Get the free Non-retirement Account Systematic Contribution / Distribution Request

Get, Create, Make and Sign non-retirement account systematic contribution

Editing non-retirement account systematic contribution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-retirement account systematic contribution

How to fill out non-retirement account systematic contribution

Who needs non-retirement account systematic contribution?

Non-retirement account systematic contribution form: A comprehensive guide

Understanding non-retirement accounts

Non-retirement accounts, also known as taxable accounts, are investment accounts that do not have tax advantages linked to retirement. These accounts differ from retirement-specific accounts, such as IRAs or 401(k)s, and they offer more flexibility in accessing your funds without penalty. Non-retirement accounts can be owned by individuals or joint account holders.

Common types of non-retirement accounts include brokerage accounts, which allow you to buy and sell securities; savings accounts, which offer a safe place to keep cash while earning modest interest; and money market accounts, which combine features of savings and checking accounts but typically offer higher yields. Each type serves distinct financial goals and preferences, providing varied liquidity and opportunities for growth.

The benefits of non-retirement accounts include high liquidity, meaning you can access your funds at any time without penalties, flexibility in contributions without limits, and the ability to invest in a range of financial products based on your risk tolerance and financial goals. This makes them particularly appealing for individuals who want to build an investment portfolio without the constraints often associated with retirement accounts.

What is a systematic contribution?

A systematic contribution is a method of investing where you commit to contributing a set amount of money at regular intervals, typically monthly or quarterly. This approach can be instrumental in wealth building as it encourages discipline in saving and investing over time. By making regular contributions, individuals can take advantage of dollar-cost averaging, mitigating the effects of market volatility.

Systematic contributions differ from lump-sum contributions, which involve investing a large amount at once. Instead, the systematic approach spreads out the investment over time, reducing the risk of timing the market incorrectly. This consistent saving strategy is particularly effective for those who may not have large sums of money to invest at once, allowing for gradual wealth accumulation.

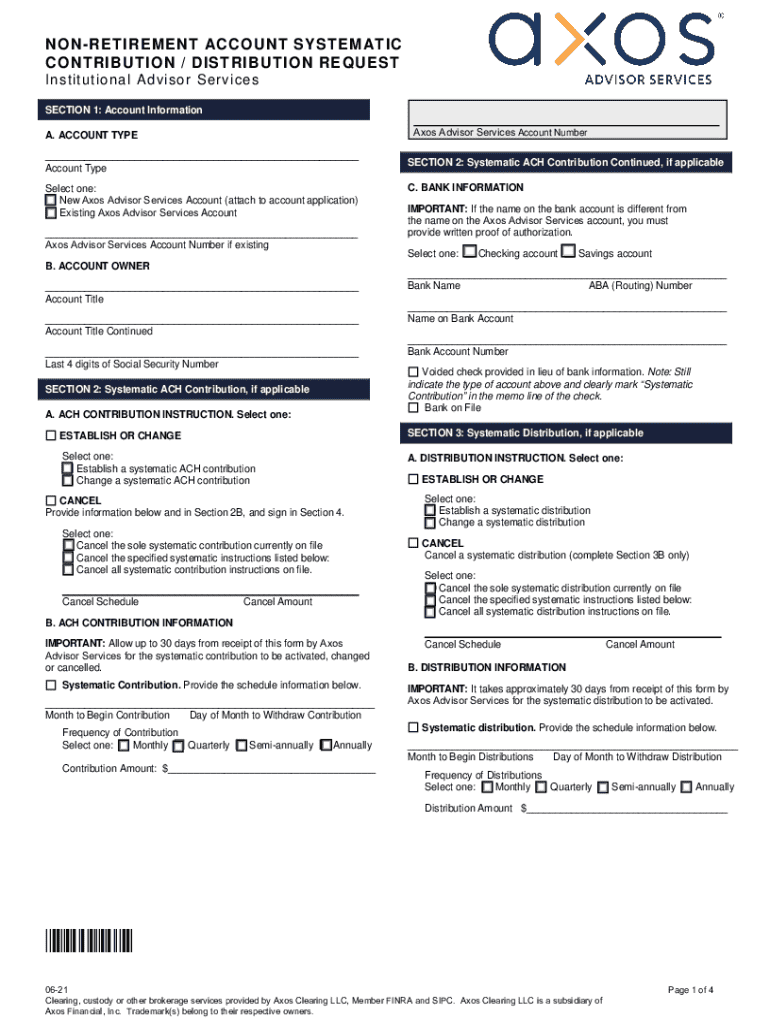

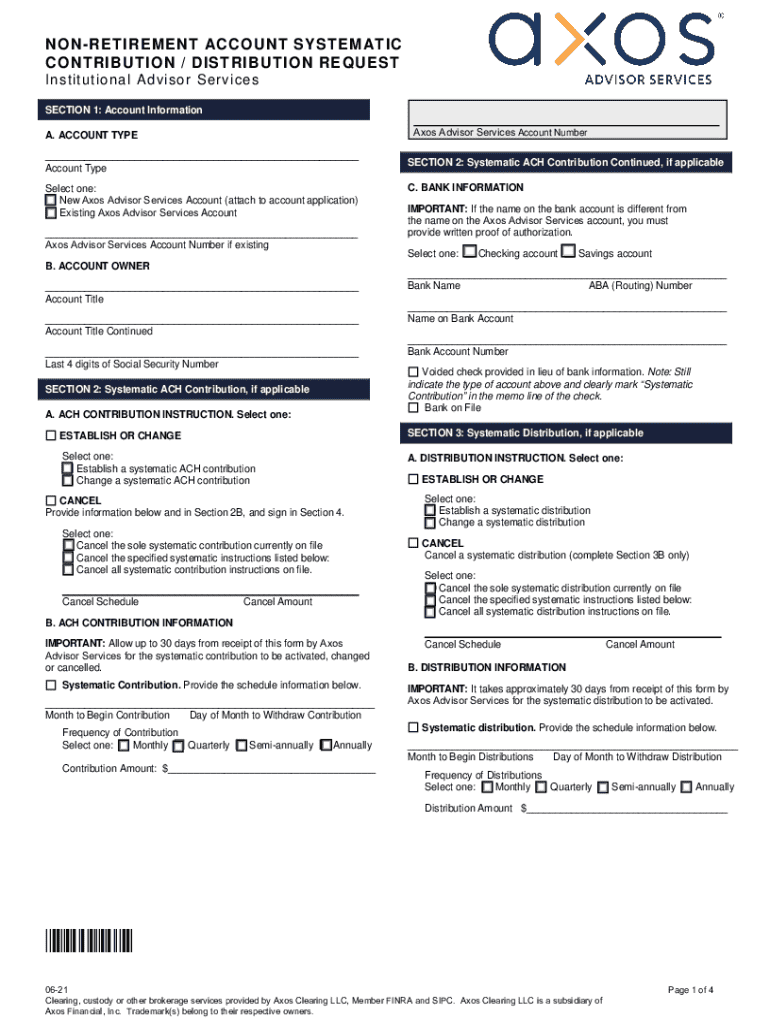

Overview of the non-retirement account systematic contribution form

The non-retirement account systematic contribution form is an essential tool that facilitates the establishment of regular investment contributions into your account. This form serves a dual purpose: documenting your investment preferences and assisting financial institutions in managing your contributions effectively. Completing this form accurately ensures that your investment strategy aligns with your financial goals.

Key elements of the form typically include account holder information, specifying the frequency of contributions—such as weekly, bi-weekly, or monthly—the exact amount to be contributed, and bank information for facilitating fund transfers. Each of these elements plays a crucial role in ensuring timely and accurate systematic contributions to your non-retirement account.

Step-by-step guide to filling out the form

To successfully complete the non-retirement account systematic contribution form, it’s crucial to prepare appropriately. Begin by gathering all necessary documentation, such as your identification, bank account information, and any existing account statements. Familiarizing yourself with the contribution limits and terms associated with your specific account will also streamline the process.

The form is typically divided into several sections, each requiring specific details. First, ensure you fill out your personal information accurately, including your name, address, and contact information. Next, move on to the contribution details where you will select the desired frequency and specify the amount you plan to contribute. Subsequently, you will need to provide your bank account information to facilitate automatic transfers. Lastly, review the authorization and signatures section to ensure you understand the agreement terms before electronically signing the document.

Managing your contributions: Tips and strategies

To maximize the effectiveness of your systematic contributions, it's essential to set realistic contribution goals that align with your financial situation. Assess your income, expenses, and financial priorities to determine how much you can afford to contribute consistently. This forward-thinking will minimize the risk of disrupting your financial stability.

Monitoring your account growth is equally important. Regularly review your investment performance and overall financial health to ensure you're on track to meet your goals. Adjusting contributions as needed, especially in response to significant life changes—like a salary increase, job loss, or a major expense—will help you maintain your investment strategy's relevance and efficiency.

Common mistakes to avoid when submitting the form

Submitting your systematic contribution form without ensuring that all requested information is complete can lead to delays or rejections. Double-check your details, especially your bank information, as errors in these sections can result in failed fund transfers. Additionally, misunderstandings about bank processing times can lead to missed contributions, affecting your investment schedule.

Finally, be sure to read and understand all terms and conditions associated with the contributions. Ignoring these agreements may result in unexpected fees or changes to your contributions, so it’s crucial to be fully informed before submission.

Troubleshooting common issues

If your form is rejected, it's essential to take prompt action. Contact your financial institution for clarification and identify what needs correction. Making changes after submission may be allowed, but procedures depend on the institution's policies—so be prepared to follow their specific instructions.

You can usually access previous submissions from your account dashboard for review. Regularly checking your submission history helps ensure all contributions align with your planned strategy and provides insights for future adjustments.

Leveraging pdfFiller for creating and managing your forms

pdfFiller is an invaluable resource for managing your non-retirement account systematic contribution form and other financial documents. It empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single cloud-based platform, streamlining the often convoluted process of document handling.

Key features of pdfFiller include real-time collaboration capabilities, making it easy for teams to work simultaneously on documents. The easy eSigning process allows you to finalize documents without printing, and the document storage and retrieval functions ensure that your important forms are always accessible. You can quickly access the systematic contribution form on pdfFiller and start managing your contributions effectively.

Additional forms related to non-retirement accounts

Beyond the systematic contribution form, various other forms relate to non-retirement accounts that can help facilitate your investment journey. Contribution forms document regular payments, while distribution forms manage withdrawals when you’re ready to access your funds. For those transitioning to a retirement account, specific forms address the process of transferring assets, ensuring a smooth transition from a non-retirement to a retirement environment.

Furthermore, updating your non-retirement account information with the relevant forms keeps your account details current and minimizes errors that could affect your contributions or access to funds.

Frequently asked questions (FAQs)

Understanding the nuances of non-retirement account systematic contributions often raises several questions. One common inquiry is how frequently you can change your systematic contribution amount. Generally, you can adjust your contributions at any time by submitting an updated form to your financial institution, though terms may vary.

Another frequent question pertains to tax implications related to non-retirement account contributions. Unlike retirement accounts that offer tax advantages, contributions to non-retirement accounts are made with after-tax funds, and any capital gains or dividends will be taxable. Lastly, many individuals wonder if they can set up systematic contributions for multiple accounts—this is typically feasible, allowing for diversified investment strategies across various platforms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-retirement account systematic contribution to be eSigned by others?

Can I create an electronic signature for signing my non-retirement account systematic contribution in Gmail?

How can I fill out non-retirement account systematic contribution on an iOS device?

What is non-retirement account systematic contribution?

Who is required to file non-retirement account systematic contribution?

How to fill out non-retirement account systematic contribution?

What is the purpose of non-retirement account systematic contribution?

What information must be reported on non-retirement account systematic contribution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.