Get the free Campaign Finance Receipts & Expenditures Report - ethics ks

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the Campaign Finance Receipts Expenditures Form

Understanding campaign finance basics

Campaign finance refers to the funds raised and spent to promote candidates, political parties, and policies during an election. It plays a crucial role in shaping political campaigns, influencing how candidates communicate their messages, reach voters, and ultimately secure their positions. Compliance with campaign finance regulations, both at federal and state levels, ensures transparency and fairness, providing a framework that candidates must navigate carefully.

Several laws govern campaign financing, including the Federal Election Campaign Act (FECA) and various state laws. These regulations dictate contribution limits, require disclosure of campaign receipts and expenditures, and ensure accountability. Understanding these rules is fundamental for any candidate aspiring to run a successful campaign.

The financing can be categorized into public and private sources. Public financing, often accessible to candidates who meet specific criteria, involves funds provided by the government to support their campaigns. Conversely, private financing includes donations from individuals and organizations.

Navigating the campaign finance receipts expenditures form

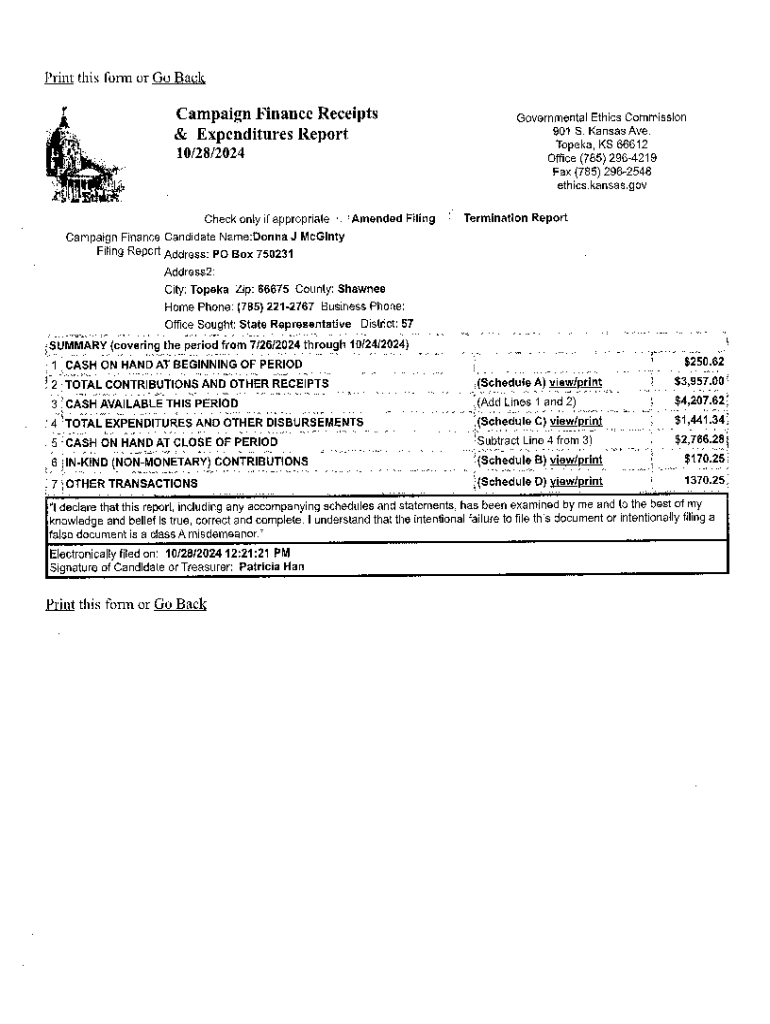

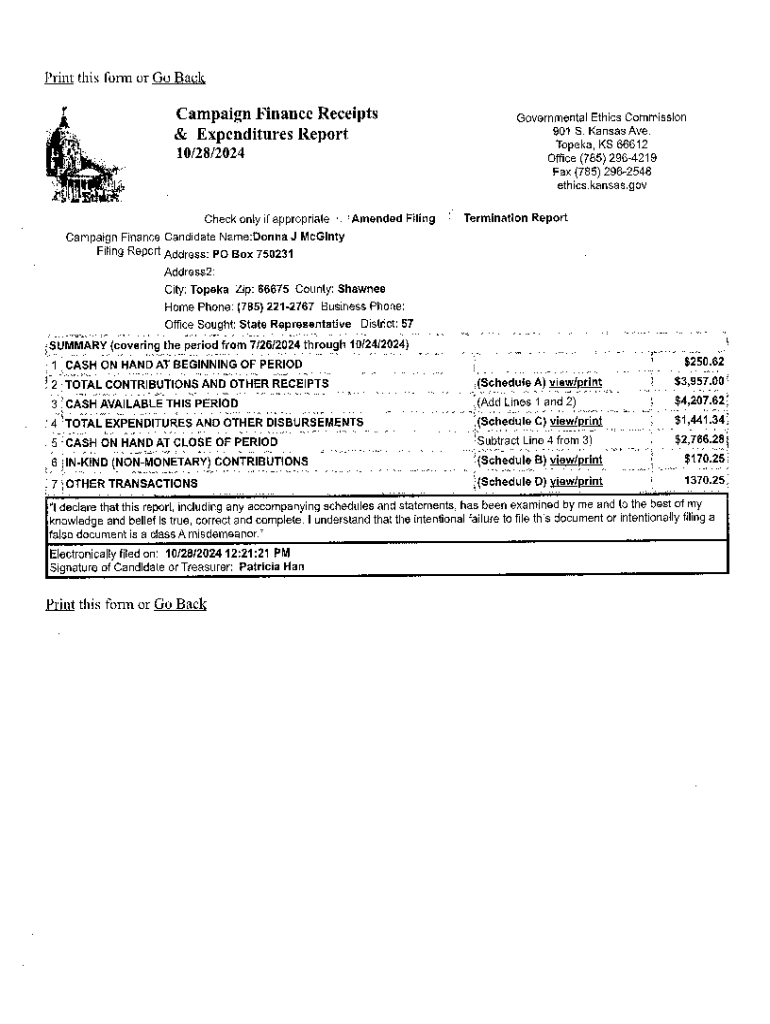

The Receipts Expenditures Form is a critical document that candidates and their committees must file to report campaign contributions and expenditures. Its primary purpose is to maintain transparency about how much money is raised and spent, thereby ensuring accountability in the electoral process.

Certain entities are legally mandated to file this form, typically including federal and state candidates, political parties, and political action committees (PACs). Understanding who is required to file is essential to avoid penalties for non-compliance, which can hinder a campaign's efficacy.

Eligibility criteria for submitting the form vary by state and federal guidelines. Candidates typically need to have already raised a specified amount of funds or spent a certain threshold to be subject to these requirements.

Components of the receipts expenditures form

The Receipts Expenditures Form comprises distinct sections for receipts and expenditures that require careful, thorough completion. Accuracy in these segments is essential for regulatory compliance and for maintaining public trust.

Receipts section

The receipts section documents all funds received, including itemized contributions from individuals, organizations, and fundraising events. Proper classification of receipts—such as distinguishing between individual contributions and corporate contributions—is crucial for compliance. Failing to report accurately can result in investigations and potential penalties.

Expenditures section

The expenditures section includes all financial outlays related to campaign activities, which encompass advertising, event costs, salaries, and operational expenses. Clear reporting categories allow for transparent tracking of how funds support campaign goals. Knowing what qualifies as an expenditure can help ensure full accountability.

Completing these sections accurately is not only a legal obligation but also a best practice that fosters transparency with the electorate.

E-filing vs. paper filing

Filing the Receipts Expenditures Form can be approached in two primary ways: e-filing and paper filing. Each method presents distinct advantages and challenges.

With advancements in technology, many candidates are opting for e-filing options, which streamline the submission process. E-filing systems, including those available on platforms like pdfFiller, allow users to complete forms online and electronically sign them, enhancing efficiency.

Interactive e-filing tools

pdfFiller provides users with interactive tools tailored specifically for campaign finance management. Through easy-to-use interfaces and features, candidates can edit forms, sign documents electronically, and track their filing status. The e-signature feature allows for quick collaboration among team members, enabling everyone involved to provide necessary approvals with minimal hassle.

Common mistakes to avoid

Amid the complexities of filing the Receipts Expenditures Form, candidates frequently encounter errors that can lead to compliance issues. Common mistakes include misreporting contributions or failing to account for specific expenditures. Such oversights can attract unwanted scrutiny from regulatory agencies.

To minimize errors, candidates can benefit from developing a checklist that includes all required entries. Regular monitoring of financial records and documentation can further ensure that everything remains in compliance.

Managing your campaign finance records

Maintaining accurate and organized records of campaign finances is essential for candidates. Effective record-keeping practices not only facilitate the completion of the Receipts Expenditures Form but also help candidates demonstrate financial responsibility to their supporters.

pdfFiller offers templates specifically designed for campaign finance, enhancing the ease with which candidates can manage their financial records, whether for personal organization or compliance.

Important deadlines and filing schedules

Adhering to filing deadlines is paramount for candidates to maintain compliance with campaign finance regulations. Each jurisdiction typically outlines specific dates by which the Receipts Expenditures Form must be submitted, and neglecting these timelines can lead to serious consequences.

For instance, federal candidates must adhere to regular reporting schedules that align with election dates, while state candidates may have different timelines based on local laws. Missing these deadlines can result in fines or other penalties that can negatively impact campaign viability.

Seeking assistance and resources

Candidates navigating the complexities of campaign financing can benefit greatly from resources available through their local election offices. These offices provide valuable information regarding the rules and requirements specific to each jurisdiction.

Additionally, platforms like pdfFiller offer dedicated support for users, assisting them in understanding forms and ensuring compliance with regulations through specialized resources and documentation.

Additional tools for campaign finance management

In the current landscape, several tools exist to streamline the management of campaign finance obligations. pdfFiller offers several interactive templates aimed at simplifying the process of completing the Receipts Expenditures Form.

By leveraging technology for campaign finance management, candidates can ensure that they remain organized, compliant, and efficient in their fundraising efforts.

Conclusion with actionable insights

Understanding and effectively managing the Receipts Expenditures Form is instrumental for candidates seeking to maximize their campaign strategies while also adhering to regulatory requirements. By staying organized and proactive, candidates can avoid pitfalls common in campaign financing.

pdfFiller serves as a robust support system for candidates, empowering them to navigate the intricacies of campaign finance documentation with ease. With the right tools and practices, candidates can focus on their objectives while keeping their campaign finance records in check.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send campaign finance receipts expenditures to be eSigned by others?

How do I edit campaign finance receipts expenditures online?

Can I edit campaign finance receipts expenditures on an iOS device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.