Get the free Audit Certificate Form

Get, Create, Make and Sign audit certificate form

Editing audit certificate form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out audit certificate form

How to fill out audit certificate form

Who needs audit certificate form?

Understanding the Audit Certificate Form: A Comprehensive Guide

Understanding the audit certificate form

An audit certificate form serves as crucial documentation that validates the findings of an audit. Essentially, it acts as a formal statement issued by independent auditors, affirming that the financial records or operational procedures of an organization adhere to relevant regulations and standards.

The importance of an audit certificate extends across various industries. Whether in finance, healthcare, or manufacturing, it verifies compliance and accuracy, thereby fostering transparency and trust among stakeholders, including investors, regulators, and clients.

Types of audit certificates

Audit certificates vary based on their purpose and industry standards. Understanding these differences is essential for choosing the right form for your needs. The primary types include financial audit certificates, which focus on financial statement accuracy; compliance audit certificates, verifying adherence to regulatory requirements; and operational audit certificates, assessing efficiency and effectiveness in processes.

Industries often require specific formats of audit certificates tailored to their regulatory environments. For instance, in healthcare, certificates focus on compliance with standards like HIPAA, while in finance, they emphasize methods of revenue recognition in accordance with GAAP.

When selecting the appropriate audit certificate form, consider factors such as the industry context, the specifics of the audit conducted, and the intended recipients of the certificate.

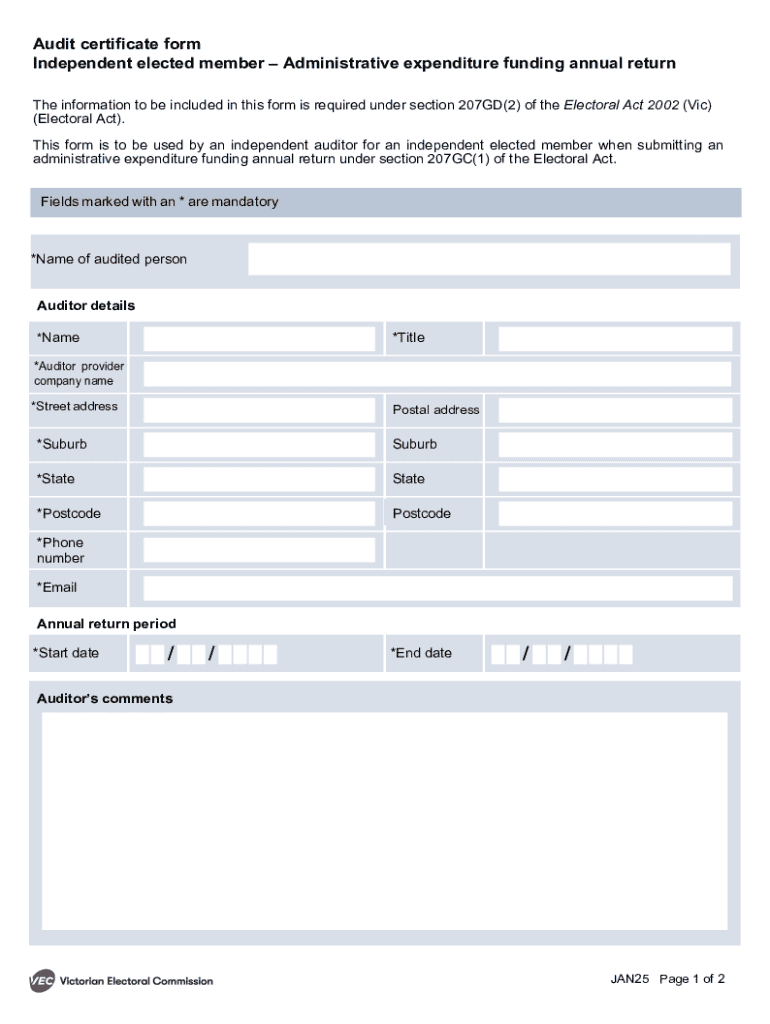

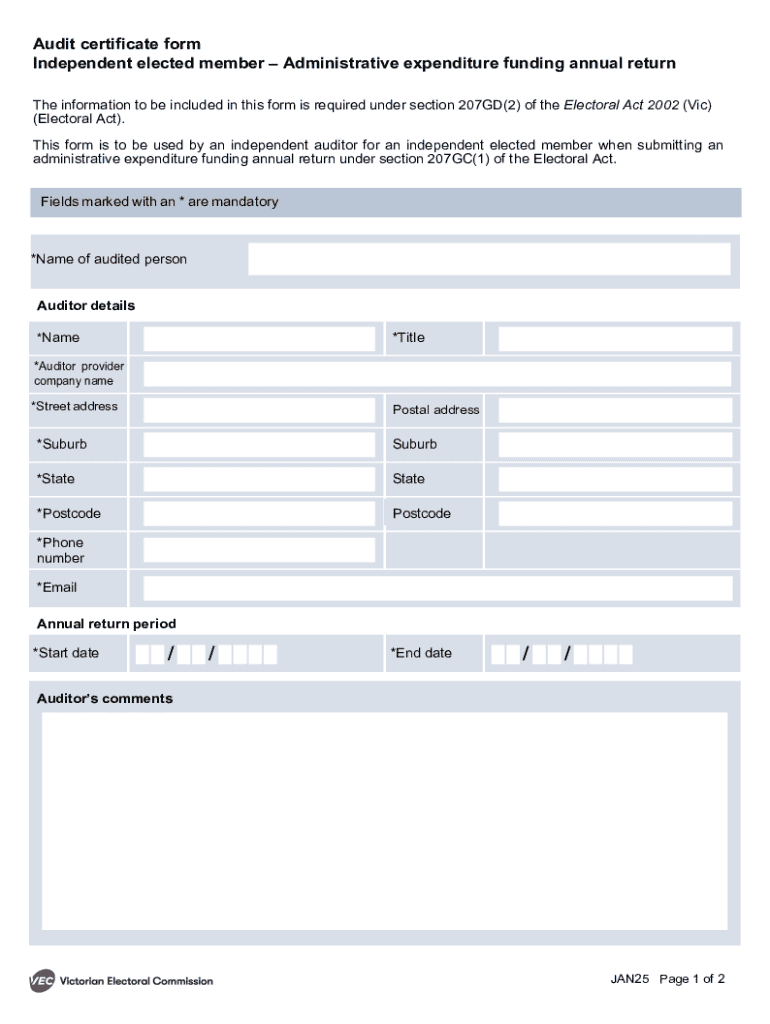

Steps to fill out the audit certificate form

Filling out an audit certificate form correctly is crucial for maintaining the integrity of the audit process. Start the process by gathering all necessary information, including personal and organizational details, as well as relevant documents that provide proof of compliance and accuracy.

The next step involves completing the form accurately. Pay close attention to each section, ensuring that you include all required details. Common mistakes include failing to provide signatures or omitting relevant data, so double-check your entries.

Editing and customizing your audit certificate

Customizing your audit certificate may be necessary to align it with specific organizational branding or to meet unique compliance demands. Tools such as pdfFiller enable users to edit standard forms easily. Modifying an audit certificate should always be done with caution, ensuring compliance with regulations and standards.

Incorporating branding, such as logos and company colors, can enhance the professionalism of the document. Maintain brand consistency by following organizational guidelines when adding visual elements.

Managing and storing your audit certificate

Once the audit certificate is completed, proper management and storage are key to maintaining its accessibility and integrity. Consider whether to store documents physically or digitally. Digital storage solutions, such as secure cloud-based platforms, offer advantages in terms of accessibility and safety.

Implementing version control is also critical. This practice involves tracking changes made to the audit certificate and maintaining historical records to ensure transparency and accountability.

Legal and regulatory considerations

Understanding the legal landscape surrounding audit certificates is essential to avoid compliance pitfalls. Different industries are governed by specific regulations that dictate how audit certificates should be produced and maintained. Knowledge of these regulations will inform your practices and ensure that your certificates are valid.

Staying updated with changes in regulations can be achieved through continuous education and utilizing resources dedicated to industry standards. This proactive approach not only aids compliance but also helps organizations adapt to evolving requirements.

Collaborating on audit certificate preparation

Successful completion of an audit certificate often requires collaboration among various stakeholders. Utilizing collaborative tools such as pdfFiller can enhance teamwork by facilitating comments and annotations, making the editing process smoother.

Identifying the right stakeholders for input is vital. Engaging team members with relevant expertise ensures comprehensive data collection, leading to a more accurate and credible certificate.

Common FAQs about audit certificates

Frequently asked questions can clarify uncertainties surrounding the audit certificate form. For instance, one common query is 'What if I make a mistake on the form?' In such cases, it’s generally advisable to consult with the certifying auditor for guidance on the proper corrective procedures.

Questions about the validity duration of an audit certificate or the possibility of submitting the form electronically are also typical. A clear understanding of these specifics enhances the process and ensures compliance with best practices.

Leveraging technology for audit certificates

Utilizing technology streamlines the creation and management of audit certificates, creating greater efficiency. pdfFiller offers numerous features that simplify the process, enabling real-time editing, collaboration, and the integration of e-signatures.

Moreover, cloud-based solutions enhance accessibility, allowing teams to work on documents from anywhere. Integrating automation for certain processes can minimize human error and expedite approval workflows.

Success stories: Organizations that excelled with proper audit certificates

Case studies highlight organizations that improved their operations through effective audit certificate management. For instance, a prominent financial institution streamlined their auditing process by adopting a digital audit certificate, leading to enhanced accuracy and reduced processing times.

These lessons demonstrate that employing best practices in audit certificate management not only ensures compliance but also elevates overall organizational efficiency and credibility.

Additional insights: Elevating your audit process

Continuous improvement within audit procedures is necessary for maximizing effectiveness. Organizations should set goals for conducting thorough audits that result in precise documentation.

Encouraging a culture of accuracy and compliance among staff can also improve outcomes significantly. Keeping an eye on future trends in audit documentation reveals innovations in digital certification processes that will continue to evolve in the coming years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my audit certificate form directly from Gmail?

How can I get audit certificate form?

How can I fill out audit certificate form on an iOS device?

What is audit certificate form?

Who is required to file audit certificate form?

How to fill out audit certificate form?

What is the purpose of audit certificate form?

What information must be reported on audit certificate form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.