reshape traditional methods, leading to more efficient and accurate audits. As these technologies progress, they will increasingly influence how audit certificates are constructed, reviewed, and interpreted.

Organizations should prepare for these future trends by adopting flexible processes and investing in training for their teams to adapt to new tools and methodologies. Embracing these changes can enhance efficiency, reliability, and stakeholder confidence in audit processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find audit certificate form?

How do I edit audit certificate form online?

Can I create an eSignature for the audit certificate form in Gmail?

What is audit certificate form?

Who is required to file audit certificate form?

How to fill out audit certificate form?

What is the purpose of audit certificate form?

What information must be reported on audit certificate form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.