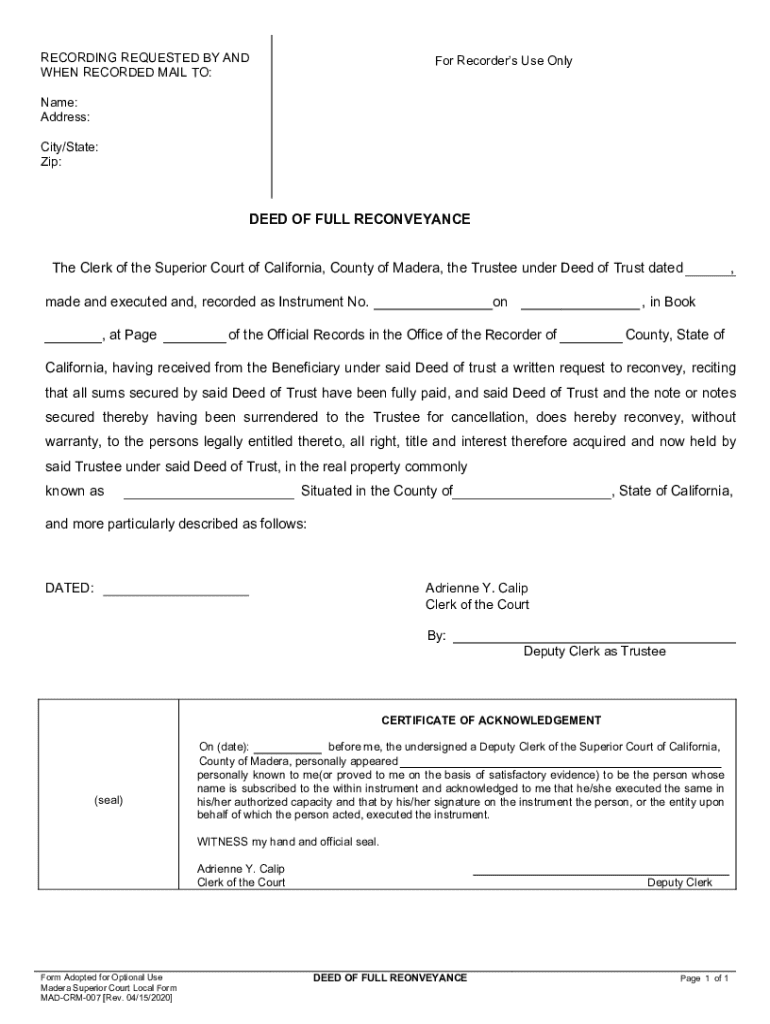

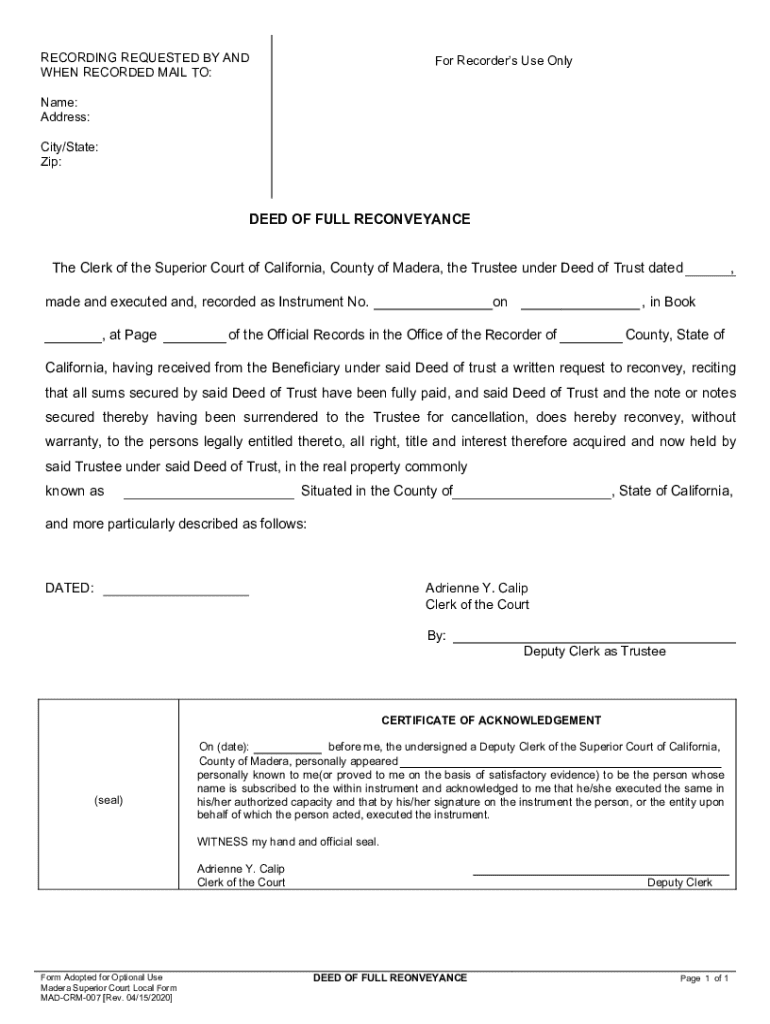

CA MAD-CRM-007 - County of Madera 2020-2026 free printable template

Get, Create, Make and Sign CA MAD-CRM-007 - County of Madera

Editing CA MAD-CRM-007 - County of Madera online

Uncompromising security for your PDF editing and eSignature needs

How to fill out CA MAD-CRM-007 - County of Madera

How to fill out deed of full reconveyance

Who needs deed of full reconveyance?

Deed of Full Reconveyance Form: A Comprehensive Guide

Understanding the deed of full reconveyance

A deed of full reconveyance is a legal document that signifies the repayment of a mortgage and effectively cancels the deed of trust that secured the loan. Upon full repayment, the lender, typically referred to as the beneficiary, issues this deed to the borrower, confirming that the loan obligation has been fulfilled. This document is crucial in property transactions as it serves to clear the title of any claims held by the lender, ensuring that the borrower owns the property free and clear of any encumbrances.

The significance of the deed of full reconveyance cannot be overstated. It not only provides peace of mind to homeowners but is also a necessary part of transferring clear ownership of a property. Without this document, potential buyers can be hesitant to purchase a home, as unresolved liens may cloud the title. To ensure smooth property transactions, understanding this deed is essential for both buyers and sellers.

Key terms explained

The difference between deed of reconveyance and satisfaction of mortgage

While both documents signify the completion of a mortgage obligation, a deed of reconveyance is specific to trust deeds, commonly used in states that permit them. A satisfaction of mortgage, on the other hand, is a broader term applied to any type of mortgage once the borrower has fulfilled their loan repayment obligations. Understanding these distinctions can help borrowers navigate their obligations and document requirements more effectively.

Legally, using the correct document for the right situation is critical. The deed of reconveyance is often mandated in states like California, where deeds of trust are prevalent, while other states may rely on satisfaction of mortgage documents. Failing to use the appropriate document could lead to legal complications, including unresolved liens on the property.

When to use a deed of full reconveyance

Understanding when to utilize a deed of full reconveyance can save you time and stress. This document is primarily used in situations requiring the complete payoff of a loan. When a borrower repays their mortgage in full, a deed of full reconveyance releases the loan’s obligation, thus canceling the deed of trust held by the lender. This process typically occurs at the end of a mortgage term, or when a borrower makes an early loan payoff.

Any time ownership changes hands, such as during a refinance or when a property is sold, the deed of full reconveyance may become necessary. If the title transfers without this document, the new owner could face issues with existing liens or claims against the property. Recognizing these signs early can ensure smooth transitions during property transfers.

Step-by-step process to complete the deed of full reconveyance

Step 1: Gather necessary information

Before initiating a deed of full reconveyance, it is essential to gather the necessary documentation. The original deed of trust is needed to verify the initial mortgage agreement, along with records showing that all payments have been made. This includes any payoff statements or receipts demonstrating the loan's closure.

In addition, collect relevant information about the borrower and lender, including names, contact information, and addresses. A comprehensive description of the property, such as its legal description and parcel number, alongside details of the loan, will ensure that the deed is completed correctly.

Step 2: Download the deed of full reconveyance form

Accessing and utilizing a deed of full reconveyance form is straightforward with pdfFiller. You can easily download a state-specific, editable template by visiting the website and searching for the form. Customizing the form accordingly is a simple process. Ensure you pay attention to fields such as borrower names, property information, and loan identifiers.

Choosing the right state-specific template is vital. Every state has specific requirements, and using the correct format will facilitate the filing process.

Step 3: Complete the form

When filling out your deed of full reconveyance form, accuracy is paramount. Verify that all information entered is correct and corresponds exactly to the documents you've gathered. Common mistakes include incorrect names, erroneous property details, and misentered loan information. Utilizing pdfFiller's editing and annotation features can help highlight important sections to focus on during this step.

Real-time editing options available in pdfFiller allow you to make changes and corrections instantly, ensuring that you maintain the document's integrity as you finalize it.

Step 4: Sign the document

Once the deed of full reconveyance form has been filled out correctly, the next step is to sign the document. You can choose between electronic signing and physical signing. Each process has its own set of instructions on pdfFiller, simplifying the task. For electronic signatures, follow the prompts provided to ensure your signature is legally valid. Physical signing requires both borrower and lender signatures in the appropriate sections.

It’s essential to validate signatures correctly to avoid future disputes. Ensure that all parties involved have signed the document before proceeding to the next step.

Step 5: File your signed deed of full reconveyance

After signing the deed of full reconveyance, the final step is to file it with the appropriate local government agency. This could be the county recorder's office or another designated authority, depending on local regulations. Familiarize yourself with filing fees, as they can vary significantly by location, and ascertain any additional requirements that must be fulfilled upon filing.

It’s also recommended to request copies of the filed document for your records. This can ensure you have proof of the reconveyance in case any questions arise in the future.

Common questions and answers regarding the deed of full reconveyance

Navigate the deed of full reconveyance process with the answers to some frequent queries that arise, providing clarity and assurance to homeowners. One common question is, 'Who needs to sign the document?' Typically, both the borrower and the lender must sign the deed to validate it legally. This ensures mutual acknowledgment of the payoff and the cancellation of the mortgage.

Many also wonder how long filing takes. While this can vary by jurisdiction, most offices process deeds within a few business days to a few weeks. Planning accordingly will relieve any potential waiting stresses. Another frequent concern is what to do if the original deed of trust has been lost. In such cases, it's advised to contact the lender for copies or their specific procedures for reinstating the deed. Lastly, some may question whether a lawyer is needed for this process. While not always necessary, legal assistance can provide additional peace of mind, especially during complex transactions.

Best practices for managing your deed of full reconveyance

Proper management of your deed of full reconveyance is crucial for maintaining clear property title and ensuring that your rights as a property owner are protected. Storing documents securely online enables easy access and sharing when needed, an option supported by pdfFiller’s secure storage features. This is vital in minimizing the risk of loss due to physical damage or misplacement.

Furthermore, keeping track of important dates related to loan payoff or property transactions is vital. Monitoring payoff dates can prevent delays in filing the deed as well as ensure you're promptly addressing any related issues. Regularly reviewing property documents ensures you remain informed about your property ownership status and any obligations tied to it.

Related documents you may need

In the interest of thorough preparation, several documents may accompany your deed of full reconveyance. These include a sample deed of full reconveyance, which can be an invaluable reference during completion. Understanding your mortgage agreement and how it interrelates with the deed of reconveyance is also essential, as is having a clear overview of your deed of trust and related forms.

Having access to these related documents facilitates informed decision-making and ensures that all links in the property transaction process are coherent and accounted for.

Tools and resources to simplify your document management

To streamline the process of creating and managing your deed of full reconveyance, consider how pdfFiller optimizes document creation and management. Their cloud-based platform enhances accessibility, allowing users to create, edit, and collaborate on documents from anywhere. This not only promotes efficiency but also facilitates teamwork for individuals or organizations navigating property transactions.

With quality guarantees and user support, pdfFiller offers expertise in dealing with legal documents, ensuring users have access to assistive resources when needed. A detailed FAQ section also provides quick answers to common questions, further enhancing the user experience.

Leveraging pdfFiller for your document needs

Leveraging pdfFiller allows for comprehensive document creation and management from virtually anywhere. The platform's capabilities enable you to engage in seamless collaboration, enhancing communication among parties involved in property transactions. The value of a cloud-based management system cannot be understated, as it provides convenient access to necessary documents while promoting security and efficiency.

Empowering teams and individuals with efficient solutions is at the core of what pdfFiller offers. The ability to edit PDFs, electronically sign documents, and manage various forms collaboratively streamlines the entire process, minimizing stress and maximizing productivity during critical property transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA MAD-CRM-007 - County of Madera?

How do I complete CA MAD-CRM-007 - County of Madera online?

How do I fill out CA MAD-CRM-007 - County of Madera on an Android device?

What is deed of full reconveyance?

Who is required to file deed of full reconveyance?

How to fill out deed of full reconveyance?

What is the purpose of deed of full reconveyance?

What information must be reported on deed of full reconveyance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.