Get the free Financial Assessment Form

Get, Create, Make and Sign financial assessment form

How to edit financial assessment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assessment form

How to fill out financial assessment form

Who needs financial assessment form?

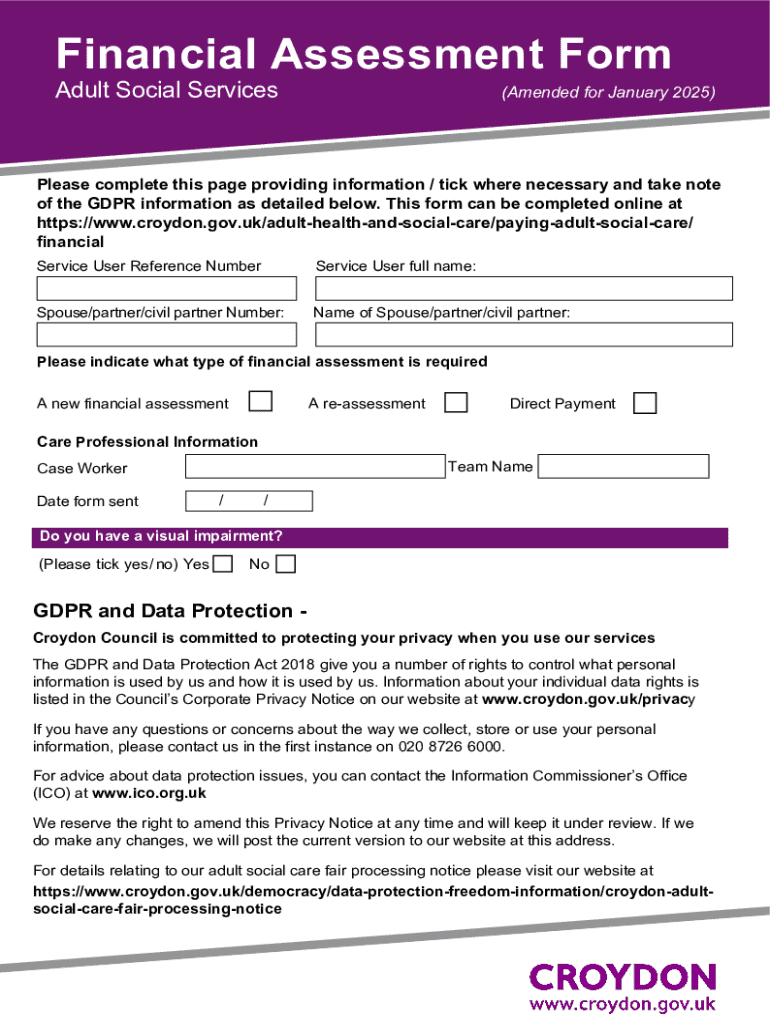

Comprehensive Guide to the Financial Assessment Form

Understanding the financial assessment form

A financial assessment form is a structured document used to evaluate an individual's or business's financial status. This form collects pertinent financial information, making it easier to understand one’s financial position and craft informed decisions. Whether for personal budgeting, assessing loan eligibility, or for business financial planning, financial assessment forms provide clarity and structure to complex financial data.

The importance of a financial assessment form extends beyond mere data collection; it serves as a foundation for effective personal and business finance management. By identifying income sources, expenses, assets, and liabilities, users can evaluate their financial health comprehensively. Typical key elements included are personal or business identification details, detailed income and expenses listings, along with a clear depiction of financial goals.

Benefits of using a financial assessment form

Utilizing a financial assessment form brings several benefits that streamline decision-making for individuals and teams. First and foremost, it enhances clarity by consolidating financial information in one place, removing the complexity involved in tracking different financial elements separately. Users can quickly reference all relevant details and make decisions based on comprehensive and accurate data.

Moreover, financial assessment forms improve transparency in financial reporting. When everyone in a team has access to the same data, it fosters trust and cooperation. Additionally, these forms significantly facilitate better budgeting and forecasting. By having a clear picture of past income versus expenses, future financial planning becomes a more precise endeavor. Lastly, their structured nature supports compliance with financial standards and regulations.

Components of an effective financial assessment form

For a financial assessment form to be effective, certain components must be present. Start with a basic information section that includes name, contact details, and relevant identification numbers. This establishes a clear identity for the form’s data.

Following the identification section, income details should be provided. This involves not only listing sources of income but also specifying documentation requirements for verification. Next, the expense breakdown must distinguish between fixed and variable expenses, allowing individuals to see where their money goes. It’s crucial to track expenses accurately, as this data can reveal spending patterns that may require adjustment. The form should also require a listing of assets like properties or investments, as well as liabilities such as loans and credit card debts, which together establish net worth. Finally, articulating financial goals — both short-term and long-term — is essential, encouraging users to think strategically about their financial futures.

How to customize your financial assessment form

Customizing your financial assessment form can enhance its usability, ensuring it meets specific financial needs. To begin, utilize pdfFiller to select from a variety of templates that suit your requirements. Whether you’re looking for a personal form or one tailored for a business context, pdfFiller provides many options.

Once you've selected a template, the next step is modifying sections to include all relevant data points particular to your financial situation. Use pdfFiller’s interactive tools to add or remove sections as required. Additionally, ensure your form is intuitive and easy to understand, focusing on clear language and logical flow. To achieve this, think about the common financial situations you encounter, and consider including prompts or examples for clarity.

Filling out the financial assessment form

Filling out a financial assessment form properly is essential for it to be an effective financial management tool. When detailing income, apply critical thinking to accurately represent your financial situation. This may involve calculating your gross income versus net income, or including side jobs and passive income streams that may otherwise be overlooked.

Similarly, it is paramount to report expenses accurately, breaking them down into categories to help avoid the common mistake of generalizing costs. This practice not only provides better insights into spending but also aids in identifying areas for potential savings. As you fill out the form, remain vigilant to common mistakes, such as overlooking certain expenses or misreporting income, which can lead to inaccurate financial assessments.

Using the financial assessment form for financial planning

Integrating your financial assessment form into your overall financial strategy is a critical next step. Use it to create a robust budgeting plan based on the insights gained from the data collected. By analyzing income against expenses, you can identify critical areas of your finances that require adjustment. Regularly revisiting and updating your financial assessment form, particularly as your circumstances change, ensures you have an ongoing understanding of your financial health.

Moreover, leverage the data within the form for investment planning and growth. A thorough understanding of your assets and liabilities equips you to make informed investment decisions, ensuring they align with your short-term and long-term financial goals. Overall, your financial assessment form can serve as a powerful tool, guiding you towards achieving financial stability and growth.

Collaborative features for teams

For businesses and teams looking to enhance their financial assessments, pdfFiller's collaborative features are invaluable. Team collaboration on financial assessments allows multiple users to contribute and edit important data within a single document simultaneously. This feature ensures that all team members are aligned and up to date on the current financial standing.

Through pdfFiller, you can assign specific roles and permissions, enabling some users to edit while others may only comment or view. Additionally, the platform provides the capability to track changes, ensuring a clear record of who made edits and what those edits entailed. This transparency enhances accountability, making it easier to address any discrepancies or retrace steps within the document.

Managing your financial assessment document

Managing your financial assessment document effectively is as vital as evaluating the finances themselves. Using pdfFiller, saving, editing, and sharing your form becomes remarkably straightforward. The cloud-based platform ensures that your form is securely stored, allowing access from anywhere, and providing peace of mind that sensitive financial details are protected.

For forms that require a formal review or agreement, eSigning features on pdfFiller facilitate official documentation processes. Once all assessments are complete, archiving old versions for future reference is essential, as it allows individuals or teams to track financial progress over time and make informed decisions based on historical data.

Case studies and examples

Real-life applications of financial assessment forms provide tangible insights into their effectiveness. Users often testify that implementing a structured financial assessment process has significantly improved their financial management skills. For instance, a small business owner outlined how using a financial assessment form allowed them to pinpoint unforeseen expenses and adjust their sales strategy accordingly, resulting in a 15% increase in profitability over the following quarter.

Another example comes from individuals seeking loans; they found that by thoroughly filling out a financial assessment form, they could identify and resolve discrepancies in their financial reporting prior to submitting to lenders. Consequently, several users have shared how their ability to manage finances has improved significantly before and after adopting a structured approach using pdfFiller.

Frequently asked questions (FAQs)

When considering the utilization of a financial assessment form, users often have several questions. For instance, one common query is about the types of financial assessments that can be conducted using the form. Various assessments, ranging from personal budgeting to comprehensive business financial reviews, can be performed.

Another concern revolves around the security of the information entered into pdfFiller. Rest assured, the platform employs advanced security measures to ensure user data remains confidential and protected against unauthorized access. Users also wonder about integration with other financial tools; pdfFiller allows for seamless integration with numerous financial management applications, enhancing the overall utility of the financial assessment form.

More templates like this

In addition to the financial assessment form, pdfFiller offers various related templates designed to complement your financial documentation needs. For instance, the Budget Approval Form assists in managing spending authority within teams, while the Loan Application Form with Rules guides users through the complexities of borrowing processes, ensuring all necessary data is included.

Additionally, an Expense Report Form with Rules allows for detailed tracking of expenses, aiding in accountability and clarity when managing budgets. Employing these templates alongside your financial assessment form creates a holistic approach to financial management, allowing users to maintain organized and efficient financial records.

Additional tools and resources offered by pdfFiller

Beyond financial assessment forms, pdfFiller comes equipped with several document management features that enhance user experience. Their user-friendly interface simplifies document creation and editing, making it accessible to individuals of all skill levels. Additionally, numerous tutorials and dedicated customer support ensure users can take full advantage of the platform's capabilities.

The integration of forms into a broader financial solution underscores pdfFiller's commitment to providing comprehensive services. From e-signing capabilities to user collaboration and data analytics, pdfFiller bridges the gap between mere form filling and effective financial management. Users can navigate the complexities of their finances with confidence, making informed decisions that lead to substantial growth and stability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial assessment form directly from Gmail?

How can I edit financial assessment form from Google Drive?

How can I send financial assessment form to be eSigned by others?

What is financial assessment form?

Who is required to file financial assessment form?

How to fill out financial assessment form?

What is the purpose of financial assessment form?

What information must be reported on financial assessment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.