Get the free 990-t

Get, Create, Make and Sign 990-t

Editing 990-t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-t

How to fill out 990-t

Who needs 990-t?

Comprehensive Guide to IRS Form 990-T

Understanding IRS Form 990-T

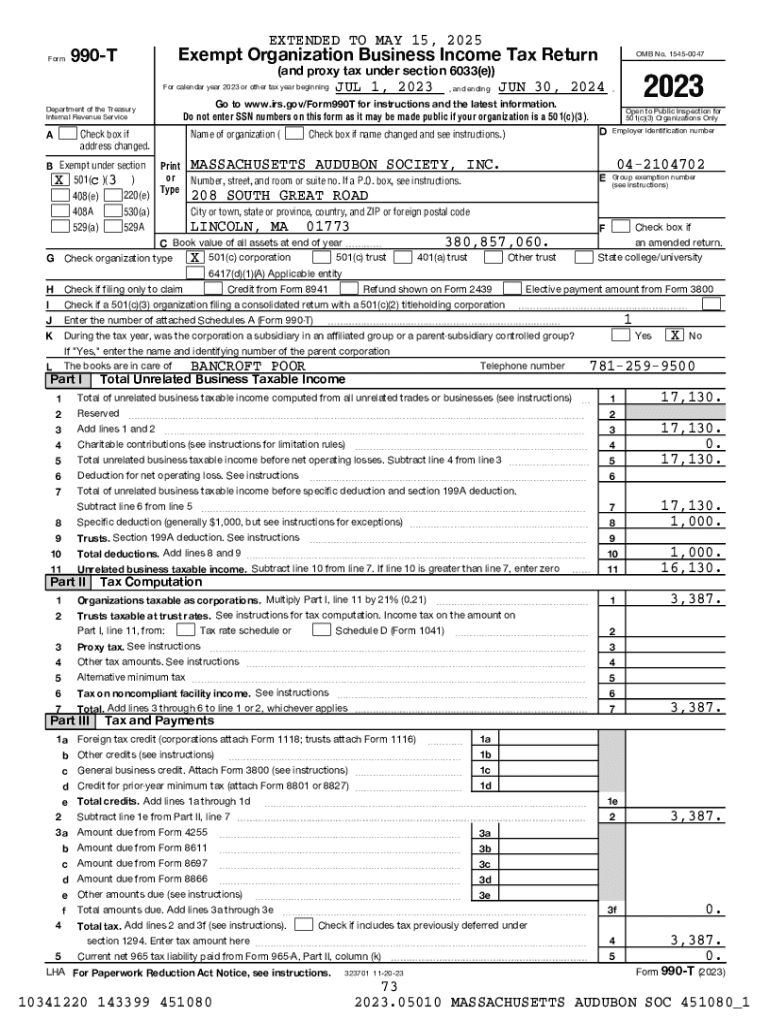

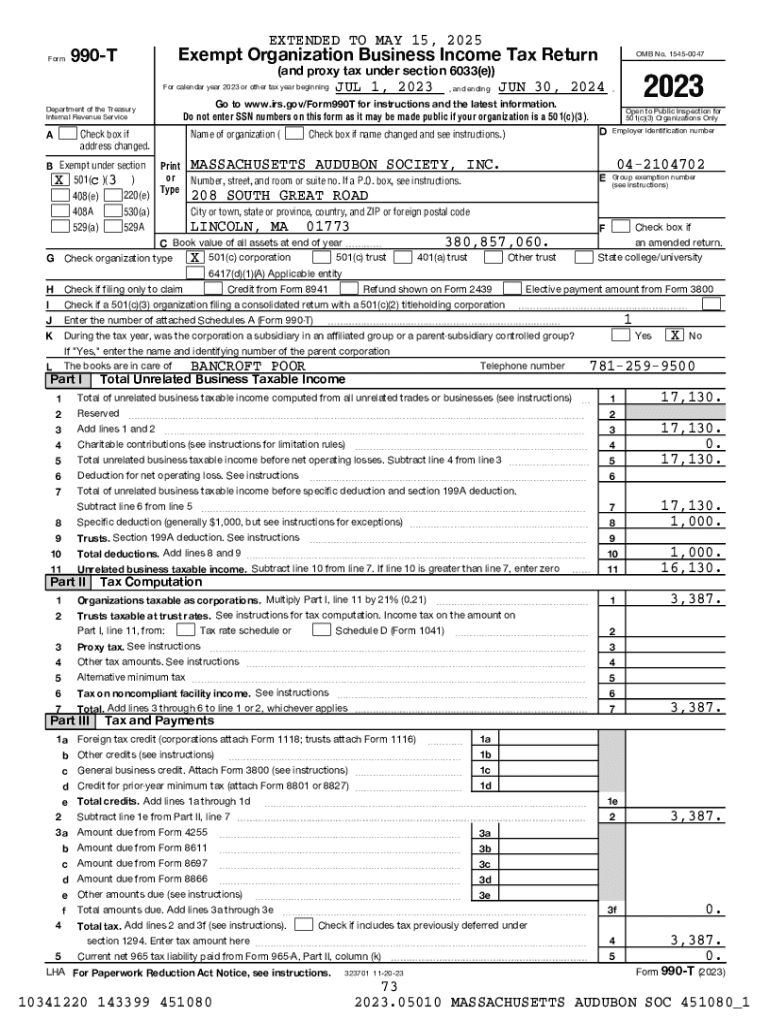

IRS Form 990-T is a crucial document for any tax-exempt organization that engages in business activities considered unrelated to their primary exempt purpose. This form is pivotal in ensuring that these organizations remain compliant with federal tax regulations while accurately reporting their unrelated business income (UBI).

The primary purpose of Form 990-T is to capture and report any UBI that a tax-exempt entity generates. UBI is defined as income from a trade or business activity that is regularly carried on and not substantially related to the organization’s exempt purpose. This means that even tax-exempt organizations must pay taxes on income derived from activities that don't align with their exempt mission.

Organizations required to file Form 990-T include nonprofit entities like charities, schools, and religious organizations. Any tax-exempt group earning $1,000 or more in UBI must file this form. This requirement extends to corporations and other forms of tax-exempt organizations, highlighting the diverse range of entities that must navigate these regulations.

When and how to file Form 990-T

Filing deadlines for Form 990-T typically mirror the deadlines for filing Form 990, which include the 15th day of the 5th month after the close of the organization's fiscal year. Extensions may also be available, providing additional time to meet the filing requirements. It’s critical for organizations to annotate the specific deadline appropriate to their tax year to maintain compliance.

When preparing to file, organizations have the option to choose between e-filing and paper filing. E-filing is often faster and enables electronic storage of the submission. However, some organizations may prefer the traditional paper route. Clarity around the types of information needed to successfully complete Form 990-T is crucial. This includes detailing the organization's structure, tax year, total income, and expenses related to UBI.

Detailed instructions for completing Form 990-T

Part I of the 990-T focuses on identifying UBI, where organizations must clearly outline which types of income qualify. Activities such as sales of products unrelated to the nonprofit mission, advertising income, and service fees that are not related to the tax-exempt purpose fall under UBI. Furthermore, organizations should identify separate revenue-generating activities distinctly to avoid confusion.

Part II of the form dives into the computation of taxable income. This involves calculating allowable deductions which can significantly impact the overall tax liability of the organization. Examples of common deductions include expenses related directly to business activities that generate UBI, such as operating costs, salaries for employees who work in these income-generating ventures, and any related marketing expenses.

For organizations needing to provide additional information about their UBI, Schedule A is included with Form 990-T. This is essential for ensuring that the IRS understands the context and specifics of the claimed income.

E-filing Form 990-T: Step-by-step guide

E-filing provides various benefits, including efficiency, security, and immediate feedback. pdfFiller streamlines this process, allowing organizations to compile their tax documents with ease. To successfully e-file using pdfFiller, users must prepare by gathering necessary documentation and setting up their accounts.

The e-filing process is straightforward. Firstly, users must create a pdfFiller account. Following this, they need to add organization details to the platform. Afterward, they will select the relevant tax year and the form type they wish to file. The next step entails entering the 990-T data using the interactive tools that pdfFiller provides.

After submission, users can expect a confirmation from the IRS and have the ability to track their filing status through pdfFiller’s platform, ensuring peace of mind and compliance.

Common challenges and how to overcome them

Reporting UBI can often create confusion for many organizations. Best practices include maintaining meticulous records of all revenue streams and their origins. This not only helps in identifying UBI but also in ensuring compliance with IRS guidelines. Moreover, addressing common mistakes proactively can lead to more accurate filings and prevent penalties.

Common mistakes when filing Form 990-T can include misreporting income, errors in calculating deductions, or failing to recognize UBI. Organizations can mitigate these risks by utilizing online resources or tools, such as those available on pdfFiller, which can guide users through the complexities of tax filings efficiently.

Understanding penalties and extensions for Form 990-T

Late filing penalties for Form 990-T can escalate quickly. Organizations that do not file on time might encounter penalties that can be both financially burdensome and damaging to their reputation. Understanding these consequences can motivate organizations to prioritize timely submissions.

To request an extension for filing Form 990-T, organizations must file Form 8868 by the original due date of the return. It’s essential to communicate specific reasons for the delay and ensure compliance to minimize penalties and maintain good standing with the IRS.

Supporting forms and schedules relevant to Form 990-T

Apart from Form 990-T, there are several related forms which aid in the broader tax filing process. Form 990 provides a comprehensive overview of an organization's finances and operations, while Form 990-EZ serves as a shorter version for smaller organizations. Form 8868 is particularly important for organizations seeking an extension for their filings.

Specialized schedules such as Schedule A and Schedule B further supplement the filing, offering a more in-depth analysis when required. These schedules are required based on specific types of income or expenses that may arise, ensuring that all financial activities are captured accurately.

Additional resources for Form 990-T

Organizations can benefit from various supportive materials to aid in the accurate completion of Form 990-T. Helpful videos and webinars offer interactive learning experiences, while tax education resources provided by pdfFiller enhance user knowledge and preparedness for filling out tax forms.

For real-time assistance, organizations can contact help desks or live assistance options available through pdfFiller, ensuring that any tax questions are answered promptly. This level of support can empower organizations to navigate filing with confidence and accuracy.

Leveraging pdfFiller for document management and collaboration

PdfFiller not only simplifies the process of completing Form 990-T but also fosters collaboration among team members. Users can securely collaborate on tax documents, sharing insights and information crucial for a successful filing. With its cloud-based platform, pdfFiller promotes easy access from anywhere, ensuring comprehensive document management.

Furthermore, the platform offers secure eSigning features, allowing individuals to sign necessary documents electronically. This added layer of security not only expedites the filing process but also confirms documents' integrity, reassuring organizations that their submissions are safe and verified.

Customer success stories and testimonials

Many users have benefited from the organized and efficient filing process provided by pdfFiller. Case studies reveal that nonprofit organizations have streamlined their tax submissions, showcasing their significant time savings and reduction of errors in reporting. Users often highlight the straightforward interface and ease of collaboration as key features that enhance their experience.

Metrics depict substantial success rates in document creation and submission, with clients reporting reduced stress when approaching tax filing deadlines. Testimonials reflect the platform's commitment to aiding users in maintaining compliance and achieving their financial goals.

Next steps for filing your Form 990-T

Getting started with pdfFiller is an uncomplicated process. Organizations can sign up with ease, accessing tailored templates that cater to specific tax needs. This platform provides an excellent resource for first-time users, often featuring exclusive offers that incentivize the adoption of the service.

Moreover, pdfFiller stands as a reliable partner in ongoing compliance with IRS regulations. By continually updating its resources and tools, organizations can feel confident in their ability to manage their tax liabilities and filings comprehensively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 990-t without leaving Chrome?

Can I edit 990-t on an iOS device?

How do I complete 990-t on an iOS device?

What is 990-t?

Who is required to file 990-t?

How to fill out 990-t?

What is the purpose of 990-t?

What information must be reported on 990-t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.