Get the free Pension Plan for Employees of the Entities of the Diocese of St. Petersburg

Get, Create, Make and Sign pension plan for employees

How to edit pension plan for employees online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pension plan for employees

How to fill out pension plan for employees

Who needs pension plan for employees?

Pension plan for employees form: Your comprehensive guide

Understanding pension plans

A pension plan is a retirement plan that provides a regular income to employees after they have retired. The primary purpose of these plans is to ensure financial security for employees, enabling them to maintain their standard of living post-retirement. There are primarily two types of pension plans: defined benefit plans and defined contribution plans. Defined benefit plans promise a specific payout at retirement based on salary history and years of service, while defined contribution plans allow employees to contribute a portion of their salary, with the final amount depending on investment performance.

Pension plans are critical for employees, as they provide a structured savings mechanism supported by potential employer contributions. These contributions enhance the financial stability of employees when they retire, allowing them to enjoy their retirement years without the constant worry of financial insecurity.

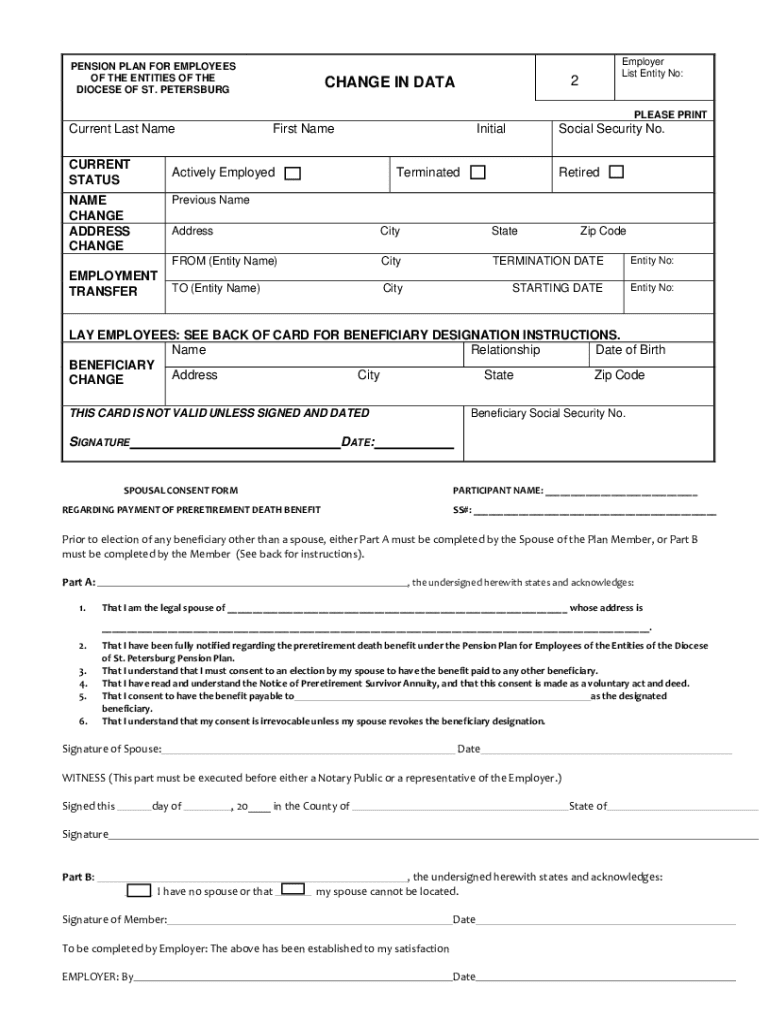

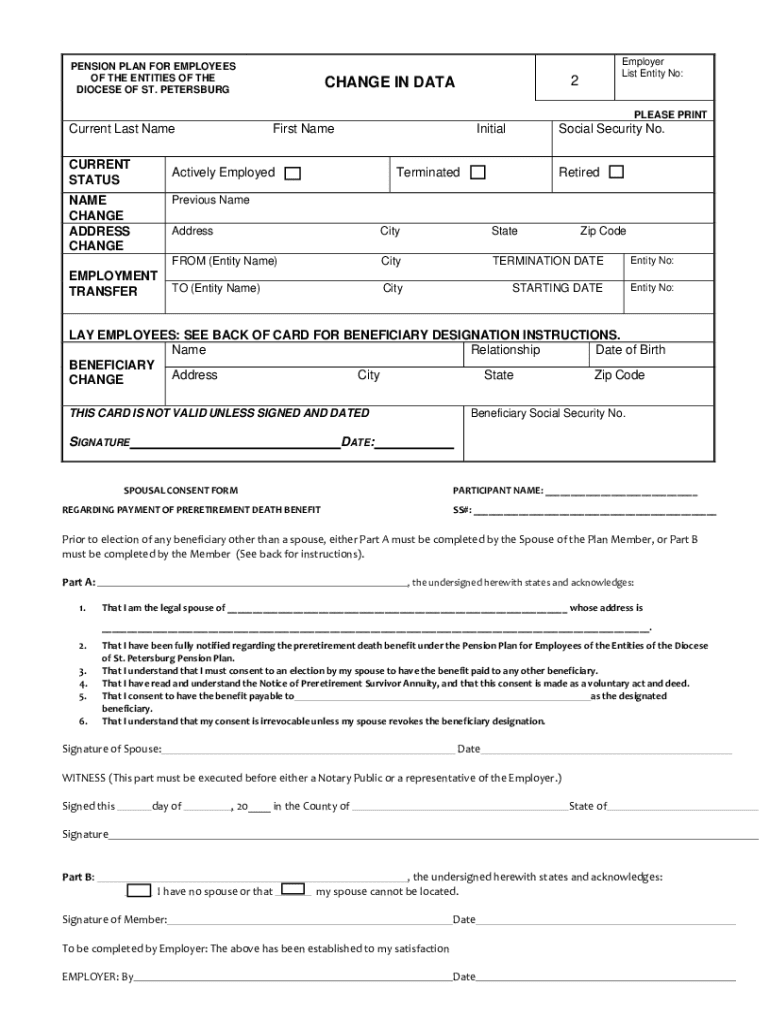

Overview of the pension plan for employees form

The pension plan for employees form is an essential document that enables employees to participate in their company's retirement plan. It serves not only to document the employee’s participation but also ensures compliance with legal requirements established under the Employee Retirement Income Security Act (ERISA). This form needs to be completed accurately and submitted in a timely manner to facilitate the setup of an employee’s retirement account.

Key elements of this form generally include required personal information such as Social Security Number (SSN), contact information, and employment details. Additionally, the form would list pension plan options available, along with specified contribution amounts and schedules that employees can choose from to best suit their financial goals.

Step-by-step guide to completing the pension plan for employees form

Completing the pension plan for employees form requires meticulous attention to detail. Start by gathering necessary documentation such as personal identification that includes your Social Security Number and contact details, employment information, and any previous pension plan information if applicable. This preparation makes the rest of the process much easier.

Next, fill out the form section by section: First, enter your personal information accurately; then provide necessary employment details like your job title and the duration of your employment. Third, review the pension plan options carefully, selecting those that meet your retirement needs. Lastly, indicate your contribution elections, which define how much of your salary you wish to contribute to your plan, along with the frequency of these contributions.

While completing this form, avoid common mistakes such as leaving fields blank, providing incorrect information, or misunderstanding the plan options available to you. These errors can lead to delays or incorrect processing of your retirement benefits.

Tips for editing and managing your pension plan for employees form

Using pdfFiller offers a seamless way to create, edit, and manage your pension plan for employees form. The platform provides interactive tools that allow you to fill out the form from anywhere with an internet connection. Make use of its editing features to customize the form to your specific requirements before final submission.

Finding electronic signing options is equally important. At pdfFiller, you're able to eSign your document quickly, adding a layer of convenience that ensures your signature is legally validated and secure. This reduces the need for paper and provides a more efficient filing process.

The collaboration features of pdfFiller further simplify the process of managing your form. You can share your pension plan for employees form with HR or financial advisors easily, allowing for real-time feedback and edits to ensure everything is accurately prepared before submission.

Filing and submission guidelines

When it comes to filing your pension plan for employees form, it’s crucial to understand where and how to submit it. Employees often have two main options: online submission through the HR portal or mail-in instructions for traditional filing. It's essential to be aware of the deadlines surrounding submission, as missing them could delay your enrollment in the retirement plan.

If you opt for electronic filing, ensure you understand the specific requirements related to this submission method. You'll need to comply with regulatory standards that govern electronic documents and signatures, ensuring that everything is appropriately processed without complications.

Frequently asked questions (FAQs)

After submitting your pension plan for employees form, you may have several questions. One common inquiry is about what happens next. Typically, HR will review your form and contact you if there are any discrepancies or if additional information is needed, followed by confirming your participation in the plan.

Many employees wonder how they can make changes to their pension plan after submission. Most organizations allow for annual reviews or specific windows where you can update your preferences. Additionally, if you ever lose your pension plan form, reaching out to HR can quickly resolve the issue, as they have copies for reference.

Other resources available for common inquiries include the HR department's FAQs, online instructional materials, or workplace seminars offered by your employer, providing clarity and support regarding your pension plan.

Additional considerations for employees

Understanding your rights under a pension plan is crucial. The Employee Retirement Income Security Act (ERISA) provides protections and regulations meant to ensure that employees are treated fairly in matters of retirement benefits. Being aware of these laws can empower you to make informed decisions regarding your pension options.

Lastly, it's wise to monitor your pension plan choices periodically and stay informed about potential adjustments. Regular reviews of your selections ensure that you are maximizing your benefits and keeping up with any changes in pension laws or employer offerings that may be beneficial for your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pension plan for employees?

Can I create an electronic signature for the pension plan for employees in Chrome?

How do I edit pension plan for employees on an Android device?

What is pension plan for employees?

Who is required to file pension plan for employees?

How to fill out pension plan for employees?

What is the purpose of pension plan for employees?

What information must be reported on pension plan for employees?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.