Get the free Multi-purpose Tax Return

Get, Create, Make and Sign multi-purpose tax return

Editing multi-purpose tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out multi-purpose tax return

How to fill out multi-purpose tax return

Who needs multi-purpose tax return?

Mastering the Multi-Purpose Tax Return Form: A Comprehensive Guide

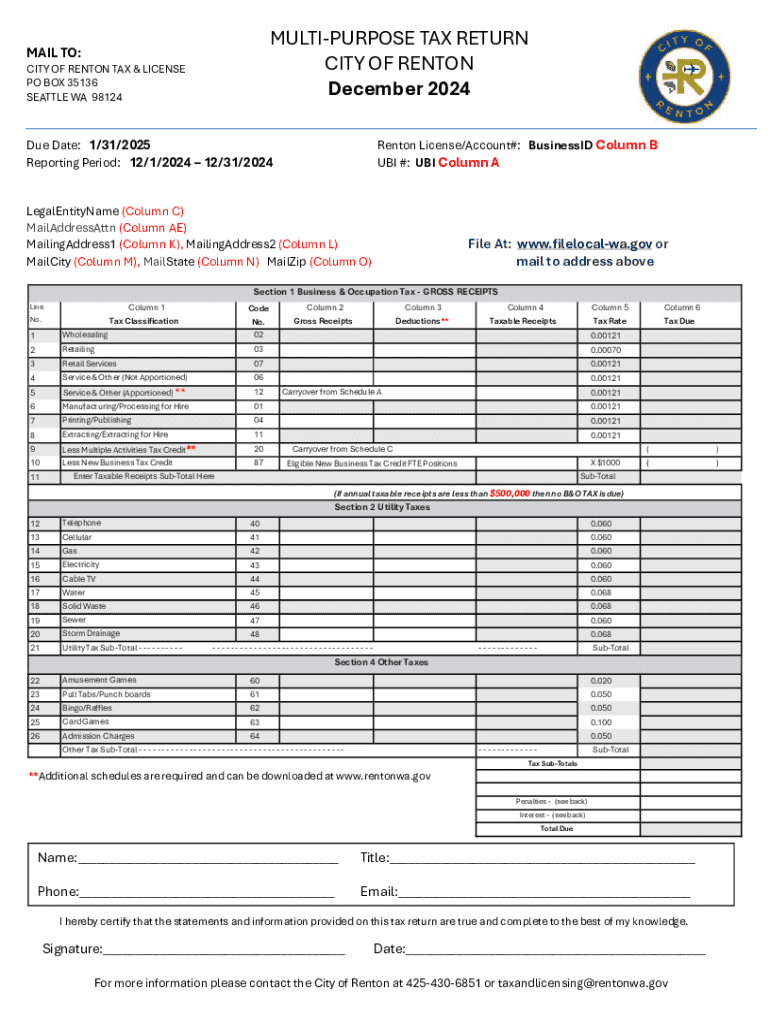

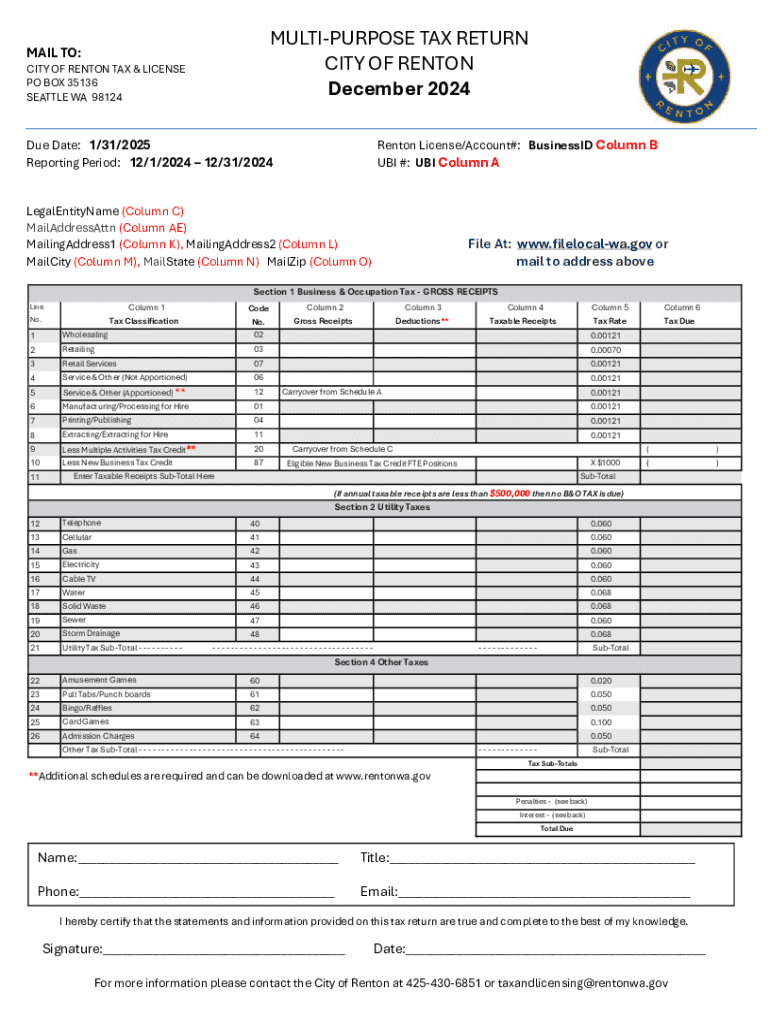

Understanding the multi-purpose tax return form

The multi-purpose tax return form serves as a foundational document for individuals and businesses alike to report their annual income and tax obligations to the IRS. Its primary purpose is to streamline the filing process, making tax compliance more efficient and organized.

Understanding the importance of this form is crucial. It not only ensures that taxpayers meet legal obligations but also enables them to accurately establish any tax liabilities, claim exemptions, and receive refunds for overpayments, achieving a smooth financial year-end.

Types of multi-purpose tax return forms

The multi-purpose tax return form encompasses several variants tailored for different taxpayers, including individuals, corporations, partnerships, and nonprofits. Each type is designed to address the unique tax structures and reporting requirements inherent to each category.

For individuals, the most common form is Form 1040, which comes with variants like 1040A and 1040EZ, suited for different financial scenarios. Businesses, on the other hand, utilize specific forms depending on their structure, including C Corporation forms, S Corporation forms, and partnership returns. Limited Liability Companies (LLCs) must follow specific filing requirements based on their tax classification, making it critical to choose the correct form.

Key components of the multi-purpose tax return form

The multi-purpose tax return form comprises several essential sections that guide taxpayers through the filing process. These components are structured to capture vital information for accurate assessment of tax liabilities.

Among the primary sections are personal information, where taxpayers enter their names, addresses, and Social Security numbers; income reporting, which details income sources; and deductions and credits, which allow taxpayers to reduce their taxable income effectively. Moreover, each form concludes with a signature and date requirement, ensuring accountability and verification.

How to fill out the multi-purpose tax return form

Filling out the multi-purpose tax return form can be straightforward when approached methodically. Here’s a step-by-step guide to ensure that you complete the form accurately.

Start by gathering all necessary documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, enter your personal information precisely. Move on to report your total income accurately, taking care to include all relevant sources. Identifying applicable deductions is critical; familiarize yourself with standard and itemized deductions to optimize your tax return. Finally, review your completed form for errors before submission.

While completing the form, it's essential to be mindful of common mistakes—such as misreporting income or overlooking deductions—that could delay processing or trigger an audit. Tools like pdfFiller can assist in editing errors seamlessly, offering a collaborative platform to work on your forms.

Managing your multi-purpose tax return form

Proper management of your multi-purpose tax return form extends beyond filing; it includes effective record-keeping and timely updates. Keep meticulous records of previous tax returns and relevant receipts to support your entries.

For those who need to edit or update their submissions, using a digital platform like pdfFiller allows for integrated editing and collaboration. You can revisit your draft, make necessary amendments, and share it with tax professionals for their input, ensuring a comprehensive review before final submission.

Important deadlines for filing multi-purpose tax returns

Being aware of filing deadlines is crucial for both individuals and businesses. Typically, individual tax returns are due by April 15, while corporate forms often have different deadlines depending on their fiscal years.

For taxpayers who require additional time, extension options are available, generally allowing for an extension of six months. However, it’s important to note that an extension for filing does not extend the payment deadline, meaning any owed taxes need to be paid by the original filing date to avoid penalties.

FAQs about multi-purpose tax return forms

When engaging with the multi-purpose tax return form, many questions often arise. One common concern is what to do if a mistake is made on the form. Taxpayers can amend their returns using Form 1040-X if errors occur after submission.

Moreover, e-filing is a convenient option available through platforms like pdfFiller, which also raises questions about audit risks. While any tax return stands a chance of audit, using reputable software and meticulous record-keeping can mitigate some risks.

Additional tools and resources

Utilizing interactive tools can significantly enhance the tax filing experience. With pdfFiller, users can access calculators designed to estimate taxes owed and maximize claimable tax credits and deductions effortlessly.

Moreover, tax planning resources are invaluable for year-round financial management. Understanding available credits and deductions can help you prepare better for future tax seasons, ensuring you're taking the most advantageous positions possible.

Real-life scenarios and case studies

Examining real-life situations can provide valuable insights into the multi-purpose tax return form's implementation. For instance, individuals often face challenges when filing their taxes due to errors in income reporting or deductions. Successfully resolving these issues often hinges on attention to detail and leveraging tools like pdfFiller.

Furthermore, businesses have learned from case studies where timely submissions and accurate reporting led to substantial tax savings and reduced liabilities. Adopting efficient document management strategies, such as maintaining organized records and using digital platforms, can streamline this process, preventing future complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find multi-purpose tax return?

Can I edit multi-purpose tax return on an iOS device?

How do I complete multi-purpose tax return on an Android device?

What is multi-purpose tax return?

Who is required to file multi-purpose tax return?

How to fill out multi-purpose tax return?

What is the purpose of multi-purpose tax return?

What information must be reported on multi-purpose tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.