Get the free Corporate Internet Banking Registration Form

Get, Create, Make and Sign corporate internet banking registration

How to edit corporate internet banking registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate internet banking registration

How to fill out corporate internet banking registration

Who needs corporate internet banking registration?

Corporate Internet Banking Registration Form: A How-to Guide

Understanding corporate internet banking

Corporate internet banking is a secure, online platform that allows businesses to manage their banking needs efficiently and effectively. Its primary purpose is to streamline banking operations, enabling companies to execute transactions from anywhere, at any time. Additionally, it eliminates the need for physical visits to bank branches, saving valuable time and resources.

Key features of corporate internet banking include fund transfers, bulk payments, account management, and access to detailed financial reports. The benefits are significant: businesses enjoy enhanced convenience, reduced transaction times, and improved financial oversight. Given these advantages, the role of the corporate internet banking registration form becomes crucial.

The corporate internet banking registration form serves as the entry point for companies to access these services, ensuring that the right individuals have authorized access. Typically, users of this service include finance teams, business owners, and authorized signatories, all of whom have unique needs that this platform addresses.

Overview of the registration process

Before filling out the corporate internet banking registration form, it’s vital to understand the requirements for registration. These usually include providing necessary documents such as business registration certificates, tax identification numbers, and any other documents required by the banking institution.

To ensure eligibility, businesses typically need to establish that they are registered entities with the appropriate governing bodies. After confirming eligibility, the next step involves completing the registration form accurately and thoroughly.

The registration form is generally straightforward, consisting of various sections that gather essential information about the company, authorized personnel, and banking preferences. By reviewing the form beforehand, you can anticipate what information you'll need to provide.

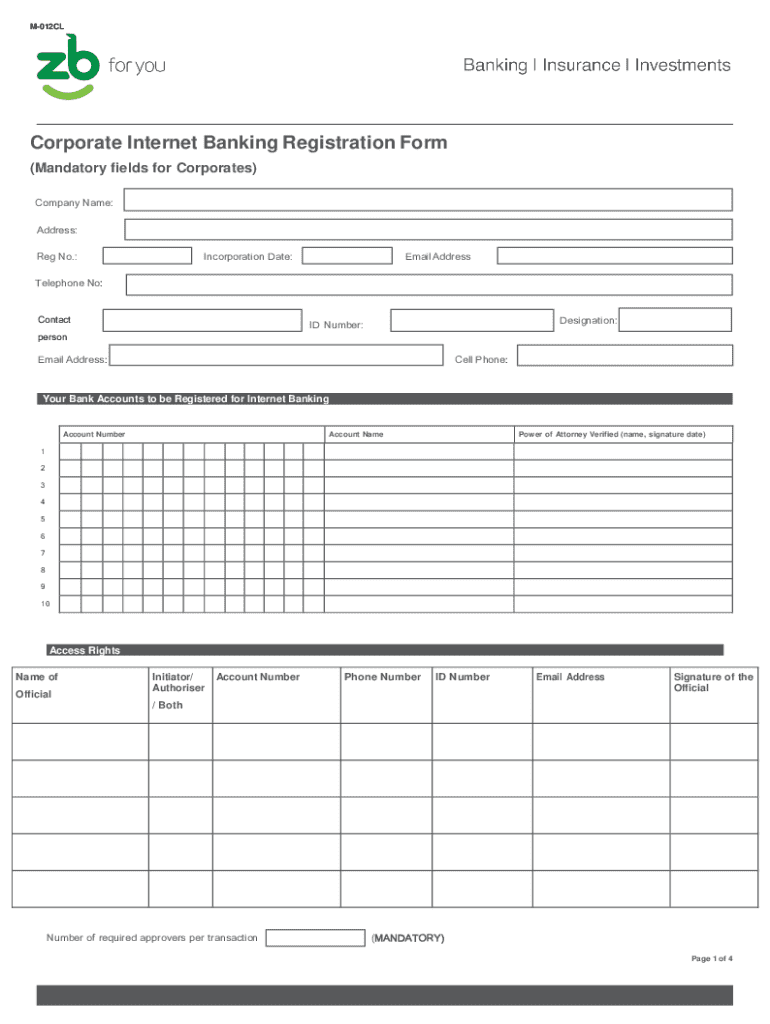

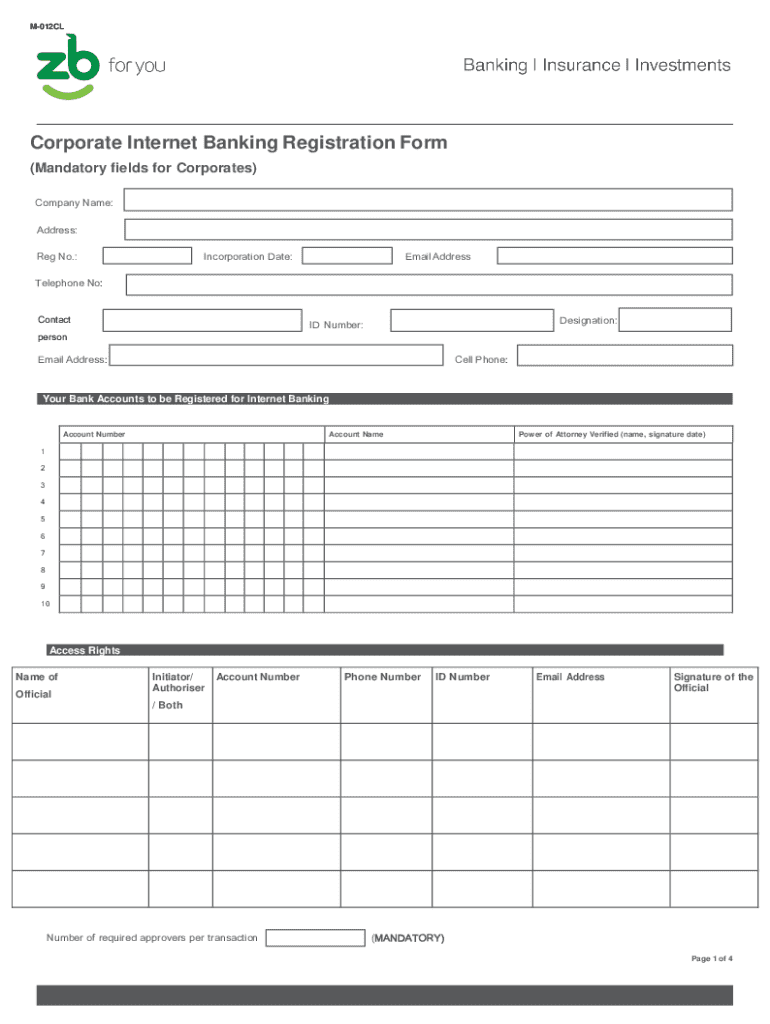

Detailed breakdown of the registration form

The corporate internet banking registration form is structured into several sections, each serving a specific purpose. Section 1 typically captures the company information, including the legal name, business registration details, address, and contact information. This section is vital as it verifies the identity of the organization.

Section 2 focuses on authorized signatories, where you will designate personnel who have the authority to manage banking transactions. Here, you’ll need to provide names, positions, and even signatures of these individuals, ensuring that the bank recognizes them as legitimate representatives of your business.

In Section 3, banking preferences must be specified. Companies can select various services such as fund transfers, payment processing, and account management options. This section also allows you to set user access levels and permissions, which is critical for maintaining security and operational efficiency.

Finally, Section 4 covers compliance and agreements. It’s essential to review the terms and conditions thoroughly, as this section outlines the legal obligations and responsibilities undertaken by the company and its authorized representatives.

How to fill out the registration form

Filling out the corporate internet banking registration form requires careful attention to detail. Begin by collecting all the necessary documents and information before you start. This preparation will expedite the process and reduce the likelihood of mistakes.

When filling out the form, avoid common pitfalls like providing incorrect information or leaving sections blank. Ensure that you understand the language and terminology used within the form to avoid confusion. It may help to use examples from completed forms to guide your entries, which can also be beneficial if visual aids or screenshots are available for reference.

Editing and reviewing the form

Before submitting the corporate internet banking registration form, utilize tools like pdfFiller to edit and refine your entries. Features available for modification include correcting typos and rephrasing information without starting from scratch. Always review the completed form to ensure that all entries are accurate and complete.

pdfFiller also allows for collaborative efforts within your team. Share the registration form easily for feedback and permissions settings, ensuring that all necessary parties can contribute to finalizing the document.

Submitting the registration form

Submission methods for the corporate internet banking registration form vary by bank. Some institutions facilitate online submission through secure portals, while others may prefer manual submission via physical addresses. Ensure you're aware of the most current submission guidelines provided by your bank.

After submission, you should know what happens next. Typically, banks provide a timeline for processing your application, allowing you to track your registration status. Keeping in communication with your bank during this period can help address any concerns or queries you may have.

Frequently asked questions (FAQs)

As businesses embark on the corporate internet banking registration process, several common queries arise. One frequently asked question is whether individuals can edit their registration after submission. Generally, this is contingent on the bank's policies, so it's crucial to check with them directly.

Another common question pertains to the timeline for the registration process. While it can vary, many institutions strive to complete registrations within a few business days. If you encounter issues during registration, most banks have established channels for support to guide you through troubleshooting steps.

Additional support and contact information

pdfFiller offers comprehensive customer support services, providing assistance during the registration process. You can reach out via live chat, email, or phone support for help as you fill out the corporate internet banking registration form. They are equipped with resources to ensure that you can navigate your document needs seamlessly.

For queries specifically related to your bank's registration process, don't hesitate to contact them directly. This outreach can be beneficial for clarifying any aspects of the corporate internet banking registration form or understanding the escalation process for urgent matters.

Benefits of using pdfFiller for your corporate internet banking needs

Using pdfFiller for corporate internet banking documentation offers numerous advantages. One key benefit is the cloud-based document management feature that allows users to manage forms and documents from any location, promoting flexibility and accessibility.

Security is paramount when dealing with sensitive company information. pdfFiller enhances security measures, ensuring that your data remains protected from unauthorized access. Additionally, the platform provides seamless e-signature and collaboration capabilities, making it easier for teams to review and approve the corporate internet banking registration form.

Practical tips for corporate internet banking success

To navigate corporate internet banking effectively, adopting best practices for managing your corporate account online is essential. Regular account monitoring and audits are advisable, as they help in identifying suspicious activities or discrepancies early on.

Security should always be a priority. Implement cybersecurity measures, such as strong password policies and two-factor authentication, to protect your account. Moreover, consider leveraging additional services offered by banks, such as financial advising or advanced analytics tools, to gain a more comprehensive understanding of your financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get corporate internet banking registration?

How do I edit corporate internet banking registration in Chrome?

How do I fill out the corporate internet banking registration form on my smartphone?

What is corporate internet banking registration?

Who is required to file corporate internet banking registration?

How to fill out corporate internet banking registration?

What is the purpose of corporate internet banking registration?

What information must be reported on corporate internet banking registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.