Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

A comprehensive guide to Form 990-EZ

Understanding Form 990-EZ

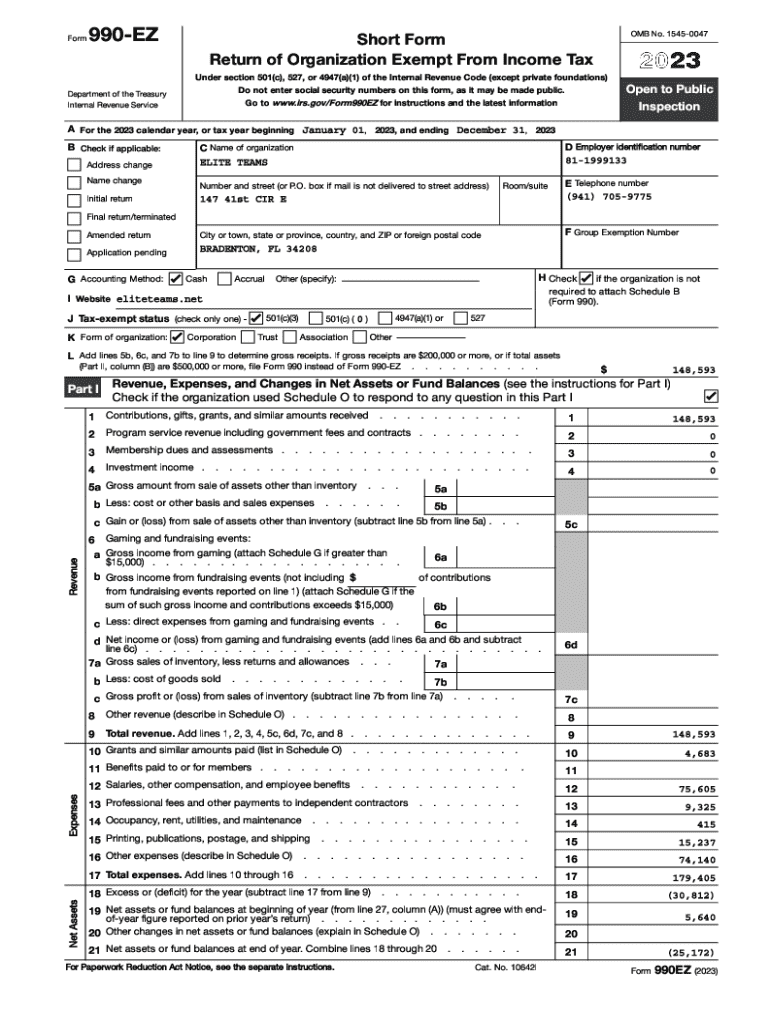

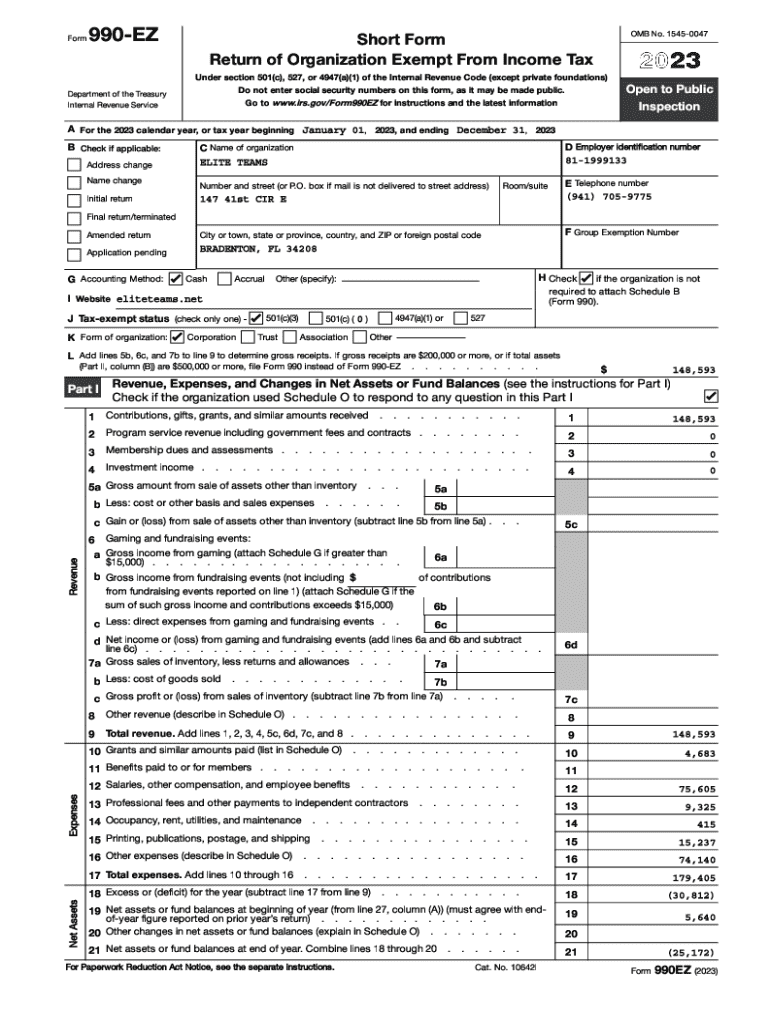

Form 990-EZ is an essential tax document for certain tax-exempt organizations in the United States. It serves as a streamlined alternative to Form 990, allowing smaller nonprofits and organizations with annual gross receipts under $200,000, and total assets under $500,000, to fulfill their annual reporting requirement with the IRS. This form is crucial for maintaining tax-exempt status and ensuring transparency with donors and the public.

Key features of Form 990-EZ include a simplified reporting structure, which covers income, expenses, and functional expenses. This makes it easier for smaller nonprofits to report their financial activities without the extensive detail required by Form 990. Furthermore, using Form 990-EZ can build trust with stakeholders, showcasing how funds are managed and spent.

Differentiating between Form 990 and Form 990-EZ is essential for organizations. While Form 990 is required for larger nonprofits, Form 990-EZ is specifically designed for smaller entities. Organizations with gross receipts of $200,000 or more, or assets exceeding $500,000, must complete the more detailed Form 990.

Identifying who should file Form 990-EZ is straightforward: any tax-exempt organization with annual gross receipts under the specified threshold should use this form. The importance of this obligation cannot be understated; timely filing is crucial for remaining compliant with federal regulations, thus preserving tax-exempt status.

Preparing to file Form 990-EZ

Preparing to file Form 990-EZ requires a clear understanding of the specific information you will need. Essential items include detailed organizational information, such as your mission statement, EIN, and the fiscal year for which you're reporting. Accurate financial data, including revenue, expenses, and the breakdown of functional expenses, is critical.

The schedule requirements for Form 990-EZ vary based on the organization’s size and activities. While every filer must complete sections that capture financial data and governance, there are also optional schedules based on specific activities like fundraising or grant-making.

Common mistakes to avoid when preparing the form include misrecording financial figures, not including required schedules, and neglecting to respond to all questions fully. Taking time to accurately complete each section can save significant headaches later, particularly around compliance.

Resources for understanding each line item on Form 990-EZ can be found on the IRS website, which offers detailed instructions. Additionally, utilizing templates and software tools, such as those offered by pdfFiller, can simplify this process.

Step-by-step instructions to fill out Form 990-EZ

Filling out Form 990-EZ is a structured process that involves several crucial steps. Start with adding your organization’s details, including the name, address, and EIN. Ensure all information is up-to-date and accurate to avoid processing delays.

Next, choose the correct tax year for which you're filing. This information is vital as it helps the IRS align your records correctly. After confirming the tax year, proceed to enter financial information accurately, ensuring every figure reflects your organization's actual performance throughout the year.

Completing the required schedules involves a thorough review of any additional activities your organization engaged in throughout the year. This might include specifics about fundraising events or grants awarded. After filling every relevant section, review the form summary to check for discrepancies or missing information.

Finalizing and signing the form is the last crucial step. The form must be signed by an authorized member of your organization. Ensure full compliance by submitting the completed form via e-filing or traditional mailing methods.

Filing Form 990-EZ

Choosing the method to file Form 990-EZ—either e-filing or paper filing—can greatly impact the efficiency of your reporting. E-filing is typically faster, allows for immediate confirmation of submission, and may be more straightforward as many online platforms guide you through the process.

To e-file Form 990-EZ, organizations can use the IRS e-file system or compatible software like pdfFiller. This integrated approach simplifies the submission process, providing real-time alerts for any errors or omissions, and enhances overall accuracy.

Filing fees for Form 990-EZ online typically vary based on the platform used. Many providers, including pdfFiller, offer competitive rates. Organizations should be aware of the associated costs before proceeding with submission.

Finally, if organizations require more time to finalize their filings, they can request an extension. This extension must be filed using Form 8868 and can provide an additional six months to complete Form 990-EZ without facing penalties.

Navigating common queries

Many organizations have questions regarding the nuances of filing Form 990-EZ. For instance, common inquiries include understanding the penalties for late filing, which can reach thousands of dollars depending on the length of delay and the organization’s size. Ensuring timely submission is vital.

Amending a previously filed Form 990-EZ is also a common concern. Organizations can do so by filing Form 990-X, which adjusts previous filings. If a deadline is missed, it is advisable to file as soon as possible and submit an explanation to minimize penalties.

Another common question is whether electronic filing is required by the IRS. As of recent guidelines, organizations with gross receipts over $10 million must e-file, making it a necessary consideration for larger nonprofits.

Understanding the Group Exemption Number (GEN) is also pertinent for organizations that are part of a larger group of exempt entities. This allows the group to file a collective Form 990, easing administrative burdens for individual members.

Advanced considerations for filing Form 990-EZ

A deeper understanding of Form 990-T is essential for those filing Form 990-EZ. Form 990-T is used to report unrelated business income, which could impact your tax-exempt status and financial reporting. Organizations engaging in non-related business activities must consider both forms carefully.

Knowing the supported schedules for Form 990-EZ eFiling can further streamline the filing process. Different schedules pertaining to fundraising, professional fundraising services, and grant-making may need to be attached, depending on your activities.

The tax year itself impacts filing obligations; organizations need to remain aware of the differences in deadlines and filing requirements as they relate to their specific fiscal year. Having clarity surrounding these timelines can prevent excess pressure when approaching filing deadlines.

Tools and features for seamless filing

Utilizing interactive tools significantly enhances the filing process. Platforms like pdfFiller provide a host of resources to aid in filling out Form 990-EZ accurately. These tools can simplify data input and offer real-time validation to prevent errors.

A robust knowledge base with support options is also beneficial for those navigating Form 990-EZ. Access to FAQs, user guides, and expert assistance can prove invaluable in streamlining the filing process.

Security measures are paramount when filing online. Ensuring that any platform you use adheres to strict security protocols can protect sensitive information. pdfFiller backs its services with comprehensive security safeguards, helping to to instill confidence during the filing process.

Client and team management

Efficient team management for nonprofit organizations can significantly ease the burden of filing Form 990-EZ. Collaborative tools facilitate team interactions, allowing various stakeholders to provide feedback, review documents, and ensure accuracy before submission.

Sharing returns for approval is essential to maintain transparency within the organization. Best practices include setting clear deadlines for reviews and utilizing digital platforms where team members can comment and make suggestions promptly.

Seamless client management tools offered by pdfFiller enable nonprofits to efficiently handle documents and stay organized, promoting smoother filing processes while allowing for swift adjustments when necessary.

Beyond filing: Long-term management of nonprofit documents

Implementing a long-term document management solution is key to maintaining compliance and organization for nonprofits. Utilizing a platform like pdfFiller provides a secure place to store Form 990-EZ and related documentation for easy access and record-keeping.

Collaborative features facilitate teamwork, promoting effective communication among team members while maintaining document integrity. Engaging in webinars and learning opportunities can further enhance the knowledge base for nonprofit leaders, helping them to stay informed about best practices and regulatory changes.

Additional forms and resources

Besides Form 990-EZ, it’s crucial to recognize related tax forms that might be relevant for your organization. For example, knowing the significance of Form 990-N—often called the e-Postcard, which is required for smaller nonprofits with gross receipts under $50,000—can clarify filing obligations.

Additionally, keeping up with changes in filing requirements is vital to ongoing compliance. The IRS periodically updates forms and regulations, and organizations must stay informed to avoid penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990-ez without leaving Google Drive?

Can I create an electronic signature for signing my form 990-ez in Gmail?

Can I edit form 990-ez on an Android device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.