Get the free Check Request

Get, Create, Make and Sign check request

How to edit check request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check request

How to fill out check request

Who needs check request?

Comprehensive Guide to Check Request Forms: Streamlining Financial Processes

What is a Check Request Form?

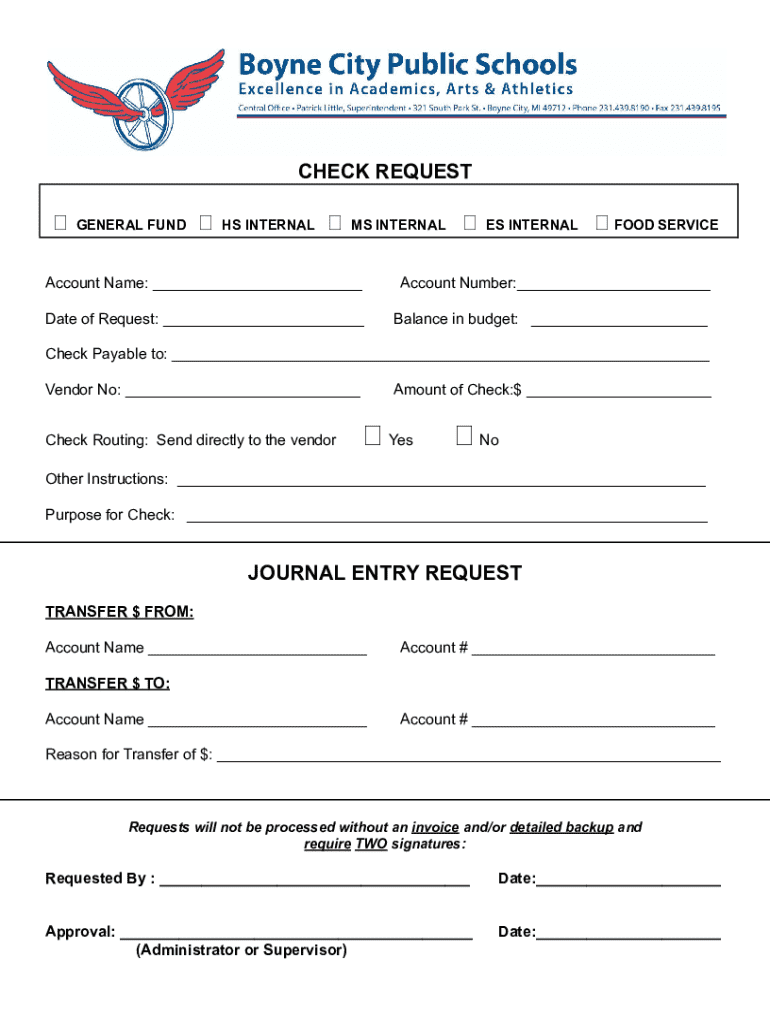

A check request form is a document used to request payment via check for goods or services rendered or to cover expenses incurred by an individual or organization. Its primary purpose is to formalize the request for funds before any payment is made, ensuring proper documentation is maintained throughout the financial transaction process. This form plays a crucial role in financial management as it provides an audit trail and ensures compliance with company policies.

The importance of check request forms in financial transactions cannot be overstated. They prevent unauthorized payments and provide clarity for both the requestor and the finance department. Commonly used in various scenarios, these forms facilitate transactions ranging from employee reimbursements to vendor payments, ensuring that everyone involved has a clear understanding of the reasons for the request.

Key components of a check request form

An effective check request form must contain several key components to ensure clarity and completeness. Essential fields include the requester's information, payee details, the purpose of the payment, and the amount requested. Each of these components helps facilitate accurate and timely processing of requests.

In addition to these core fields, optional fields can enhance the clarity of the request. Including an invoice number, purchase order number, or budget reference can significantly aid in tracking and traceability. These details also help finance departments reconcile payments and manage budgets more effectively.

Sample check request forms

A well-structured check request form streamlines the submission and approval process. Below are examples of different formats to illustrate how these forms can be tailored to various contexts. A basic template provides a straightforward outline for essential information, while a detailed template may include checks for compliance and additional fields for clarity.

Industry-specific variants also exist, catering to unique needs. For nonprofits, a check request form may include sections for project codes, while corporations may require department approvals embedded in the form design.

Step-by-step guide: How to fill out a check request form

Filling out a check request form accurately is essential for efficient processing. Start by selecting the appropriate form based on your organization's guidelines. Factors to consider include the purpose of the payment and any existing templates provided by your finance department.

Gather the required information before you dive into completing the form. Ensure you have access to necessary documents such as invoices or receipts, which may provide vital details needed for your request. Once you have everything, proceed to fill the form carefully, paying attention to detail to avoid common mistakes. This may include miscalculations in amounts or incorrect payee information.

Best practices for using check request forms

To maximize the effectiveness of check request forms, adherence to best practices is crucial. Ensure compliance with your company's policies to facilitate smooth processing. This includes regularly updating template fields to reflect any changes in payment protocols or legal requirements.

Moreover, maintain clear communication with relevant departments, such as finance and procurement, to align expectations and avoid miscommunication. This proactive approach encourages timely approvals and helps prioritize urgent requests.

Benefits of using check request forms

Utilizing check request forms streamlines the approval process, as they provide a clear structure for tracking requests. This visibility enhances budgeting and financial tracking, allowing organizations to manage their funds more effectively.

Furthermore, check request forms play a vital role in preventing fraudulent transactions. With a documented request process, organizations can verify payments against the initial request, reducing the risk of unauthorized transactions occurring.

When to use a check request form

Check request forms are appropriate in various contexts. They should be utilized for pre-purchase requests, where approval is sought prior to incurring expenses. This ensures that the requested amount is budgeted and authorized before any purchasing actions are taken.

Conversely, they are also vital for post-purchase reimbursable requests. In these scenarios, employees submit check requests to recoup expenses already incurred, ensuring that documentation and justifications are robust and verifiable.

Check request form examples in action

Examining real-world applications of check request forms highlights their effectiveness. For instance, a small business can streamline its payment processes by implementing a standardized form for all employee reimbursements, thus improving financial oversight.

User testimonials reveal the benefits of utilizing check request forms. Many users note that having a clear and structured form reduces processing time, minimizes errors, and enhances communication between departments, leading to a more efficient financial workflow.

Common mistakes and how to avoid them

Many individuals encounter issues when submitting check request forms. Common mistakes often include incomplete submissions, miscalculations in amounts requested, and incorrect payee information. Such errors can lead to delays in processing or even rejected requests.

To avoid these pitfalls, it is advisable to establish a checklist prior to submitting a request. Double-checking amounts, ensuring all necessary fields are filled out, and verifying payee details can significantly reduce the chances of mistakes.

Interactive tools for check request management

pdfFiller offers a comprehensive solution for managing check request forms. As an all-in-one document platform, it empowers users to easily edit PDFs, eSign, collaborate, and manage documents all from a single, cloud-based interface. This functionality means that teams can streamline their processes, reduce errors, and significantly improve turnaround times.

With pdfFiller, users can quickly edit and customize their check request forms according to their organizational needs. The platform also facilitates easy signing and collaboration, with features that include cloud storage and seamless sharing, making it ideal for teams seeking an efficient solution.

Key takeaways

Check request forms are essential components of financial operations, promoting accountability and efficiency in payment processing. By understanding their purpose, key components, and best practices, organizations can leverage these tools to improve their financial management processes.

Utilizing platforms like pdfFiller enhances the effectiveness of these forms, allowing users to streamline their document management activities and ensure a more collaborative approach to handling such requests. The role of check request forms in financial transactions is vital, facilitating clear communication and helping to establish a reliable audit trail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get check request?

How do I edit check request online?

Can I create an eSignature for the check request in Gmail?

What is check request?

Who is required to file check request?

How to fill out check request?

What is the purpose of check request?

What information must be reported on check request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.